Enlarge image

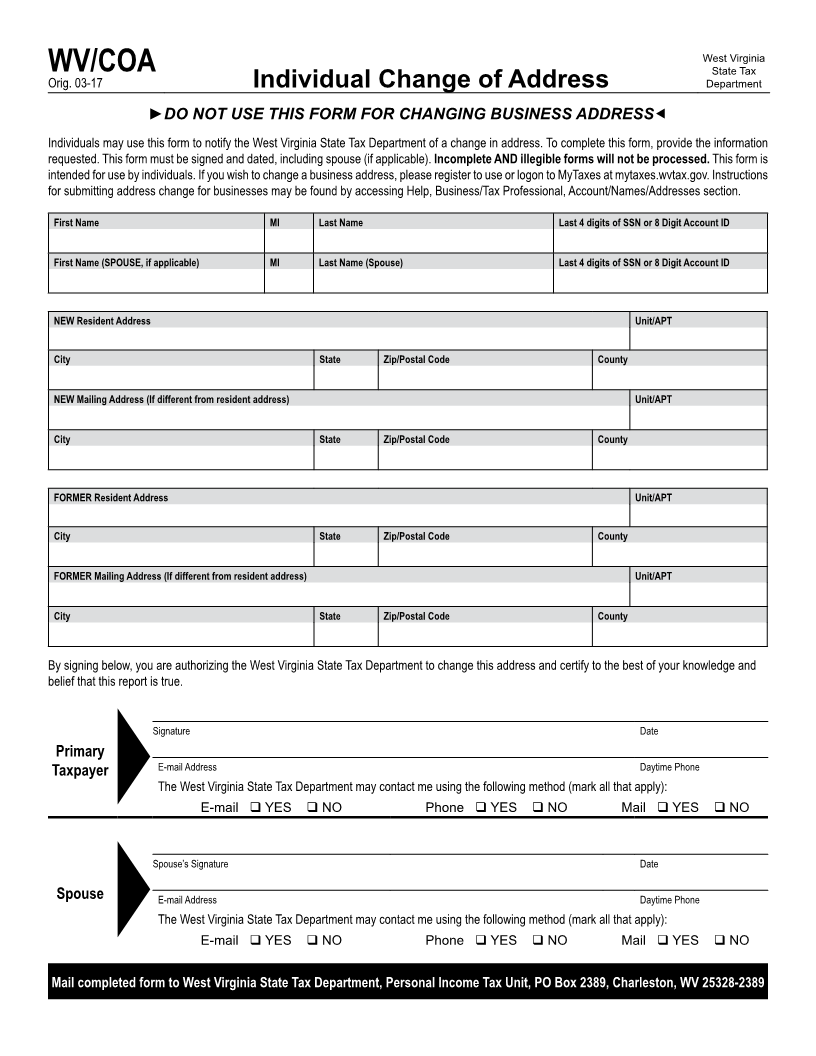

West Virginia

WV/COA State Tax

Orig. 03-17 Individual Change of Address Department

►Do not use this form for changing business aDDress

Individuals may use this form to notify the West Virginia State Tax Department of a change in address. To complete this form, provide the information

requested. This form must be signed and dated, including spouse (if applicable). Incomplete AND illegible forms will not be processed. This form is

intended for use by individuals. If you wish to change a business address, please register to use or logon to MyTaxes at mytaxes.wvtax.gov. Instructions

for submitting address change for businesses may be found by accessing Help, Business/Tax Professional, Account/Names/Addresses section.

First Name MI Last Name Last 4 digits of SSN or 8 Digit Account ID

First Name (SPOUSE, if applicable) MI Last Name (Spouse) Last 4 digits of SSN or 8 Digit Account ID

NEW Resident Address Unit/APT

City State Zip/Postal Code County

NEW Mailing Address (If different from resident address) Unit/APT

City State Zip/Postal Code County

FORMER Resident Address Unit/APT

City State Zip/Postal Code County

FORMER Mailing Address (If different from resident address) Unit/APT

City State Zip/Postal Code County

By signing below, you are authorizing the West Virginia State Tax Department to change this address and certify to the best of your knowledge and

belief that this report is true.

Signature Date

Primary

Taxpayer E-mail Address Daytime Phone

The West Virginia State Tax Department may contact me using the following method (mark all that apply):

E-mail YES NO Phone YES NO Mail YES NO

Spouse’s Signature Date

Spouse E-mail Address Daytime Phone

The West Virginia State Tax Department may contact me using the following method (mark all that apply):

E-mail YES NO Phone YES NO Mail YES NO

Mail completed form to West Virginia State Tax Department, Personal Income Tax Unit, PO Box 2389, Charleston, WV 25328-2389