Enlarge image

DR 7118 (01/12/23)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0009

(303) 205-8205

Tax.Colorado.gov Fuel Tax Refund Claim

Instructions

See form on page 2

General Information Form Instructions

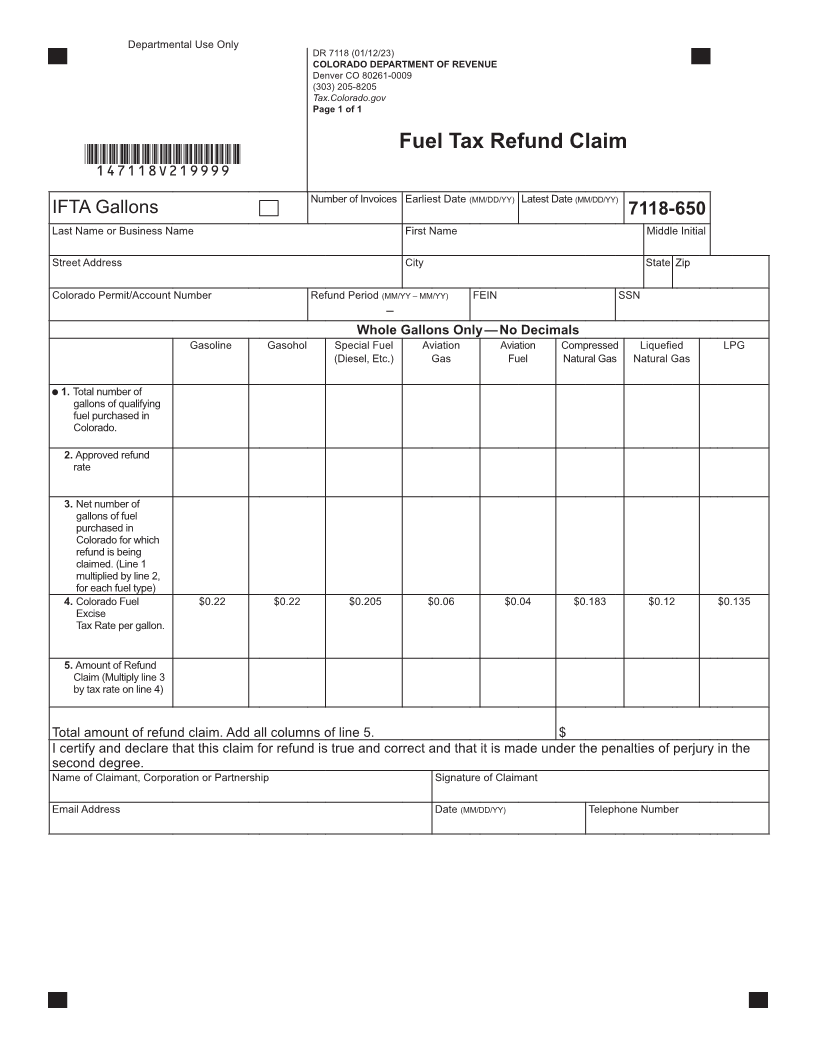

A claim for refund must be submitted within 12 months after If including invoices with claim, indicate number of invoices

the date of purchase of the fuel. Only one claim may be under Number of Invoices box. Enter first date of invoice

filed in a calendar quarter. in the Earliest Date box, and the Last Date included in the

Latest Date box. (Optional)

A refund will not be allowed when:

Complete Refund Period as first month of calendar quarter

• the excise tax was not paid,

and last month of calendar quarter.” “ ie: 01/23-3/23”

• for operating a motor vehicle on public roads,

Enter your Colorado Account number (if known) and the

streets or highways, except as provided in C.R.S.

FEIN or Social Security Number of the business.

39-27-103(2),

Line 1 — Enter number of gallons used for business

• the total quantity claimed is less than 20 gallons.

purposes and drawn from bulk storage facilities or

For additional information, see the Fuel Users Guide. purchased from a dealer for exempt use.

Line 2 — Enter the approved refund rate. The approved

Refund Permit

refund rate is available on Revenue Online.

A refund permit must be issued before any claim for refund

can be paid. This can be obtained by filing a tax refund Line 3 — For each fuel type, multiply line 1 by the approved

permit application (form DR 7189). The first claim may percentage on line 2.

accompany the application. A permit is not transferable. Line 4 — Colorado Fuel Excise Tax Rate per gallon.

Claimants are required to notify the office of changes

in address or nature of business including changes to Line 5 — Amount of refund claim: multiply line 3 by tax rate

ownership, name, DBA, FEIN, and operations. Changes to a on line 4.

FEIN will require a new application be approved.

IFTA Vehicles

Invoices Taxpayers that have an IFTA account must submit a

Invoices and claims are required to be maintained for three separate refund claim for their IFTA vehicles. To report

years. Failure to comply with any of the requirements may IFTA gallons, check box marked IFTA gallons and report

result in the disallowance of your claim, or may subject you Colorado tax paid gallons.

to penalties.

• Report fuel placed in the ordinary fuel tank of a vehicle

whose miles are reported on an IFTA return, and

Propane (LPG)

• You must attach a copy of the corresponding IFTA return

Taxpayers requesting a refund on exempt use of propane to each quarterly claim for refund.

must attach copies of invoice(s) verifying tax paid.

Mail to:

Colorado Department of Revenue

Denver, CO 80261-0009

or File via our website at Colorado.gov/RevenueOnline