Enlarge image

AB 01-148 HHHH PRINT FORM CLEAR FIELDS

CD (Rev.5-19/9)

b. *0114800W051909*

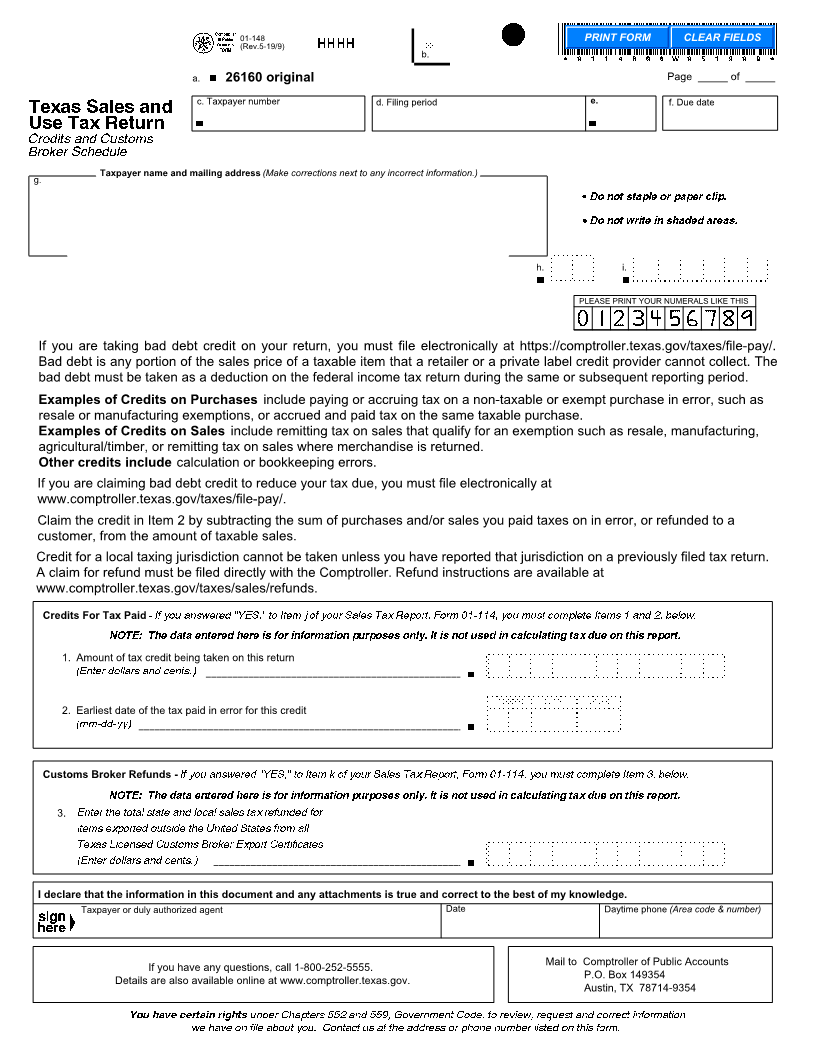

a. b 26160 original Page _____ of _____

Texas Sales and c. Taxpayer number d. Filing period e. f. Due date

Use Tax Return b b

Credits and Customs

Broker Schedule

Taxpayer name and mailing address (Make corrections next to any incorrect information.)

g.

I Do not staple or paper clip.

I Do not write in shaded areas.

I

h. i.

b b

PLEASE PRINT YOUR NUMERALS LIKE THIS

012 3456789

If you are taking bad debt credit on your return, you must file electronically at https://comptroller.texas.gov/taxes/file-pay/.

Bad debt is any portion of the sales price of a taxable item that a retailer or a private label credit provider cannot collect. The

bad debt must be taken as a deduction on the federal income tax return during the same or subsequent reporting period.

Examples of Credits on Purchases include paying or accruing tax on a non-taxable or exempt purchase in error, such as

resale or manufacturing exemptions, or accrued and paid tax on the same taxable purchase.

Examples of Credits on Sales include remitting tax on sales that qualify for an exemption such as resale, manufacturing,

agricultural/timber, or remitting tax on sales where merchandise is returned.

Other credits include calculation or bookkeeping errors.

If you are claiming bad debt credit to reduce your tax due, you must file electronically at

www.comptroller.texas.gov/taxes/file-pay/.

Claim the credit in Item 2 by subtracting the sum of purchases and/or sales you paid taxes on in error, or refunded to a

customer, from the amount of taxable sales.

Credit for a local taxing jurisdiction cannot be taken unless you have reported that jurisdiction on a previously filed tax return.

A claim for refund must be filed directly with the Comptroller. Refund instructions are available at

www.comptroller.texas.gov/taxes/sales/refunds.

Credits For Tax Paid - If you answered "YES," to Item j of your Sales Tax Report, Form 01-114, you must complete Items 1 and 2, below.

NOTE: The data entered here is for information purposes only. It is not used in calculating tax due on this report.

1. Amount of tax credit being taken on this return

(Enter dollars and cents.) b

2. Earliest date of the tax paid in error for this credit

(mm-dd-yy) b

Customs Broker Refunds - If you answered "YES," to Item k of your Sales Tax Report, Form 01-114, you must complete Item 3, below.

NOTE: The data entered here is for information purposes only. It is not used in calculating tax due on this report.

3. Enter the total state and local sales tax refunded for

items exported outside the United States from all

Texas Licensed Customs Broker Export Certificates

(Enter dollars and cents.) b

I declare that the information in this document and any attachments is true and correct to the best of my knowledge.

Taxpayer or duly authorized agent Date Daytime phone (Area code & number)

AB

If you have any questions, call 1-800-252-5555. Mail to Comptroller of Public Accounts

Details are also available online at www.comptroller.texas.gov. P.O. Box 149354

Austin, TX 78714-9354

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information

we have on file about you. Contact us at the address or phone number listed on this form.