Enlarge image

DR 5782 (11/30/21)

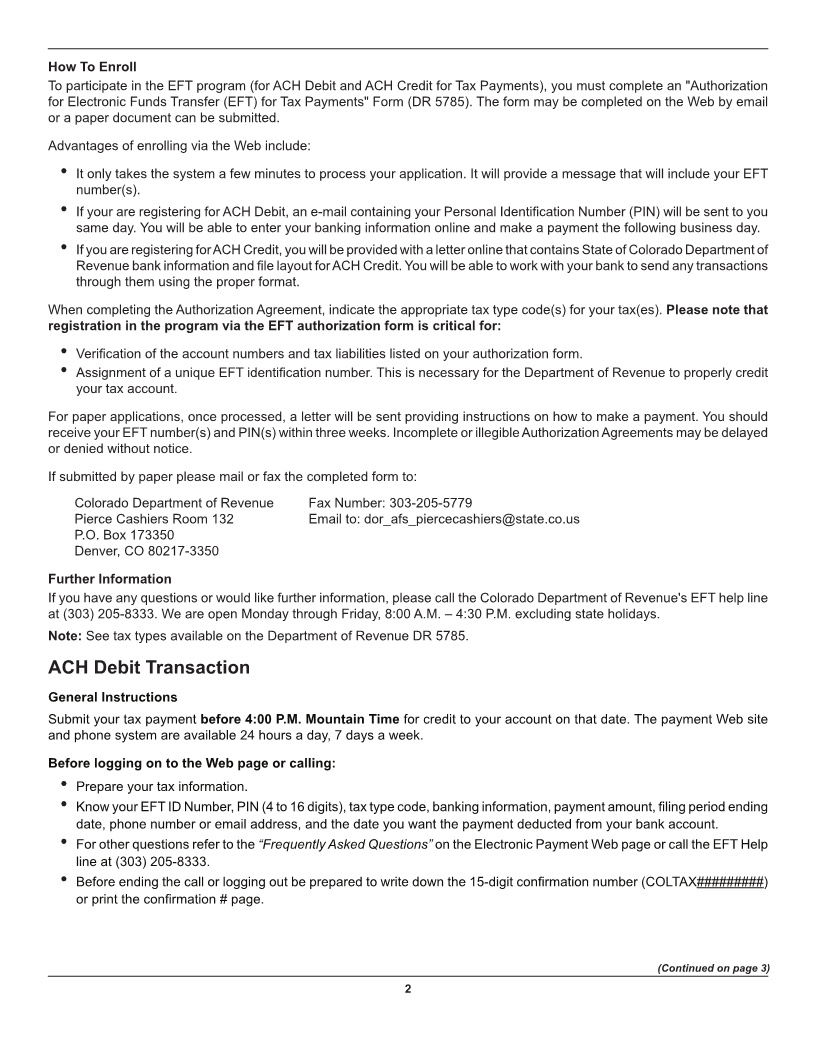

Colorado Department of Revenue Electronic

Funds Transferred (EFT) Program For Tax Payments

The Colorado Department of Revenue requires all organizations filing fuel, cigarette or tobacco taxes, retail marijuana sales

and excise taxes, withholding of income from an oil and gas interest, employers with annual wage withholding liabilities

greater than $50,000.00, and businesses with annual state sales tax liabilities greater than $75,000.00 to pay through

Electronic Funds Transfer (EFT). Other individuals and organizations may also choose to pay electronically. Electronic

payments offer you a number of benefits:

• The cost and time to write checks is eliminated.

• You know exactly when your account will be debited.

• You are assured that the funds are received on time, every time.

• You may also register to pay other taxes electronically. For all taxes except wage withholding, estimated income, income,

income extensions, estimated severance and PUC fixed utility fees you will still need to file a tax return.

• You must file a complete sales and use tax return at the same time you make a sales/use tax payment.

Electronic Payment Options

Colorado's Electronic Funds Transfer program offers two methods of electronic payment:

• Automated Clearing House Debit (ACH debit), Web payment and telephone options.

• Automated Clearing House Credit (ACH credit).

Automated Clearing House Debit

To remit taxes via ACH debit e-check, access our Web site or place a call to a toll-free number. Both processes will prompt

you to enter seven pieces of information: your EFT identification number, your PIN (Personal Identification Number), tax

type code, filing period ending date, dollar amount owed, the settlement/effective date, and your phone number. The

systems, in return, provide a reference number as proof of payment. The funds are withdrawn from your account as soon

as the following day. We offer payment warehousing which provides the opportunity to designate a payment date up to

365 days in the future, allowing you to place your payment in advance of the due date and have your funds withdrawn on

the specified date. The Department of Revenue pays for the transaction.

Our Web feature allows you to make tax payments, access your phone and Web payment history, change your

PIN, and add or change banking information online through a secured Web site. Please visit our Web site at

www.colorado.gov/revenueonline/

Automated Clearing House Credit

To initiate an ACH credit, instruct your financial institution to transfer funds from your account to the Department of Revenue's

depository account.

ACH Credits for Paying Taxes

The ACH credit must be formatted utilizing the tax payment (TXP) within the addenda record of a CCD+ application. The ACH

credit must be initiated on, or before, the due date; the funds are transferred to be received the next day by the Department

of Revenue. The TXP addenda convention has been provided in this guide. Your financial institution may charge you for the

transaction. Since some financial institutions can not originate ACH transactions, please contact them for more information.

ACH Credits for Paying Third Party Payments (TPP)

The Third-Party Tax Payments (TPP) are those payments made by a third-party to a federal or state taxing agency on behalf

of a taxpayer. Examples of third-party payments are 1) payments from employers or financial institutions in response to tax

agency levies to garnish employee wages or accounts for tax liability and 2) employee tax withholdings remitted by payroll

service providers on behalf of employers. You will be able to work with your bank to send any transactions through them

using the proper format.

(Continued on page 2)

1