Enlarge image

CR 0100 (05/02/22)

COLORADO DEPARTMENT OF REVENUE

Taxpayer Service Center

**DO*NOT*SEND** PO Box 17087

Denver CO 80217-0087

Instructions for the Colorado Sales Tax

and Withholding Account Application

General Information subject to withholding for federal income tax must also

The CR 0100 is used to open a sales tax and withholding withhold Colorado income tax.

account, or to add an additional new physical location to • Oil and Gas Withholding. Every entity that produces

an existing account. Please complete all the sections in or extracts oil shale or oil and gas deposits in Colorado

the application for the applicable account type(s) needed. and every first purchaser of oil shale or oil and gas

Colorado Department of Revenue (DOR) forms and Tax produced from deposits in Colorado who disburse

Guidance Publications referenced in this document are funds to interest owners shall withhold one percent of

available on the DOR taxation website at Tax.Colorado.gov. the gross income from the amount owed to interest

owners. No withholding is required for exempt interest

Licensing and Registration Requirements owners. See Severance Tax Guidance Publications –

and Information: Severance Tax Withholding 4 for more information at

• State Sales Tax License. A state sales tax Tax.Colorado.gov/guidance-publications.

license is required for any person that engages in

the business of selling tangible personal property

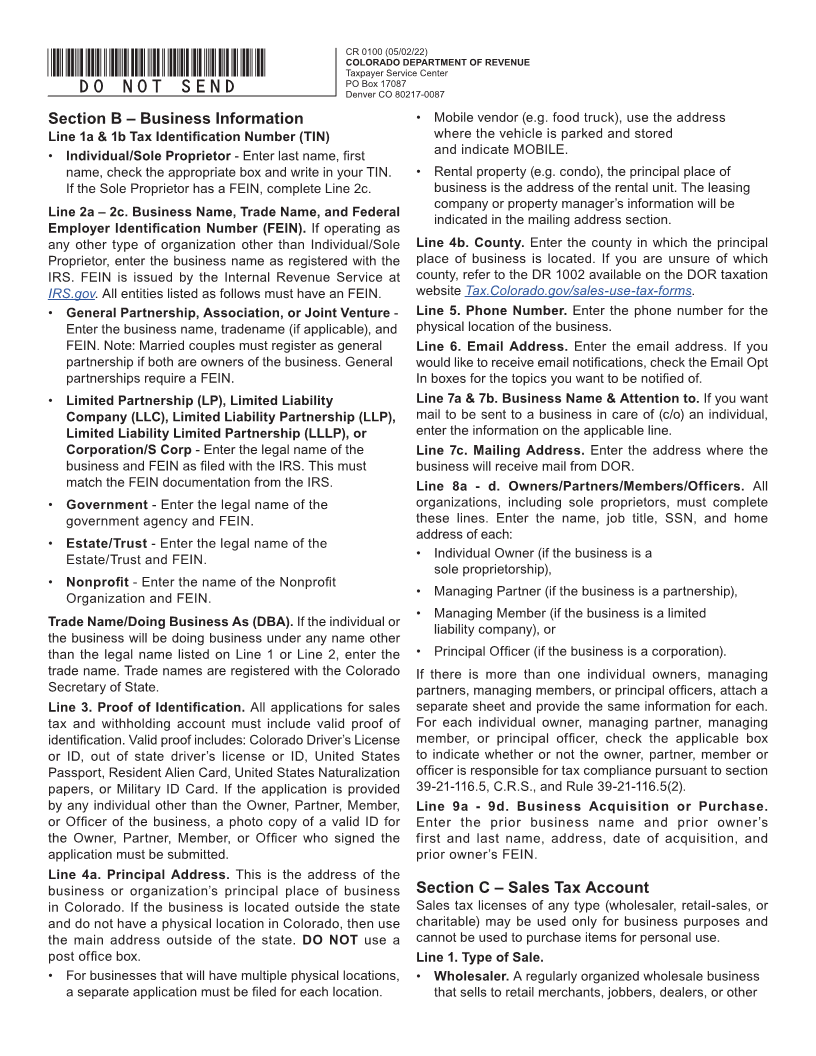

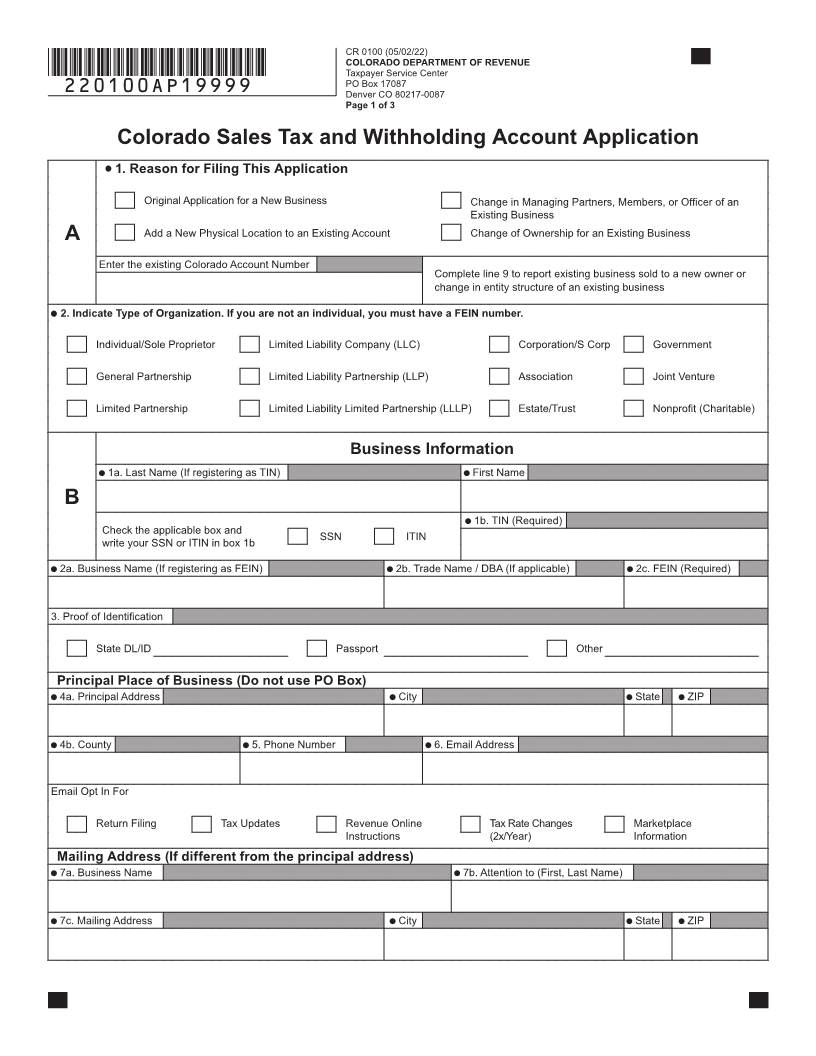

Section A – Reason for Filing This Application

at retail. Any person operating exclusively as a

Box 1.

wholesaler may apply for a license to engage in

the business of selling at wholesale. A license is • Original Application for a New Business. Check this

not required for persons engaged exclusively in the box to request a new sales tax or withholding account

business of selling commodities or services which are for a new (start-up) business.

exempt from taxation. • Add a New Physical Location to an Existing

• State and Local Sales Tax. Colorado has a 2.9% sales Account. Check this box to add a new business location

tax. Additionally, many cities and counties impose their to an existing business that previously registered a

own local sales tax on purchases and transactions sales tax account with DOR, then enter the existing

within their boundaries. There are also special district Colorado Account Number.

taxes that apply in certain boundaries. The Department • Change in Managing Partners, Members, or

administers special districts, counties, and many cities Officers of an Existing Business. Check this

in Colorado, but does not administer sales tax for many box and complete lines 8a-d to report any change

home-rule cities in Colorado. For a complete listing of all in the managing partners, managing members,

applicable tax rates and exemption information for state- or principal officers of an existing business that

administered local sales taxes, see “Colorado Sales/Use previously registered a sales tax or withholding

Tax Rates” (DR 1002) under Forms on the DOR taxation account with the DOR.

website at Tax.Colorado.gov. The DR 1002 is revised

in January and July of each year. You may also visit • Change of Ownership for an Existing Business.

Colorado.gov/Revenue/GIS to find the tax rates. Check this box and complete line 9 to report a change

in ownership for an existing business that previously

Due to the complexities surrounding the laws on registered a sales tax or withholding account with

the collection and remittance of sales/use tax in DOR. A change in ownership may occur if an existing

Colorado, it is recommended that you attend a business is sold to a new owner or if there is a change

business tax offered by the department after opening in the ownership structure of an existing business to

your business and/or obtaining a sales tax license. create a new legal entity. In either case, a new sales tax

Visit Tax.Colorado.gov/business-tax-class for class and/or withholding account is required. NOTE: A new

schedule and registration. sales tax and/or withholding account is not required

• W-2 Withholding. Employers are required to withhold merely as the result of changes in stockholders of a

state income tax from wages paid to all employees corporation, partners in a partnership, or members in a

working in Colorado or who are Colorado residents. limited liability companies. However, any change in the

• 1099 Withholding. Under certain circumstances, managing partners, managing members, or principal

payers may withhold tax on Colorado income reported officers of an existing business change, must be

on 1099 forms (example: retirement income). reported, as described below.

• Gaming Withholding (W2-G). In general, any person Box 2. Type of Organization. Check the box to indicate the

making payment of winnings within Colorado which are legal structure of your business/organization.