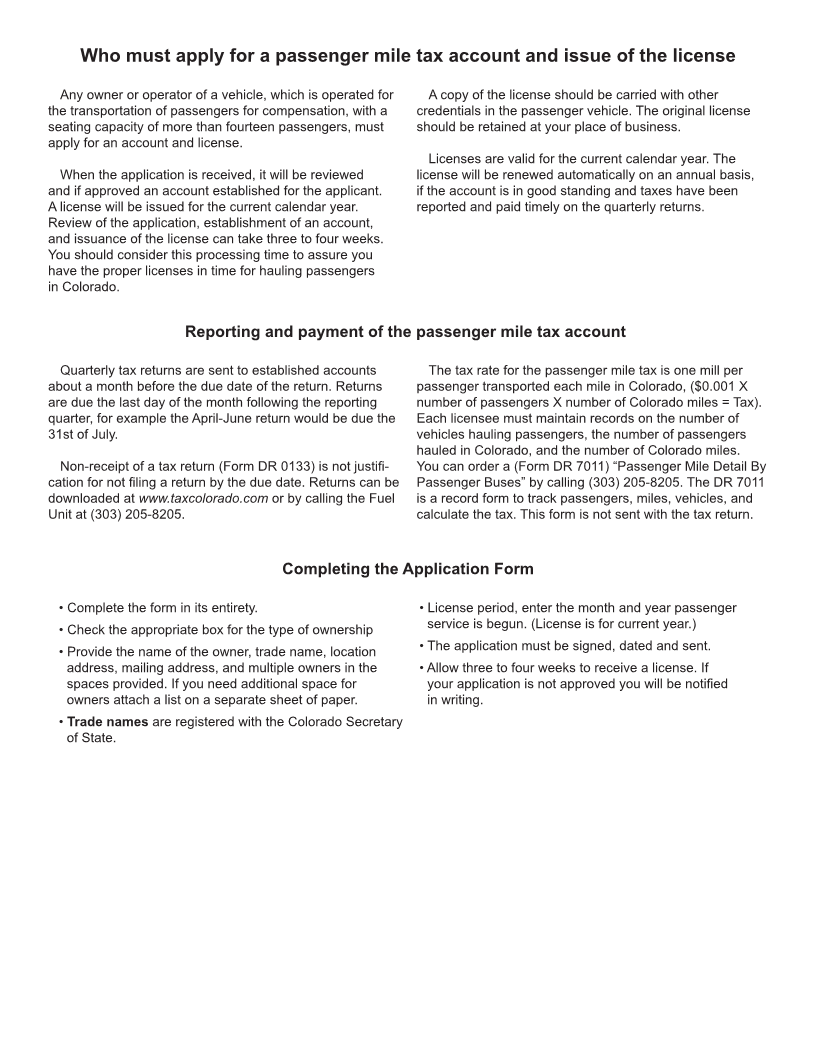

Enlarge image

Departmental Use Only

DR 0278 (09/25/13)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261 - 0009

(303) 205-8205

Application for Passenger

Mile Tax Account *130278==19999*

Instructions: fourteen and which are used for transportation of passen-

This application must be completed to establish the gers for compensation.

passenger mile tax account(s).

The Department of Revenue requires quarterly reporting.

A passenger mile account is required for all vehicles Liability Date - Enter the date that the account should

which have passenger seating capacity of more than become effective.

Registration Number

Type of Ownership Individual General Partnership Corporation

Limited Partnership Other-specify below

If other, please specify

Taxpayer’s Last Name (owner, partners or other business organization) First Name Middle Initial

Trade Name/Doing Business As (if applicable) Corporations, Limited Partnerships and Limited Liability Companies using their true name need not

register for trade name.

Address of Principal Place of Business City State Zip

County Phone Number

( )

Mailing Address (if different from above) (include unit no.) City State Zip

County Phone Number

( )

FEIN (if unavailable, SSN) Liability Date – see above (MM/DD/YY)

(1) Owner/Partner Last Name First Name Middle Initial SSN

Address (residence or P.O. Box) City State Zip

(2) Owner/Partner Last Name First Name Middle Initial SSN

Address (residence or P.O. Box) City State Zip

License Period (MM/YY-MM/YY)

Passenger Mile Tax Account –

License Period - The first date should be the current month and year. The second date should be December of the current year.

All accounts must file quarterly returns.

I certify, under penalty of perjury in the second degree, that the information provided on this application is true and complete to the best of

my knowledge. (Signature required below.)

Type or Print Authorized Signature Title

Signature of Owner, Partner or Corporate Office Date (MM/DD/YY)