Enlarge image

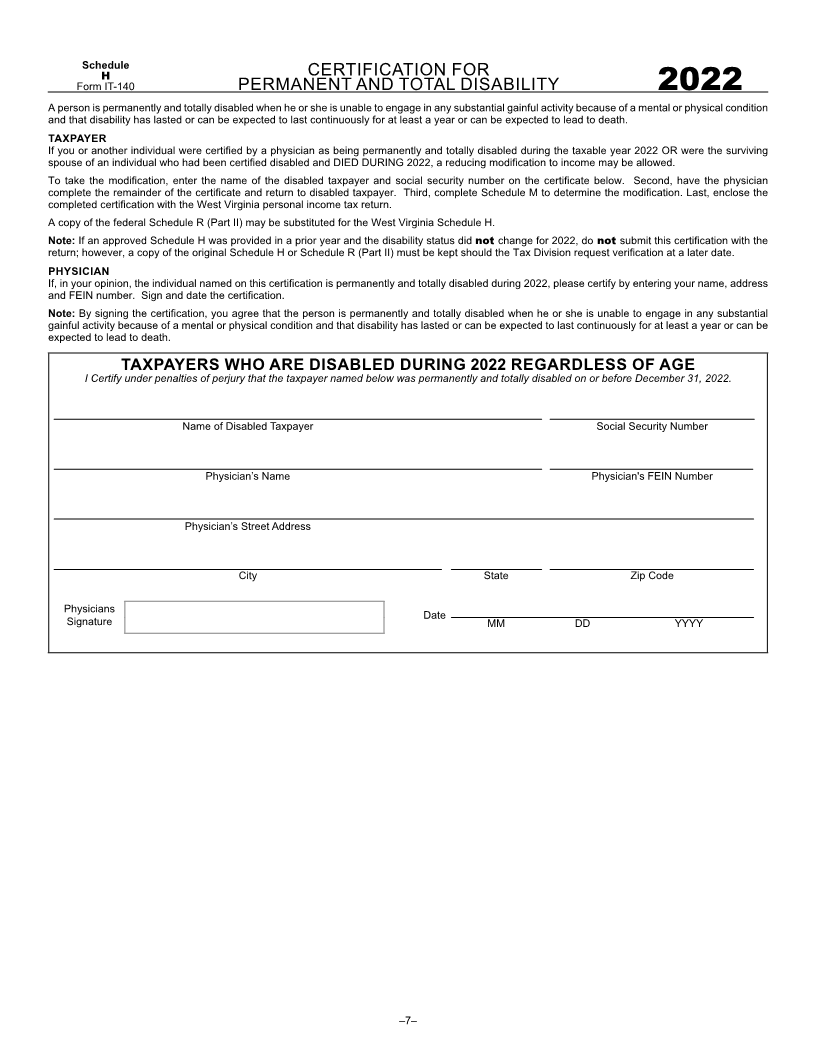

Schedule

H CERTIFICATION FOR

Form IT-140 PERMANENT AND TOTAL DISABILITY 2022

A person is permanently and totally disabled when he or she is unable to engage in any substantial gainful activity because of a mental or physical condition

and that disability has lasted or can be expected to last continuously for at least a year or can be expected to lead to death.

TAXPAYER

If you or another individual were certified by a physician as being permanently and totally disabled during the taxable year 2022 OR were the surviving

spouse of an individual who had been certified disabled and DIED DURING 2022, a reducing modification to income may be allowed.

To take the modification, enter the name of the disabled taxpayer and social security number on the certificate below. Second, have the physician

complete the remainder of the certificate and return to disabled taxpayer. Third, complete Schedule M to determine the modification. Last, enclose the

completed certification with the West Virginia personal income tax return.

A copy of the federal Schedule R (Part II) may be substituted for the West Virginia Schedule H.

Note: If an approved Schedule H was provided in a prior year and the disability status did not change for 2022, do not submit this certification with the

return; however, a copy of the original Schedule H or Schedule R (Part II) must be kept should the Tax Division request verification at a later date.

PHYSICIAN

If, in your opinion, the individual named on this certification is permanently and totally disabled during 2022, please certify by entering your name, address

and FEIN number. Sign and date the certification.

Note: By signing the certification, you agree that the person is permanently and totally disabled when he or she is unable to engage in any substantial

gainful activity because of a mental or physical condition and that disability has lasted or can be expected to last continuously for at least a year or can be

expected to lead to death.

TAXPAYERS WHO ARE DISABLED DURING 2022 REGARDLESS OF AGE

I Certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2022.

Name of Disabled Taxpayer Social Security Number

Physician’s Name Physician's FEIN Number

Physician’s Street Address

City State Zip Code

Physicians Date

Signature MM DD YYYY

–7–