Enlarge image

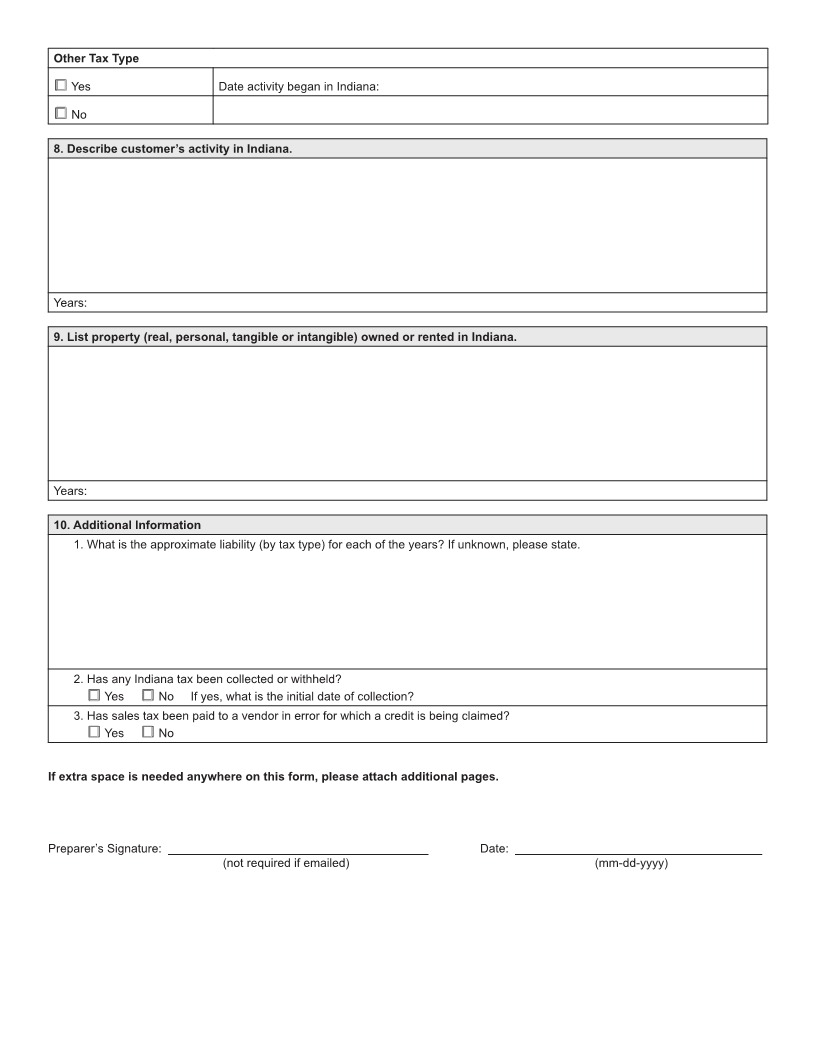

Form Indiana Department of Revenue Voluntary Disclosure Office

Indiana Department of Revenue

VDA-1 Voluntary Disclosure Request 100 N. Senate Ave., IGCN Room N241

State Form 56462

(1-18) Indianapolis, Indiana 46204

Phone: (317) 233-6036 | FAX: (317) 234-5531 | Website:www.in.gov/dor

1.Customer Identification

□ Yes □ No Are you representating a taxpayer requesting Voluntary Disclosure?

Customer or Representative Name Taxpayer FEIN or SSN

Contact Name Contact Title

Mailing Address Telephone FAX

City State ZIP Code Email Address

2. Type of Entity/Ownership

□ Sole Proprietor □ Partnership □ LLC-Taxed as a Partnership □ LLC-Taxed as a Corporation □ C-Corp

□ S-Corp □ Other (describe):

3. Is customer reqistered with the Indiana Secretary of State?

□ Yes □ No If yes, year:

4. Has the customer been contacted by the Indiana Department of Revenue regarding this liability?

□ Yes □ No

5. Does customer’s income tax end on December 31?

□ Yes □ No If no, enter the fiscal year end date:

6. Has customer filed any recent short period income tax returns?

□ Yes □ No If yes, specify period ends:

7. Voluntary Disclosure by Tax Type

Returns □ Yes □ No If yes, please list below.

Sales and Use Tax

□ Yes Date activity began in Indiana:

□ No, explain □ Already filing □ Exempt □ Other, explain:

Franchise/Income Tax

□ Yes Date activity began in Indiana:

□ No, explain □ Already filing □ Protected by PL86-272 □ Other, explain:

Withholding Tax

□ Yes Date activity began in Indiana:

□ No, explain □ Already filing □ Exempt □ Other, explain: