Enlarge image

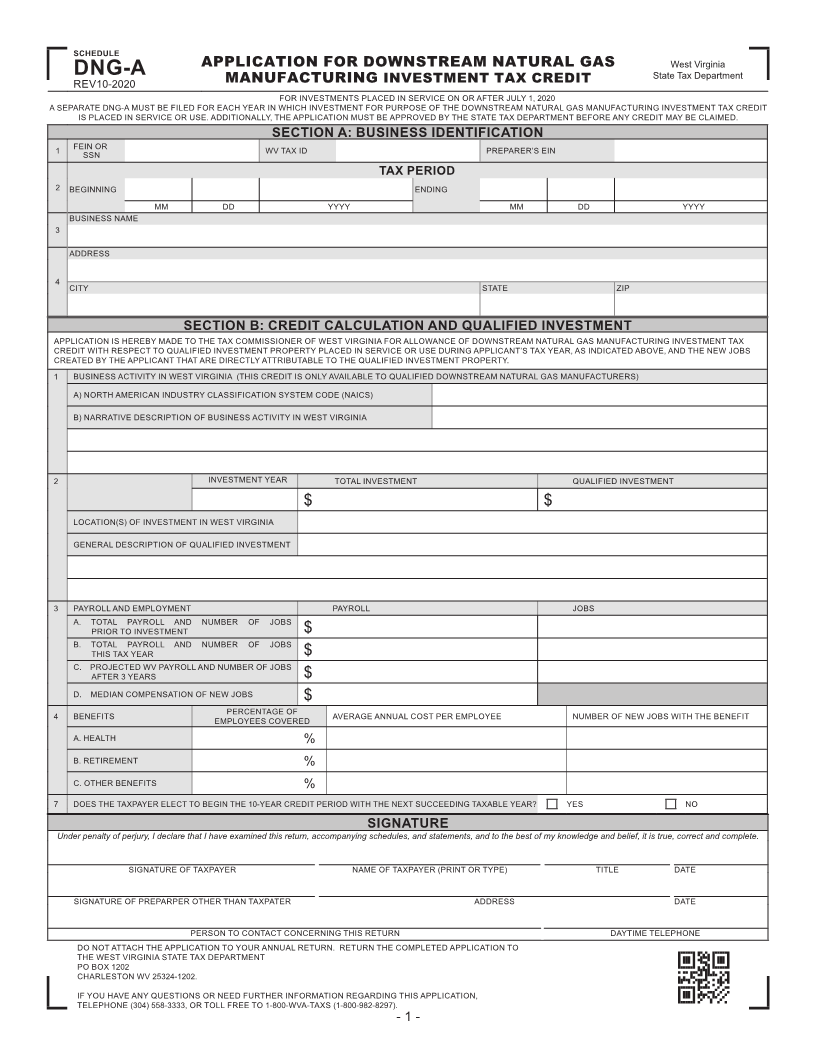

SCHEDULE

APPLICATION FOR DOWNSTREAM NATURAL GAS West Virginia

DNG-A State Tax Department

REV10-2020 MANUFACTURING INVESTMENT TAX CREDIT

FOR INVESTMENTS PLACED IN SERVICE ON OR AFTER JULY 1, 2020

A SEPARATE DNG-A MUST BE FILED FOR EACH YEAR IN WHICH INVESTMENT FOR PURPOSE OF THE DOWNSTREAM NATURAL GAS MANUFACTURING INVESTMENT TAX CREDIT

IS PLACED IN SERVICE OR USE. ADDITIONALLY, THE APPLICATION MUST BE APPROVED BY THE STATE TAX DEPARTMENT BEFORE ANY CREDIT MAY BE CLAIMED.

SECTION A: BUSINESS IDENTIFICATION

1 FEIN OR WV TAX ID PREPARER’S EIN

SSN

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

ADDRESS

4 CITY STATE ZIP

SECTION B: CREDIT CALCULATION AND QUALIFIED INVESTMENT

APPLICATION IS HEREBY MADE TO THE TAX COMMISSIONER OF WEST VIRGINIA FOR ALLOWANCE OF DOWNSTREAM NATURAL GAS MANUFACTURING INVESTMENT TAX

CREDIT WITH RESPECT TO QUALIFIED INVESTMENT PROPERTY PLACED IN SERVICE OR USE DURING APPLICANT’S TAX YEAR, AS INDICATED ABOVE, AND THE NEW JOBS

CREATED BY THE APPLICANT THAT ARE DIRECTLY ATTRIBUTABLE TO THE QUALIFIED INVESTMENT PROPERTY.

1 BUSINESS ACTIVITY IN WEST VIRGINIA (THIS CREDIT IS ONLY AVAILABLE TO QUALIFIED DOWNSTREAM NATURAL GAS MANUFACTURERS)

A) NORTH AMERICAN INDUSTRY CLASSIFICATION SYSTEM CODE (NAICS)

B) NARRATIVE DESCRIPTION OF BUSINESS ACTIVITY IN WEST VIRGINIA

2 INVESTMENT YEAR TOTAL INVESTMENT QUALIFIED INVESTMENT

$$

LOCATION(S) OF INVESTMENT IN WEST VIRGINIA

GENERAL DESCRIPTION OF QUALIFIED INVESTMENT

3 PAYROLL AND EMPLOYMENT PAYROLL JOBS

A. TOTAL PAYROLL AND NUMBER OF JOBS

PRIOR TO INVESTMENT $

B. TOTAL PAYROLL AND NUMBER OF JOBS

THIS TAX YEAR $

C. PROJECTED WV PAYROLL AND NUMBER OF JOBS

AFTER 3 YEARS $

D. MEDIAN COMPENSATION OF NEW JOBS $

4 BENEFITS PERCENTAGE OF AVERAGE ANNUAL COST PER EMPLOYEE NUMBER OF NEW JOBS WITH THE BENEFIT

EMPLOYEES COVERED

A. HEALTH %

B. RETIREMENT %

C. OTHER BENEFITS %

7 DOES THE TAXPAYER ELECT TO BEGIN THE 10-YEAR CREDIT PERIOD WITH THE NEXT SUCCEEDING TAXABLE YEAR? YES NO

SIGNATURE

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (PRINT OR TYPE) TITLE DATE

SIGNATURE OF PREPARPER OTHER THAN TAXPATER ADDRESS DATE

PERSON TO CONTACT CONCERNING THIS RETURN DAYTIME TELEPHONE

DO NOT ATTACH THE APPLICATION TO YOUR ANNUAL RETURN. RETURN THE COMPLETED APPLICATION TO

THE WEST VIRGINIA STATE TAX DEPARTMENT

PO BOX 1202

CHARLESTON WV 25324-1202.

IF YOU HAVE ANY QUESTIONS OR NEED FURTHER INFORMATION REGARDING THIS APPLICATION,

TELEPHONE (304) 558-3333, OR TOLL FREE TO 1-800-WVA-TAXS (1-800-982-8297).

- 1 -