Enlarge image

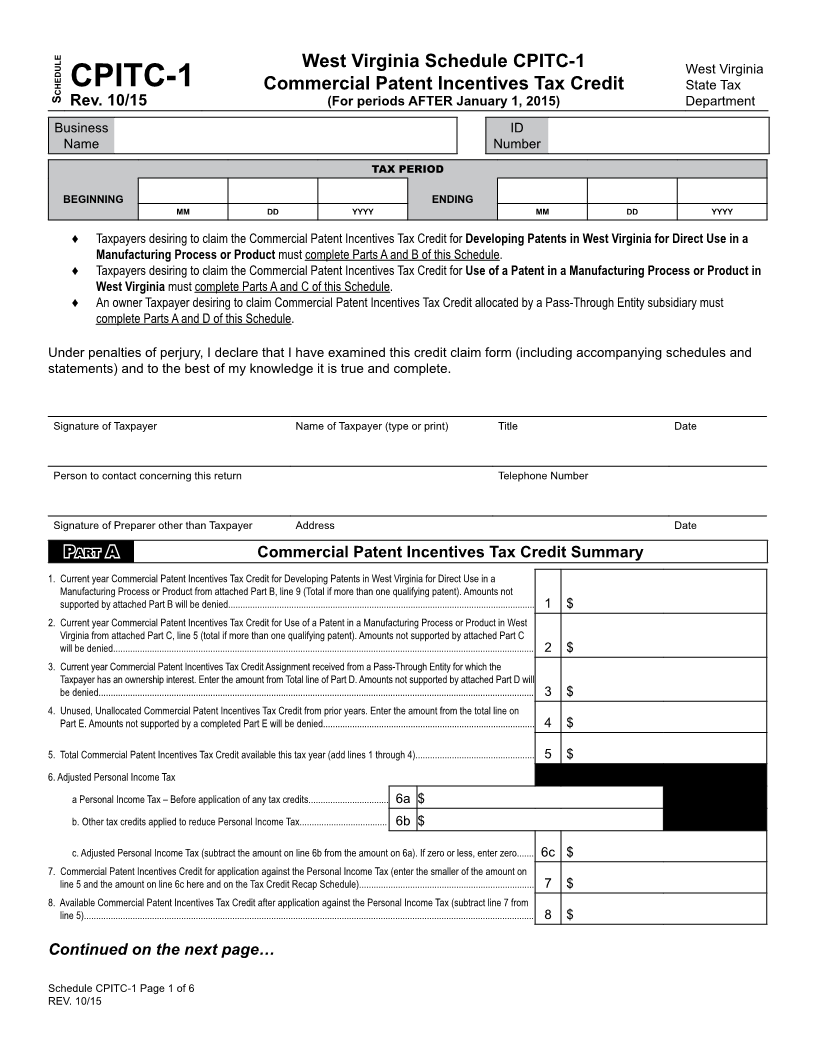

West Virginia Schedule CPITC-1 West Virginia

S CPITC-1 Commercial Patent Incentives Tax Credit State Tax

chedule

Rev. 10/15 (For periods AFTER January 1, 2015) Department

Business ID

Name Number

Tax period

BEgInnIng EnDIng

MM DD YYYY MM DD YYYY

♦ Taxpayers desiring to claim the Commercial Patent Incentives Tax Credit for Developing Patents in West Virginia for Direct Use in a

Manufacturing Process or Product must complete Parts A and B of this Schedule.

♦ Taxpayers desiring to claim the Commercial Patent Incentives Tax Credit for Use of a Patent in a Manufacturing Process or Product in

West Virginia must complete Parts A and C of this Schedule.

♦ An owner Taxpayer desiring to claim Commercial Patent Incentives Tax Credit allocated by a Pass-Through Entity subsidiary must

complete Parts A and D of this Schedule.

Under penalties of perjury, I declare that I have examined this credit claim form (including accompanying schedules and

statements) and to the best of my knowledge it is true and complete.

Signature of Taxpayer Name of Taxpayer (type or print) Title Date

Person to contact concerning this return Telephone Number

Signature of Preparer other than Taxpayer Address Date

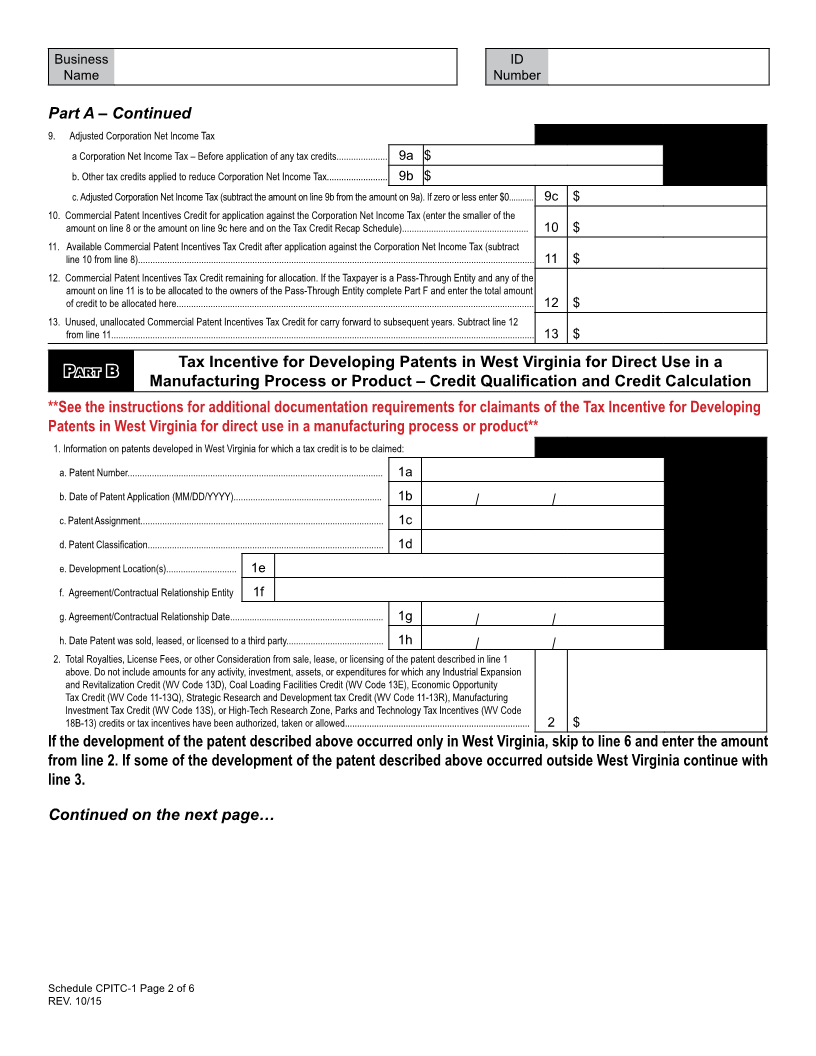

Part a Commercial Patent Incentives Tax Credit Summary

1. Current year Commercial Patent Incentives Tax Credit for Developing Patents in West Virginia for Direct Use in a

Manufacturing Process or Product from attached Part B, line 9 (Total if more than one qualifying patent). Amounts not

supported by attached Part B will be denied.............................................................................................................................. 1 $

2. Current year Commercial Patent Incentives Tax Credit for Use of a Patent in a Manufacturing Process or Product in West

Virginia from attached Part C, line 5 (total if more than one qualifying patent). Amounts not supported by attached Part C

will be denied............................................................................................................................................................................. 2 $

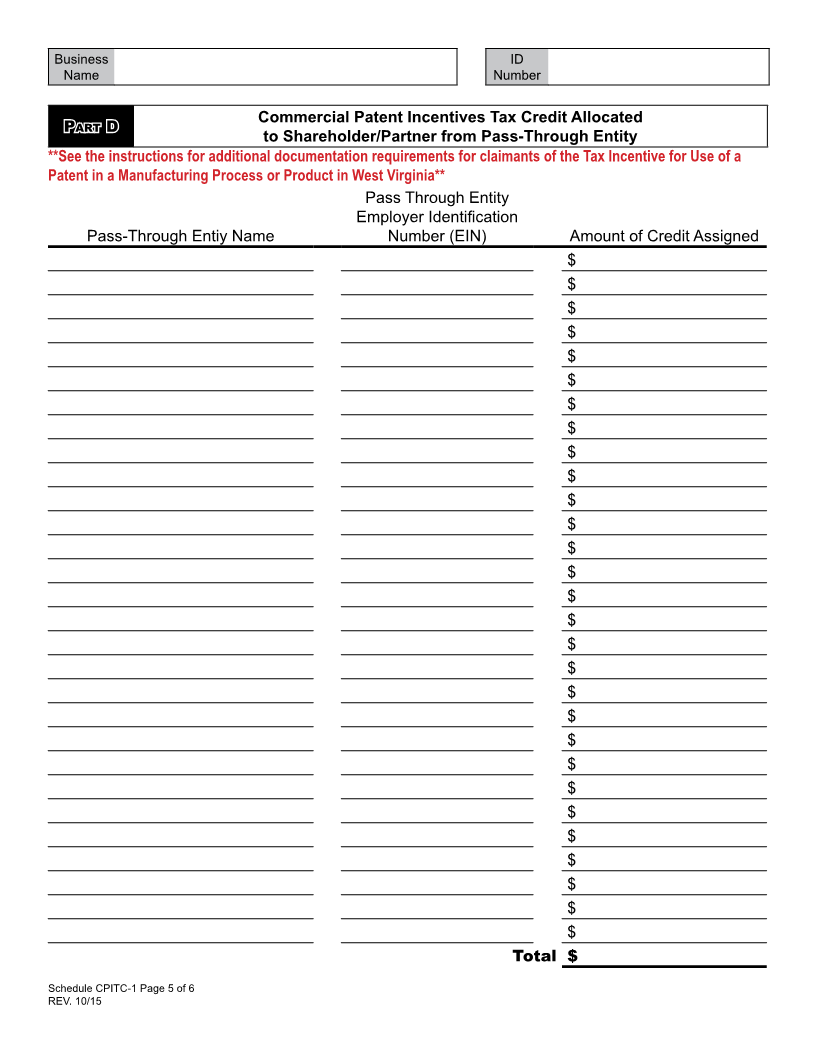

3. Current year Commercial Patent Incentives Tax Credit Assignment received from a Pass-Through Entity for which the

Taxpayer has an ownership interest. Enter the amount from Total line of Part D. Amounts not supported by attached Part D will

be denied................................................................................................................................................................................... 3 $

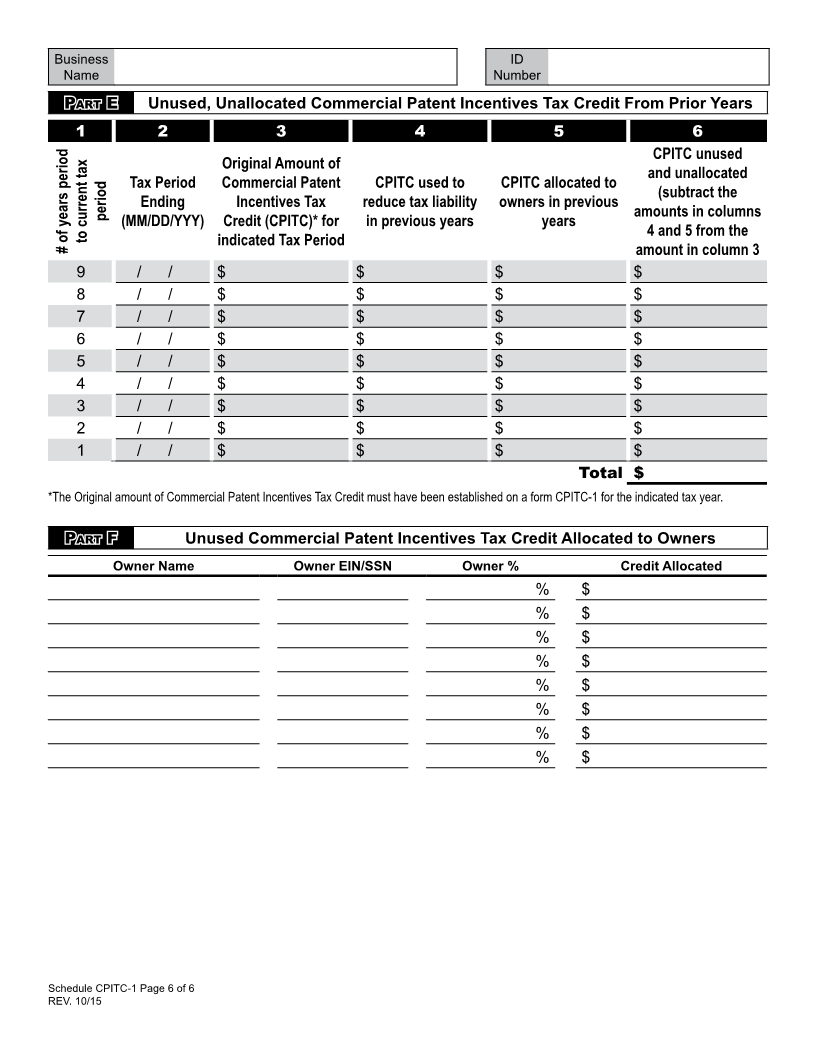

4. Unused, Unallocated Commercial Patent Incentives Tax Credit from prior years. Enter the amount from the total line on

Part E. Amounts not supported by a completed Part E will be denied....................................................................................... 4 $

5. Total Commercial Patent Incentives Tax Credit available this tax year (add lines 1 through 4)................................................. 5 $

6. Adjusted Personal Income Tax

a Personal Income Tax – Before application of any tax credits................................. 6a $

b. Other tax credits applied to reduce Personal Income Tax.................................... 6b $

c. Adjusted Personal Income Tax (subtract the amount on line 6b from the amount on 6a). If zero or less, enter zero....... 6c $

7. Commercial Patent Incentives Credit for application against the Personal Income Tax (enter the smaller of the amount on

line 5 and the amount on line 6c here and on the Tax Credit Recap Schedule)........................................................................ 7 $

8. Available Commercial Patent Incentives Tax Credit after application against the Personal Income Tax (subtract line 7 from

line 5)......................................................................................................................................................................................... 8 $

Continued on the next page…

Schedule CPITC-1 Page 1 of 6

REV. 10/15