Enlarge image

Schedule

M W

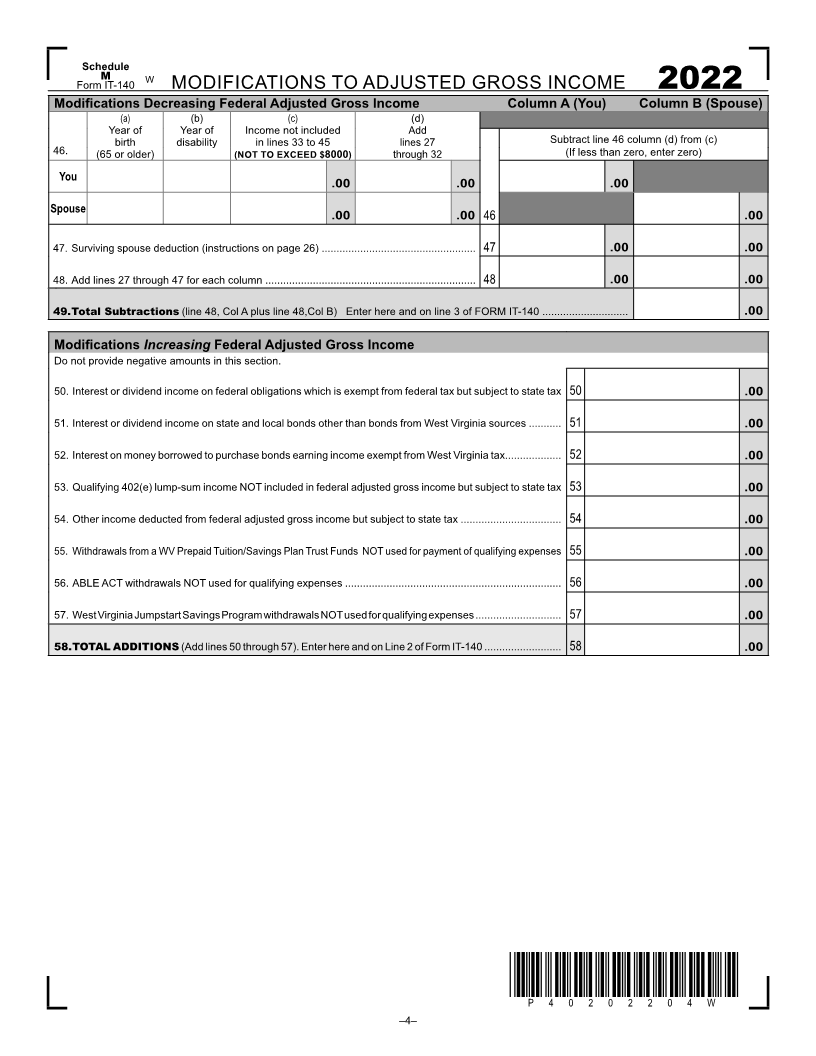

Form IT-140 MODIFICATIONS TO ADJUSTED GROSS INCOME 2022

Modi fications Decreasing Federal Adjusted Gross Income Column A (You) Column B (Spouse)

27. Interest or dividends received on United States or West Virginia obligations, or

allowance for government obligation income, included in federal adjusted gross income .00 .00

but exempt from state tax 27

28. Total amount of any bene fit (including survivorship annuities) received from certain

federal retirement systems by retired federal law enforcement o fficers ........................ 28 .00 .00

29. Total amount of any bene tfi(including survivorship annuities) received from WV

state or local police, deputy sheri ffs’ or firemen’s retirement system, Excluding PERS .00 .00

– see page 23 ................................................................................................................. 29

30. Military Retirement Modi fication .....................................................................................

30 .00 .00

31. Other Retirement Modi fication Column A (You) Column B (Spouse)

(a) West Virginia Teachers’ and

Public Employees’ Retirement .00 .00 Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000

(b)Federal Retirement Systems

(Title 4 USC §111) .00 .00 31 .00 .00

32. Social Security Bene fits You cannot claim this modi fication if

(a) TOTAL Social Security Bene fits. .00 .00 your Federal AGI exceeds

$ 50,000 for SINGLE or MARRIED SEPARATE fi lers

(b) Bene fits exempt for Federal tax $100,000 for MARRIED JOINT filers

purposes .00 .00

(c) Bene fits taxable for Federal tax purposes (line a minus line b) ..................................... 32 .00 .00

33. Certain assets held by subchapter S Corporation bank.................................................. 33 .00 .00

34. Certain Active Duty Military pay (See instructions on page 18) ......................................

If not domiciled in WV, complete Part II of Schedule A instead. 34 .00 .00

35. Active Military Separation (see instructions on page 18)

Must enclose military orders and discharge papers ....................................................... 35 .00 .00

36. Refunds of state and local income taxes received and reported as income to the IRS ... 36 .00 .00

37. Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds

Annual Statement must be included ............................................................................... 37 .00 .00

38. Railroad Retirement Board Income received .................................................................. 38 .00 .00

39. Long-Term Care Insurance ............................................................................................ 39 .00 .00

40. IRC 1341 Repayments ................................................................................................... 40 .00 .00

41. Autism Modi fication (instructions on page 19) ................................................................ 41 .00 .00

42. ABLE Act

Annual Statement must be included ............................................................................... 42 .00 .00

43. West Virginia Jumpstart Savings Program deposits made (not to exceed $25000)

Annual Statement must be included................................................................................ 43 .00 .00

44. PBGC Modi fication .....................

(a) retirement bene fits that would have been .00 .00 Subtract line 44 (b) from (a)

paid from your employer-provided plan

(b) retirement bene tsfiactually received

from PBGC .00 .00 44 .00 .00

45. Quali fied Opportunity Zone business income ................................................................. 45 .00 .00

Modi fications Decreasing Federal Adjusted Gross Income

Continues on next page

*P40202203W*

P40202203W

–3–