- 2 -

Enlarge image

|

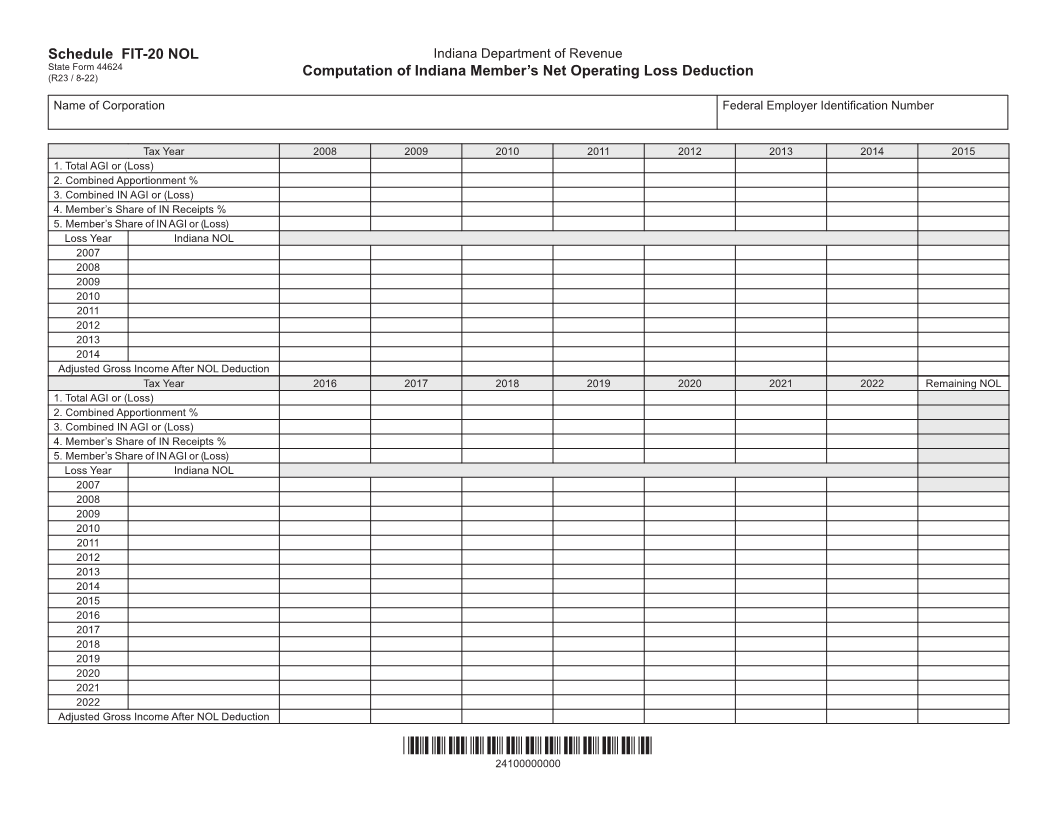

Instructions for Completing Schedule FIT-20NOL

Computation of Indiana Member’s Net Operating Loss Deduction

All taxpayers must complete and enclose this schedule with the ble, for the tax year.

Financial Institution Tax Return if they are claiming a net oper-

ating loss (NOL) deduction. The NOL that will be recognized for Line 3. Enter the combined amount of Indiana business income or

financial institution tax purposes will be the NOL apportioned to loss. Multiply the amount on line 1 by the apportionment percent-

Indiana for the taxable year of the loss. age on line 2.

An Indiana NOL incurred under the Financial Institution Tax Act Line 4. Enter the ratio of member’s Indiana receipts. Divide mem-

may be carried forward for 15 years following the loss year and ber’s Indiana receipts by receipts of entire unitary group attributed

applied in any year in which there is Indiana taxable income. to Indiana for year. Enter as a percent. See Indiana Code (IC)

There is no provision under the Financial Institution Tax Act for the 6-5.5-2-1(d)(1) and example below.

carryback of a net operating loss or capital loss. An Indiana NOL

incurred for adjusted gross income (AGI) tax purposes may not be Line 5. Enter each taxpayer member’s attributed Indiana income

applied to income subject to financial institutions tax. An Indiana or loss available to offset combined income or to reduce the

NOL must be used the first year available for the deduction. carryforward loss. Caution: The income or loss available is limited

to the amount of each taxpayer member’s portion of the receipts

Use the net operating loss computed under this schedule for attributable to Indiana. See example below. Use amount from line

a member who was not part of the combined group or when a 3 or multiply line 3 by ratio on line 4, if applicable.

member is no longer part of a combined group. To compute the

allowable net operating loss deduction, do the following: The total of each taxpayer member’s remaining share of the com-

bined group’s NOL deduction is applied on line 25 of Form FIT-20.

If the taxpayer is filing a combined return, any net capital loss However, the combined total may not exceed the taxable income

or net operating loss attributable to Indiana in the combined for the year.

return shall be prorated between each member of the unitary

group having nexus in Indiana by the quotient of: Loss Year Carryforwards Applied Against AGI

In the second column next to the appropriate loss year, enter the

(1) The Indiana receipts of those taxpayer members attribut- total Indiana NOL coinciding with line 3 for the corresponding loss

able to Indiana; divided by: year. When utilizing the NOL deduction for a particular loss year,

(2) The total receipts of all taxpayer members attributed to enter the amount of the deduction in the same column of the year

Indiana. A separate Schedule FIT-20NOL will be com- the loss is being applied against AGI.

pleted by each member to calculate their share of the

loss and amount available to be applied for the combined When calculating the AGI after the NOL deduction, subtract the

return. total deductions taken from the AGI and enter the amount on the

line titled “Adjusted Gross Income after NOL Deduction.” The

Completing FIT-20NOL amount cannot be less than 0.

Tax Year: Determine the years to which the NOL applies across

the top of the schedule. Enclose the complete schedule and any NOL worksheets with the

return when the NOL is being utilized.

Line 1. Enter the total adjusted gross income or (loss) from line

19 of the FIT-20.

Line 2. Enter the combined apportionment percentage, if applica-

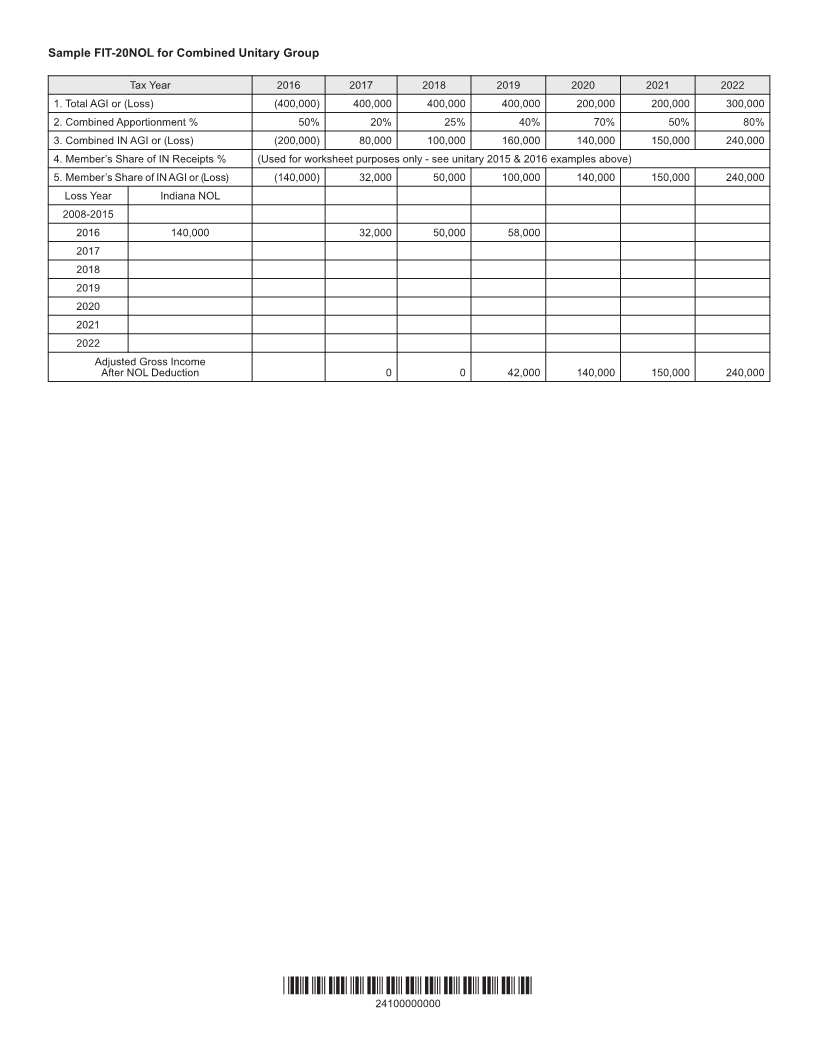

Sample FIT-20NOL for Unitary Group - A form is to be completed by each member of a combined return filing FIT-20NOL.

Members A, B, and C are taxpayers under IC 6-5.5-1-17 and are required to be included in the combined return (IC 6-5.5-1-18) for the

2015 tax year.

Loss Year 2021 Member A Member B Member C Combined Total

AGI or (Loss) ($300,000) $300,000 ($400,000) Line 1. ($400,000)

IN Apportionment Line 2. 50%

Combined IN AGI (Loss) Line 3. ($200,000)

IN Receipts for A, B, & C $2,000,000 + $7,000,000 + $1,000,000 Total IN Receipts $10,000,000

Line 4. Ratio of IN Receipts 20% 70% 10% [IN Receipts of A, B, & C divided by total receipts]

Line 5. Available share of NOL

[Line 3 X line 4 of A, B, & C] ($40,000) ($140,000) ($20,000) Line 5. ($200,000)

Carryover Year 2022 (For tax year 2016, member C is no longer required to be included in the combined return (IC 6-5.5-1-18(a).)

AGI or (Loss) $500,000 ($100,000) N/A Line 1. $400,000

IN Apportionment Line 2. 20%

Combined IN AGI (Loss) Line 3. $80,000

IN Receipts for A & B $6,000,000 + $4,000,000 = Total IN Receipts $10,000,000

Line 4. Ratio of IN Receipts 60% 40% [Receipts of A & B divided by total IN receipts]

Line 5. IN AGI

[Line 3 X line 4 of A & B] $48,000 $32,000

Applied share of 2015 NOL ($40,000) ($32,000) [$160,000 available] FIT-20NOL, line 25. $72,000

Taxable income $8,000 $ 0 FIT-20NOL, line 26. $8,000

NOL to carry forward $ 0 ($108,000) ($20,000)

*24100000000*

24100000000

|