Enlarge image

DR 1510 (10/05/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

*DO=NOT=SEND* Tax.Colorado.gov

(303) 205-8205

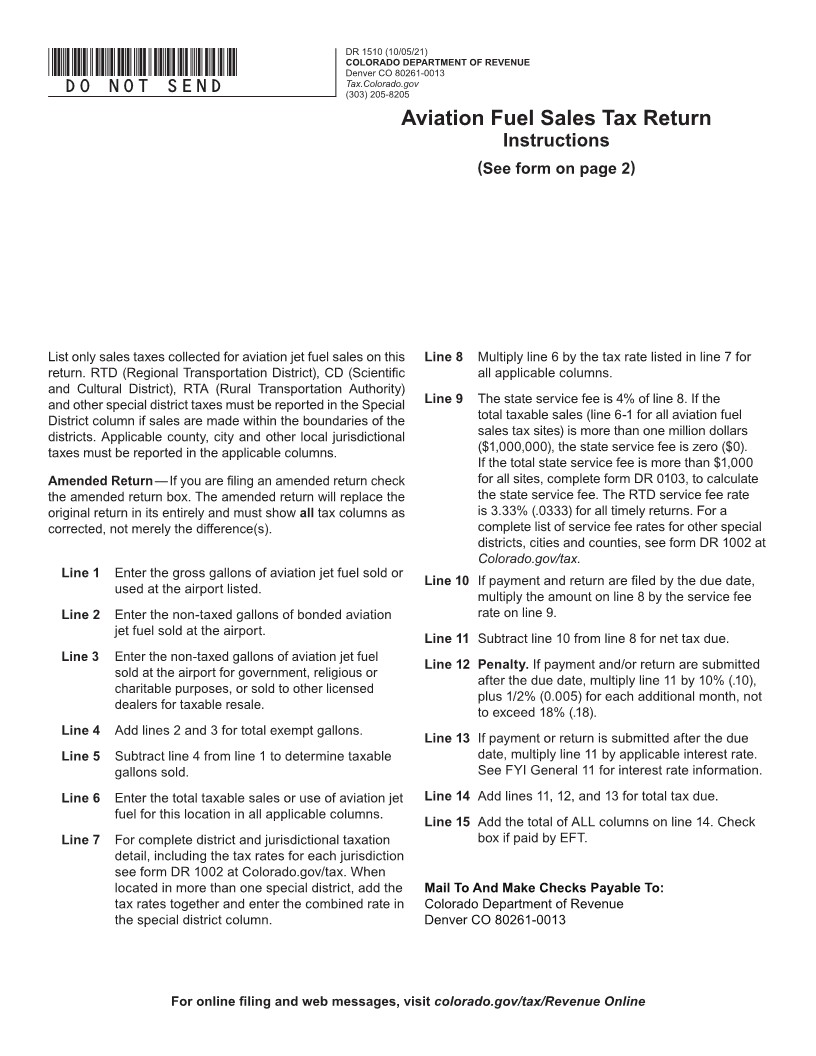

Aviation Fuel Sales Tax Return

Instructions

(See form on page 2)

List only sales taxes collected for aviation jet fuel sales on this Line 8 Multiply line 6 by the tax rate listed in line 7 for

return. RTD (Regional Transportation District), CD (Scientific all applicable columns.

and Cultural District), RTA (Rural Transportation Authority)

and other special district taxes must be reported in the Special Line 9 The state service fee is 4% of line 8. If the

District column if sales are made within the boundaries of the total taxable sales (line 6-1 for all aviation fuel

districts. Applicable county, city and other local jurisdictional sales tax sites) is more than one million dollars

taxes must be reported in the applicable columns. ($1,000,000), the state service fee is zero ($0).

If the total state service fee is more than $1,000

Amended Return — If you are filing an amended return check for all sites, complete form DR 0103, to calculate

the amended return box. The amended return will replace the the state service fee. The RTD service fee rate

original return in its entirely and must show all tax columns as is 3.33% (.0333) for all timely returns. For a

corrected, not merely the difference(s). complete list of service fee rates for other special

districts, cities and counties, see form DR 1002 at

Colorado.gov/tax.

Line 1 Enter the gross gallons of aviation jet fuel sold or

Line 10 If payment and return are filed by the due date,

used at the airport listed.

multiply the amount on line 8 by the service fee

Line 2 Enter the non-taxed gallons of bonded aviation rate on line 9.

jet fuel sold at the airport.

Line 11 Subtract line 10 from line 8 for net tax due.

Line 3 Enter the non-taxed gallons of aviation jet fuel

Line 12 Penalty. If payment and/or return are submitted

sold at the airport for government, religious or

after the due date, multiply line 11 by 10% (.10),

charitable purposes, or sold to other licensed

plus 1/2% (0.005) for each additional month, not

dealers for taxable resale.

to exceed 18% (.18).

Line 4 Add lines 2 and 3 for total exempt gallons.

Line 13 If payment or return is submitted after the due

Line 5 Subtract line 4 from line 1 to determine taxable date, multiply line 11 by applicable interest rate.

gallons sold. See FYI General 11 for interest rate information.

Line 6 Enter the total taxable sales or use of aviation jet Line 14 Add lines 11, 12, and 13 for total tax due.

fuel for this location in all applicable columns.

Line 15 Add the total of ALL columns on line 14. Check

Line 7 For complete district and jurisdictional taxation box if paid by EFT.

detail, including the tax rates for each jurisdiction

see form DR 1002 at Colorado.gov/tax. When

located in more than one special district, add the Mail To And Make Checks Payable To:

tax rates together and enter the combined rate in Colorado Department of Revenue

the special district column. Denver CO 80261-0013

For online filing and web messages, visit colorado.gov/tax/Revenue Online