Enlarge image

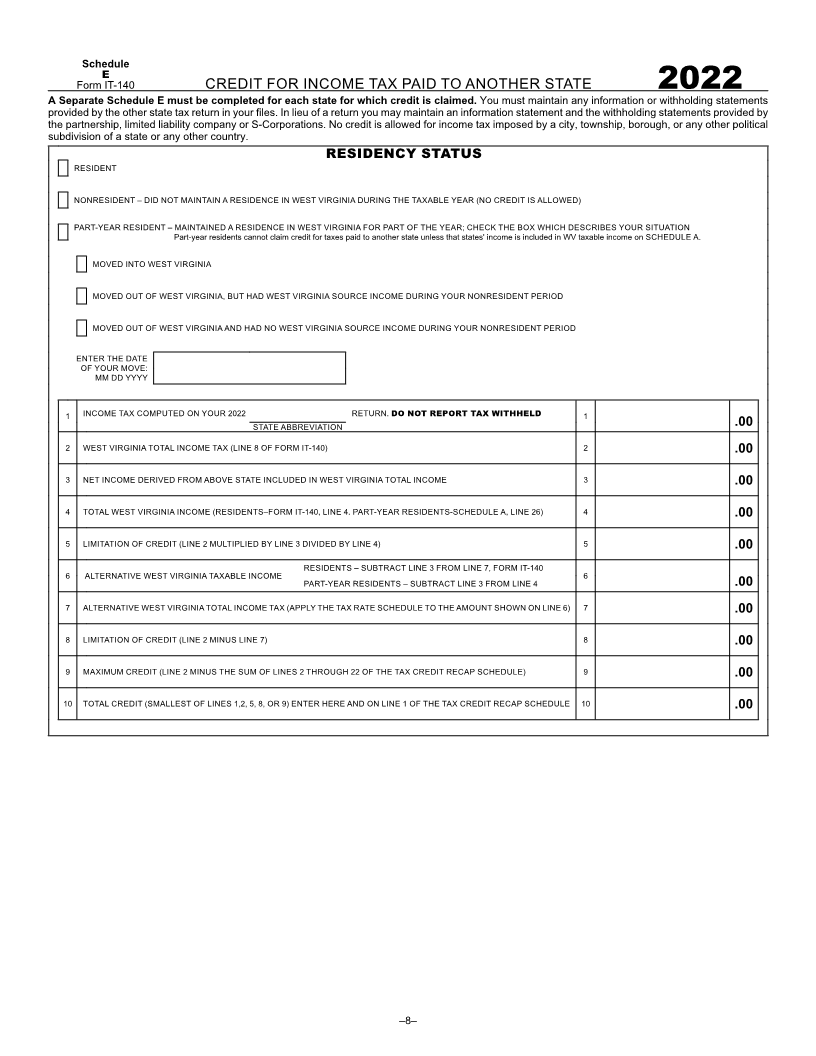

Schedule

E

Form IT-140 CREDIT FOR INCOME TAX PAID TO ANOTHER STATE

2022

A Separate Schedule E must be completed for each state for which credit is claimed. You must maintain any information or withholding statements

provided by the other state tax return in your files. In lieu of a return you may maintain an information statement and the withholding statements provided by

the partnership, limited liability company or S-Corporations. No credit is allowed for income tax imposed by a city, township, borough, or any other political

subdivision of a state or any other country.

RESIDENCY STATUS

RESIDENT

NONRESIDENT – DID NOT MAINTAIN A RESIDENCE IN WEST VIRGINIA DURING THE TAXABLE YEAR (NO CREDIT IS ALLOWED)

PART-YEAR RESIDENT – MAINTAINED A RESIDENCE IN WEST VIRGINIA FOR PART OF THE YEAR; CHECK THE BOX WHICH DESCRIBES YOUR SITUATION

Part-year residents cannot claim credit for taxes paid to another state unless that states' income is included in WV taxable income on SCHEDULE A.

MOVED INTO WEST VIRGINIA

MOVED OUT OF WEST VIRGINIA, BUT HAD WEST VIRGINIA SOURCE INCOME DURING YOUR NONRESIDENT PERIOD

MOVED OUT OF WEST VIRGINIA AND HAD NO WEST VIRGINIA SOURCE INCOME DURING YOUR NONRESIDENT PERIOD

ENTER THE DATE

OF YOUR MOVE:

MM DD YYYY

1 INCOME TAX COMPUTED ON YOUR 2022 RETURN. DO NOT REPORT TAX WITHHELD 1

STATE ABBREVIATION .00

2 WEST VIRGINIA TOTAL INCOME TAX (LINE 8 OF FORM IT-140) 2 .00

3 NET INCOME DERIVED FROM ABOVE STATE INCLUDED IN WEST VIRGINIA TOTAL INCOME 3 .00

4 TOTAL WEST VIRGINIA INCOME (RESIDENTS–FORM IT-140, LINE 4. PART-YEAR RESIDENTS-SCHEDULE A, LINE 26) 4 .00

5 LIMITATION OF CREDIT (LINE 2 MULTIPLIED BY LINE 3 DIVIDED BY LINE 4) 5 .00

RESIDENTS – SUBTRACT LINE 3 FROM LINE 7, FORM IT-140

6 ALTERNATIVE WEST VIRGINIA TAXABLE INCOME 6

PART-YEAR RESIDENTS – SUBTRACT LINE 3 FROM LINE 4 .00

7 ALTERNATIVE WEST VIRGINIA TOTAL INCOME TAX (APPLY THE TAX RATE SCHEDULE TO THE AMOUNT SHOWN ON LINE 6) 7 .00

8 LIMITATION OF CREDIT (LINE 2 MINUS LINE 7) 8 .00

9 MAXIMUM CREDIT (LINE 2 MINUS THE SUM OF LINES 2 THROUGH 22 OF THE TAX CREDIT RECAP SCHEDULE) 9 .00

10 TOTAL CREDIT (SMALLEST OF LINES 1,2, 5, 8, OR 9) ENTER HERE AND ON LINE 1 OF THE TAX CREDIT RECAP SCHEDULE 10 .00

–8–