Enlarge image

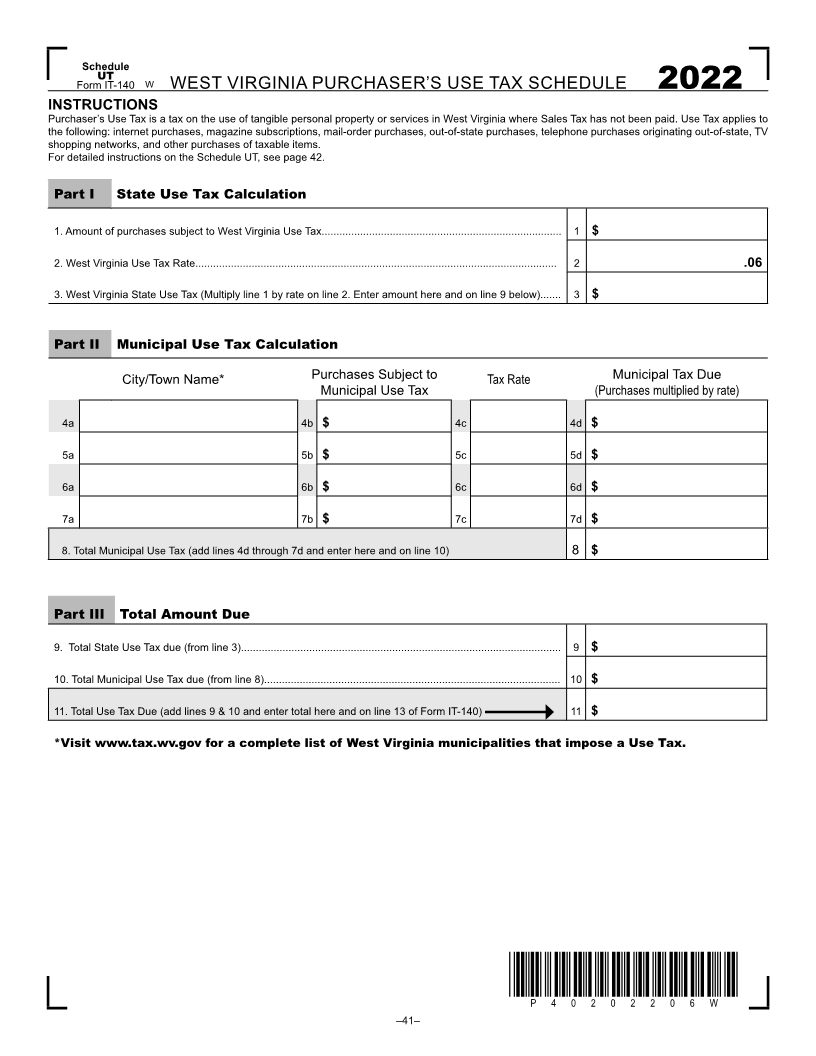

Schedule

UT

Form IT-140 W WEST VIRGINIA PURCHASER’S USE TAX SCHEDULE 2022

INSTRUCTIONS

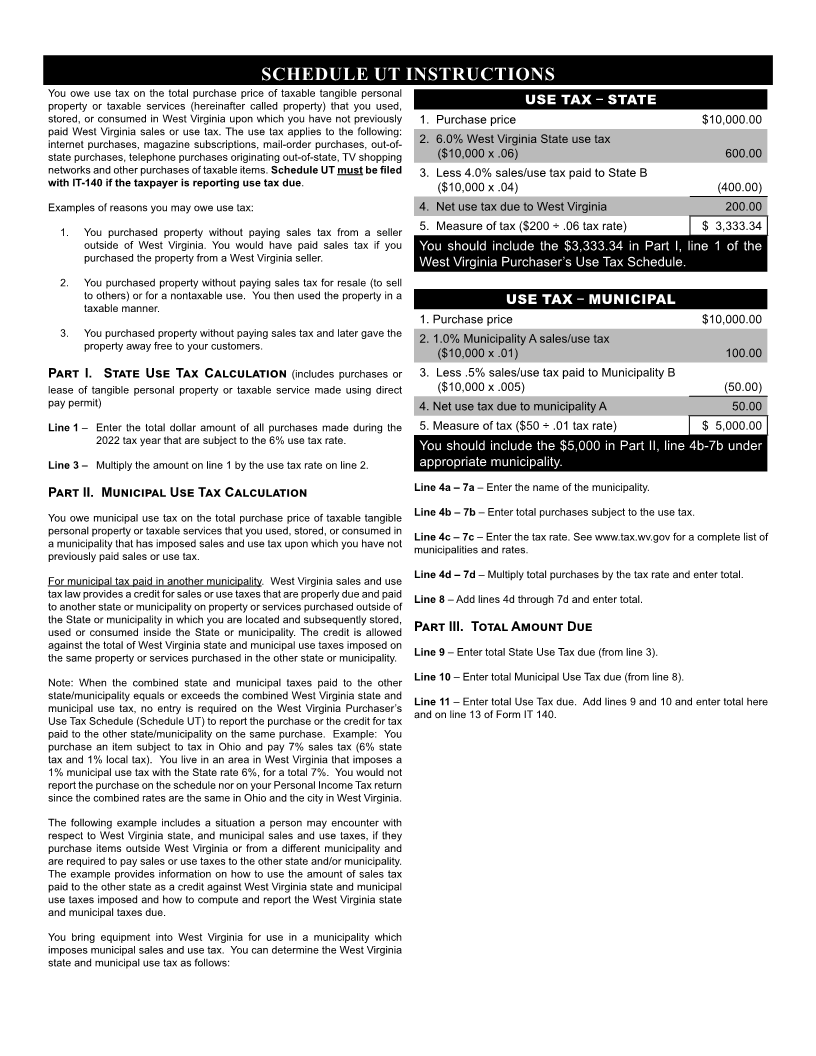

Purchaser’s Use Tax is a tax on the use of tangible personal property or services in West Virginia where Sales Tax has not been paid. Use Tax applies to

the following: internet purchases, magazine subscriptions, mail-order purchases, out-of-state purchases, telephone purchases originating out-of-state, TV

shopping networks, and other purchases of taxable items.

For detailed instructions on the Schedule UT, see page 42.

Part I State Use Tax Calculation

1. Amount of purchases subject to West Virginia Use Tax................................................................................. 1 $

2. West Virginia Use Tax Rate.......................................................................................................................... 2 .06

3. West Virginia State Use Tax (Multiply line 1 by rate on line 2. Enter amount here and on line 9 below)....... 3 $

Part II Municipal Use Tax Calculation

City/Town Name* Purchases Subject to Tax Rate Municipal Tax Due

Municipal Use Tax (Purchases multiplied by rate)

4a 4b $ 4c 4d $

5a 5b $ 5c 5d $

6a 6b $ 6c 6d $

7a 7b $ 7c 7d $

8. Total Municipal Use Tax (add lines 4d through 7d and enter here and on line 10) 8 $

Part III Total Amount Due

9. Total State Use Tax due (from line 3)............................................................................................................ 9 $

10. Total Municipal Use Tax due (from line 8).................................................................................................... 10 $

11. Total Use Tax Due (add lines 9 & 10 and enter total here and on line 13 of Form IT-140) 11 $

*Visit www.tax.wv.gov for a complete list of West Virginia municipalities that impose a Use Tax.

*P40202206W*

P40202206W

–41–