Enlarge image

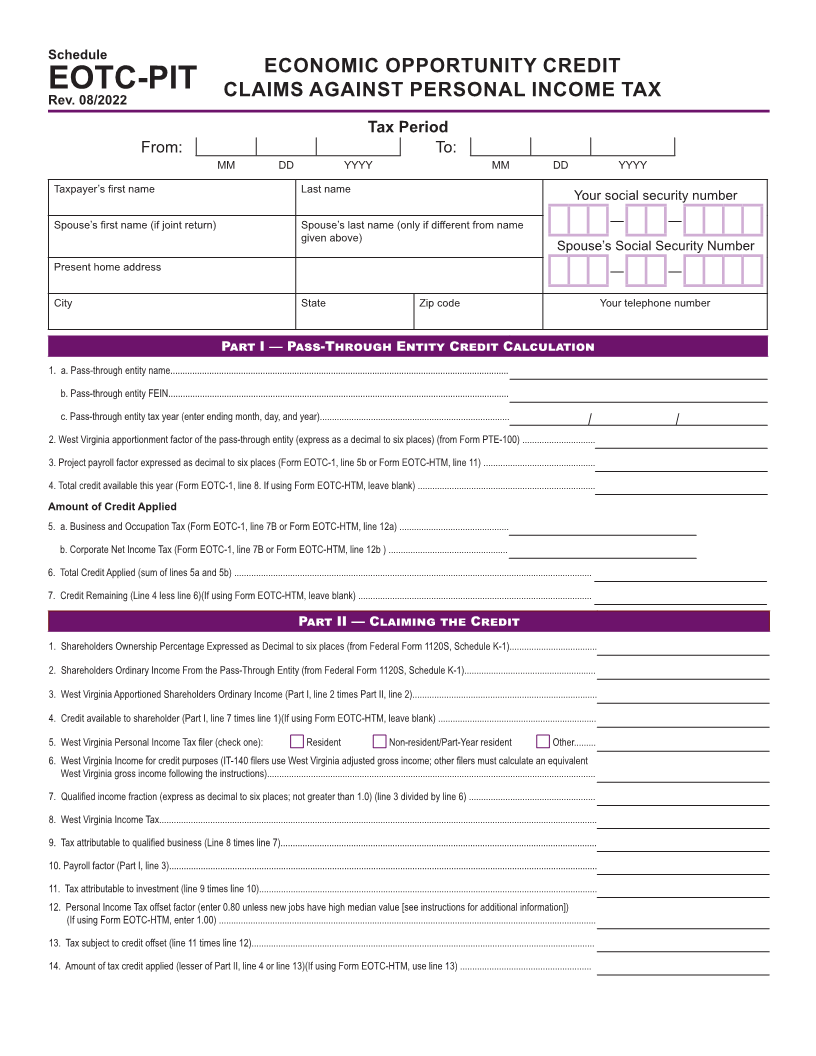

Schedule

ECONOMIC OPPORTUNITY CREDIT

EOTC-PIT CLAIMS AGAINST PERSONAL INCOME TAX

Rev. 08/2022

Tax Period

From: To:

MM DD YYYY MM DD YYYY

Taxpayer’s first name Last name

Your social security number

Spouse’s first name (if joint return) Spouse’s last name (only if di fferent from name ——

given above)

Spouse’s Social Security Number

Present home address ——

City State Zip code Your telephone number

Pˊ˛˝ I — Pˊ˜˜-Tˑ˛˘˞ːˑ E˗˝˒˝ˢ C˛ˎˍ˒˝ Cˊ˕ˌ˞˕ˊ˝˒˘˗

1. a. Pass-through entity name...........................................................................................................................................

b. Pass-through entity FEIN............................................................................................................................................

c. Pass-through entity tax year (enter ending month, day, and year).............................................................................. / /

2. West Virginia apportionment factor of the pass-through entity (express as a decimal to six places) (from Form PTE-100) ..............................

3. Project payroll factor expressed as decimal to six places (Form EOTC-1, line 5b or Form EOTC-HTM, line 11) ..............................................

4. Total credit available this year (Form EOTC-1, line 8. If using Form EOTC-HTM, leave blank) .........................................................................

Amount of Credit Applied

5. a. Business and Occupation Tax (Form EOTC-1, line 7B or Form EOTC-HTM, line 12a) .............................................

b. Corporate Net Income Tax (Form EOTC-1, line 7B or Form EOTC-HTM, line 12b ) .................................................

6. Total Credit Applied (sum of lines 5a and 5b) ...................................................................................................................................................

7. Credit Remaining (Line 4 less line 6)(If using Form EOTC-HTM, leave blank) ................................................................................................

Pˊ˛˝ II — C ˕ˊ˒˖˒˗ː ˝ˑˎ C˛ˎˍ˒˝

1. Shareholders Ownership Percentage Expressed as Decimal to six places (from Federal Form 1120S, Schedule K-1)....................................

2. Shareholders Ordinary Income From the Pass-Through Entity (from Federal Form 1120S, Schedule K-1)......................................................

3. West Virginia Apportioned Shareholders Ordinary Income (Part I, line 2 times Part II, line 2)............................................................................

4. Credit available to shareholder (Part I, line 7 times line 1)(If using Form EOTC-HTM, leave blank) .................................................................

5. West Virginia Personal Income Tax filer (check one): Resident Non-resident/Part-Year resident Other.........

6. West Virginia Income for credit purposes (IT-140 filers use West Virginia adjusted gross income; other filers must calculate an equivalent

West Virginia gross income following the instructions).......................................................................................................................................

7. Quali fied income fraction (express as decimal to six places; not greater than 1.0) (line 3 divided by line 6) ....................................................

8. West Virginia Income Tax....................................................................................................................................................................................

9. Tax attributable to quali fied business (Line 8 times line 7)..................................................................................................................................

10. Payroll factor (Part I, line 3)................................................................................................................................................................................

11. Tax attributable to investment (line 9 times line 10)...........................................................................................................................................

12. Personal Income Tax offset factor (enter 0.80 unless new jobs have high median value [see instructions for additional information])

(If using Form EOTC-HTM, enter 1.00) ...........................................................................................................................................................

13. Tax subject to credit offset (line 11 times line 12).............................................................................................................................................

14. Amount of tax credit applied (lesser of Part II, line 4 or line 13)(If using Form EOTC-HTM, use line 13) ......................................................