Enlarge image

2022 Pass Through Entity Tax Instructions 2022 Instructions Last revised: May 2023 Indiana Department of Revenue

Enlarge image | 2022 Pass Through Entity Tax Instructions 2022 Instructions Last revised: May 2023 Indiana Department of Revenue |

Enlarge image | Table of Contents How to Make the Election ........................................................................................................................................... 2 Tax Return and Extension............................................................................................................................................. 2 Making 2022 Pass Through Entity Tax Payments ............................................................................................... 2 Making Estimated Tax Payments ................................................................................................................................. 3 Withholding Requirements with Pass Through Entity Tax .............................................................................. 4 Calculating the Tax ......................................................................................................................................................... 4 Example 1: Determining Indiana-Sourced Income in a Single-Tiered Structure ................................ 5 Example 2: Determining Indiana-Sourced Income in a Multi-Tiered Structure .................................. 5 Partnership A’s Computation of Income Attributable to Indiana ............................................................ 6 Partnership B’s Partners’ Computation of Income Attributable to Indiana .......................................... 7 Reporting Income and Tax on Schedule Composite & Schedule Composite-COR............................... 7 Paper Returns ............................................................................................................................................................... 7 Electronic Returns ....................................................................................................................................................... 7 Computation Codes 1–3 .......................................................................................................................................... 8 Computation Codes 4–6 .......................................................................................................................................... 8 Computation Codes 7-12 ..................................................................................................................................... 10 Reporting Pass Through Entity Tax ....................................................................................................................... 12 Claiming Credits for Indiana Pass Through Entity Tax Paid ......................................................................... 12 Additional Resources ................................................................................................................................................... 13 Contact Us ....................................................................................................................................................................... 13 Indiana Department of Revenue | 1 |

Enlarge image |

How to Make the Election

The annual election to opt into the Indiana Pass Through Entity Tax must be made on an

annual basis on the IN-PTET form prescribed by the Indiana Department of Revenue. Starting

with tax years beginning after Dec. 31, 2022, the election may also be made on the entity’s

annual return.

The election is irrevocable and must be made by an authorized person from the eligible

electing entity. An authorized person is any individual with the authority from the electing entity

to bind the electing entity or sign returns on its behalf. The form can be signed either by

traditional signature or by electronic signature. Electing entities must list resident and

nonresident entity owners on Schedule Composite and, if applicable, Schedule Composite-COR.

For tax year 2022, the election must be madeafter March 31, 2023,and before Aug. 31, 2024. If

the 2022 return was filed by April 18, 2023, a pass-through entity can amend their return to

reflect the election. For 2023 and tax years thereafter, the election may be made at any time

during the taxable year or before filing the entity’s return; or the election may be made after the

taxable year on the entity’s timely filed return, including extensions.

For tax year 2022 elections, you must submit the Form IN-PTET by mail to the address listed on

the Form IN-PTET or by email to ptetelectionform@dor.in.gov.

Tax Return and Extension

The Pass Through Entity Tax shall be due on the same date as the entity’s annual return for the

taxable year, without regard to extensions. On its return for the taxable year, the electing entity

shall attach a schedule showing the calculation of the tax and the credit for each entity owner, and

remit the tax with the return, taking into account prior estimated tax payments remitted by the

electing entity, along with other payments that are credited to the electing entity as tax paid or

withheld.

For tax years beginning in 2022, the Pass Through Entity Tax will be reported on the entity’s

composite schedule.

If the 2022 return is filed by April 18, 2023, a pass-through entity can amend their return to make

the election through Aug. 30, 2024.

Making 2022 Pass Through Entity Tax Payments

If you are making a Pass Through Entity Tax payment for the 2022 tax year, the payment of pass

through entity tax is due on the same due date as regular withholding/composite payments. For

tax years ending on December 31, 2022, the payment is due April 18, 2023. However, if the

payment is remitted after the due date but before August 31, 2024, no penalties or interest are

due on the unpaid balance of Pass Through Entity Tax.

Indiana Department of Revenue | 2

|

Enlarge image |

The payment for Pass Through Entity Tax can be submitted in the same manner as nonresident

withholding tax payments for the partnership or S corporation. Please see the instructions for

Form IT-20S or Form IT-65 for further information on submitting nonresident withholding tax

payments.

If you are paying both nonresident withholding tax and Pass Through Entity Tax, any

withholding tax that would have been due absent the Pass Through Entity Tax will be reduced

by the Pass Through Entity Tax. However, the extended period for Pass Through Entity Tax

payments does not apply to any remaining withholding tax due. Further, any remaining

withholding tax will be subject to interest and penalties if not paid by the return deadline.

If you are paying Pass Through Entity Tax via INTIME, see the following resources on the DOR’s

website for making a payment on INTIME:

• INTIME resources and guides

• INTIME User Guide for Business Customers pages 23-25

• Make a Bill Payment Without Logging in to INTIME

• INTIME Guide to Making a Tax Return Payment

Making Estimated Tax Payments

For taxable years ending on or before June 30, 2023, an electing entity is not required to make

estimated tax payments. For taxable years ending after June 30, 2023, and on or before

Dec. 31, 2024, an electing entity shall make a single estimated tax payment for the taxable years on

or before the end of the taxable year. Estimated payments must be made with Form IT-6WTH.

There is no penalty for underpayment of estimated tax, except to the extent the underpayment

fails to equal or exceed 50% of the tax imposed for the taxable year in the case of taxable years

ending after June 30, 2023, and on or before Dec. 31, 2024. For these periods, do not self-assess

an estimated tax penalty. DOR will compute the estimated tax penalty and issue any billing.

For taxable years ending after Dec. 31, 2024, there shall be no penalty for underpayment of

estimated tax, except to the extent the payments during the taxable year fail to equal or exceed the

lesser of 80% of the tax imposed for the taxable year or 100% of the tax imposed for the preceding

taxable year.

Indiana Department of Revenue | 3

|

Enlarge image |

Withholding Requirements for

Pass Through Entity Tax

If an entity elects to be subject to the Pass Through Entity Tax for a partner or shareholder or

treats Pass Through Entity Tax paid by another entity as Pass Through Entity Tax to its direct

owners, the entity is still subject to withholding tax on those owners. However, any withholding

tax required for the owners is reduced dollar-for-dollar by the Pass Through Entity Tax credited

to that owner.

For example, if a partnership has two equal partners—Individual A and Corporation B, a C

corporation—and the partnership has $20,000 of Indiana adjusted gross income, the partnership

will pay $323 of Pass Through Entity Tax for each partner. However, Corporation B would have

had withholding tax of $490 without an election. The partnership is still required to pay $167

($490 minus $323) in withholding tax in addition to the Pass Through Entity Tax.

If an entity pays or is credited with both Pass Through Entity Tax and withholding tax, any

payments of tax will be attributed first to Pass Through Entity Tax, then to withholding tax. Any

penalties and safe harbors for withholding tax shall be determined after the application of the Pass

Through Entity Tax.

Calculating the Tax

On its return for the taxable year, the electing entity must attach a Schedule Composite and, if

applicable, Schedule Composite-COR, showing the calculation of the tax and the credit available

to each direct owner and remit the tax with the return, taking into account prior estimated tax

payments by the electing entity along with other payments that are credited to the electing entity

as tax paid or withheld.

The adjusted gross income of the electing entity shall be the aggregate of the direct owners’ share

of the electing entity’s adjusted gross income. The electing entity shall determine each

nonresident direct owner’s share after allocation and apportionment. Each resident direct owner’s

share can be determined either before or after allocation and apportionment at the discretion of

the electing entity. The electing entity must use the same method for all resident direct owners. If

a direct owner has an adjusted gross income from the pass-through entity of less than zero, then

the direct owner’s share shall be treated as zero.

The tax rate is the same as the individual income tax rate for any given tax year. If the electing

entity has a tax year that is in part of more than one tax year, the tax rate is determined for

the individual rate in effect on the last day of the electing entity’s tax year.

Indiana Department of Revenue | 4

|

Enlarge image |

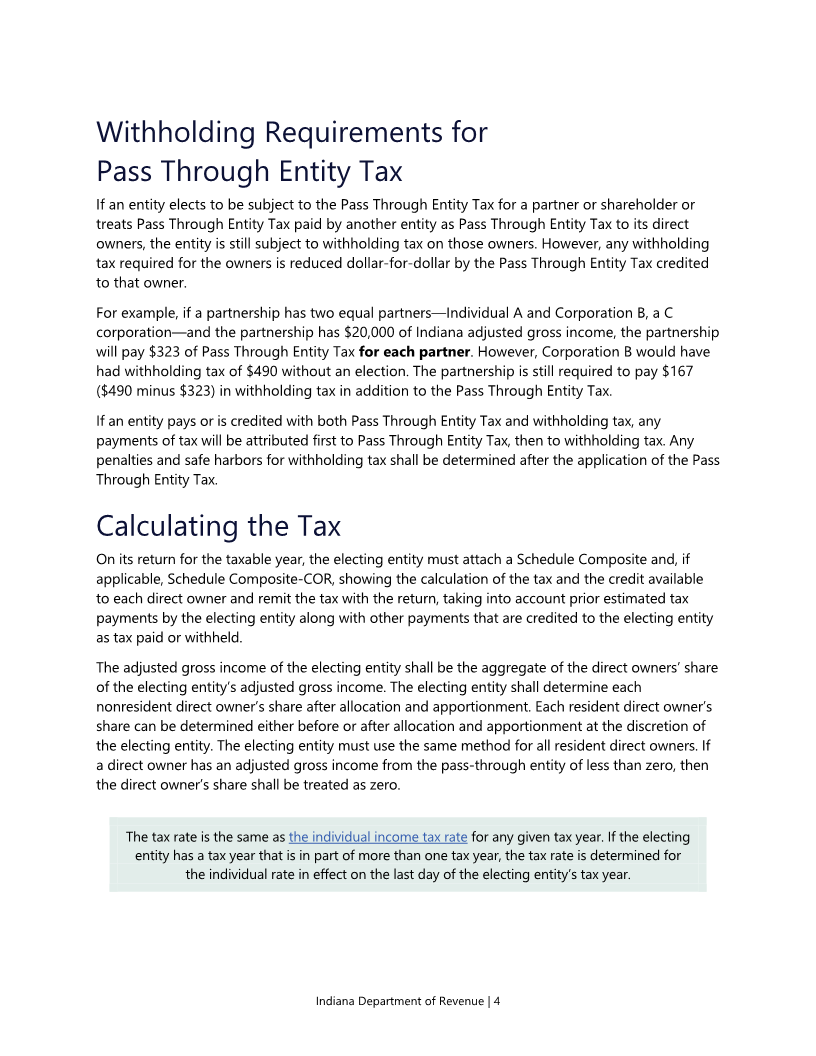

Example 1: Determining Indiana-Sourced Income

in a Single-Tiered Structure

Individual Partners A and B each have a 50% ownership interest in their Partnership. Partner A was

an Indiana resident for all of 2022 (3.23% tax rate). Partner B was a nonresident during that time.

The Partnership earned 25% of its income in Indiana and 75% from other states. The Partnership

netted $100,000 of ordinary business income from the sale of tangible personal property. The

Partnership makes an election to pay tax at the entity level for 2022 and elects to tax Partner A on

a pre-apportionment basis.

Taxable income: The electing partnership’s Indiana-sourced income is therefore $62,500

($50,000 plus $12,500).

Type Partner A (resident) Partner B (nonresident)

Portion of income from partnership $50,000 $50,000

Indiana apportionment % 100% 25%

Partnership’s Indiana Gross Income $50,000 $12,500

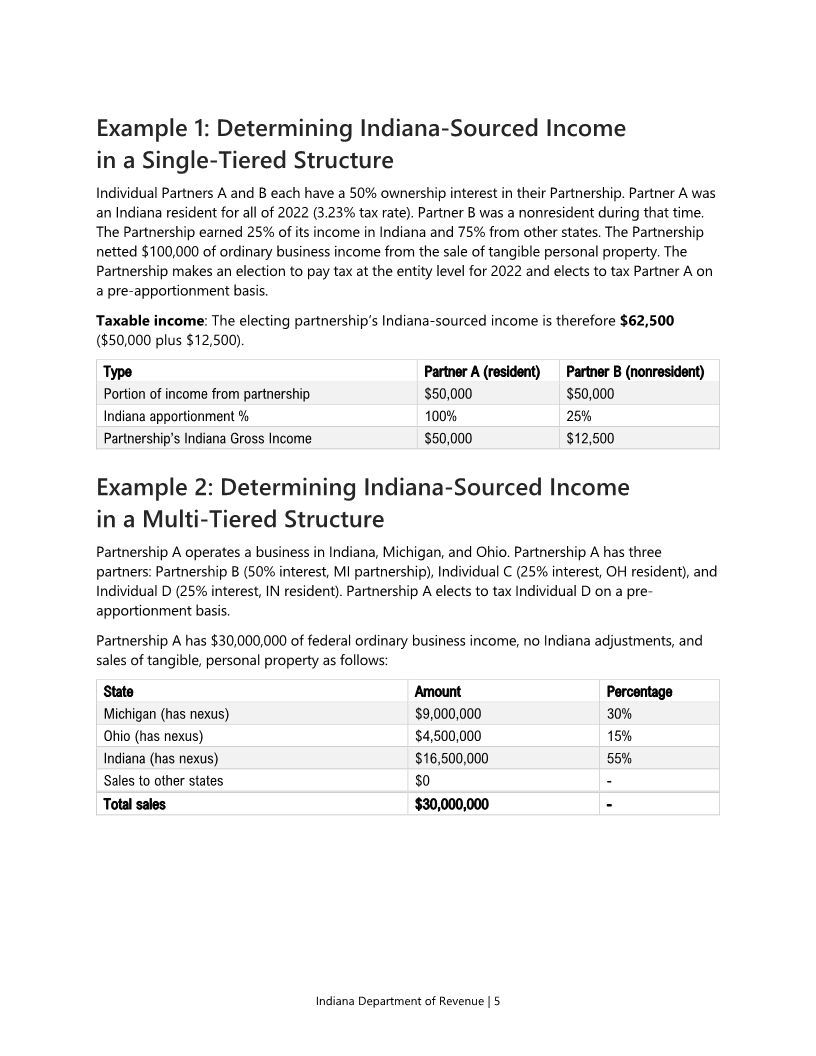

Example 2: Determining Indiana-Sourced Income

in a Multi-Tiered Structure

Partnership A operates a business in Indiana, Michigan, and Ohio. Partnership A has three

partners: Partnership B (50% interest, MI partnership), Individual C (25% interest, OH resident), and

Individual D (25% interest, IN resident). Partnership A elects to tax Individual D on a pre-

apportionment basis.

Partnership A has $30,000,000 of federal ordinary business income, no Indiana adjustments, and

sales of tangible, personal property as follows:

State Amount Percentage

Michigan (has nexus) $9,000,000 30%

Ohio (has nexus) $4,500,000 15%

Indiana (has nexus) $16,500,000 55%

Sales to other states $0 -

Total sales $30,000,000 -

Indiana Department of Revenue | 5

|

Enlarge image |

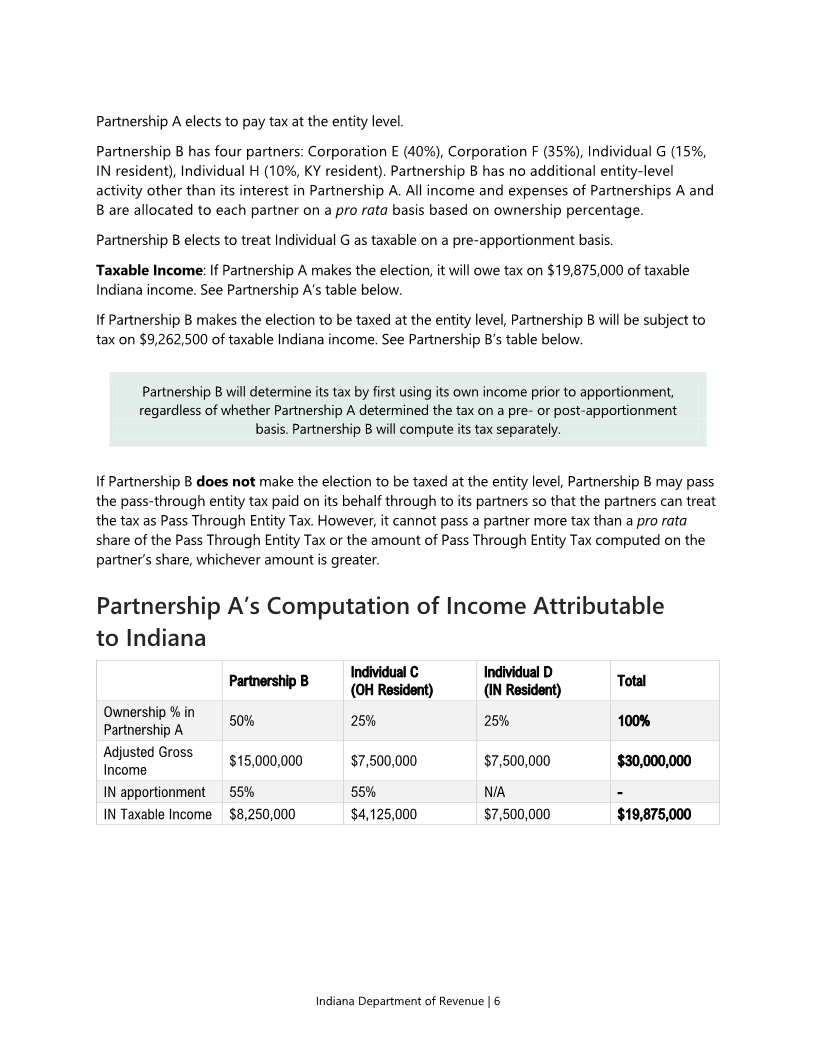

Partnership A elects to pay tax at the entity level.

Partnership B has four partners: Corporation E (40%), Corporation F (35%), Individual G (15%,

IN resident), Individual H (10%, KY resident). Partnership B has no additional entity-level

activity other than its interest in Partnership A. All income and expenses of Partnerships A and

B are allocated to each partner on a pro rata basis based on ownership percentage.

Partnership B elects to treat Individual G as taxable on a pre-apportionment basis.

Taxable Income: If Partnership A makes the election, it will owe tax on $19,875,000 of taxable

Indiana income. See Partnership A’s table below.

If Partnership B makes the election to be taxed at the entity level, Partnership B will be subject to

tax on $9,262,500 of taxable Indiana income. See Partnership B’s table below.

Partnership B will determine its tax by first using its own income prior to apportionment,

regardless of whether Partnership A determined the tax on a pre- or post-apportionment

basis. Partnership B will compute its tax separately.

If Partnership B does not make the election to be taxed at the entity level, Partnership B may pass

the pass-through entity tax paid on its behalf through to its partners so that the partners can treat

the tax as Pass Through Entity Tax. However, it cannot pass a partner more tax than a pro rata

share of the Pass Through Entity Tax or the amount of Pass Through Entity Tax computed on the

partner’s share, whichever amount is greater.

Partnership A’s Computation of Income Attributable

to Indiana

Individual C Individual D

Partnership B Total

(OH Resident) (IN Resident)

Ownership % in

50% 25% 25% 100%

Partnership A

Adjusted Gross

$15,000,000 $7,500,000 $7,500,000 $30,000,000

Income

IN apportionment 55% 55% N/A -

IN Taxable Income $8,250,000 $4,125,000 $7,500,000 $19,875,000

Indiana Department of Revenue | 6

|

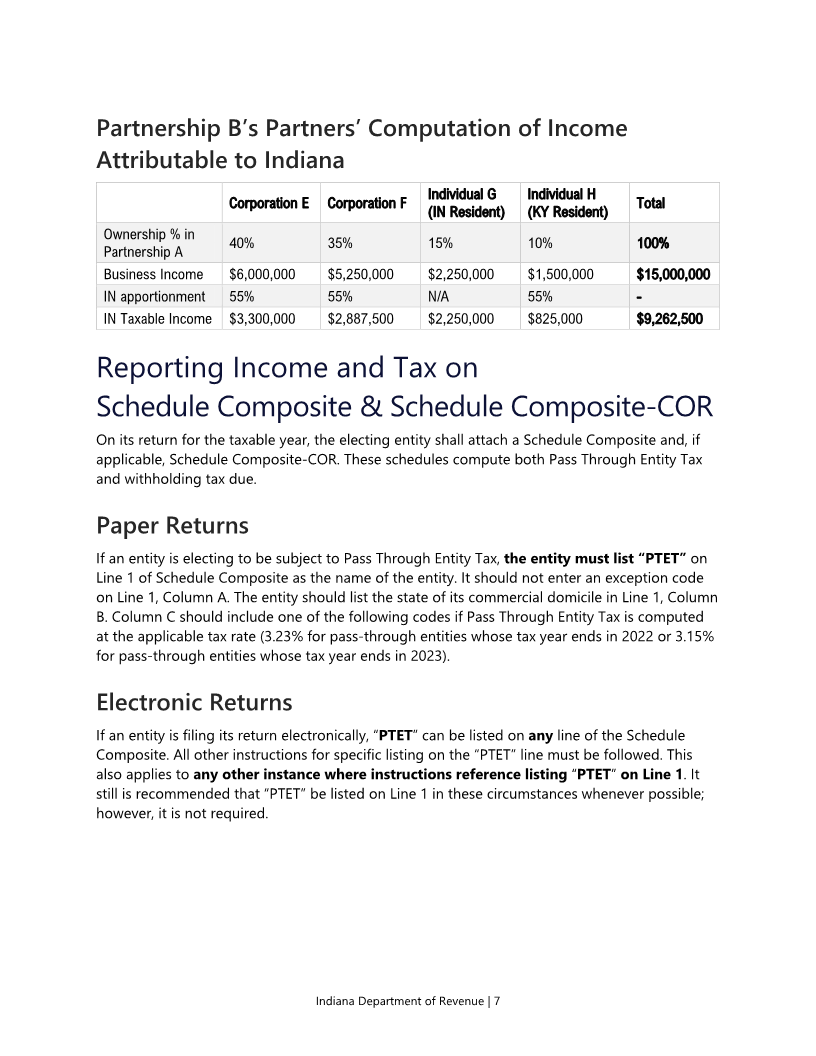

Enlarge image |

Partnership B’s Partners’ Computation of Income

Attributable to Indiana

Individual G Individual H

Corporation E Corporation F Total

(IN Resident) (KY Resident)

Ownership % in

40% 35% 15% 10% 100%

Partnership A

Business Income $6,000,000 $5,250,000 $2,250,000 $1,500,000 $15,000,000

IN apportionment 55% 55% N/A 55% -

IN Taxable Income $3,300,000 $2,887,500 $2,250,000 $825,000 $9,262,500

Reporting Income and Tax on

Schedule Composite & Schedule Composite-COR

On its return for the taxable year, the electing entity shall attach a Schedule Composite and, if

applicable, Schedule Composite-COR. These schedules compute both Pass Through Entity Tax

and withholding tax due.

Paper Returns

If an entity is electing to be subject to Pass Through Entity Tax, the entity must list “PTET” on

Line 1 of Schedule Composite as the name of the entity. It should not enter an exception code

on Line 1, Column A. The entity should list the state of its commercial domicile in Line 1, Column

B. Column C should include one of the following codes if Pass Through Entity Tax is computed

at the applicable tax rate (3.23% for pass-through entities whose tax year ends in 2022 or 3.15%

for pass-through entities whose tax year ends in 2023).

Electronic Returns

If an entity is filing its return electronically, “PTET” can be listed on any line of the Schedule

Composite. All other instructions for specific listing on the “PTET” line must be followed. This

also applies to any other instance where instructions reference listing “PTET ”on Line 1 . It

still is recommended that “PTET” be listed on Line 1 in these circumstances whenever possible;

however, it is not required.

Indiana Department of Revenue | 7

|

Enlarge image |

Computation Codes 1–3

Code 1

Resident owners are subject to Pass Through Entity Tax on all income and the Pass Through

Entity Tax is calculated at the applicable tax rate.

Code 2

Resident owners are subject to Pass Through Entity Tax on only the share of the eligible entity’s

income apportioned to Indiana and the Pass Through Entity Tax is calculated at the applicable tax rate.

Code 3

There are no resident owners and the Pass Through Entity Tax is calculated at the applicable tax rate.

Computation Codes 4–6

These should only be used in tiered structures when:

• the Pass Through Entity Tax passed through from one electing entity to another electing

entity is greater than the recipient’s Pass Through Entity Tax, and

• the recipient entity passes through more Pass Through Entity Tax to one or more owners

than would otherwise be due from the recipient entity.

Example: Partnership B’s share of income from Partnership A is $1,000,000. Partnership

A makes a Pass Through Entity Tax election and pays $32,300 on behalf of Partnership B.

Partnership B determines its income for its Indiana sources and determines that its total

share of all partners’ income is $900,000. Assume Partnership B has no excluded owners

such as a bank. Partnership B has a Pass Through Entity Tax liability of $29,070. If

Partnership B passes through more than $29,070, it should use codes 4–6. However, if

Partnership B elected to pass through only $29,070, it should use codes 1–3.

Code 4

Resident direct owners are subject to Pass Through Entity Tax on all income.

Code 5

Resident direct owners are subject to Pass Through Entity Tax on only the share of the eligible

entity’s income apportioned to Indiana.

Code 6

There are no resident direct owners.

Indiana Department of Revenue | 8

|

Enlarge image |

Instructions for Completing Remaining Lines on Schedule Composite

On line 1 of the Schedule Composite, enter zero (0) in Columns D through G.

For each direct owner subject to Pass Through Entity Tax, enter the owner’s name beginning on

Line 2 of the Schedule Composite. For Column A, leave the column blank unless one of the

following occurs:

• The owner is an Indiana resident. Enter exception code “15” in column A.

• The owner is an employee stock option plan that has completed Schedule IN-COMPA.

Enter exception code “03” in Column A.

• The owner is an individual retirement account that has completed Schedule IN-COMPA.

Enter exception code “06” in Column A.

• The owner is a bank and trust company, national banking association, savings bank,

building and loan association, savings and loan association, or international banking

facility and the owner is not an S corporation, partnership, or trust for federal tax

purposes. Enter exception code “02” in Column A.

• The owner is a non-resident of Indiana, is not an employee stock option plan, an individual

retirement account, a bank or international banking facility, and the Pass Through Entity

Tax (or combined Pass Through Entity Tax and withholding tax) passed through to the

owner is greater than the Pass Through Entity Tax otherwise computed for the owner of

the non-resident’s income reported in Column C. Enter exception code “01” in Column A.

For each owner, beginning on Line 2 of the Schedule Composite, report the income subject to

Pass Through Entity Tax and withholding tax in Column C and the combined Pass Through

Entity Tax and withholding tax in Column D. Column D must be at least the product of the rate

of Column C unless the entity is expressly permitted to use exemption codes 02, 03, or 06 as

provided above. Complete Columns E through F for withholding tax purposes only. Enter the

sum of Column D and Column F in Column G.

A pass-through entity is not permitted to use most tax credits to reduce the amount of Pass

Through Entity Tax owed for a direct owner nor can the pass-through entity use those credits to

offset its Pass Through Entity Tax liability. The only credits that a pass-through entity can use are

Indiana Pass Through Entity Tax paid or Indiana withholding tax credits.

Indiana Department of Revenue | 9

|

Enlarge image |

Computation Codes 7-12

If you are an entity that has not elected to be subject to Pass Through Entity Tax (“non-electing

entity”), you may pass through Pass Through Entity Tax to your owners as Pass Through Entity

Tax or treat the Pass Through Entity Tax as withholding tax. Even though estates and trusts

cannot elect to be subject to Pass Through Entity Tax themselves, they can pass through Pass

Through Entity Tax paid by another entity.

For 2022, no special election is required. However, you must enter “PTET” for the name of the

partner, shareholder, or beneficiary on Line 1 of the Schedule Composite.

The special instructions for electronically filed returns that permit listing “PTET” on Schedule

Composite on a line other than Line 1 also apply here.

In addition, in Column C on Line 1, enter the following computation codes depending on the

how the resident share is to be computed:

Code 7

Resident owners are subject to Pass Through Entity Tax on all income from the non-electing entity

and all Pass Through Entity Tax is calculated either at the applicable tax rate or at a lower rate.

Code 8

Resident owners are subject to Pass Through Entity Tax on only the share of the non-electing

entity’s income apportioned to Indiana and all Pass Through Entity Tax is calculated either at the

applicable Pass Through Entity Tax rate or at a lower rate.

Code 9

There are no resident owners of the non-electing entity and all Pass Through Entity Tax is

calculated either at the applicable tax rate or at a lower rate.

Code 10

Resident owners are subject to Pass Through Entity Tax on all income from the non-electing

entity and the Pass Through Entity Tax is calculated for at least one individual or entity at a rate

greater than the applicable tax rate.

Code 11

Resident owners are subject to Pass Through Entity Tax only on the share of the non-electing

entity’s income apportioned to Indiana and the Pass Through Entity Tax is calculated for at least

one individual or entity at a rate greater than the applicable tax rate.

Indiana Department of Revenue | 10

|

Enlarge image |

Code 12

There are no resident owners of the non-electing entity, and the Pass Through Entity Tax is

calculated for at least one individual or entity at a rate greater than the applicable tax rate.

Enter the same exception codes that apply for direct owners of entities that make an election to

be subject to Pass Through Entity Tax. In addition, an entity that does not make an election to

be subject to Pass Through Entity Tax may use regular exception codes applicable to

withholding but solely for purposes of withholding. An entity passing through Pass Through

Entity Tax cannot use most tax credits or exceptions to reduce Pass Through Entity Tax that is

actually passed through.

For Schedule Composite-COR, enter “PTET” on Line 1 under the name of the entity if the entity

has elected to be subject to Pass Through Entity Tax or if the entity is passing through Pass

Through Entity Tax. No other information should be entered on Line 1. For electronically filed

returns, “PTET” can be used on a different line if your software does not permit listing “PTET” on

Line 1.

For each C corporation subject to Pass Through Entity Tax, list the information as you otherwise

would on Schedule Composite-COR beginning on line 2. Use an exception code only if the tax

reported is different than 4.9% (not the applicable individual rate) and follow the procedures

applicable for the exception code.

If the corporation is exempt as a bank or international banking facility, enter exception code “02”

for that entity if the withholding is less than 4.9%.

In certain circumstances, an entity could be subject to both Pass Through Entity Tax and

withholding tax. For instance, if a C corporation has $10,000 of income as a partner in a

partnership for the year ending December 31, 2022, the partnership elects to be subject to Pass

Through Entity Tax, and the C corporation does not provide an exception for the C corporation,

the partnership will treat $323 as Pass Through Entity Tax and $167 as withholding. The Pass

Through Entity Tax and withholding tax will be subject to different penalty and interest rules.

Indiana Department of Revenue | 11

|

Enlarge image |

Reporting Pass Through Entity Tax

If an entity remits Pass Through Entity Tax for its owners, the entity on its return must report:

• Pass Through Entity Tax in the same manner as other withholding tax payments

• Pass Through Entity Tax paid for the owner on Schedule IN K-1 on the same line for state

taxes withheld (Schedule IN K-1, Part 1, Line 11)

• The owner’s share of Pass Through Entity Tax as a state income tax deducted for purposes

of Part 4, Line 1 of Schedule IN K-1. Include only the amount that the pass-through entity

deducted for federal tax purposes for the current tax year. Due to federal reporting

requirements, amounts paid for 2022 may be reported by a pass-through entity as a 2023

(or later) deduction. If this happens, report the amount as a 2023 (or later, if applicable)

modification.

If the entity does not make an election to be subject to Pass Through Entity Tax, the entity must

report the Pass Through Entity Tax passed through to its owners or beneficiaries in the manner

that it would otherwise report taxes withheld for the owners or beneficiaries (Schedule IN K-1, Part

1, Line 11 or IT-41 Schedule K-1, Part 1, Line 12). The entity must also report that owner’s or

beneficiary’s share of Pass Through Entity Tax as a state income tax deducted for purposes of Part

4, Line 1 of Schedule IN K-1 or IT-41 Schedule IN K-1.

For tax year 2022, a pass-through entity that either pays Pass Through Entity Tax or passes

through Pass Through Entity Tax will report the Pass Through Entity Tax amounts and other

withholding amounts. This will be reported via a letter or other statement breaking out the

separate amounts. DOR will not be issuing a state form for these breakouts for 2022.

Claiming Credits for Indiana Pass Through

Entity Tax Paid

Each entity owner is entitled to a refundable credit for the Pass Through Entity Tax, allowed

against income tax for a taxpayer who is a partner in a partnership or a shareholder of an S

corporation that has elected to pay the Pass Through Entity Tax. The amount of the credit is equal

to the portion of the tax paid by the entity that is attributable to the partner or shareholder's share

of income taxable in Indiana. This would effectively offset any impact of payment of tax at the

entity level on the entity owners.

The eligible individual taxpayers that receive an Indiana Pass Through Entity Tax credit may claim

the credit by attaching Schedule IN K-1 or IT-41 Schedule K-1, reflecting the credit and listing the

credit on the individual’s IT-40 Schedule 5 or IT-40PNR Schedule F of their Indiana personal

income tax return.

Partnerships and S corporations report Pass Through Entity Tax paid by another entity as pass-

through withholding (Form IT-65, Line 8 or IT-20S, Line 17).

Indiana Department of Revenue | 12

|

Enlarge image |

In addition to the lines required for individuals, partnerships, and S corporations, the credit

should be listed on these lines of other returns if applicable:

• Nonprofit corporations: IT-20NP, line 23

• Corporations: IT-20, line 37.

• Financial institutions: FIT-20, Line 42

• Estates and trusts: IT-41, Line 14

Additional Resources

Senate Enrolled Act 2 (2023)

Indiana Code 6-3-2.1

Information Bulletin (coming soon)

Contact Us

Questions on Pass Through Entity Tax? Contact Tax Policy.

Indiana Department of Revenue | 13

|