Enlarge image

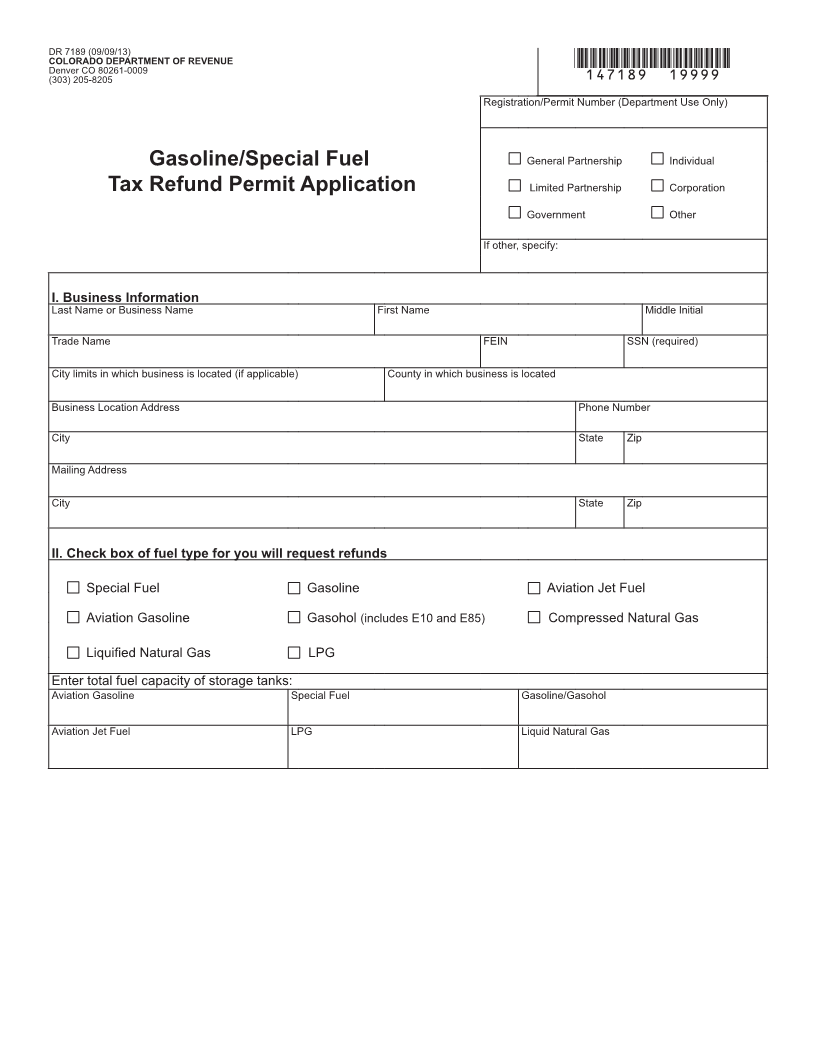

DR 7189 (09/09/13)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0009 *147189==19999*

(303) 205-8205

Registration/Permit Number (Department Use Only)

Gasoline/Special Fuel General Partnership Individual

Tax Refund Permit Application Limited Partnership Corporation

Government Other

If other, specify:

I. Business Information

Last Name or Business Name First Name Middle Initial

Trade Name FEIN SSN (required)

City limits in which business is located (if applicable) County in which business is located

Business Location Address Phone Number

( )

City State Zip

Mailing Address

City State Zip

II. Check box of fuel type for you will request refunds

Special Fuel Gasoline Aviation Jet Fuel

Aviation Gasoline Gasohol (includes E10 and E85) Compressed Natural Gas

Liquified Natural Gas LPG

Enter total fuel capacity of storage tanks:

Aviation Gasoline Special Fuel Gasoline/Gasohol

Aviation Jet Fuel LPG Liquid Natural Gas