Enlarge image

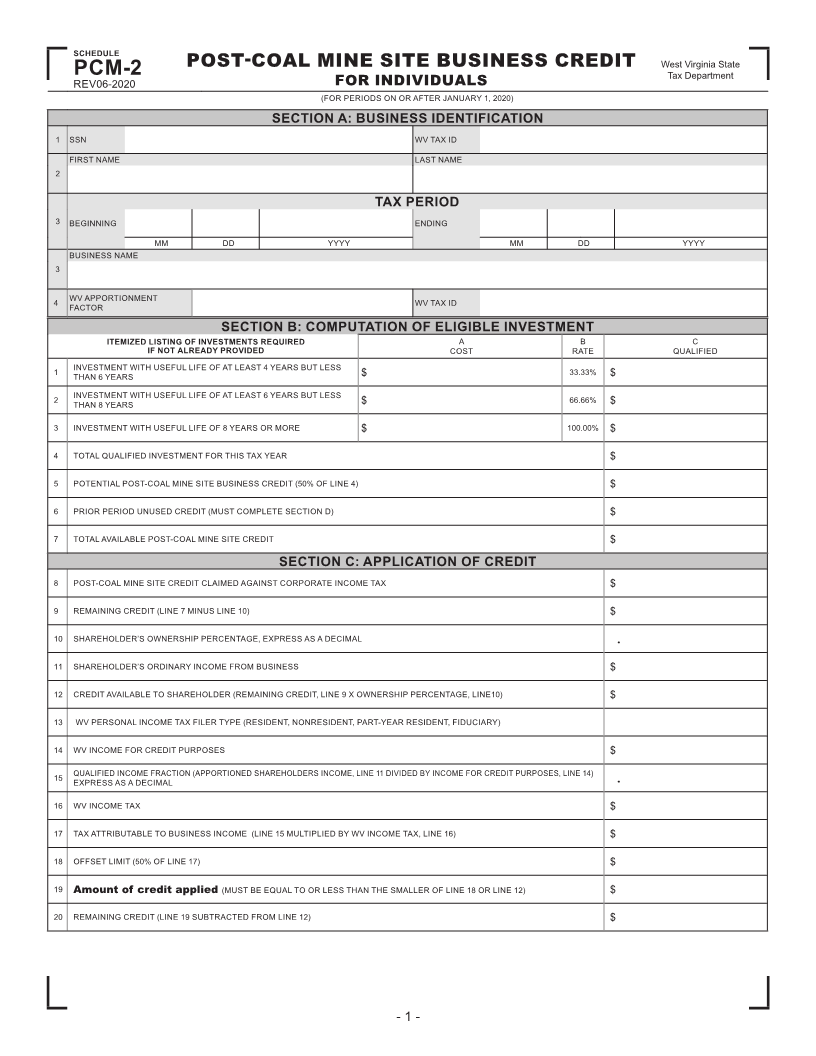

SCHEDULE

POST-COAL MINE SITE BUSINESS CREDIT West Virginia State

PCM-2 Tax Department

REV06-2020 FOR INDIVIDUALS

(FOR PERIODS ON OR AFTER JANUARY 1, 2020)

SECTION A: BUSINESS IDENTIFICATION

1 SSN WV TAX ID

FIRST NAME LAST NAME

2

TAX PERIOD

3 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

4 WV APPORTIONMENT WV TAX ID

FACTOR

SECTION B: COMPUTATION OF ELIGIBLE INVESTMENT

ITEMIZED LISTING OF INVESTMENTS REQUIRED A B C

IF NOT ALREADY PROVIDED COST RATE QUALIFIED

1 INVESTMENT WITH USEFUL LIFE OF AT LEAST 4 YEARS BUT LESS $ 33.33% $

THAN 6 YEARS

2 INVESTMENT WITH USEFUL LIFE OF AT LEAST 6 YEARS BUT LESS $ 66.66% $

THAN 8 YEARS

3 INVESTMENT WITH USEFUL LIFE OF 8 YEARS OR MORE $ 100.00% $

4 TOTAL QUALIFIED INVESTMENT FOR THIS TAX YEAR $

5 POTENTIAL POST-COAL MINE SITE BUSINESS CREDIT (50% OF LINE 4) $

6 PRIOR PERIOD UNUSED CREDIT (MUST COMPLETE SECTION D) $

7 TOTAL AVAILABLE POST-COAL MINE SITE CREDIT $

SECTION C: APPLICATION OF CREDIT

8 POST-COAL MINE SITE CREDIT CLAIMED AGAINST CORPORATE INCOME TAX $

9 REMAINING CREDIT (LINE 7 MINUS LINE 10) $

10 SHAREHOLDER’S OWNERSHIP PERCENTAGE, EXPRESS AS A DECIMAL .

11 SHAREHOLDER’S ORDINARY INCOME FROM BUSINESS $

12 CREDIT AVAILABLE TO SHAREHOLDER (REMAINING CREDIT, LINE 9 X OWNERSHIP PERCENTAGE, LINE10) $

13 WV PERSONAL INCOME TAX FILER TYPE (RESIDENT, NONRESIDENT, PART-YEAR RESIDENT, FIDUCIARY)

14 WV INCOME FOR CREDIT PURPOSES $

15 QUALIFIED INCOME FRACTION (APPORTIONED SHAREHOLDERS INCOME, LINE 11 DIVIDED BY INCOME FOR CREDIT PURPOSES, LINE 14)

EXPRESS AS A DECIMAL .

16 WV INCOME TAX $

17 TAX ATTRIBUTABLE TO BUSINESS INCOME (LINE 15 MULTIPLIED BY WV INCOME TAX, LINE 16) $

18 OFFSET LIMIT (50% OF LINE 17) $

19 Amount of credit applied (MUST BE EQUAL TO OR LESS THAN THE SMALLER OF LINE 18 OR LINE 12) $

20 REMAINING CREDIT (LINE 19 SUBTRACTED FROM LINE 12) $

- 1 -