Enlarge image

DR 7011 (03/10/10)

COLORADO DEPARTMENT OF REVENUE

DR 7011 (09/04/13)

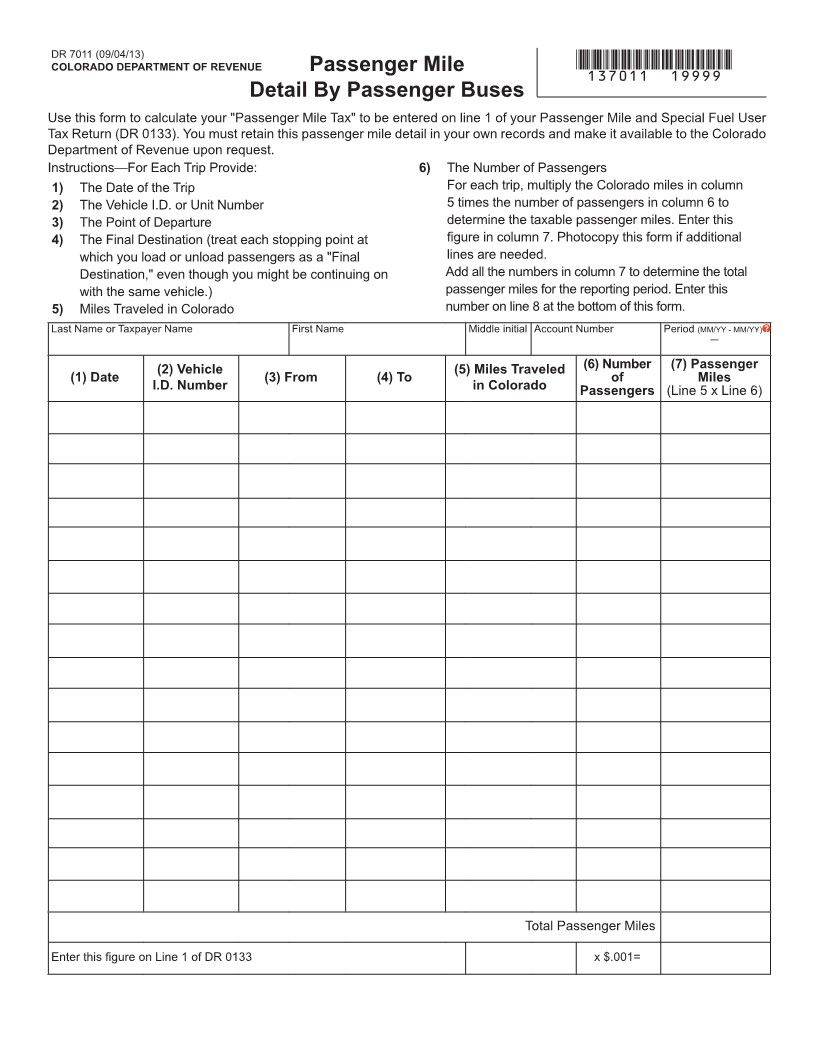

COLORADO DEPARTMENT OF REVENUE Passenger Mile *137011==19999*

Detail By Passenger Buses

Use this form to calculate your "Passenger Mile Tax" to be entered on line 1 of your Passenger Mile and Special Fuel User

Tax Return (DR 0133). You must retain this passenger mile detail in your own records and make it available to the Colorado

Department of Revenue upon request.

PASSENGERInstructions—For EachMILETrip Provide:DETAIL BY PASSENGER6) The Number of PassengersBUSES

1) The Date of the Trip For each trip, multiply the Colorado miles in column

2) The Vehicle I.D. or Unit Number 5 times the number of passengers in column 6 to

3) The Point of Departure determine the taxable passenger miles. Enter this

4) The Final Destination (treat each stopping point at figure in column 7. Photocopy this form if additional

which you load or unload passengers as a "Final lines are needed.

Destination," even though you might be continuing on Add all the numbers in column 7 to determine the total

with the same vehicle.) passenger miles for the reporting period. Enter this

5) Miles Traveled in Colorado number on line 8 at the bottom of this form.

Last Name or Taxpayer Name First Name Middle initial Account Number Period (MM/YY - MM/YY)

—

(2) Vehicle (5) Miles Traveled (6) Number (7) Passenger

(1) Date (3) From (4) To of Miles

I.D. Number in Colorado Passengers (Line 5 x Line 6)

Total Passenger Miles

Enter this figure on Line 1 of DR 0133 x $.001=