Enlarge image

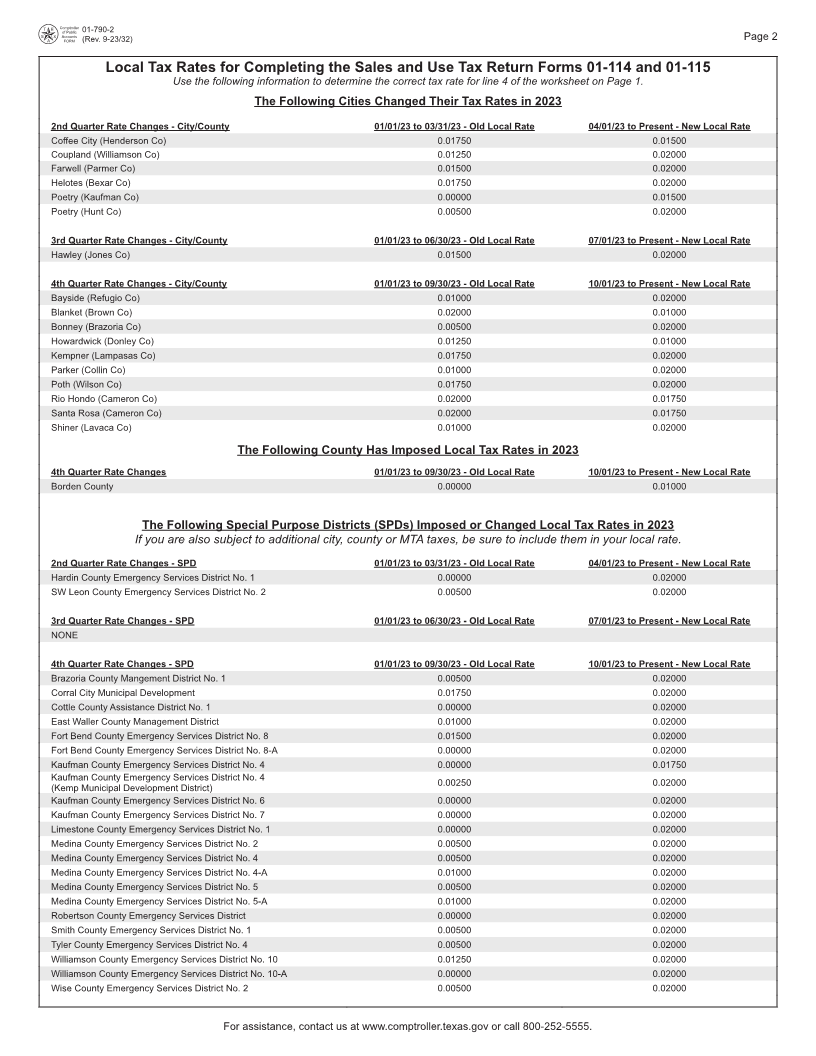

01-790-1

(Rev. 9-23/32)

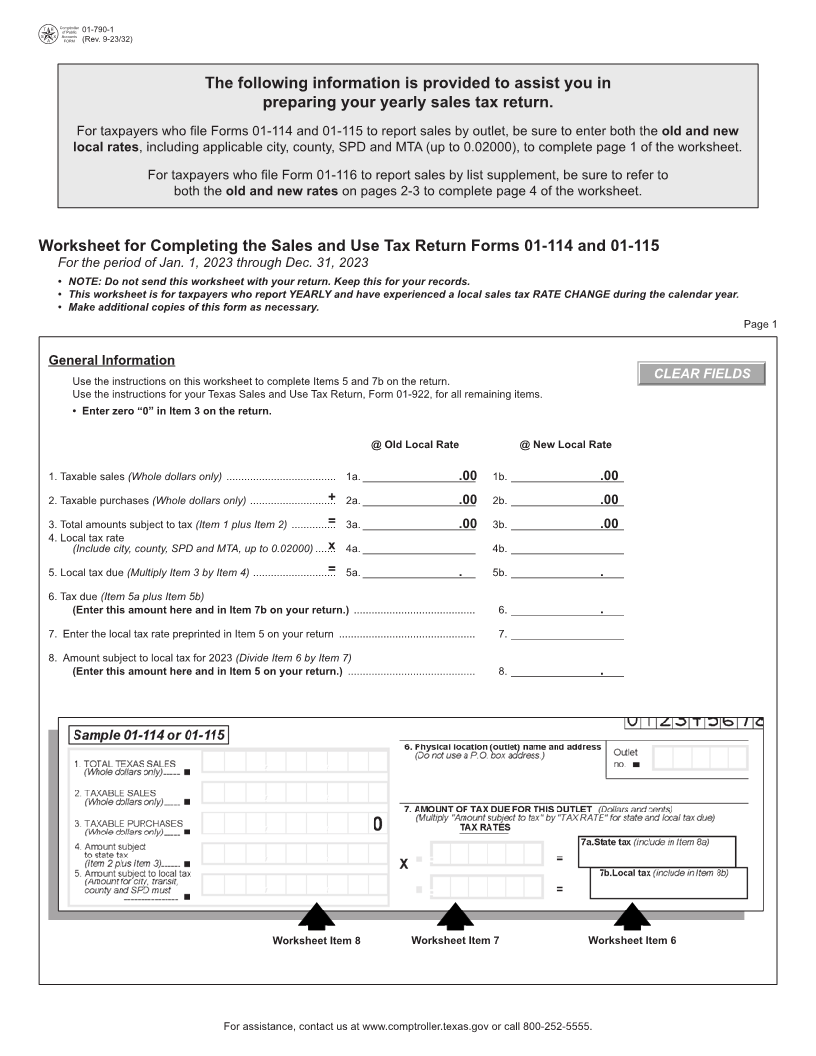

The following information is provided to assist you in

preparing your yearly sales tax return.

For taxpayers who file Forms 01-114 and 01-115 to report sales by outlet, be sure to enter both the old and new

local rates, including applicable city, county, SPD and MTA (up to 0.02000), to complete page 1 of the worksheet.

For taxpayers who file Form 01-116 to report sales by list supplement, be sure to refer to

both the old and new rates on pages 2-3 to complete page 4 of the worksheet.

Worksheet for Completing the Sales and Use Tax Return Forms 01-114 and 01-115

For the period of Jan. 1, 2023 through Dec. 31, 2023

• NOTE: Do not send this worksheet with your return. Keep this for your records.

• This worksheet is for taxpayers who report YEARLY and have experienced a local sales tax RATE CHANGE during the calendar year.

• Make additional copies of this form as necessary.

Page 1

General Information

CLEAR FIELDS

Use the instructions on this worksheet to complete Items 5 and 7b on the return.

Use the instructions for your Texas Sales and Use Tax Return, Form 01-922, for all remaining items.

• Enter zero “0” in Item 3 on the return.

@ Old Local Rate @ New Local Rate

1. Taxable sales(Whole dollars only) ..................................... 1a. ___________________.00 1b. ___________________.00

2. Taxable purchases(Whole dollars only) ............................. + 2a. ___________________.00 2b. ___________________.00

3. Total amounts subject to tax(Item 1 plus Item 2) ...............= 3a. ___________________.00 3b. ___________________.00

4. Local tax rate

(Include city, county, SPD and MTA, up to 0.02000) .......x 4a. ___________________ 4b. ___________________

5. Local tax due(Multiply Item 3 by Item 4) ............................ = 5a. ___________________. 5b. ___________________.

6. Tax due (Item 5a plus Item 5b)

(Enter this amount here and in Item 7b on your return.) ......................................... 6. ___________________.

7. Enter the local tax rate preprinted in Item 5 on your return .............................................. 7. ___________________

8. Amount subject to local tax for 2023 (Divide Item 6 by Item 7)

(Enter this amount here and in Item 5 on your return.) ........................................... 8. ___________________.

Worksheet Item 8 Worksheet Item 7 Worksheet Item 6

For assistance, contact us at www.comptroller.texas.gov or call 800-252-5555.