Enlarge image

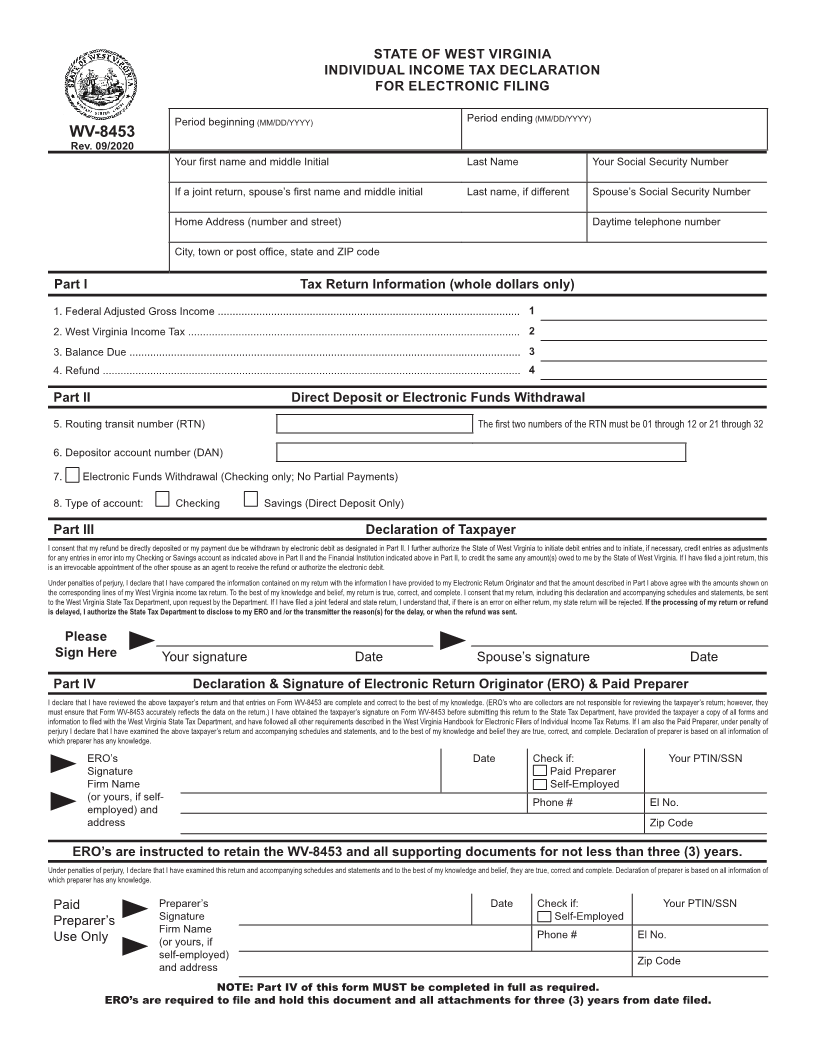

STATE OF WEST VIRGINIA

INDIVIDUAL INCOME TAX DECLARATION

FOR ELECTRONIC FILING

Period beginning (MM/DD/YYYY) Period ending (MM/DD/YYYY)

WV-8453

Rev. 09/2020

Your first name and middle Initial Last Name Your Social Security Number

If a joint return, spouse’s first name and middle initial Last name, if di fferent Spouse’s Social Security Number

Home Address (number and street) Daytime telephone number

City, town or post o ffi ce, state and ZIP code

Part I Tax Return Information (whole dollars only)

1. Federal Adjusted Gross Income ...................................................................................................... 1

2. West Virginia Income Tax ................................................................................................................ 2

3. Balance Due .................................................................................................................................... 3

4. Refund ............................................................................................................................................. 4

Part II Direct Deposit or Electronic Funds Withdrawal

5. Routing transit number (RTN) The fi rst two numbers of the RTN must be 01 through 12 or 21 through 32

6. Depositor account number (DAN)

7. Electronic Funds Withdrawal (Checking only; No Partial Payments)

8. Type of account: Checking Savings (Direct Deposit Only)

Part III Declaration of Taxpayer

I consent that my refund be directly deposited or my payment due be withdrawn by electronic debit as designated in Part II. I further authorize the State of West Virginia to initiate debit entries and to initiate, if necessary, credit entries as adjustments

for any entries in error into my Checking or Savings account as indicated above in Part II and the Financial Institution indicated above in Part II, to credit the same any amount(s) owed to me by the State of West Virginia. If I have fi led a joint return, this

is an irrevocable appointment of the other spouse as an agent to receive the refund or authorize the electronic debit.

Under penalties of perjury, I declare that I have compared the information contained on my return with the information I have provided to my Electronic Return Originator and that the amount described in Part I above agree with the amounts shown on

the corresponding lines of my West Virginia income tax return. To the best of my knowledge and belief, my return is true, correct, and complete. I consent that my return, including this declaration and accompanying schedules and statements, be sent

to the West Virginia State Tax Department, upon request by the Department. If I have filed a joint federal and state return, I understand that, if there is an error on either return, my state return will be rejected.If the processing of my return or refund

is delayed, I authorize the State Tax Department to disclose to my ERO and /or the transmitter the reason(s) for the delay, or when the refund was sent.

Please

Sign Here Your signature Date Spouse’s signature Date

Part IV Declaration & Signature of Electronic Return Originator (ERO) & Paid Preparer

I declare that I have reviewed the above taxpayer’s return and that entries on Form WV-8453 are complete and correct to the best of my knowledge. (ERO’s who are collectors are not responsible for reviewing the taxpayer’s return; however, they

must ensure that Form WV-8453 accurately re flects the data on the return.) I have obtained the taxpayer’s signature on Form WV-8453 before submitting this return to the State Tax Department, have provided the taxpayer a copy of all forms and

information to filed with the West Virginia State Tax Department, and have followed all other requirements described in the West Virginia Handbook for Electronic Filers of Individual Income Tax Returns. If I am also the Paid Preparer, under penalty of

perjury I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and belief they are true, correct, and complete. Declaration of preparer is based on all information of

which preparer has any knowledge.

ERO’s Date Check if: Your PTIN/SSN

Signature Paid Preparer

Firm Name Self-Employed

(or yours, if self- Phone # El No.

employed) and

address Zip Code

ERO’s are instructed to retain the WV-8453 and all supporting documents for not less than three (3) years.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer is based on all information of

which preparer has any knowledge.

Paid Preparer’s Date Check if: Your PTIN/SSN

Preparer’s Signature Self-Employed

Firm Name Phone # El No.

Use Only (or yours, if

self-employed) Zip Code

and address

NOTE: Part IV of this form MUST be completed in full as required.

ERO’s are required to file and hold this document and all attachments for three (3) years from date filed.