Enlarge image

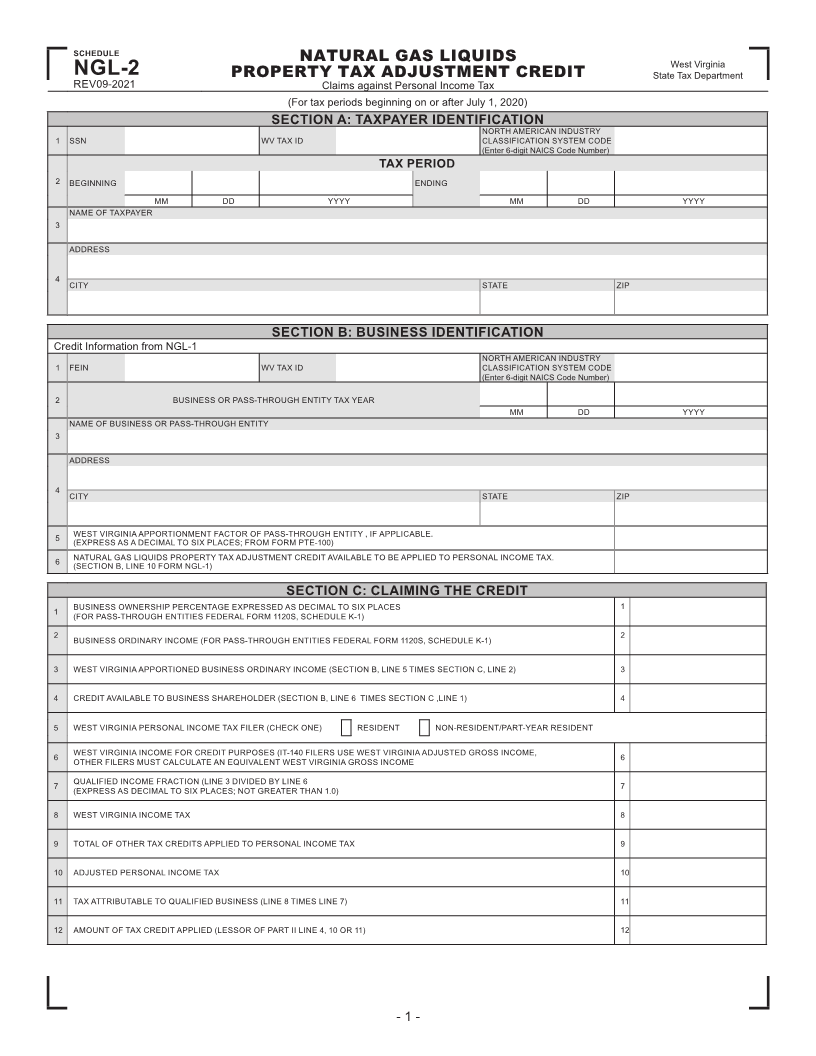

SCHEDULE

NATURAL GAS LIQUIDS West Virginia

NGL-2 PROPERTY TAX ADJUSTMENT CREDIT State Tax Department

REV09-2021 Claims against Personal Income Tax

(For tax periods beginning on or after July 1, 2020)

SECTION A: TAXPAYER IDENTIFICATION

NORTH AMERICAN INDUSTRY

1 SSN WV TAX ID CLASSIFICATION SYSTEM CODE

(Enter 6-digit NAICS Code Number)

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

NAME OF TAXPAYER

3

ADDRESS

4 CITY STATE ZIP

SECTION B: BUSINESS IDENTIFICATION

Credit Information from NGL-1

NORTH AMERICAN INDUSTRY

1 FEIN WV TAX ID CLASSIFICATION SYSTEM CODE

(Enter 6-digit NAICS Code Number)

2 BUSINESS OR PASS-THROUGH ENTITY TAX YEAR

MM DD YYYY

NAME OF BUSINESS OR PASS-THROUGH ENTITY

3

ADDRESS

4 CITY STATE ZIP

5 WEST VIRGINIA APPORTIONMENT FACTOR OF PASS-THROUGH ENTITY , IF APPLICABLE.

(EXPRESS AS A DECIMAL TO SIX PLACES; FROM FORM PTE-100)

6 NATURAL GAS LIQUIDS PROPERTY TAX ADJUSTMENT CREDIT AVAILABLE TO BE APPLIED TO PERSONAL INCOME TAX.

(SECTION B, LINE 10 FORM NGL-1)

SECTION C: CLAIMING THE CREDIT

1 BUSINESS OWNERSHIP PERCENTAGE EXPRESSED AS DECIMAL TO SIX PLACES 1

(FOR PASS-THROUGH ENTITIES FEDERAL FORM 1120S, SCHEDULE K-1)

2 BUSINESS ORDINARY INCOME (FOR PASS-THROUGH ENTITIES FEDERAL FORM 1120S, SCHEDULE K-1) 2

3 WEST VIRGINIA APPORTIONED BUSINESS ORDINARY INCOME (SECTION B, LINE 5 TIMES SECTION C, LINE 2) 3

4 CREDIT AVAILABLE TO BUSINESS SHAREHOLDER (SECTION B, LINE 6 TIMES SECTION C ,LINE 1) 4

5 WEST VIRGINIA PERSONAL INCOME TAX FILER (CHECK ONE) RESIDENT NON-RESIDENT/PART-YEAR RESIDENT

6 WEST VIRGINIA INCOME FOR CREDIT PURPOSES (IT-140 FILERS USE WEST VIRGINIA ADJUSTED GROSS INCOME, 6

OTHER FILERS MUST CALCULATE AN EQUIVALENT WEST VIRGINIA GROSS INCOME

7 QUALIFIED INCOME FRACTION (LINE 3 DIVIDED BY LINE 6 7

(EXPRESS AS DECIMAL TO SIX PLACES; NOT GREATER THAN 1.0)

8 WEST VIRGINIA INCOME TAX 8

9 TOTAL OF OTHER TAX CREDITS APPLIED TO PERSONAL INCOME TAX 9

10 ADJUSTED PERSONAL INCOME TAX 10

11 TAX ATTRIBUTABLE TO QUALIFIED BUSINESS (LINE 8 TIMES LINE 7) 11

12 AMOUNT OF TAX CREDIT APPLIED (LESSOR OF PART II LINE 4, 10 OR 11) 12

- 1 -