Enlarge image

01-137 PRINT FORM RESET FORM

(5-22/4)

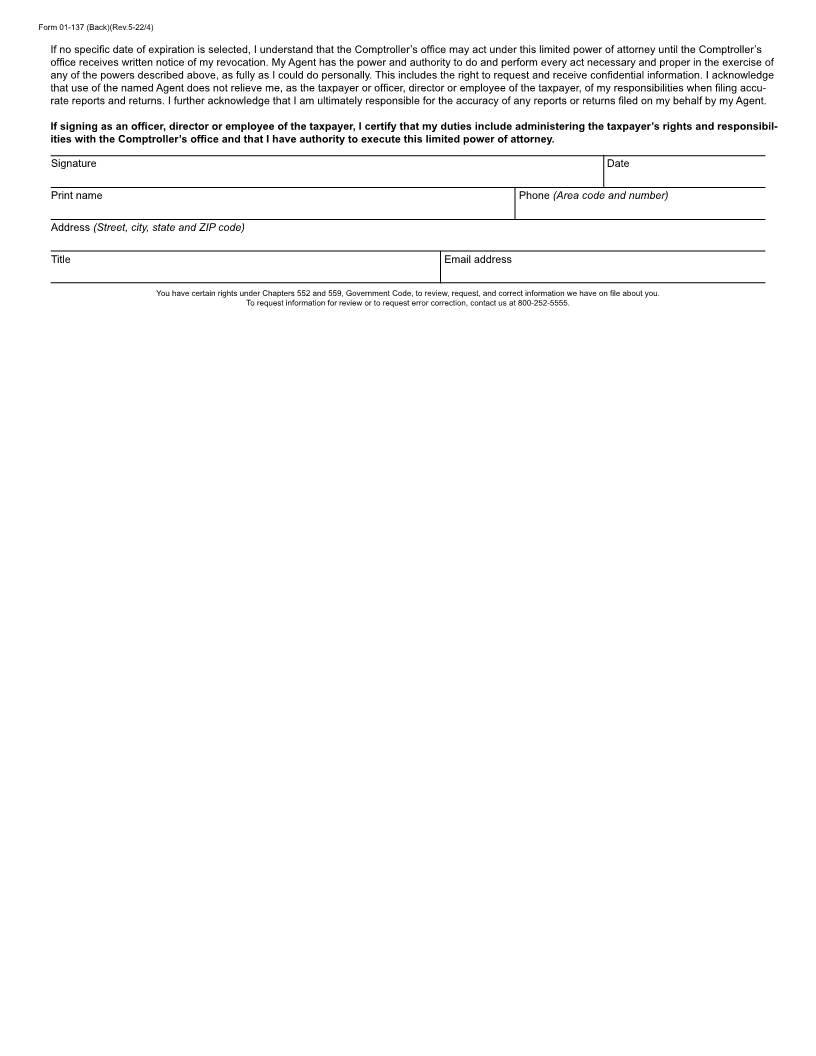

Limited Power of Attorney

Purpose – This form satisfies specific statutory requirements for taxpayers to designate agents to represent them before the Texas Comptroller of Public

Accounts. See Texas Tax Code Section 111.023. You may use this form to grant authority to an attorney, accountant or other representative to act on your

behalf for all tax-related matters. If you choose to use this form, provide all the information requested; we will return incomplete forms.

Taxpayer Granting Limited Power of Attorney

Taxpayer legal name 11-digit Texas taxpayer number

Attorney, Accountant, Firm or Other Representative Appointed to Act on Behalf of the Taxpayer (Agent)

Agent legal name 11-digit Texas taxpayer number

Relationship to taxpayer (Attorney, CPA, tax return preparer, etc.) Contact name

Street Phone (Area code and number)

City, state and ZIP code Email address

Tax type(s)/Subtype(s)/Fee(s) Period(s)/Report year(s)

I appoint the named Agent as my true and lawful agent and attorney-in-fact to communicate with the Texas Comptroller of Public Accounts

(Comptroller’s office) for one or more of the following purposes:

(Check all that apply)

To communicate with the Comptroller’s office for purposes other than those listed below, including requesting and receiving information by telephone,

email, fax, mail, private letter rulings, general information letters or in person.

To request and receive my Webfile number(s) from the Comptroller’s office.

To file my claim for refund for the tax/fee types and periods/report years identified, and to provide information as requested by the Comptroller’s office.

To sign and file my documents, including tax/fee reports, applications and returns.

To provide information as requested and discuss relevant issues with regard to my tax/fee audit(s) and/or examination(s), and to accept a notification of

sampling procedure for the tax/fee types and periods/report years identified.

To receive a copy of my Texas Notification of Audit, Refund and/or Examination Results.

To access account data for crude oil production taxes for the periods _____________ through _____________.

This appointment is only effective from ______________ to _______________ or

This appointment is effective during the period identified below.

To access account data for natural gas production taxes for the periods ______________through _____________ .

This appointment is only effective from ______________ to _______________ or

This appointment is effective during the period identified below.

To file for a redetermination or refund hearing, to accept a notification of the 90-day requirement to obtain records and/or certificates, to represent me

during the contested case proceeding for the tax/fee types and periods/report years identified and to sign a withdrawal form if I no longer wish to

proceed through the administrative hearings process.

To enter into a written agreement extending the period of limitation during my audit(s) and/or examination(s) for the tax/fee types and periods/report

years identified.

To authorize one or more individuals from the firm identified to carry out the authority and duties granted for the tax/fee types and periods/report years

identified.

Other: ___________________________________________________________________________________________________________

This limited power of attorney is effective on ________________ (Date) and will continue in effect:

until ________________ (Date) or

until I revoke it in writing.