Enlarge image

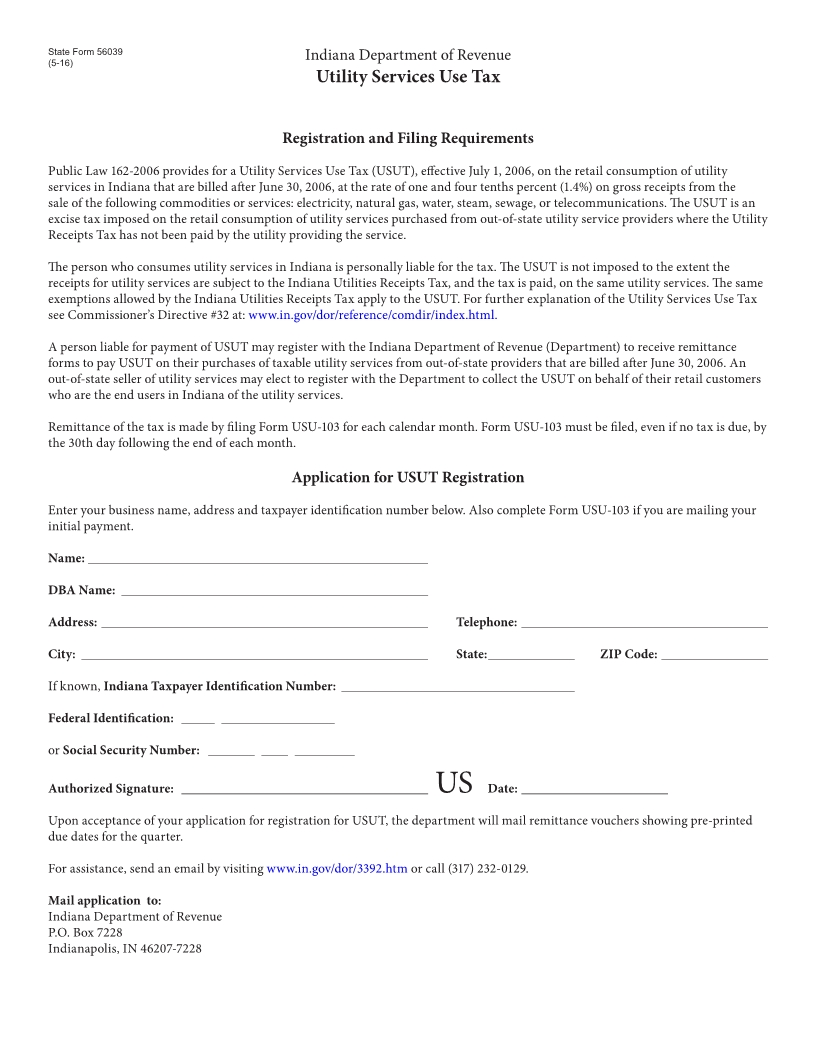

State Form 56039

(5-16) Indiana Department of Revenue

Utility Services Use Tax

Registration and Filing Requirements

Public Law 162-2006 provides for a Utility Services Use Tax (USUT), effective July 1, 2006, on the retail consumption of utility

services in Indiana that are billed after June 30, 2006, at the rate of one and four tenths percent (1.4%) on gross receipts from the

sale of the following commodities or services: electricity, natural gas, water, steam, sewage, or telecommunications. The USUT is an

excise tax imposed on the retail consumption of utility services purchased from out-of-state utility service providers where the Utility

Receipts Tax has not been paid by the utility providing the service.

The person who consumes utility services in Indiana is personally liable for the tax. The USUT is not imposed to the extent the

receipts for utility services are subject to the Indiana Utilities Receipts Tax, and the tax is paid, on the same utility services. The same

exemptions allowed by the Indiana Utilities Receipts Tax apply to the USUT. For further explanation of the Utility Services Use Tax

see Commissioner’s Directive #32 at: www.in.gov/dor/reference/comdir/index.html.

A person liable for payment of USUT may register with the Indiana Department of Revenue (Department) to receive remittance

forms to pay USUT on their purchases of taxable utility services from out-of-state providers that are billed after June 30, 2006. An

out-of-state seller of utility services may elect to register with the Department to collect the USUT on behalf of their retail customers

who are the end users in Indiana of the utility services.

Remittance of the tax is made by filing Form USU-103 for each calendar month. Form USU-103 must be filed, even if no tax is due, by

the 30th day following the end of each month.

Application for USUT Registration

Enter your business name, address and taxpayer identification number below. Also complete Form USU-103 if you are mailing your

initial payment.

Name: ___________________________________________________

DBA Name: ______________________________________________

Address: _________________________________________________ Telephone: _____________________________________

City: ____________________________________________________ State: _____________ ZIP Code: ________________

If known, Indiana Taxpayer Identification Number: ___________________________________

Federal Identification: _____ _________________

or Social Security Number: _______ ____ _________

Authorized Signature: _____________________________________ Date: ______________________

US

Upon acceptance of your application for registration for USUT, the department will mail remittance vouchers showing pre-printed

due dates for the quarter.

For assistance, send an email by visiting www.in.gov/dor/3392.htm or call (317) 232-0129.

Mail application to:

Indiana Department of Revenue

P.O. Box 7228

Indianapolis, IN 46207-7228