Enlarge image

PRINT FORM CLEAR FIELDS

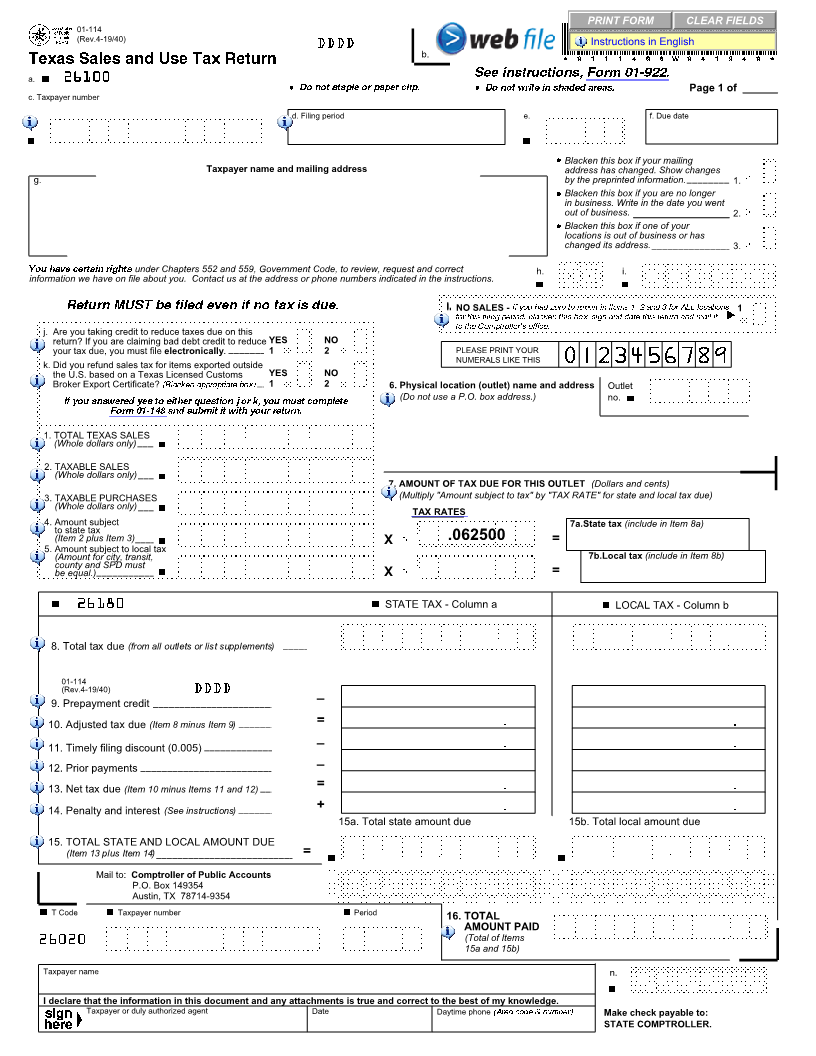

01-114

(Rev.4-19/40) DDDD Instructions in English

Texas Sales and Use Tax Return b. *0111400W041940*

a. 26100 See instructions, Form 01-922.

Do not staple or paper clip. Do not write in shaded areas. Page 1 of

c. Taxpayer number

d. Filing period e. f. Due date

Blacken this box if your mailing

Taxpayer name and mailing address address has changed. Show changes

g. by the preprinted information. 1.

Blacken this box if you are no longer

in business. Write in the date you went

out of business. 2.

Blacken this box if one of your

locations is out of business or has

changed its address. 3.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct h. i.

information we have on file about you. Contact us at the address or phone numbers indicated in the instructions.

Return MUST be filed even if no tax is due. l. l. NO SALES - If you had zero to report in Items 1, 2 and 3 for ALL locations 1

for this filing period, blacken this box, sign and date this return and mail it R

j. Are you taking credit to reduce taxes due on this to the Comptroller's office.

return? If you are claiming bad debt credit to reduce YES NO

your tax due, you must file electronically. 1 2 PLEASE PRINT YOUR

k. Did you refund sales tax for items exported outside NUMERALS LIKE THIS

the U.S. based on a Texas Licensed Customs YES NO

Broker Export Certificate? (Blacken appropriate box) 1 2 6. Physical location (outlet) name and address Outlet

If you answered yes to either question j or k, you must complete (Do not use a P.O. box address.) no.

Form 01-148 and submit it with your return.

1. TOTAL TEXAS SALES

(Whole dollars only) b

2. TAXABLE SALES

(Whole dollars only) b 7. AMOUNT OF TAX DUE FOR THIS OUTLET (Dollars and cents)

3. TAXABLE PURCHASES (Multiply "Amount subject to tax" by "TAX RATE" for state and local tax due)

(Whole dollars only) b TAX RATES

4. Amount subject 7a.State tax (include in Item 8a)

to state tax

(Item 2 plus Item 3) b X .062500 =

5. Amount subject to local tax

(Amount for city, transit, 7b.Local tax (include in Item 8b)

county and SPD must

be equal.) b X =

b 26180 b STATE TAX - Column a b LOCAL TAX - Column b

8. Total tax due (from all outlets or list supplements)

01-114

(Rev.4-19/40) DDDD _

9. Prepayment credit

10. Adjusted tax due (Item 8 minus Item 9) = . .

_ . .

11. Timely filing discount (0.005)

_

12. Prior payments

13. Net tax due (Item 10 minus Items 11 and 12) = . .

14. Penalty and interest (See instructions) + . .

15a. Total state amount due 15b. Total local amount due

15. TOTAL STATE AND LOCAL AMOUNT DUE

(Item 13 plus Item 14) =

b b

Mail to: Comptroller of Public Accounts

P.O. Box 149354

Austin, TX 78714-9354

T Code Taxpayer number Period 16. TOTAL

26020 AMOUNT(Total of ItemsPAID

15a and 15b)

Taxpayer name n.

I declare that the information in this document and any attachments is true and correct to the best of my knowledge.

Taxpayer or duly authorized agent Date Daytime phone (Area code & number) Make check payable to:

STATE COMPTROLLER.