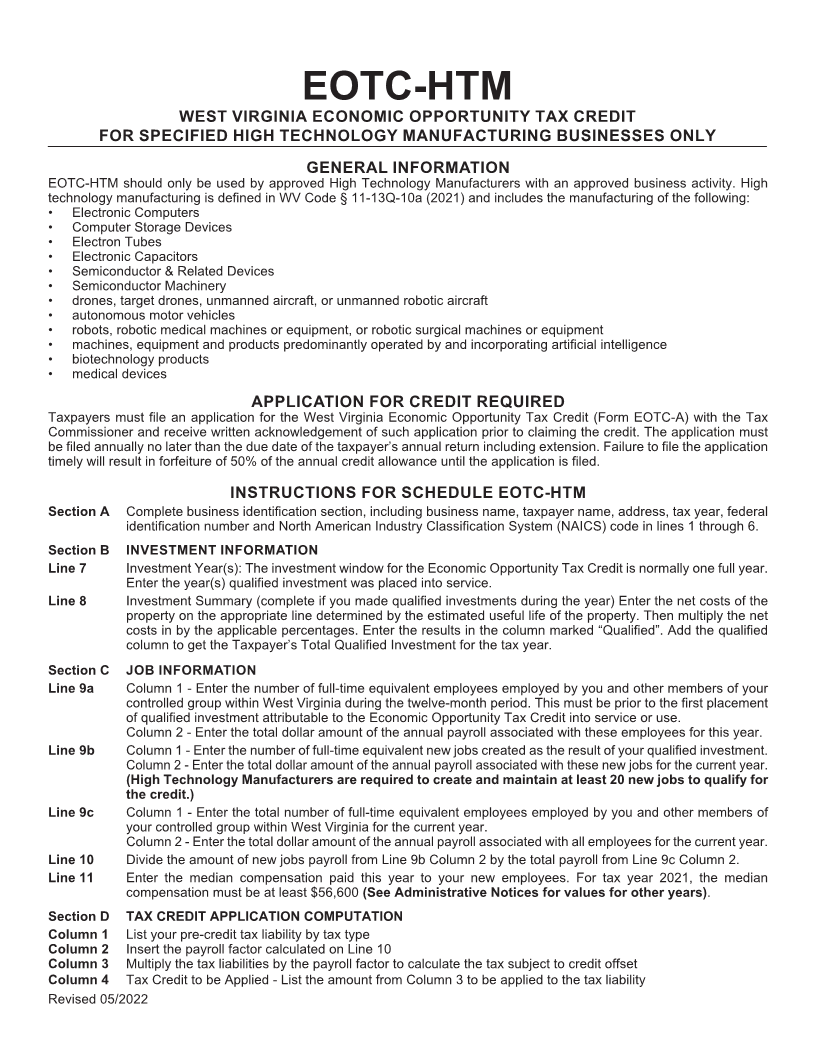

Enlarge image

SCHEDULE

EOTC-HTM ECONOMIC OPPORTUNITY TAX CREDIT West Virginia

FOR SPECIFIED HIGH TECHNOLOGY MANUFACTURING BUSINESSES ONLY Tax Division

REV05/2022

(FOR PERIODS BEGINNING ON AND AFTER JANUARY 1, 2022)

EOTC-HTM SHOULD ONLY BE USED BY APPROVED HIGH TECHNOLOGY MANUFACTURERS WITH AN APPROVED BUSINESS ACTIVITY.

HIGH TECHNOLOGY MANUFACTURING IS DEFINED IN WV CODE § 11-13Q-10A (2021).

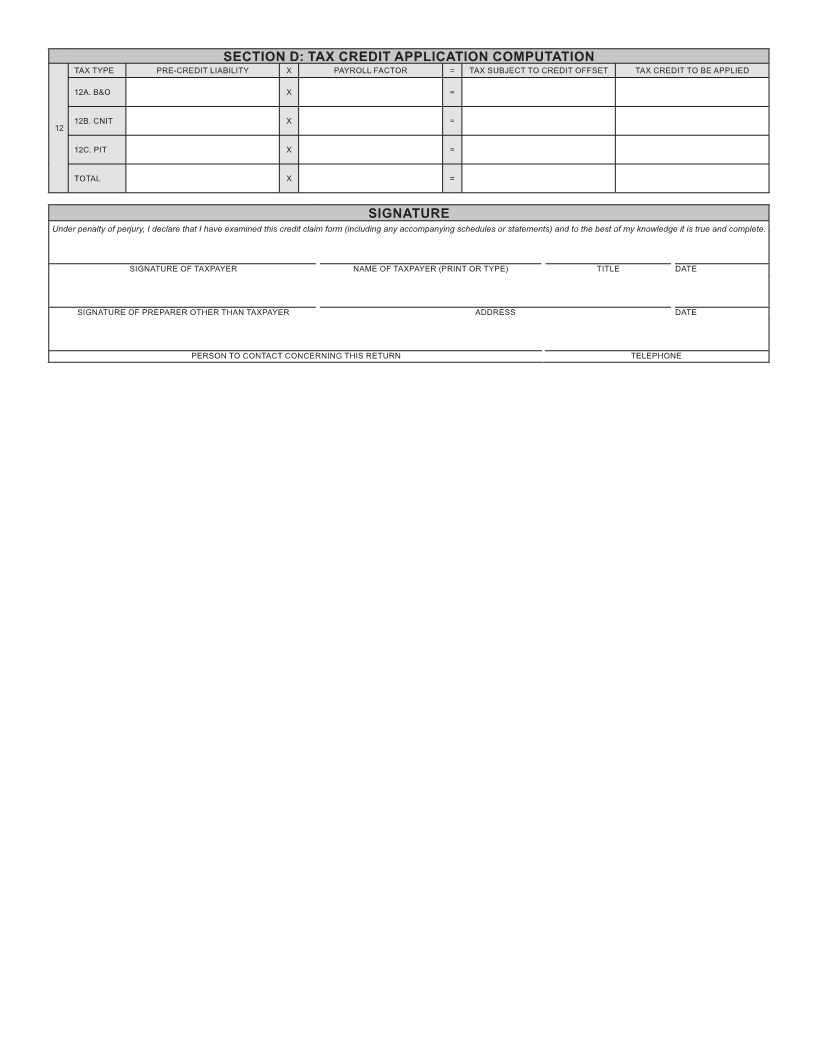

SECTION A: BUSINESS IDENTIFICATION

1 FEIN OR SSN WV TAX ID

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

TAXPAYER NAME

4

ADDRESS OF TAXPAYER

5 CITY STATE ZIP

6 NORTH AMERICAN INDUSTRY CLASSIFICATION SYSTEM CODE (ENTER 6 DIGIT NAICS CODE NUMBER)

SECTION B: INVESTMENT INFORMATION

7 INVESTMENT YEAR(S): ESTIMATED IN-SERVICE

DATE OF INVESTMENTS

INVESTMENT SUMMARY COST PERCENTAGE QUALIFIED

INVESTMENT WITH USEFUL X 33 1/3 %

LIFE OF 4-6 YEARS

INVESTMENT WITH USEFUL

8 LIFE OF 6-8 YEARS X 66 2/3 %

INVESTMENT WITH USEFUL X 100 %

LIFE OF 8+ YEARS

TOTAL QUALIFIED INVESTMENT

SECTION C: JOB INFORMATION

THE BUSINESS MUST CREATE AND MAINTAIN AT LEAST 20 NEW JOBS IN ORDER TO BE ELIGIBLE TO USE THE CREDIT.

ANNUAL NEW JOBS/PAYROLL FACTOR COMPUTATION # EMPLOYEES PAYROLL OF EMPLOYEES

9A. PRE-CREDIT EMPLOYMENT LEVELS

9

9B. NEW-JOBS EMPLOYED FOR CREDIT

9C. TOTAL EMPLOYMENT IN WV

NEW JOBS PAYROLL TOTAL WV PAYROLL PAYROLL FACTOR

10 PAYROLL FACTOR

/=

11 MEDIAN COMPENSATION OF NEW JOBS FOR THE TAX YEAR MUST MEET OR EXCEED THE MEDIAN WAGE AS

PRESCRIBED IN THE ADMINISTRATIVE NOTICE.