Enlarge image

01-119 RRRR

(Rev.5-19/18) PRINT FORM CLEAR FIELDS

b. *0111900W051918*

a. 27100 Do not staple or paper clip.

Do not write in shaded areas. Page 1 of

c. Taxpayer number d. Filing period e. f. Due date

Texas Direct

Payment Return

IMPORTANT

Blacken this box if your mailing

Taxpayer name and mailing address(Make corrections next to any incorrect information.) address has changed. Show changes

g. by the preprinted information. 1.

PLEASE NOTE: Blacken this box if you are no longer

You cannot file this return unless you hold a Texas Direct in business. Write in the date you went

out of business. 2.

Payment Permit, issued by the Comptroller's office.

h. i.

CLICK HERE TO CONTINUE PLEASE PRINT YOUR NUMERALS LIKE THIS

Make copies for your records.

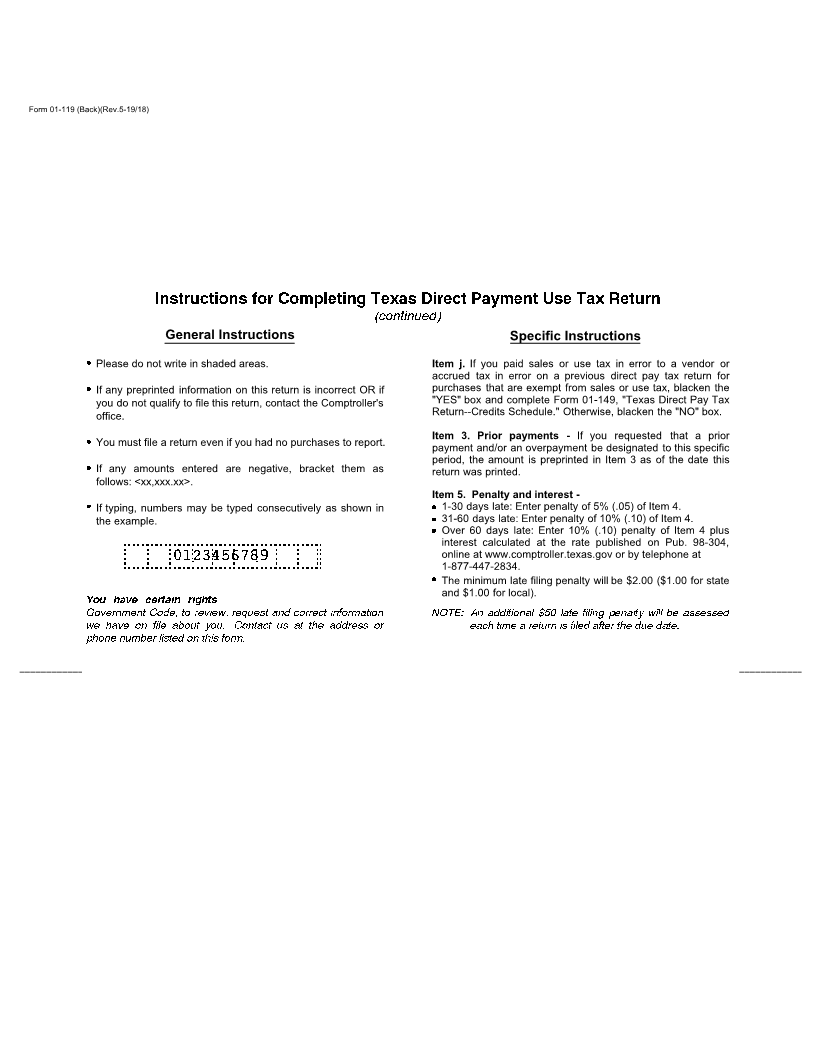

Instructions for Completing Texas Direct Payment Use Tax Return

Who Must File - Every person (sole owner, When to File - Returns must be filed on or before Whom to Contact for Assistance - If you

partnership, corporation or other organization) the 20th day of the month following each reporting have any questions regarding the Direct

who is responsible for payment of Texas direct period. The due date for filing this return is printed in Payment Use Tax, you may contact the Texas

payment use tax must file a return. Failure to file Item f. State Comptroller's field office in your area or

this return and pay applicable tax may result in Business Changes - It is your responsibility to call 1-800-252-5555.

collection action as prescribed by Title 2 of the notify the Comptroller's office of any business More instructions on back.

Tax Code. Returns and supplements must be filed changes or if you do not receive the correct forms to

for every period even if there is no tax due. report your taxes. If you're interested in

ELECTRONIC TAX FILING

j. Are you taking credit to reduce taxes due on this return YES NO please call us at 1-800-442-3453 or

for taxes you paid in error on your own purchases? 1 2 email us at etf.cpa@cpa.texas.gov.

If you answered "YES" to question j, complete Form 01-149Form 01-149and submit it with your return.

1. Amount subject to state tax (Taxable purchases on which tax

was not paid to supplier. REPORT WHOLE DOLLARS ONLY.) 1.

27180 02 STATE TAX - Column a 04 LOCAL TAX - Column b

2a. Multiply Item 1 by .062500 2b. Total of Item 7b on all list supplements

2. Total tax due

01-119 AAAA

(Rev.5-19/18)

-

3. Prior payments (See instructions)

= . .

4. Net tax due (Item 2 minus Item 3)

5. Penalty and interest + . .

(See instructions.)

6a. Total state amount due 6b. Total local amount due

6. TOTAL STATE AND LOCAL 02 04

=

AMOUNT DUE (Add Items 4 and 5.)

Mail to COMPTROLLER OF PUBLIC ACCOUNTS

P.O. Box 149354

Austin, TX 78714-9354

T Code Taxpayer number Period 7. TOTAL AMOUNT PAID

(Total of Items 6a and 6b. Make check

payable to: STATE COMPTROLLER.)

Taxpayer name n.

I declare that the information in this document and any attachments is true and correct to the best of my knowledge.

Taxpayer or duly authorized agent Date Daytime phone (Area code & number)