Enlarge image

FLORIDA DEPARTMENT OF STATE

DIVISION OF CORPORATIONS

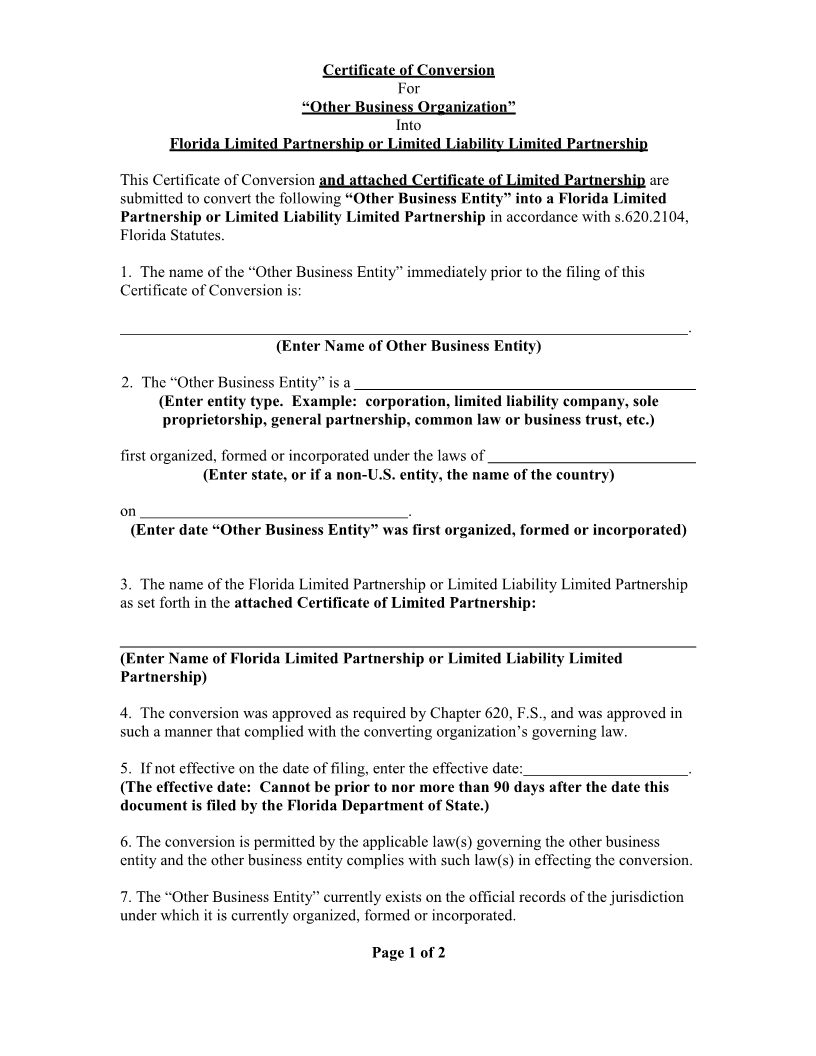

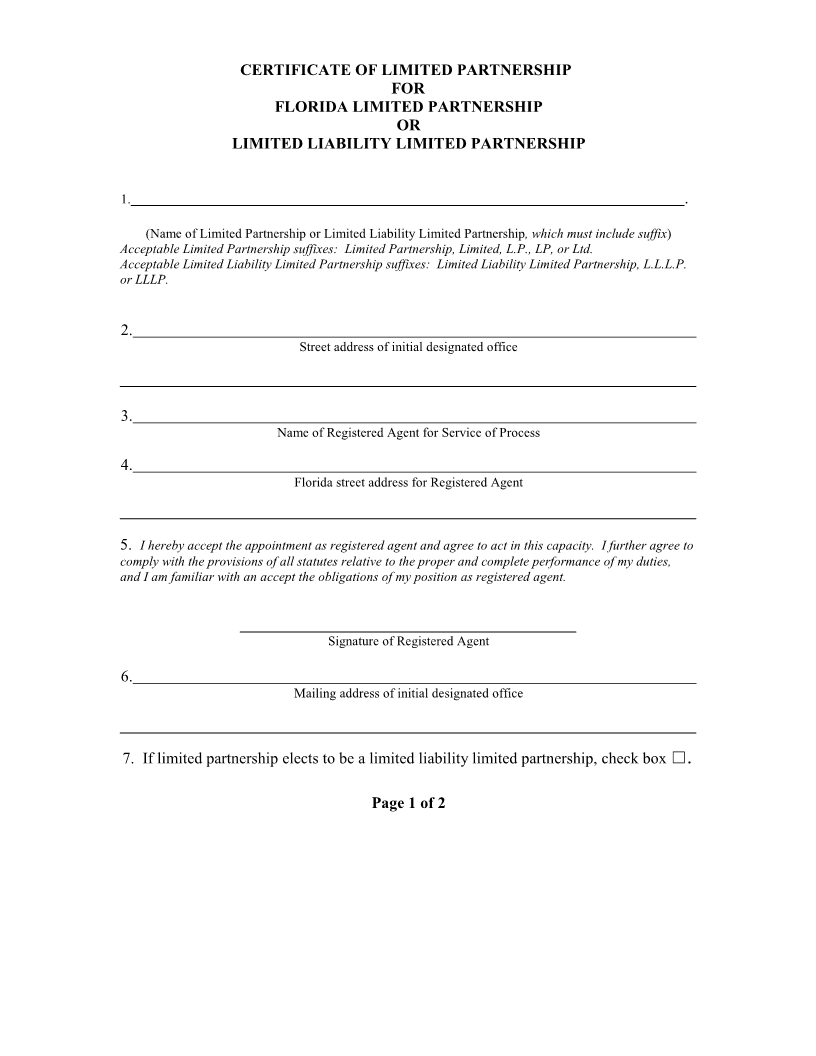

Attached are the forms to convert an “Other Organization” into a Florida Limited

Partnership or Limited Liability Limited Partnership pursuant to section 620.2104,

Florida Statutes. These forms are basic and may not meet all conversion needs. The

advice of an attorney is recommended.

Pursuant to s. 620.2102(1), F.S., an organization other than a domestic limited

partnership may convert to a Florida limited partnership.

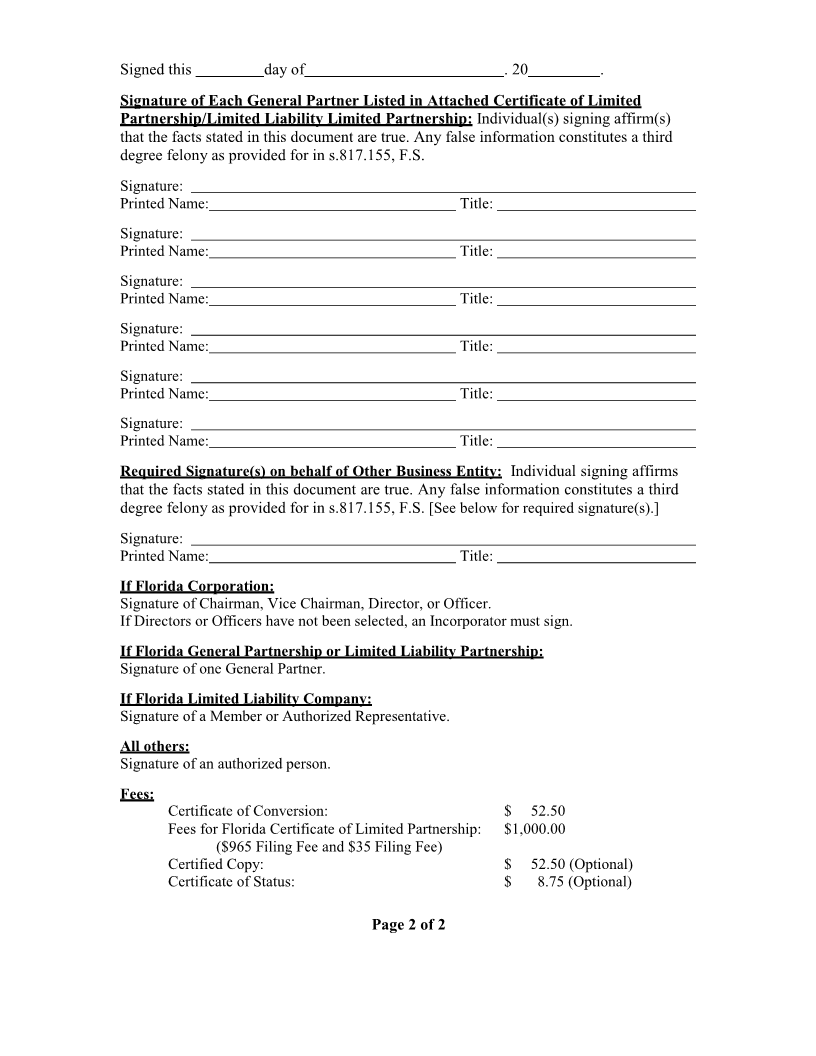

Filing Fees: $52.50 Certificate of Conversion

$1,000 Florida Certificate of Limited Partnership

(includes $965 filing fee and $35 registered agent

designation fee)

Certified Copy (optional): $52.50

Certificate of Status

(Optional): $8.75

Send one check in the total amount payable to the Florida Department of State.

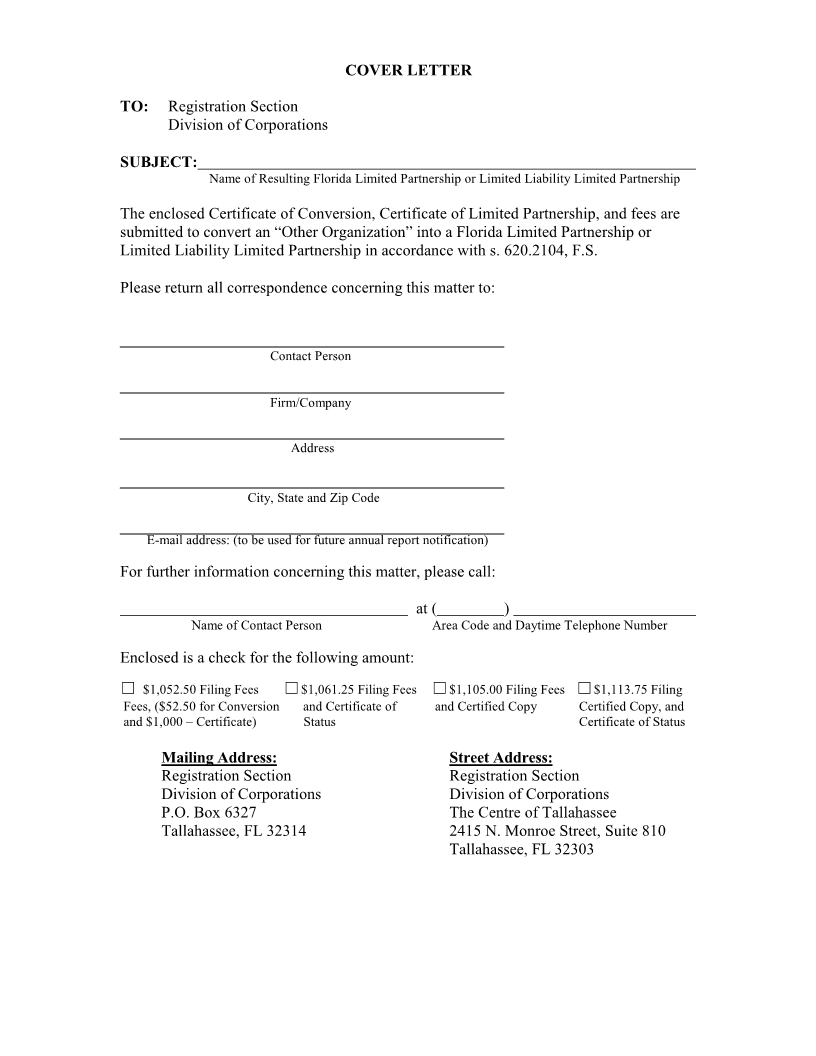

Please include a cover letter containing your telephone number, return address and

certification requirements, or complete the attached cover letter.

Mailing Address: Street Address:

Registration Section Registration Section

Division of Corporations Division of Corporations

P.O. Box 6327 The Centre of Tallahassee

Tallahassee, FL 32314 2415 N. Monroe Street, Suite 810

Tallahassee, FL 32303

For further information, you may contact the Registration Section at (850) 245-6051.

IMPORTANT NOTICE: If the conversion involves a limited liability company, pursuant to 605.0212 (10),

F.S. each party to the conversion must be active and current through December 31 stof the calendar year the

conversion is being submitted to the Department of State for filing.

CR2E112 (7/17)