Enlarge image

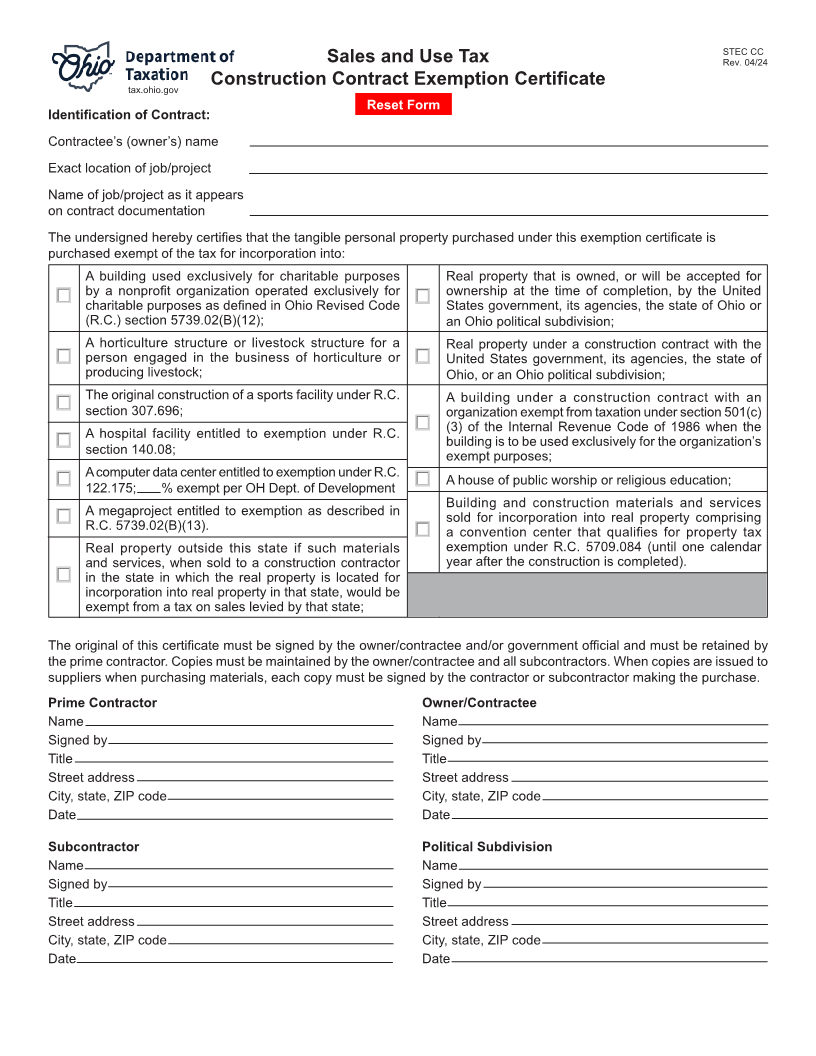

STEC CC

Sales and Use Tax Rev. 04/24

tax.ohio.gov Construction Contract Exemption Certificate

Reset Form

Identification of Contract:

Contractee’s (owner’s) name

Exact location of job/project

Name of job/project as it appears

on contract documentation

The undersigned hereby certifies that the tangible personal property purchased under this exemption certificate is

purchased exempt of the tax for incorporation into:

A building used exclusively for charitable purposes Real property that is owned, or will be accepted for

by a nonprofit organization operated exclusively for ownership at the time of completion, by the United

charitable purposes as defined in Ohio Revised Code States government, its agencies, the state of Ohio or

(R.C.) section 5739.02(B)(12); an Ohio political subdivision;

A horticulture structure or livestock structure for a Real property under a construction contract with the

person engaged in the business of horticulture or United States government, its agencies, the state of

producing livestock; Ohio, or an Ohio political subdivision;

The original construction of a sports facility under R.C. A building under a construction contract with an

section 307.696; organization exempt from taxation under section 501(c)

(3) of the Internal Revenue Code of 1986 when the

A hospital facility entitled to exemption under R.C.

building is to be used exclusively for the organization’s

section 140.08;

exempt purposes;

A computer data center entitled to exemption under R.C.

A house of public worship or religious education;

122.175; % exempt per OH Dept. of Development

Building and construction materials and services

A megaproject entitled to exemption as described in

sold for incorporation into real property comprising

R.C. 5739.02(B)(13).

a convention center that qualifies for property tax

Real property outside this state if such materials exemption under R.C. 5709.084 (until one calendar

and services, when sold to a construction contractor year after the construction is completed).

in the state in which the real property is located for

incorporation into real property in that state, would be

exempt from a tax on sales levied by that state;

The original of this certificate must be signed by the owner/contractee and/or government official and must be retained by

the prime contractor. Copies must be maintained by the owner/contractee and all subcontractors. When copies are issued to

suppliers when purchasing materials, each copy must be signed by the contractor or subcontractor making the purchase.

Prime Contractor Owner/Contractee

Name Name

Signed by Signed by

Title Title

Street address Street address

City, state, ZIP code City, state, ZIP code

Date Date

Subcontractor Political Subdivision

Name Name

Signed by Signed by

Title Title

Street address Street address

City, state, ZIP code City, state, ZIP code

Date Date