Enlarge image

West Virginia

State Tax

Conceal Carry Gun Permit Training Credit

Rev.CCGP-18-16 Department

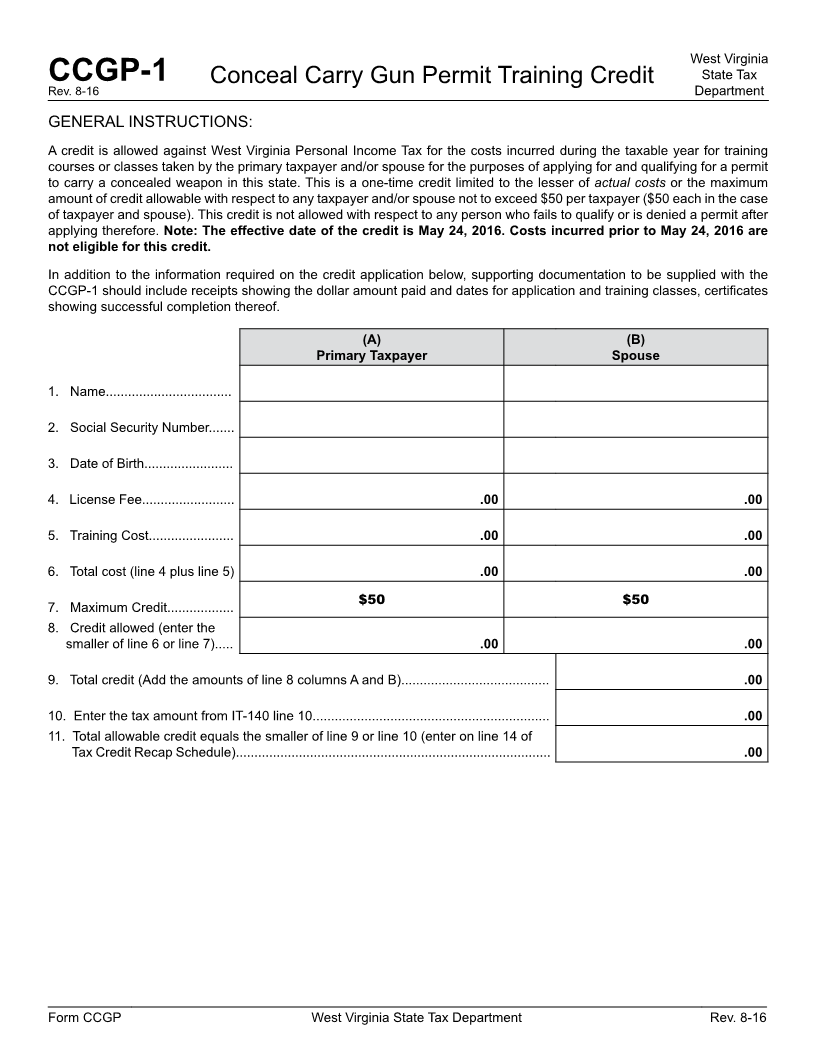

GeneRal InSTRuCTIonS:

a credit is allowed against West Virginia Personal Income Tax for the costs incurred during the taxable year for training

courses or classes taken by the primary taxpayer and/or spouse for the purposes of applying for and qualifying for a permit

to carry a concealed weapon in this state. This is a one-time credit limited to the lesser of actual costs or the maximum

amount of credit allowable with respect to any taxpayer and/or spouse not to exceed $50 per taxpayer ($50 each in the case

of taxpayer and spouse). This credit is not allowed with respect to any person who fails to qualify or is denied a permit after

applying therefore. Note: The effective date of the credit is May 24, 2016. Costs incurred prior to May 24, 2016 are

not eligible for this credit.

In addition to the information required on the credit application below, supporting documentation to be supplied with the

CCGP-1 should include receipts showing the dollar amount paid and dates for application and training classes, certificates

showing successful completion thereof.

(A) (B)

Primary Taxpayer Spouse

1. name..................................

2. Social Security number.......

3. Date of Birth........................

4. license Fee......................... .00 .00

5. Training Cost....................... .00 .00

6. Total cost (line 4 plus line 5) .00 .00

$50 $50

7. Maximum Credit..................

8. Credit allowed (enter the

smaller of line 6 or line 7)..... .00 .00

9. Total credit (add the amounts of line 8 columns a and B)........................................ .00

10. enter the tax amount from IT-140 line 10................................................................ .00

11. Total allowable credit equals the smaller of line 9 or line 10 (enter on line 14 of

Tax Credit Recap Schedule)..................................................................................... .00

Form CCGP West Virginia State Tax Department Rev. 8-16