Enlarge image

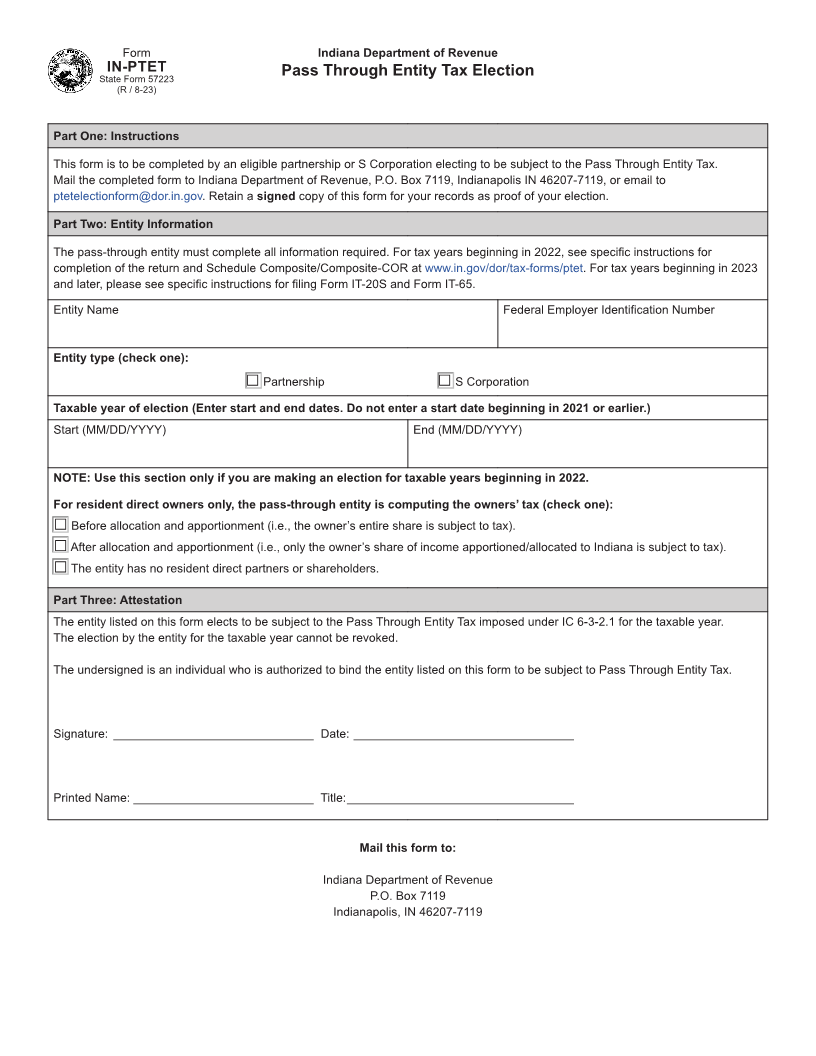

Form Indiana Department of Revenue

IN-PTET Pass Through Entity Tax Election

State Form 57223

(R / 8-23)

Part One: Instructions

This form is to be completed by an eligible partnership or S Corporation electing to be subject to the Pass Through Entity Tax.

Mail the completed form to Indiana Department of Revenue, P.O. Box 7119, Indianapolis IN 46207-7119, or email to

ptetelectionform@dor.in.gov. Retain a signed copy of this form for your records as proof of your election.

Part Two: Entity Information

The pass-through entity must complete all information required. For tax years beginning in 2022, see specific instructions for

completion of the return and Schedule Composite/Composite-COR at www.in.gov/dor/tax-forms/ptet. For tax years beginning in 2023

and later, please see specific instructions for filing Form IT-20S and Form IT-65.

Entity Name Federal Employer Identification Number

Entity type (check one):

□ Partnership □ S Corporation

Taxable year of election (Enter start and end dates. Do not enter a start date beginning in 2021 or earlier.)

Start (MM/DD/YYYY) End (MM/DD/YYYY)

NOTE: Use this section only if you are making an election for taxable years beginning in 2022.

For resident direct owners only, the pass-through entity is computing the owners’ tax (check one):

□ Before allocation and apportionment (i.e., the owner’s entire share is subject to tax).

□ After allocation and apportionment (i.e., only the owner’s share of income apportioned/allocated to Indiana is subject to tax).

□ The entity has no resident direct partners or shareholders.

Part Three: Attestation

The entity listed on this form elects to be subject to the Pass Through Entity Tax imposed under IC 6-3-2.1 for the taxable year.

The election by the entity for the taxable year cannot be revoked.

The undersigned is an individual who is authorized to bind the entity listed on this form to be subject to Pass Through Entity Tax.

Signature: ______________________________ Date: _________________________________

Printed Name: ___________________________ Title: __________________________________

Mail this form to:

Indiana Department of Revenue

P.O. Box 7119

Indianapolis, IN 46207-7119