Enlarge image

INDIANA 2 02 2 FIT-20 Financial Institution Tax Booklet This booklet contains forms and instructions for preparing Indiana financial institution returns for tax year 2022 and for fiscal years beginning in 2022 and ending in 2023.

Enlarge image | INDIANA 2 02 2 FIT-20 Financial Institution Tax Booklet This booklet contains forms and instructions for preparing Indiana financial institution returns for tax year 2022 and for fiscal years beginning in 2022 and ending in 2023. |

Enlarge image |

SP 244

(R20 / 8-22)

Page 2 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

INDIANA FIT-20

Financial Institution Tax Booklet Year 2022

Contents

What’s New for 2022 ..............................................................................................................................................................4

General Information ..............................................................................................................................................................4

General Filing Requirements for FIT-20 Forms and Schedules .......................................................................................4

Instructions for Completing Form FIT-20 ..........................................................................................................................7

Certification of Signatures and Authorization Section ..................................................................................................15

Mailing Options ....................................................................................................................................................................16

Other Tax Liability Credits Available to Financial Institutions ......................................................................................16

Instructions for FIT-20 Schedule E-U Apportionment of Receipts to Indiana ...........................................................19

Instructions for Filing a Combined Return: Attributing Receipts of a Taxpayer Filing a Combined Return .........20

Instructions for Schedule FIT-NRTC – Nonresident Tax Credit ...................................................................................20

Instructions for Form FT-ES ..............................................................................................................................................21

Additional Information .......................................................................................................................................................21

FIT-20 Financial Institution Booklet 2022 Page 3

|

Enlarge image |

INTIME e-Services Portal Available

INTIME, DOR’s e-services portal, available at intime.dor.in.gov, General Information

provides the following functionalities for FIT-20 customers:

• Make payments using a bank account or credit card Annual Public Hearing

• View and respond to correspondence from DOR In accordance with the Indiana Taxpayer Bill of Rights, the

• Request and print return transcripts on-demand Indiana Department of Revenue will conduct an annual public

• Electronic delivery of correspondence hearing in Indianapolis in June of 2023. Event details will be listed

• Online customer service support through secure messaging at www.in.gov/dor/news-media-and-publications/dor-public-

events/annual-public-hearings. Please come and share feedback

Increased Online Support for Tax Preparers or comments about how DOR can better administer Indiana tax

In addition to the functionality listed above, INTIME provides laws. If you cannot attend, please submit feedback or comments

increased access and functionality for tax preparers. INTIME in writing to Indiana Department of Revenue, Commissioner’s

provides the following functionality for tax preparers: Office MS# 101, 100 N. Senate Ave., Indianapolis, IN 46204.

• Gain access to view and manage multiple customers under

one login Our homepage provides access to forms, information bulletins

• Ability to file returns, make payments, and view file and pay and directives, tax publications, email, and various filing options.

history for clients Visit www.in.gov/dor.

• Request electronic power of attorney (ePOA) authorization to

view customer accounts

• View and respond to correspondence for clients

General Filing Requirements for FIT-20

We strongly encourage all taxpayers to make payments and file Forms and Schedules

returns electronically whenever possible. INTIME also allows Copies of pages 1 through 5 of the corporation’s federal income tax

customers to make estimated payments electronically with just a return must be enclosed with Form FIT-20 along with Schedule M-3

few clicks. as well as any extension of time to file form(s). This requirement is

made under the authority of Indiana Code (IC) 6-5.5-6-5.

Extension of Time to File

What’s New for 2022

All Indiana financial institutions tax return due dates are treated

the same as extensions granted because of a federal income tax

References to the Internal Revenue Code

The definition of adjusted gross income (AGI) is updated to due date extension.

correspond to the federal definition of adjusted gross income

contained in the Internal Revenue Code (IRC). Any reference to Who Must File Form FIT-20

the IRC and subsequent regulations means the Internal Revenue IC 6-5.5-2-1 imposes a financial institution tax on the adjusted gross

Code of 1986, as amended and in effect on March 31, 2021. For a income of any corporation transacting the business of a financial

complete summary of new legislation regarding taxation, please see institution, including a holding company, a regulated financial

the Synopsis of 2022 Legislation Affecting the Indiana Department of corporation, a subsidiary of a holding company or regulated

Revenue at www.in.gov/dor/files/2022-legislative-synopsis.pdf. financial corporation, or any other corporation carrying on the

business of a financial institution. Any taxpayer who is subject to tax

under IC 6-5.5 is exempt from Indiana’s adjusted gross income tax.

Credits

• School Scholarship Tax Credit Contribution ceiling

increased. The total of allowable net contributions to the The financial institution tax extends to financial institutions and

program has increased to $18.5 million for the program’s to all other corporate entities when 80% or more of its gross

fiscal year of July 1, 2022 through June 30, 2023. income is derived from activities that constitute the business

• A new credit (867) is available for qualifying donations to of a financial institution. The business of a financial institution

approved foster care organizations. See page 1 7 for more is defined as activities authorized by the federal reserve board; the

details. making, acquiring, selling, or servicing of loans or extensions of

• A new credit (868) is available for the venture capital credit; acting as an agent, a broker, or an advisor in connection

investment credit for amounts provided to a Qualified Indiana with leasing real and personal property that is the economic

Investment Fund. See page 1 9 for more information. equivalent of an extension of credit; or operating a credit card,

• A new credit (869) is available for qualified film and media debit card, or charge card business.

productions. See page 1 6for more information.

• Beginning in 2022, the Headquarters Relocation Credit File the general Indiana corporate adjusted gross income

(818) must be reported on Schedule IN-OCC. tax return, Form IT-20, if for the taxable year the 80%

threshold of gross income derived from activities that

constitute the business of a financial institution is not met.

Utility Receipts Tax and Utility Services Use Tax

The utility receipts tax has been repealed for gross receipts This form is available online at www.in.gov/dor/tax-forms/2022-

received after June 30, 2022. In addition, the utility services use corporatepartnership-income-tax-forms/.

tax has been repealed for billings issued after June 30, 2022.

Page 4 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

Due Date • Maintaining or defending an action or a suit;

The return due date is the 15th day of the 5th month after the end • Filing, modifying, renewing, extending, or transferring a

of the tax year. mortgage, deed of trust, or security interest;

• Acquiring, foreclosing, or otherwise conveying property in

Apportionment of Adjusted Gross Income Indiana as a result of a default under the terms of a mortgage,

The financial institution tax is imposed on the apportioned deed of trust, or security interest relating to the property;

Indiana income of financial institutions. The law employs a • Selling tangible personal property, if taxation under this law

single-factor receipts formula to determine the percentage of the is precluded because of P.L. 86-272;

taxpayer’s income subject to the tax. The single-factor formula is • Owning an interest in the following types of property

derived by dividing the gross receipts attributable to transacting even though activities are conducted in Indiana that are

business in Indiana by the total receipts from transacting business reasonably required to evaluate and complete the acquisition

in all taxing jurisdictions. or disposition of the property, the servicing of the property,

or the income from the property, or the acquisition or

Nexus Rules liquidation of collateral relating to the property;

The law is based on the ability of a corporation under modern • An interest in a real estate mortgage investment conduit, a

technology to transact the business of a financial institution in real estate investment trust, or a regulated investment

Indiana, regardless of the principal location of its offices and company;

employees. • An interest in a loan-backed security representing ownership

or participation in a pool of promissory notes or certificates

A taxpayer is transacting business in Indiana for purposes of the of interest providing for payments in relation to payments

FIT when it satisfies any of the following eight tests: or reasonable projections of payments on the notes or

• Maintains an office in Indiana; certificates;

• Has an employee, a representative, or an independent • An interest in a loan or other asset where the interest is

contractor conducting business in Indiana; attributed to a consumer loan, commercial loan, or secured

• Regularly sells products or services of any kind or nature to commercial loan and where the payment obligations were

customers in Indiana who receive the product or service in solicited and entered into by a person who is independent

Indiana; and not acting on behalf of the owner;

• Regularly solicits business from potential customers in • An interest in the right to service or collect income from a

Indiana; loan or other asset where interest on the loan is attributed

• Regularly performs services outside Indiana that are as a loan described above and the payment obligations were

consumed within Indiana; solicited and entered into by a person who is independent

• Regularly engages in transactions with customers in Indiana and not acting on behalf of the owner; or

involving intangible property, including loans, but not • An amount held in an escrow or trust account with respect to

property described in IC 6-5.5-3-8(5), and resulting in the property described previously.

receipts flowing to the taxpayer from within Indiana; Acting:

• Owns or leases tangible personal or real property located in • As an executor of an estate;

Indiana; or • As a trustee of a benefit plan;

• Regularly solicits and receives deposits from customers in • As a trustee of an employee’s pension, profit sharing, or other

Indiana. retirement plan;

• As a trustee of a testamentary or inter vivos trust or corporate

A taxpayer is presumed to “regularly” engage in the above indenture; or

activities when its assets attributable to Indiana are equal to at • In any other fiduciary capacity, including holding title to real

least $5 million or it has 20 or more Indiana customers. property in Indiana.

Exempt Entities Method of Reporting

Four specific types of organizations are exempted from the FIT: A taxpayer is allowed to file a separate return only in those

• Insurance companies otherwise subject to tax under instances where the taxpayer is not a member of a unitary

IC 6-3, IC 27-1-2-2.3, or IC 27-1-18-2; group. Members of a unitary group must file collectively on one

• International banking facilities; combined return. No provision is made for filing consolidated

• S corporations exempt from income tax under IRC Section returns.

1363; and

• Nonprofit corporations unless the nonprofit corporation If the taxpayer is a member of a unitary group, combined

has unrelated business income (with the exception of state reporting is mandatory. However, if the taxpayer determines that

chartered credit unions). Federal law prohibits state taxation its Indiana income is not accurately reflected by the filing of a

of federally chartered credit unions. combined return, the taxpayer can petition DOR. Such petition is

subject to approval by DOR. The petition must include the name

Exempt Transactions and federal employer identification number of each member of

A taxpayer is not considered to be transacting business in Indiana the group petitioning for an alternative method. Each member

if the ONLY activities of the taxpayer in Indiana are in connection must include its justification for the alternative method.

with any of the following:

FIT-20 Financial Institution Booklet 2022 Page 5

|

Enlarge image |

Petitions may be sent to: A partnership is not required to withhold FIT on behalf of its

Indiana Department of Revenue resident corporate taxpayers as defined by IC 6-5.5-1-13. The

Tax Policy Division resident corporate partners are responsible for paying the relevant

100 N Senate Ave, N248, MS 102 FIT or adjusted gross income tax themselves. See the Instructions

Indianapolis, IN 46204-2253 for Form IT-65 for further information regarding withholding

requirements.

Once the petition is approved, the taxpayer will indicate on the

annual return that the return is a separate return made by a Example. A bank in Maine and a bank in Indiana form a

member of a unitary group. Attach DOR’s letter granting petition partnership to make loans to Indiana borrowers. The only Indiana

to the annual return filing. activity of the Maine bank is its involvement in the partnership.

The partnership is required to withhold FIT on the Maine bank’s

Members of a Unitary Group share of the partnership income.

The combined return shall include the adjusted gross income of

all members of the unitary group that are transacting business United States Government Obligations

wholly or partially within Indiana. The statute provides exclusion Although interest earned on U.S. obligations is not subject to

for the income of corporations or other entities organized in income taxation, it is not preempted by federal law from being

foreign countries, except a federal or state branch of a foreign included in the tax base of a franchise tax. Therefore, interest

bank or its subsidiary that transacts business in Indiana. from U.S. obligations is not to be subtracted from federal taxable

income in determining the adjusted gross income for the FIT.

“Unitary business” means business activities or operations that

are of mutual benefit, dependent upon or contributory to one Extensions for Filing

another, individually or as a group, in transacting the business DOR accepts the federal extension of time application (Form

of a financial institution. The term can be applied within a 7004) or the federal electronic extension. If the taxpayer has

single entity or between multiple entities and without regard to one, there is no need to contact DOR prior to filing the annual

whether each entity is a corporation, partnership, or trust. Unity return. Returns postmarked within one month after the last date

is presumed if there is unity of ownership, operation, or use as indicated on the federal extension will be considered timely filed.

evidenced by centralized purchasing, advertising, accounting, or If the taxpayer does not need a federal extension of time but needs

other controlled interaction among entities that are members of one for filing a state return, an extension request and prepayment

the unitary group as defined in IC 6-5.5-1-18(a). of 90% can be submitted via INTIME, DOR’s e-services portal

at intime.dor.in.gov, or by submitting a letter requesting an

Unity of ownership exists for a corporation if it is a member of a extension prior to the annual return’s due date.

group of two or more business entities, 50% of whose voting stock

is owned by a common owner or owners or by one or more of the To request an Indiana extension of time to file by letter, contact:

member corporations of the group. Indiana Department of Revenue

Corporate Income Tax

The taxpayer designated as the reporting member of a unitary Tax Administration

group shall file a combined return that includes all operations P.O. Box 7206

of the unitary business. List members included in the combined Indianapolis, IN 46207-7206

return by completing FIT-20 Schedule H. See Instructions for

Filing a Combined Return beginning on page 20. If there is a valid extension of time or a federal electronic extension

to file, check Yes on line V on the front of the return. If applicable,

Partnerships enclose a copy of the federal extension of time when filing the state

Partnerships and trusts as entities are not subject to FIT. return.

Partnerships conducting the business of a financial institution are

required to file the appropriate informational return, Form IT-65. An extension of time granted under IC 6-8.1-6-1 waives the late

Trusts conducting the business of a financial institution in Indiana payment penalty for the extension period on the balance of tax

are required to file the appropriate tax returns. due provided at least 90% of the tax due is paid by the original due

date and the remaining balance, plus interest, is paid in full by the

If the entity is a partnership and has nonresident corporate extended due date. Use DOR’s e-services portal, INTIME, at intime.

partners that are themselves conducting the business of a dor.in.gov to make an extension payment for the taxable year.

financial institution, the partnership is required to withhold FIT

on behalf of the non-resident corporate partner on the non- If a payment is not submitted electronically, it must be made with

resident partner’s share of the partnership income. If the non- the financial institution preprinted extension form included with

resident corporate partner is not otherwise itself conducting the the estimated coupon packet Form FT-ES. This payment will be

business of a financial institution, the partnership is required to processed as a fifth estimated payment.

withhold Indiana adjusted gross income tax on the non-resident

partner’s share of the partnership income. The apportionable Note. Any tax paid after the original due date must include interest.

income attributable to the partner is the same percentage as its Interest on the balance of tax due must be included with the return

distributive share of the partnership’s income. when it is filed. Interest is computed from the original due date

until the date of payment. In October of each year, DOR establishes

Page 6 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

the interest rate for the next calendar year. See Departmental Notice If DOR notifies a corporation of the requirements to remit by

#3 at www.in.gov/dor/files/reference/dn03.pdf for interest rates. EFT, the corporation must remit via EFT by the date/tax period

specified by DOR.

Amended Returns

A taxpayer must notify DOR within 180 days of final alterations Failure to comply with the EFT requirement will result in a 10%

or modifications to its federal income tax return (federal penalty on each quarterly estimated tax payment not sent by

adjustment, RAR, etc.) by filing an amended Form FIT-20. EFT. Indiana Code does not require the extension of time to file

payment or final payment due with the annual tax return to be

To amend a previously filed Form FIT-20, file a corrected copy of made by EFT. Be sure to claim any EFT payment as an extension

the original form. Check the box at the top of the form for filing or estimated payment credit. Do not file a return indicating an

an amended return. amount due for an amount that has been paid by EFT.

To claim a refund of an overpayment, file the return within three Penalty for Underpayment of Estimated Taxes

years from the latter of the date of the overpayment or the due date (IC 6-5.5-7-1)

of the return. IC 6-8.1-9-1 entitles a taxpayer to claim a refund Corporations estimating financial institution tax liability are

because of a reduction in tax liability resulting from a final federal subject to a 10% underpayment penalty if the corporation fails

modification. The claim for refund must be filed within 180 days to file estimated tax payments or fails to remit the sufficient

from the date of notice of the final modification by the Internal amount of estimated payments. To avoid the penalty, the required

Revenue Service unless the normal three year statute of limitations quarterly estimated payment(s) should include at least 20% of the

has yet to expire. If an agreement to extend the statute of limitations final financial institution tax liability for the current taxable year

for an assessment is entered into between the taxpayer and DOR, or 25% of the corporation’s final financial institution tax liability

the period for filing a claim for refund is likewise extended. for the previous tax year.

Estimated Quarterly Payments The penalty for the underpayment of estimated tax is assessed

Quarterly payments of estimated financial institution tax are on the difference between the actual amount paid by the

required under IC 6-5.5-6-3 if the annual tax liability is $2,500 or corporation for each quarter and 20% of the final liability for the

more. The quarterly due dates for estimated quarterly payments current year or 25% of the corporation’s final tax liability for the

of a calendar year filer are April 20, June 20, September 20, and previous tax year, whichever is less. Refer to Schedule FIT-2220,

December 20 of the taxable year. Underpayment of Estimated Tax by Financial Institutions, on

return page 4 of Form FIT-20.

If a taxpayer uses a taxable year that does not end on December

31, the due dates for the estimated quarterly financial institution

tax payments are on or before the 20th day of the 4th, 6th,

Instructions for Completing Form FIT-20

9th, and 12th months of the taxpayer’s taxable year. Estimated

quarterly payments can be made via INTIME, DOR’s e-services Filing Period and Identification

portal at intime.dor.in.gov. File a 2022 Form FIT-20 return for a taxable year ending Dec.

31, 2022; a short tax year beginning in 2022; or a fiscal tax year

If a payment is not submitted electronically via INTIME, it beginning in 2022 and ending in 2023. For a short or fiscal tax

must be made with the financial institution estimated quarterly year, fill in the beginning month and day and the ending date of

vouchers, Form FT-QP. DOR mails preprinted FT-QP vouchers to the taxable year at the top of the form.

current FIT estimated account holders.

Please use the correct legal name of the corporation and its

Important. Estimated payments of $5,000 or more are required present mailing address.

to be made electronically, with a penalty assessed for failure to

comply. See page 4 for information about using INTIME, For foreign addresses, please note the following:

DOR’s e-services portal. • Be sure to enter the name of the city, town, or village in the

box labeled City;

Electronic Payment Requirements • Be sure to enter the name of the state or province in the box

If the amount of financial institution tax exceeds an average liability labeled State; and

of $5,000 per quarter (or $20,000 annually), a customer’s quarterly • Enter the postal code in the box labeled ZIP Code; and

estimated tax payments must be remitted electronically via INTIME, • Enter the 2-digit country code.

DOR’s e-services portal at intime.dor.in.gov, or with an electronic

funds transfer (EFT). If DOR is unable to obtain payment by the For a name change, check the box at the top of the return. Enclose

EFT, a penalty of $35 will be assessed. Because there is no minimum with the return copies of the amended Articles of Incorporation

amount of payment, DOR encourages all taxpayers not required to or an Amended Certificate of Authority filed with the Indiana

remit by EFT to participate voluntarily in our EFT program. Secretary of State.

Note. Taxpayers remitting by EFT should not file quarterly FT-QP Note. Corporate addresses, contact names, and other account

coupons. The amounts paid by EFT are reconciled when filing the information may be updated using our self-service portal, INTIME.

annual income tax return.

FIT-20 Financial Institution Booklet 2022 Page 7

|

Enlarge image |

The federal employer identification number (FEIN) shown in the Line 5. Enter the amount deducted for bad debt reserves of banks

box must be correct. (IRC Sec. 585).

List the two-digit county code if filing a return for a corporate Line 6. Enter the amount deducted for bad debt reserves (IRC

address in Indiana. See Departmental Notice #1 located at www. Sec. 593).

in.gov/dor/files/reference/dn01.pdf for a list of county codes.

Enter “00” (two zeroes) in the county box D if corporate address Line 7. Enter the amount deducted for charitable contributions

lies outside of Indiana. (IRC Sec. 170).

Enter the principal business activity code, derived from the Line 8. Enter the amount deducted on the federal return for all state

North American Industry Classification System (NAICS), in the and local taxes based on or measured by income (IRC Sec. 63).

designated block of the return. Use the six-digit activity code as

reported on the federal corporation return. Line 9. Enter an amount equal to the capital loss carryover (from

federal Schedule D: line 6, minus line 18 loss amount) to the

Lines L through W of the FIT-20 must be completed for the extent used in offsetting capital gains allowed under IRC Section

return to be accepted by DOR. Check or complete all boxes that 1212. See the instructions to line 23 for subtracting the amount

apply to the return. deductible for Indiana net capital losses.

Check the “final return” box only if the corporation is dissolved, Line 10. Enter the amount of interest on state and local

liquidated, or has withdrawn from the state. Timely file Form BC- obligations excluded under IRC Section 103, or under any other

100 to close out any sales and withholding accounts. Complete these federal law, minus the associated expenses disallowed in the

online at www.in.gov/dor/business-tax/closing-a-business-account/. computation of taxable income under IRC Section 265.

Check the appropriate box if filing as a real estate mortgage Lines 11 A, B, C, and D. Other Income Modifications

investment conduit (REMIC). Note. The return for a REMIC is Enclose a complete explanation for adjustments.

due on the 15th day of the 4th month following the close of the

taxpayer’s tax year. Line 11A. Add or subtract an amount equal to the amount claimed

as a deduction for excess business interest. If a deduction for

Indicate on line Vif an extension of time to file is in effect. If interest paid or incurred in the current year has been disallowed

applicable, enclose a copy of federal Form 7004 when filing the under IRC Section 163(j), subtract the amount of interest

state return. disallowed in the current year. If you have interest that was actually

paid or incurred in a previous taxable year but disallowed for

Schedule A – Line Instructions federal purposes due to the limitations under IRC Section 163(j)

Per IC 6-8.1-6-4.5, round amounts to the nearest whole dollar. AND deducted for federal purposes in the current taxable year,

Each line on which an amount can be entered has a “.00” already add back the amount of interest so deducted for federal purposes.

filled in. This is a reminder that rounding is now required when

completing the tax return. Line 11B. Add or subtract an amount attributable to bonus

depreciation in excess of any regular depreciation that would be

Also, do not use a comma in dollar amounts of four digits or allowed had not an election under IRC Section 168(k) been made

more. For example, instead of entering “3,455” enter “3455.” as applied to property in the year that it was placed into service.

Taxpayers who own property for which additional first-year

Line 1. Enter federal taxable income from Federal Form 1120 special depreciation for qualified property, including 100% bonus

before the net operating loss deduction or the special federal depreciation, was allowed in the current taxable year or in an

deduction. earlier taxable year, must add or subtract an amount necessary

to make adjusted gross income equal to the amount computed

Note. If filing as a state-chartered credit union or an investment without applying any bonus depreciation. The subsequent

company registered under the Investment Company Act of 1940, depreciation allowance is to be calculated as if no bonus

proceed to line 19 to enter adjusted gross income as defined under depreciation had been claimed until the property is disposed or

IC 6-5.5-1-2(b) and(c). the property is fully depreciated for Indiana purposes. If line 11B’s

amount is negative, use a minus sign to denote that.

Line 2. Enter the qualifying dividend deduction.

Special rules may apply if the bonus depreciation is taken against

Line 3. Subtract line 2 from line 1. property acquired in a like-kind exchange. See Income Tax

Information Bulletin #118 at www.in.gov/dor/files/reference/

Add backs: Lines 4 through 10. ib118.pdf for additional information.

Line 4. Enter the amount deducted for bad debt (IRC Sec. 166).

See line 16 to report recovery of a previously reported worthless The additional regular depreciation may be excluded in subsequent

debt to the extent a deduction was allowed from gross income in a years from the amounts to be added back on line 11B, or 11C

prior tax year under IRC Sec. 166(a). when excess IRC Section 179 deduction or bonus depreciation was

elected for assets placed in service in those subsequent years.

Page 8 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

See Income Tax Information Bulletin #118 available at www. for federal purposes that exceeded the amount allowable for

in.gov/dor/files/reference/ib118.pdf for information on the Indiana purposes. The accumulated depreciation on such an asset

allowance of depreciation for state tax purposes. through 2012 is, therefore, different for federal and state purposes.

This difference will remain until the asset is fully depreciated or

Line 11C. Add or subtract the amount necessary to make the until the time of its disposition.

adjusted gross income of the taxpayer that placed any IRC Section

179 property in service in the current taxable year or in an earlier So, in this example, the asset was acquired in January 2009 at a

taxable year equal to the amount of adjusted gross income that purchase price of $120,000. This normally would have a 25-year

would have been computed as if the federal limit for expensing recovery period, but IRC Sec. 168 allows for a 15-year recovery

under IRC section 179 was $25,000 as opposed to $1,000,000 period. Tax year 2012 is the last year ABC Company will have

(adjusted for inflation). reported a qualified restaurant equipment add-back until the end

of the 15-year recovery period.

Indiana has adopted an expensing cap of $25,000. This

modification affects the basis of the property if a higher Section If this asset was sold before being fully depreciated, the catch-up

179 limit was applied. The federal increase to a $1,000,000 modification would be reflected in the year of the sale. However, if

deduction was not allowed for purposes of calculating Indiana this property is held through 2023 (the 15th year of depreciation),

adjusted gross income. However, the $2,500,000 threshold for ABC Company will report a negative $9,600 catch-up add-back

phase-out (adjusted for inflation) is allowed for purposes of on the 2023 state tax return.

calculating Indiana AGI. The depreciation allowances in the

year of purchase and in later years must be adjusted to reflect The following add-backs and deductions should be entered on

the additional first-year depreciation deduction, including the lines 12A through 12D:

special depreciation allowance for 100% bonus depreciation

property, until the property is sold or fully depreciated for Indiana Meal Deduction Add-Back (3-digit code: 149)

purposes. If you:

• claimed a deduction for meal expenses with regard to food

Special rules may apply if the Section 179 expensing is taken and beverages provided by a restaurant in computing your

against property acquired in a like-kind exchange. See Income federal taxable income; AND

Tax Information Bulletin #118 at www.in.gov/dor/files/reference/ • the deduction would have been limited to 50% of the meal

ib118.pdf for additional information. expenses if the expenses had been incurred before Jan. 1, 2021,

add back the amount deducted for federal purposes in excess of

Note. The net amount determined for the net bonus depreciation 50% of the food or beverage expenses.

or the IRC Section 179 add-back might be a negative figure

(because of a higher depreciation basis in subsequent years). If Do not add back any amounts for which an exception to the 50%

it is, use a minus sign to denote that. (If the taxable income is a limitation was in effect for amounts paid before Jan. 1, 2021.

loss, this adjustment increases a loss when added back.) Enclose a

statement to explain the adjustment. Example. Bank, Inc. incurs $2,000 in meal expenses during 2022

and deducts the entire $2,000 in computing Bank, Inc.’s 2022

Line 11D. Deduct the amount of income from qualified utility federal taxable income. The meal expenses do not qualify for a

and plant patents included in federal taxable income as permitted federal exception from the 50% limitation under IRC § 274. Bank,

under IC 6-3-2-21.7. Note. Use a minus sign to denote the Inc., is required to add back $1,000.

negative amount. For tax years beginning after Dec. 31, 2007, a

portion of this income is exempt from Indiana AGI. For more Government or Civic Group Capital Contribution Deduction

information, see Income Tax Information Bulletin #104 available (3-digit code: 633)

at www.in.gov/dor/files/reference/ib104.pdf. Subtract any amount included in federal taxable income that are

capital contributions from a government or civic group and not

Lines 12 A, B, C, and D. Total Add-Backs excluded under IRC Section 118.

Enter any add-backs and deductions on lines 12A through 12D.

Enter the name of the add-back/deduction, its 3-digit code, and COVID-related Employee Retention Credit Disallowed

its amount. Use a minus sign to denote a negative amount. Attach Expenses Deduction (3-digit code: 634)

additional sheets if necessary. If you had a deduction that was disallowed for federal purposes

because an employer claimed a federal COVID-related employee

Adding Back Depreciation Expenses retention credit, deduct the amount that was:

Several of the discontinued add-backs were created by timing • disallowed for federal purposes; and

differences between federal and Indiana allowable expenses. • that otherwise would have been allowable in determining

Following is an example of how to report a difference: Indiana adjusted gross income.

Example. ABC Company has qualified restaurant equipment. For Do not deduct any amounts for amounts disallowed for non-

federal tax purposes, they use the accelerated 15-year recovery COVID related employee retention credits such as disaster-related

period for an asset placed in service in 2009. Since 2009, ABC employee retention credits.

Company has been adding back the depreciation expense taken

FIT-20 Financial Institution Booklet 2022 Page 9

|

Enlarge image |

For 2022, this should only be deducted if the deduction is derived Investment companies, defined under IC 6-5.5-1-2(d), must

from a pass through entity that has a fiscal year beginning in 2021. begin on line 19 by reporting federal taxable income computed

according to the Internal Revenue Code plus interest on state and

Line 13. Total Add-Backs: Add lines 4 through line 12D. local obligations acquired by the taxpayer after Dec. 31, 2011,

and excluded from federal gross income under IRC section 103 ,

Line 14. Subtotal Income: Add line 3 and line 13. before any net operating loss deduction. An investment company

must also complete line 12 of FIT-20 Schedule E-U.

Deductions from Income

Line 15. Subtract net income (foreign gross receipts less the Line 20. Total Income Prior to Apportionment: Enter the

foreign deductions) derived from sources outside the United States amount carried from line 19.

as defined in the Internal Revenue Code and included in federal

taxable income. Include all repatriated dividend income listed on Line 21. Apportionment Percentage: (See instructions for

the IRC 965 Transition Tax Statement and included in Line 1 of the Schedule E-U.) This line should be used by all taxpayers and

FIT-20 on this line. Filers should keep detailed records as DOR can unitary groups. Enter the amount from line 15 of Schedule E-U.

ask for this information at a later date.

Line 22. Apportioned Adjusted Gross Income for Indiana:

Line 16. Subtract an amount equal to a debt or portion of a debt Multiply line 20, total income subject to apportionment, by line

becoming worthless (IRC Sec. 166). This will include reporting 21, apportionment percentage from Schedule E-U.

a modification as a positive adjustment for any recovery of an

amount of previously reported bad debts that were included in Line 23. Indiana Net Capital Loss Adjustment: Enter your

a bad debt deduction in prior years (applicable to taxpayers not Indiana net capital loss carryover (see the sample worksheet on

defined as a large bank under IRC Section 585(c)(2) or Savings page 11). Line 23 is limited to the amount on line 22. Also, line

Association under IRC Section 593). 9 must be completed to add back an amount equal to the federal

net capital loss deduction.

Line 17. Subtract an amount equal to any bad debt reserves

included in federal income because of accounting method Note. Excess capital losses may be carried forward for five years

changes required by IRC Sec. 585(c)(3)(A) or IRC Section 593. following the loss year; however, there is no provision for the

carryback of a capital loss incurred under the FIT.

Line 18. Total Deductions: Add lines 15 through 17.

Line 19. Total Income Prior to Apportionment: Subtract line 18

from line 14.

State-chartered credit unions must begin on line 19 by entering

“adjusted gross income.” For state-chartered credit unions,

“adjusted gross income” equals the total transfers to undivided

earnings, minus dividends for that taxable year after statutory

reserves are set aside under IC 28-7-1-24. In other words,

“adjusted gross income” can be defined as net transfers to

undivided earnings. No other deductions are permitted. The

above definition also applies to a nonresident credit union doing

business in Indiana.

Page 10 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

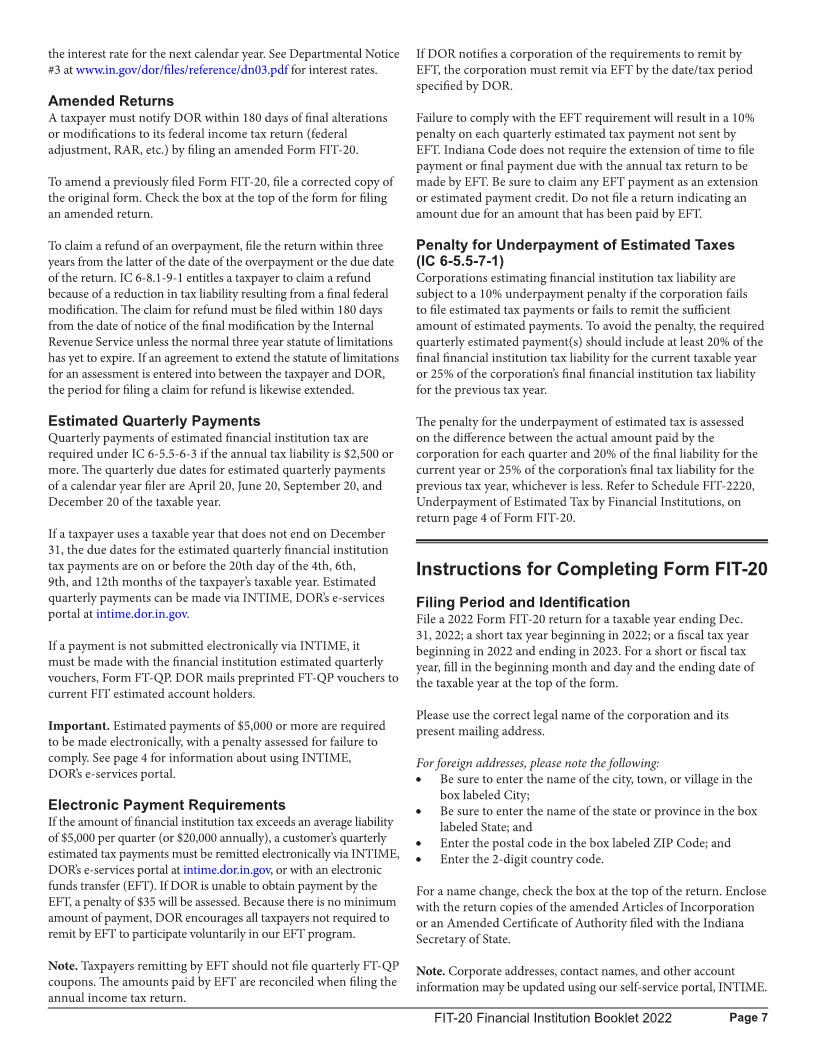

Net Capital Loss Adjustment for FIT-20 Line 23 – Sample Worksheet

Enclose with the return the worksheet that shows the following calculations. Use this format to determine the available amount of an Indiana

net capital loss and the remainder to carry forward. Add sheets to include all members of a unitary group. See the worksheet on page 12.

Computation of Indiana Net Capital Loss for Carryforward

For a taxpayer who is not filing a combined return, the taxpayer’s taxable income consists of an adjustment for net capital losses computed

under the Internal Revenue Code and derived from Indiana. Capital losses and capital gains derived from Indiana are determined by the

apportionment percentage applicable to each taxable year.

Example – Loss Year Ending 12-31-2021:

1. Net capital loss from federal Schedule D without IRC Section 1212 carryover ..............................................................................-$80,000

2. FIT-20 Indiana apportioned income percentage for the taxable year of the capital loss ..................................................................... 50%

3. Indiana net capital loss for carry forward (limited to succeeding five years) .................................................................................-$40,000

Additional provisions required for a combined return. Any net capital loss or net operating loss attributable to Indiana in the combined

return must be prorated between each member of the unitary group having nexus in Indiana. Each member must calculate its share of

the capital loss and amount available to be applied for the combined return.

The net capital loss attributable to Indiana in the combined return is prorated between each taxpayer member of the unitary group by

the quotient of:

a. The Indiana receipts of those taxpayer members attributable to Indiana, divided by;

b. The total receipts of all taxpayer members to Indiana.

Example:

Indiana receipts attributable to: Member A Member B Member C Combined Indiana Total

$6,000,000 $9,600,000 $8,400,000 $24,000,000

Member’s ratio of Indiana receipts: 25% 40% 35% 100%

Prorated share of Indiana net capital loss: -$10,000 -$16,000 -$14,000

Carry forward these amounts separately on the combined return.

Use this portion of the worksheet as many times as needed to determine the deductible net capital loss applied against any Indiana net

capital gains during the five-year carryforward period following the year of a loss.

Computation of Net Capital Loss Adjustment

The net capital loss available to be applied, if any, and carried forward to any subsequent year shall be limited to the capital gains for

the subsequent year of each taxpayer member. The amount of net capital gains is determined by the same receipts formula used in

computing the amount of loss derived from Indiana and is prorated between members of a unitary group (IC 6-5.5-2-1).

Example – Gain Year Ending 12-31-2022:

4. Net capital gain from federal Schedule D (recomputed without any IRC Section 1212 unused capital loss carryover) ............$50,000

5. FIT-20 Indiana apportioned income percentage for the taxable year ..................................................................................................... 60%

6. Available Indiana net capital gain for the year......................................................................................................................................$30,000

Example for members of a unitary group filing a combined return having a net capital gain in 2022:

Indiana receipts attributable to: Member A Member B Member C Combined Indiana Total

$5,000,000 $35,000,000 $10,000,000 $50,000,000

Member’s ratio of Indiana receipts: 10% 70% 20% 100%

Prorated share of Indiana net capital loss: -$3,000 -$21,000 -$6,000

Application of Indiana Net Capital Loss Adjustment

Enter the unused net capital loss from loss year (prorated amounts) or remaining amount(s) of each member as reduced during each of

the intervening years following the year of loss. The current year adjustment for Indiana is limited to the unused amount of net capital

loss, up to the amount of the net capital gains prorated for each member.

Member A Member B Member C

Amount of Loss Applied to (2022): $3,000 $16,000 $6,000

7. Combined total of Indiana net capital loss adjustment for the tax year. Carry to line 23 of Form FIT-20 .............................. $25,000

Note. This amount may be applied only up to the amount of the current year’s income tax liability.

8. Remaining share of taxable capital -0- $5,000 -0-

gain and (unused net capital loss): -$7,000 -0- $8,000 (Share of carryover to 2022)

FIT-20 Financial Institution Booklet 2022 Page 11

|

Enlarge image |

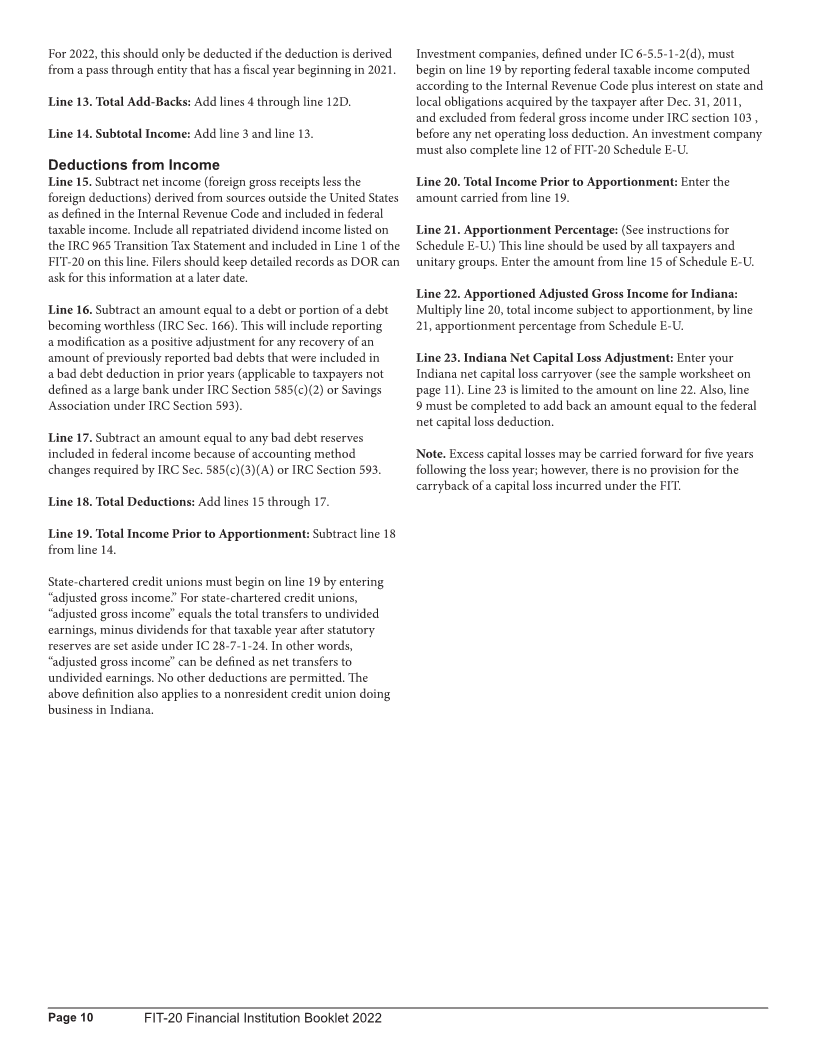

Summary of Total Indiana Net Capital Loss Carryover(s)

Compile for each year the total amount of net capital loss applied against net capital gains. The gain or loss available is limited to the

amount of each taxpayer member’s portion as apportioned to Indiana. For net capital loss carryovers from two or more years, show

amounts applied through all carryforward years. Unused net capital loss from loss years occurring since 2017, after application against

any net capital gains, may be carried through taxable year 2022.

Combined total Indiana net capital gains for each year.

Example of

carryover Enter 2018 2019 2020 2021 2022

below total Indiana $ $ $ $ $30,000 Carryover(s) of unused prorated

net capital loss from

net capital losses available

loss year(s): Total amount of Indiana net capital loss applied against

prorated net capital gains in each year for 2023

2017 -$

2018 -$

2019 -$

2020 -$

2021 -$40,000 -$25,000 -$15,000

Remaining taxable

net capital gains $5,000

Instructions for Schedule A, continued To determine the amount of tax attributable to the loan

transaction, divide the total receipts from qualified loans by the

Line 24. Total Adjusted Gross Income: Subtract line 23 from line total receipts attributable to Indiana. Multiply that quotient,

22. If subtotal is less than zero, enter 0. expressed as a percentage, by the total amount of tax due to

determine the amount of tax attributable to the loan. This is the

Line 25. Indiana Net Operating Loss Deduction: The amount amount of credit that may be available. The actual credit is equal

to report on this line is the Indiana portion of the net operating to the lesser of the actual taxes paid to the domiciliary state for

loss, and it cannot exceed the amount reported on line 24. Net the loan transaction and the amount due to Indiana on the loan

operating losses can be carried forward for 15 years. There is no transaction. If the taxpayer’s domiciliary state grants a credit

provision for net operating loss carrybacks. Complete and enclose for taxes paid to other states, the credit available for purposes of

Schedule FIT-20NOL with the return. Indiana’s tax must be reduced by the amount of the credit granted

by the taxpayer’s domiciliary state. (See the instructions for

Line 26. Indiana Adjusted Gross Income: Subtract line 25 from completing Schedule FIT-NRTC on page 20.)

line 24.

Nonresident credits are determined for each taxpayer member

Line 27. Indiana Financial Institution Tax Due: Multiply the of a unitary group on an individual basis, notwithstanding that

amount on line 26 by the current tax rate. If line 26 is a loss the adjusted gross income is reported on a combined basis for all

amount, enter zero on this line. members of a unitary group.

Financial institutions are subject to a FIT under IC 6-5.5 at the Line 29. Net Financial Institution Tax Due: Subtract the amount

following declining rates: on line 28 from the amount on line 27.

• For taxable years beginning after Dec. 31, 2021, and before

Jan. 1, 2023 5.0%. Line 30. Use Tax Due: Taxpayers are required to report and pay

• For taxable years beginning after Dec. 31, 2022, 4.9%. 7% use tax on taxable purchases. Purchases subject to use tax

include (but are not limited to) subscriptions to magazines and

Line 28. Nonresident Taxpayer Credit (816): To claim this periodicals as well as property that is purchased exempt from tax

credit, enclose a copy of the domiciliary state’s tax return. and that is later converted to a nonexempt use by the business. To

Nonresident taxpayers might be able to claim a credit for taxes calculate the amount of purchases subject to the use tax, please

paid to domiciliary states. To be eligible to claim the credit, the complete the worksheet on page 13.

following conditions must be met: (1) the receipt of interest or

other income from the loan is attributed to both the domiciliary For more information regarding use tax, visit www.in.gov/dor or

state and also to Indiana; and (2) the principal amount of the loan call (317) 232-2240.

is at least $2 million.

Line 31. Subtotal Due: Add line 29 and line 30.

Page 12 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

Tax Liability Credits — Limited to One Per Project Line 32. Neighborhood Assistance Tax Credit 828

If you made a contribution or engaged in activities to upgrade

Restriction for Certain Tax Credits – Limited to One Per Project areas in Indiana, you may be able to claim a credit for this

Within a certain group of credits, a taxpayer may not be granted assistance. Contact the Indiana Housing & Community

more than one credit for the same project. You can choose the Development Authority, Neighborhood Assistance Program, 30 S.

credit to be applied. However, the credit selected cannot be Meridian, Suite 1000, Indianapolis, IN 46204, telephone number

changed nor can the investment be redirected for a different credit (317) 232-7777 (800- 872-0371 outside Indianapolis), for more

in subsequent years. See Income Tax Information Bulletin #59 at information. Pass-through entities are eligible for the credit.

www.in.gov/dor/files/reference/ib59.pdf for more information.

Line 33. Enterprise Zone Employment Expense Tax Credit 812

Six credits are included in this group: This credit is based on qualified investments made within an Indiana

1. Alternative fuel vehicle manufacturer credit; enterprise zone. It is the lesser of 10% of qualifying wages or $1,500

2. Community revitalization enhancement district credit; per qualified employee, up to the amount of tax liability on income

3. Enterprise zone investment cost credit (not applicable to FIT-20); derived from an enterprise zone. Enclose the completed Schedule

4. Hoosier business investment credit; EZ 1, 2, 3 with the return, otherwise the credit will be denied.

5. Industrial recovery credit; and

6. Venture capital investment credit. Find the Indiana Schedule EZ 1, 2, 3 at www.in.gov/dor/tax-

forms/enterprise-zone-forms for more information on how to

Order of Credit Application calculate this credit.

If claiming more than one credit, first use the credits that cannot

be carried over and applied against the state FIT in another year. Line 34. Enterprise Zone Loan Interest Tax Credit 814

Next, use the credits that can be carried over for a limited number This credit is allowed for up to 5% of the interest received from all

of years and applied against the state FIT. If one or more credits qualified loans made during a tax year for use in an active Indiana

are available, apply the credits in the order that the credits would enterprise zone.

expire. Finally, use the credits that can be carried over and applied

against the state FIT in another year. See Income Tax Information Bulletin #66 available at www.in.gov/

dor/tax-forms/enterprise-zone-forms for more information on

Example. A taxpayer has a neighborhood assistance credit for how to calculate this credit.

which no carryover is available, a school scholarship credit that

can be carried forward to 2023, and a community revitalization Note. Schedule LIC must be enclosed if claiming this credit; it is

enhancement district credit with an indefinite carryforward. The available at www.in.gov/dor/tax-forms/enterprise-zone-forms.

taxpayer would apply the credits in the following order until the Contact the Indiana Economic Development Corporation at 1

credit is exhausted or the taxpayer’s liability is reduced to zero, N. Capitol Ave., Suite 700, Indianapolis, IN 46204; call them at

whichever comes first: (317) 232-8800; or visit the IEDC website at www.iedc.in.gov for

• Neighborhood assistance credit additional information.

• School scholarship credit expiring in 2023

• Community revitalization enhancement district credit Enclose Schedule LIC with the return, otherwise the credit will be

denied.

For more information about Indiana tax credits, see Income

Tax Information Bulletin #59 available at www.in.gov/dor/files/

reference/ib59.pdf.

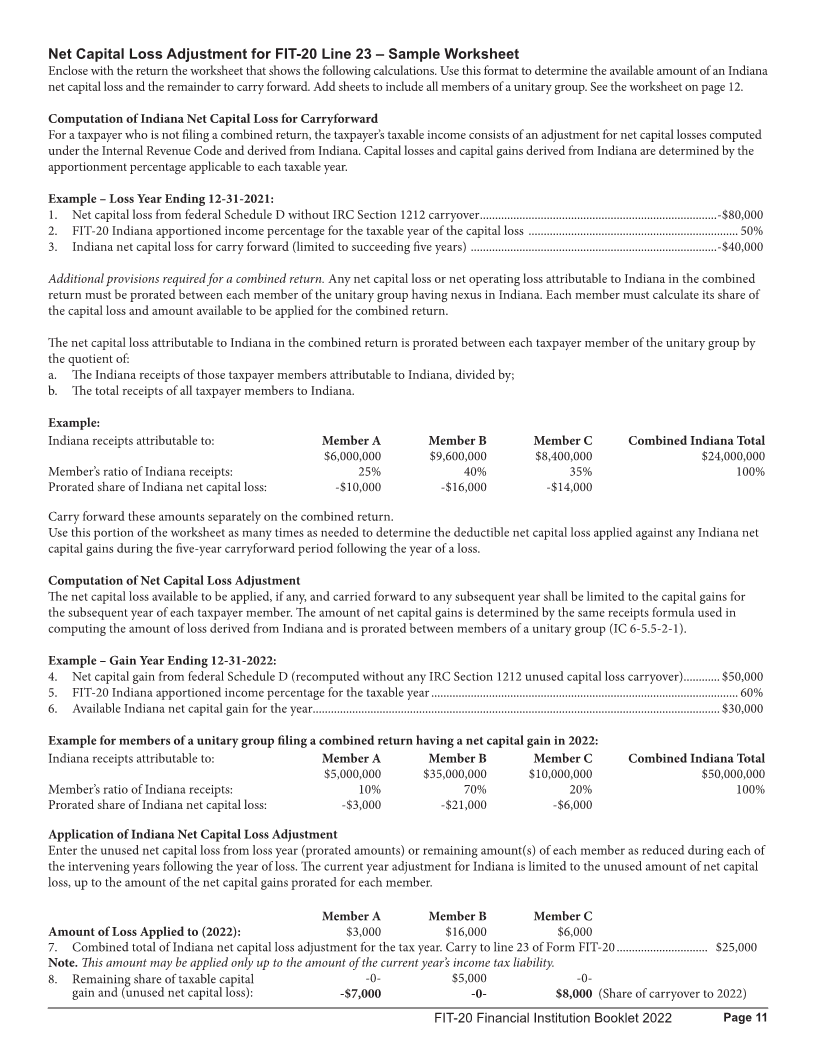

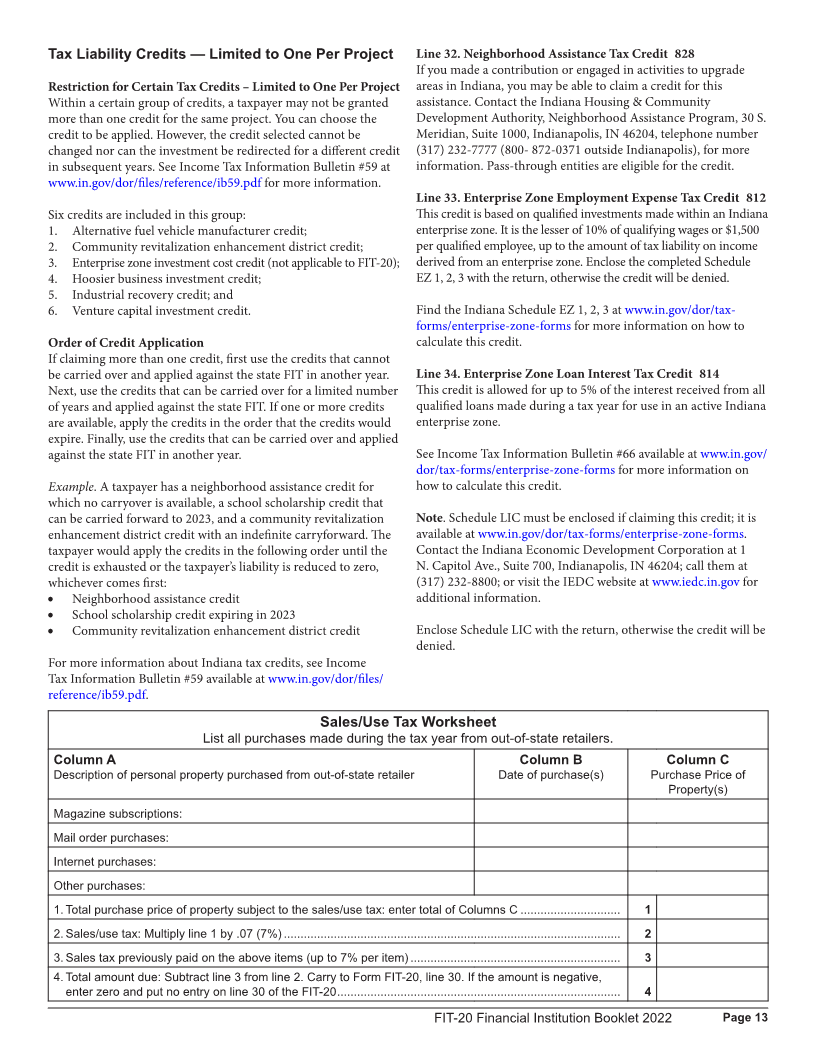

Sales/Use Tax Worksheet

List all purchases made during the tax year from out-of-state retailers.

Column A Column B Column C

Description of personal property purchased from out-of-state retailer Date of purchase(s) Purchase Price of

Property(s)

Magazine subscriptions:

Mail order purchases:

Internet purchases:

Other purchases:

1. Total purchase price of property subject to the sales/use tax: enter total of Columns C .............................. 1

2. Sales/use tax: Multiply line 1 by .07 (7%) ..................................................................................................... 2

3. Sales tax previously paid on the above items (up to 7% per item) ............................................................... 3

4. Total amount due: Subtract line 3 from line 2. Carry to Form FIT-20, line 30. If the amount is negative,

enter zero and put no entry on line 30 of the FIT-20 ..................................................................................... 4

FIT-20 Financial Institution Booklet 2022 Page 13

|

Enlarge image |

Note. Claimants must be in good standing to remain eligible for the Line 42. Other Payments/Credits

enterprise zone loan interest credit. The term “zone business” includes Enter any other payments that are allowable and enclose an

an entity that claims certain tax benefits available to businesses explanation.

located in an enterprise zone. A taxpayer can claim the enterprise

zone loan interest credit only if that taxpayer pays a registration Headquarters Relocation Credit (refundable portion)

fee, provides additional assistance to urban enterprise associations Generally, this credit is nonrefundable. Beginning with the 2019

required of zone businesses, and complies with the requirements tax year, some or all of this credit may be refundable. This credit is

adopted by the Indiana Economic Development Corporation. This administered by the Indiana Economic Development Corporation

credit is also not available for loans made after December 31, 2017. (IEDC). If the IEDC has determined some or all of this credit to be

refundable, enter on this line the refundable amount of the credit

Lines 35 and 36 – Other Tax Liability Credits Available to less the portion of the credit used to offset your tax liability. You

Financial Institutions must maintain the documentation provided to you that supports

Claim other allowable tax liability credits by entering the name, the refundable portion of this credit as DOR may request it.

credit ID code number, and amount using line 35 or 36 (see

page 16 for a list of credits available for these lines). The total For more information (including limitations on the credit and the

nonrefundable tax liability credit is limited to the amount of application process), see Income Tax Information Bulletin #97,

income tax on line 29, unless otherwise noted. If your claim available at www.in.gov/dor/files/reference/ib97.pdf.

exceeds the amount of your tax liability, adjust by recalculating

the credit to the amount that you can apply. If you qualify for Line 43. Economic Development for a Growing Economy

the refundable Economic Development for a Growing Economy Credit (EDGE)

(EDGE) job retention credit, claim that credit on line 43. Claim the approved Economic Development for a Growing

Economy (EDGE) credit on this line. Enter the amount from

A detailed explanation or supporting schedule must be enclosed line 19 of Schedule IN-EDGE here. This credit is for businesses

with the return when claiming any credits on lines 35, 36, 43, and that conduct certain activities designed to foster job creation in

44. See Income Tax Information Bulletin #59 available at www. Indiana. It is a refundable tax liability credit.

in.gov/dor/files/reference/ib59.pdf for more information about

the Indiana tax credits available to taxpayers. Note. Complete Schedule IN-EDGE and enclose it with the return,

otherwise the credit will be denied. Obtain a PIN from the IEDC.

Line 37 – Certified Credits Available to Financial Institutions

If you are claiming any credits on Schedule IN-OCC, including Contact the Indiana Economic Development Corporation at One

credits passed through from Schedule IN K-1 Part 2, enter the total North Capitol, Suite 700, Indianapolis, IN 46204, for eligibility

of those credits here and enclose Schedule IN-OCC with you return. requirements. Call (317) 232-8800 or visit www.iedc.in.gov for

The credit codes reported on Schedule IN-OCC are 818, 820, 835, additional information.

849, 858, 860, 863, 865, 867, 868, 869, 1818, 1820, 1835, 1849, 1858,

1860, 1863, 1865, 1867, 1868, and 1869. Line 44. Economic Development for a Growing Economy

Retention Credit (EDGE-R)

Line 38. Total Credits Claim the approved Economic Development for a Growing

Add the amounts on lines 32 through 37. Economy Retention Credit on this line. Enter the amount from

line 19 of Schedule IN-EDGE-R here.

Line 39. Total Tax Due

Subtract the amount on line 38 from the amount on line 31. This credit is for businesses that conduct certain activities designed to

foster job retention in Indiana. It is a refundable tax liability credit.

Line 40. Total Estimated Tax Paid

Enter the total amount of estimated tax paid for the taxable year. Note. Complete Schedule IN-EDGE-R and enclose it with the return,

Itemize each quarterly payment in the spaces provided. otherwise the credit will be denied. Obtain a PIN from the IEDC.

List all members included in a combined return by completing Contact the Indiana Economic Development Corporation at One

FIT-20 Schedule H. Show any amount of estimated tax you are North Capitol, Suite 700, Indianapolis, IN 46204, for eligibility

claiming that might have been paid by a member under the requirements. Visit www.iedc.in.gov for additional information.

federal employer identification number.

Line 45. Total Payments

Line 41. Extension Payment and Prior Year Overpayment Add lines 40 through 44.

Enter on line (a) the payment made resulting from an extension of

time to file request, and on line (b) list your carryover credit of a Line 46. Balance of Tax Due

prior-year overpayment. This provision is applicable to a prior-year Subtract line 45 from line 39.

overpayment of the financial institution tax only. Indiana will accept

the federal extension date, plus an additional one month. However, Line 47. Penalty for Underpayment

an extension of time to file is not an extension of time to pay. You Enter the penalty, if any, for underpayment of estimated tax. Complete

must pay at least 90% of the current year liability by the original due and enclose Schedule FIT-2220 to determine if the underpayment of

date of the FIT return. Enter the total amount on line 41. estimated tax penalty or an exception to the penalty applies.

Page 14 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

Note. If a taxpayer’s annual liability exceeds $2,500, filing

quarterly estimated payments to remit 25% of the estimated

Certification of Signatures and

annual tax liability is required.

Authorization Section

Line 48. Interest Sign, date, and print the corporation name on the return. If a paid

If payment is made after the original due date, interest must be preparer completes the return, authorize DOR to discuss the tax

included with the payment. Interest is calculated from the original return with the preparer by checking the authorization box above

due date of the return until the date of payment. the line for the name of the personal representative.

For the current rate of interest charged see Departmental Notice Personal Representative Information

#3 available at www.in.gov/dor/files/reference/dn03.pdf, or call Typically, DOR contacts the corporation if there are any questions

DOR at (317) 232-2240. or concerns about the tax return. If DOR is authorized to discuss

the tax return with someone else (e.g., the person who prepared it

An extension of time to file the return does not grant an extension or a designated person), complete this area.

of time to pay any tax due; therefore, interest must be calculated.

First, check the “Yes” box that follows the sentence “I authorize

Line 49. Late Penalty the Department to discuss my tax return with my personal

Enter the computed penalty amount that applies. representative.”

If a payment is made after the original due date, a penalty that is Next, enter:

the greater of $5 or 10% of the remaining tax due must be entered. • The name of the individual designated as the corporation’s

The penalty for late payment or late filing will not be imposed if personal representative; and

all three of the following conditions are met: • The individual’s email address.

1. A valid extension of time to file exists;

2. At least 90% of the tax was paid by the original due date; and If this area is completed, DOR is authorized to contact the

3. The remaining tax and interest due is paid by the extended personal representative, instead of the corporation, about this

due date. tax return. After the return is filed, DOR will communicate

primarily with the designated personal representative on matters

If the return showing no tax liability (on line 31) is filed late, the concerning the return.

penalty for failure to file by the due date will be $10 for each day

that the return is past due, up to a maximum of $250. Note. The authorization for DOR to be in contact with a personal

representative can be revoked at any time. To do so, submit a signed

Line 50. Total Due statement to DOR. The statement must include a name, Federal

Add lines 46 through 49. If a payment is due, enter the total Employer Identification Number of the corporation, and the year

tax due plus any applicable penalty and interest. Payment can of the tax return. Mail the statement to Indiana Department of

be made electronically via INTIME, DOR’s e-services portal Revenue, P.O. Box 7206, Indianapolis, IN 46207-7206.

at intime.dor.in.gov, or checks should be made payable to the

Indiana Department of Revenue for each Form FIT-20 filed. All Officer Information

payments must be made in U.S. funds. An officer of the organization must sign and date the tax return

and enter the officer’s name and title. Please provide a daytime

Lines 51, 52, and 53. Total Overpayment telephone number DOR can call if there are any questions about

If the taxpayer has an overpayment determined by subtracting the the tax return. Also, provide an email address if contact via email

amounts on lines 39, 47, and 49 from the amount on line 45, the is desired.

corporation can elect to have a portion or all of its overpayment

credited to following year’s estimated tax account. The portion to Paid Preparer Information

be refunded should be entered on line 52, and the portion to be Fill out this area if a paid preparer completed this tax return. The

applied to next year’s account should be entered on line 53. The paid preparer must sign and date the return. In addition, please

total of line 52 and line 53 must equal the amount on line 51. enter the following:

• The paid preparer’s email address;

An election to apply an overpayment to the following year is • The name of the firm the paid preparer is employed by;

irrevocable. If your overpayment is reduced due to an error on • The paid preparer’s PTIN (personal tax identification

the return or an adjustment by DOR, the amount to be refunded number). This must be the paid preparer’s PTIN; do not enter

will be corrected before any changes are made to the estimated an FEIN or Social Security number;

account for next year. A refund may be set off and applied to other • The paid preparer’s complete address.

liabilities under IC 6-8.1-9-2(a) and 6-8.1-9.5 before it is credited

to the following year’s estimated tax account. Note. Complete this area even if the paid preparer is the same

individual designated as the personal representative.

FIT-20 Financial Institution Booklet 2022 Page 15

|

Enlarge image |

• Reduces other Indiana operations to relocate them into the

district.

Mailing Options

Please mail completed returns to:

Indiana Department of Revenue The taxpayer can assign the credit to a lessee who remains subject

P.O. Box 7228 to the same requirements. The assignment must be in writing.

Indianapolis, IN 46207-7228 Also, any consideration may not exceed the value of the part of

the credit assigned. Both parties must report the assignment on

the state income tax returns for the year of assignment.

Other Tax Liability Credits Available to Contact the Indiana Economic Development Corporation at One

Financial Institutions North Capitol, Suite 700, Indianapolis, IN 46204, or visit the IEDC

website at www.iedc.in.gov for more information about this credit.

Alternative Fuel Vehicle Manufacturer Credit 845

This credit has been repealed. However, any previously approved Note. See the section “Restriction for Certain Tax Credits -

yet unused credit is available to be claimed. Limited to One per Project” on page 13.

Note. See the section “Restriction for Certain Tax Credits - Economic Development for a Growing Economy -

Limited to One per Project” on page 13. Nonresident Employees (EDGE-NR) 865

This credit is for incremental state income tax amounts that would

Coal Gasification Technology Investment have been withheld on employees from reciprocal states if those

Credit 806 employees had been subject to Indiana state tax withholding.

A credit is available for a qualified investment in an integrated

coal gasification power plant or fluidized bed combustion Owners of pass-through entities such as S corporations,

technology. It must serve Indiana gas utility and electric utility partnerships, limited liability companies, etc., are eligible for this

consumers to qualify. This can include an investment in a facility credit. Unlike the EDGE and EDGE-R credits, the EDGE-NR

located in Indiana that converts coal into synthesis gas that can be credit is a non-refundable credit.

used as a substitute for natural gas.

This credit is administered by the IEDC. Contact them at One

You must file an application for certification with the IEDC. If the North Capitol, Suite 700, Indianapolis, IN 46204, via website at

credit is assigned, it must be approved by the utility regulatory www.iedc.in.gov, or by phone at (317) 232-8800.

commission and taken in 10 annual installments. The amount of

credit for a coal gasification power plant is 10% of the first $500 The approved credit must be reported on Schedule IN-OCC,

million invested and 5% for any amount over that. The amount of found at www.in.gov/dor/tax-forms/2022-individual-income-tax-

credit for a fluidized bed combustion technology is 7% of the first forms. Make sure to enclose this schedule with your tax filing. If

$500 million invested and 3% for any amount over that. you are claiming this credit as an owner of a pass-through entity

such as S corporations, partnerships, limited liability companies,

For more information, visit the Indiana Economic Development etc., make sure to keep Schedule IN K-1 with your records as

Corporation’s website at www.iedc.in.gov or contact them at One DOR can require you to provide this information.

North Capitol, Suite 700, Indianapolis, IN 46204. Or, see Income

Tax Information Bulletin #99 available at www.in.gov/dor/files/ Ethanol Production Credit 815

reference/ib99.pdf. This credit has been repealed. However, any previously approved

yet unused credit is available to be claimed.

Enclose a copy of the utility regulatory commission’s

determination and the certificate of compliance issued by IEDC Film and Media Production Tax Credit 869

with the return, otherwise the credit will be denied. Effective July 1, 2022, a credit is available for expenses incurred

for qualified film and media production expenses. The amount

Community Revitalization Enhancement District of the taxpayer’s credit is equal to the taxpayer’s qualified film

Credit 808 and media production expenses multiplied by a percentage

A state and local income tax liability credit is available for a determined by the Indiana Economic Development Corporation,

qualified investment for the redevelopment or rehabilitation of but not more than 30% of the expenses.

property within a community revitalization enhancement district.

Note. Certification for this credit must be obtained from the

To be eligible for the credit, the intended expenditure plan must Indiana Economic Development Corporation. See iedc.in.gov/

be approved by the IEDC before the expenditure is made. The indiana-advantages/investments/film-and-media-tax-credit for

credit is equal to 25% of the IEDC-approved qualified investment further information.

made by the taxpayer during the tax year. DOR has the authority

to disallow any credit if the taxpayer: This credit must be reported on Schedule IN-OCC, found at www.

• Ceases existing operations; in.gov/dor/tax-forms/2022-corporatepartnership-income-tax-

• Substantially reduces its operations within the district or forms/. Make sure to enclose this schedule with your tax filing.

elsewhere in Indiana; or

Page 16 FIT-20 Financial Institution Booklet 2022

|

Enlarge image |

Enclose the certification letter from the IEDC with the return, Submit a copy of the certificate from the Indiana Economic

otherwise the credit will be denied. Development Corporation verifying the amount of tax credit for the

taxable year with the return. Otherwise, the credit will be denied.

Foster Care Donations Credit 867

Effective starting in taxable year 2022, a credit for donations Important. If the IEDC has granted a refundable credit under

to qualifying foster care organizations is available. The credit the second test, see the instructions on page 14 for completing

is 50% of the donation made to qualifying organizations, up to Form FIT-20, Line 42.

a maximum of $10,000 per taxable year. In addition, no more

than $2,000,000 in credits can be awarded during a state fiscal Hoosier Business Investment Credit 820

year. See www.in.gov/dor/tax-forms/foster-care-credit-donation- This credit is for qualified investments, including costs associated

information/ for further information regarding the application with the following:

and approval process. • Constructing special-purpose buildings and foundations;

• Making onsite infrastructure improvements;

This credit must be reported on Schedule IN-OCC, found at www. • Modernizing existing equipment;

in.gov/dor/tax-forms/2022-corporatepartnership-income-tax- • Purchasing equipment used to make motion pictures or

forms/. Make sure to enclose this schedule with your tax filing. audio production;

• Purchasing or constructing new equipment directly related to

Enclose the approval letter from the Department of Revenue with expanding the workforce in Indiana;

the return, otherwise the credit will be denied. • Retooling existing machinery and equipment;

• Constructing or modernizing transportation or logistical

Headquarters Relocation Credit 818 distribution facilities;

A business may be eligible for a credit if it meets one of two sets • Improving the transportation of goods via highway, rail, air,

of criteria. The first set of criteria (“first test”) is that the business or water; and

meets all of the following: • Improving warehousing and logistical capabilities.

• Has an annual worldwide revenue of $50 million; • Purchasing new pollution control, energy conservation, or

• Has at least 75 Indiana employees (for credits awarded before renewable energy generation equipment; and

July 1, 2022); and • Purchasing new onsite digital manufacturing equipment.

• Relocates its corporate headquarters to Indiana.

This credit is administered by the IEDC. Contact IEDC at One

The second set of criteria (“second test”) is that the business meets North Capitol, Suite 700, Indianapolis, IN 46204. Visit the IEDC

either (1) or (2), meets (3), and meets (4) or (5): website at www.iedc.in.gov or call them at (317) 232-8800. Please

1. Received at least $4 million in venture capital in the see Income Tax Information Bulletin #95 available at www.in.gov/

six months immediately preceding the business’s application dor/files/reference/ib95.pdf for additional information. Submit

for this tax credit. a copy of the certificate from the IEDC verifying the amount of

2. Closes on at least $4,000,000 in venture capital not more than tax credit for the taxable year to DOR with the FIT-20 return,

six months after submitting the business’s application for this otherwise the credit will be denied.

tax credit.

3. Has at least 10 Indiana employees (for credits awarded before Note. See the section “Restriction for Certain Tax Credits -

July 1, 2022). Limited to One per Project” on page 13.

4. Relocates its corporate headquarters to Indiana.

5. Relocates the number of jobs equal to 80% of the business’s Claim this credit on Schedule IN-OCC.

total payroll during the immediately preceding quarter to an

Indiana location. Individual Development Account Credit 823

A credit is available for qualified contributions made to a

The credit may be as much as 50% of the cost incurred in community development corporation participating in an

relocating the taxpayer’s headquarters. For more information Individual Development Account (IDA) program. The IDA

(including limitations on the credit and the application process), program is designed to assist qualifying low-income residents

see Income Tax Information Bulletin #97, available at www. in accumulating savings and building personal finance skills.

in.gov/dor/files/reference/ib97.pdf. The organization must have an approved program number from

the Indiana Housing and Community Development Authority

Beginning with the 2022 tax year, this credit must be reported on (IHCDA) before a contribution qualifies for preapproval. The

Schedule IN-OCC, found at www.in.gov/dor/tax-forms/2022- credit is equal to 50% of the qualified contribution, which must

corporatepartnership-income-tax-forms/. Make sure to enclose not be less than $100 and not more than $50,000.

this schedule with your tax filing.

Applications for the credit are filed through the IHCDA. To

This credit is administered by the IEDC. You may contact them at request additional information about the definitions, procedures,

One North Capitol, Suite 700, Indianapolis, IN 46204, via website and qualifications for obtaining this credit, contact the Indiana

at www.iedc.in.gov, or by phone at (317) 232-8800. Housing and Community Development Authority, 30 S. Meridian

Street, Suite 1000, Indianapolis, IN 46204, (317) 232-7777.

FIT-20 Financial Institution Booklet 2022 Page 17

|

Enlarge image |