Enlarge image

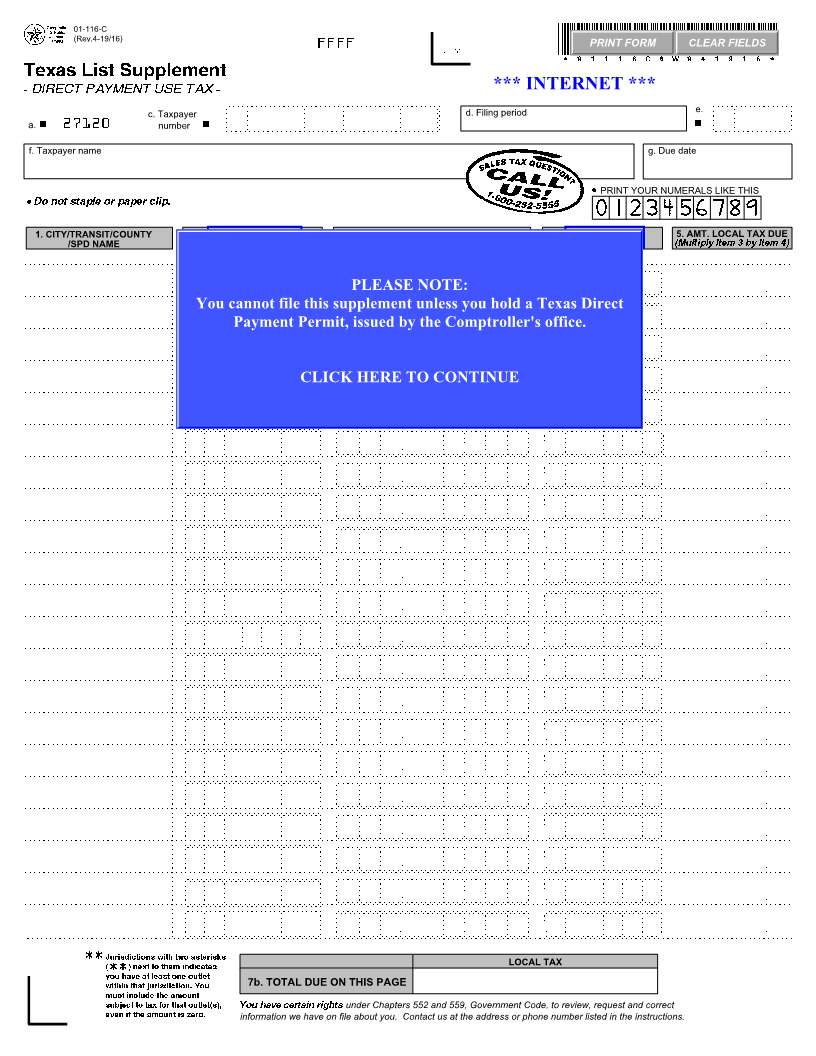

01-116-C

(Rev.4-19/16) FFFF PRINT FORM CLEAR FIELDS

*01116C0W041916*

Texas List Supplement

- DIRECT PAYMENT USE TAX - *** INTERNET ***

c. Taxpayer d. Filing period e.

a. 27120 number

f. Taxpayer name g. Due date

PRINT YOUR NUMERALS LIKE THIS

Do not staple or paper clip.

1. CITY/TRANSIT/COUNTY/SPD NAME COUNTY/SPD2. CITY/TRANSIT/NO. 3. AMOUNT(WholeSUBJECTdollars only)TO TAX 4. TAX RATE (Multiply5. AMT.ItemLOCAL3 byTAXItem 4)DUE

PLEASE NOTE:

You cannot file this supplement unless you hold a Texas Direct

Payment Permit, issued by the Comptroller's office.

CLICK HERE TO CONTINUE

** Jurisdictions with two asterisks

( **) next to them indicates LOCAL TAX

you have at least one outlet

within that jurisdiction. You 7b. TOTAL DUE ON THIS PAGE

must include the amount

subject to tax for that outlet(s), You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct

even if the amount is zero. information we have on file about you. Contact us at the address or phone number listed in the instructions.