Enlarge image

FLORIDA DEPARTMENT OF STATE

DIVISION OF CORPORATIONS

INSTRUCTIONS FOR A FLORIDA PROFIT BENEFIT CORPORATION

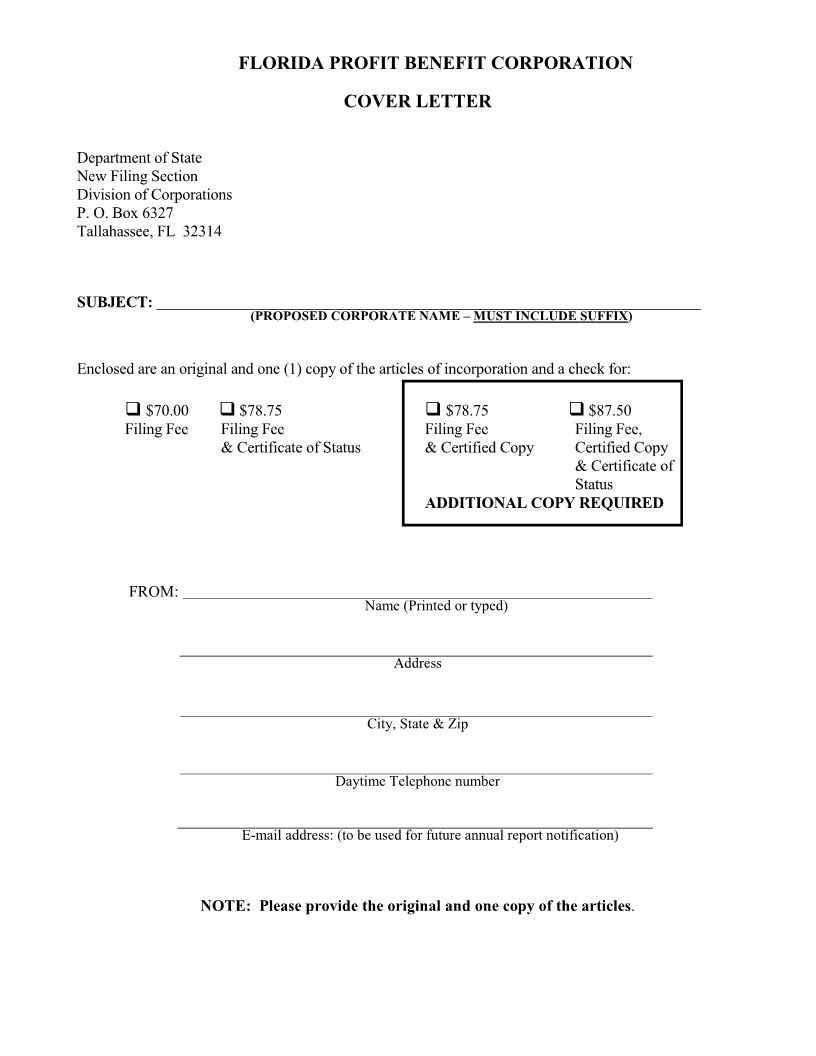

The following are instructions, a cover letter and sample articles of incorporation for a benefit corporation

pursuant to Part III of Chapter 607 and 621 Florida Statutes (F.S.), if applicable.

NOTE: THIS IS A BASIC FORM MEETING MINIMAL REQUIREMENTS FOR FILING

ARTICLES OF INCORPORATION.

The Division of Corporations strongly recommends that corporate documents be reviewed by your legal

counsel. The Division is a filing agency and as such does not render any legal, accounting, or tax advice.

This office does not provide you with corporate seals, minute books, or stock certificates. It is the

responsibility of the corporation to secure these items once the corporation has been filed with this office.

Questions concerning S Corporations should be directed to the Internal Revenue Service by telephoning

1-800-829-1040. This is an IRS designation, which is not determined by this office.

A preliminary search for name availability can be made on the Internet through the Division’s records at

www.sunbiz.org. Preliminary name searches and name reservations are no longer available from the

Division of Corporations. You are responsible for any name infringement that may result from your

corporate name selection.

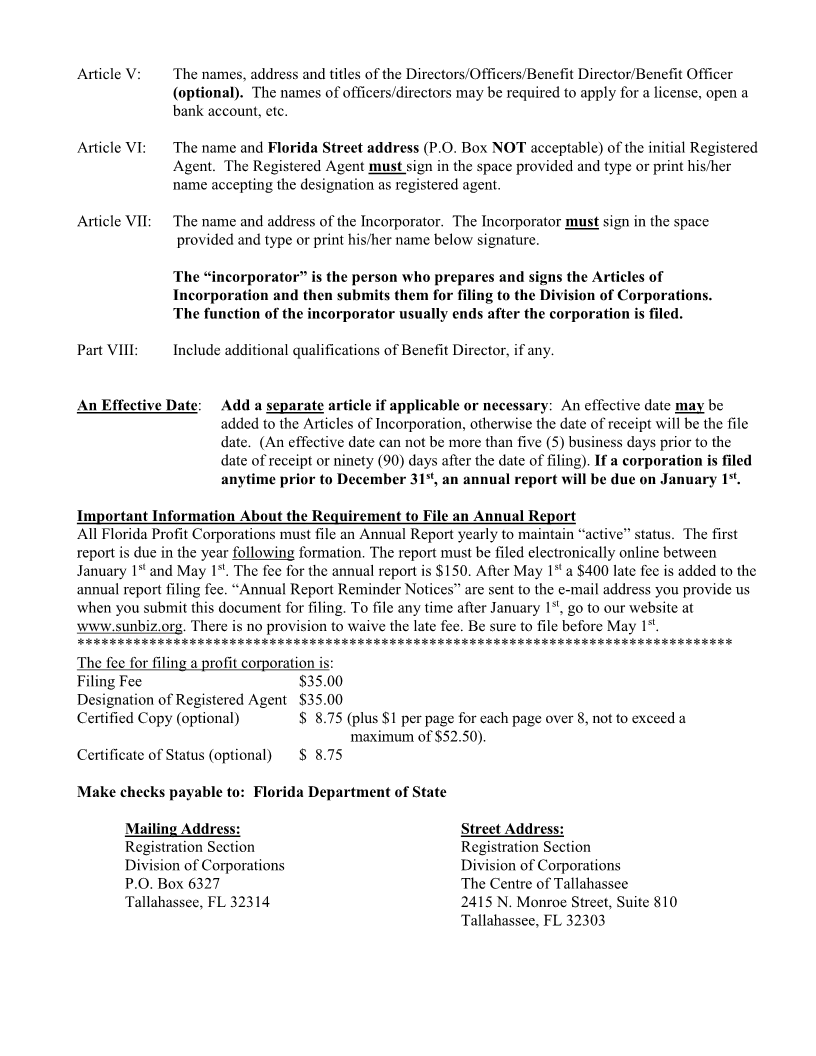

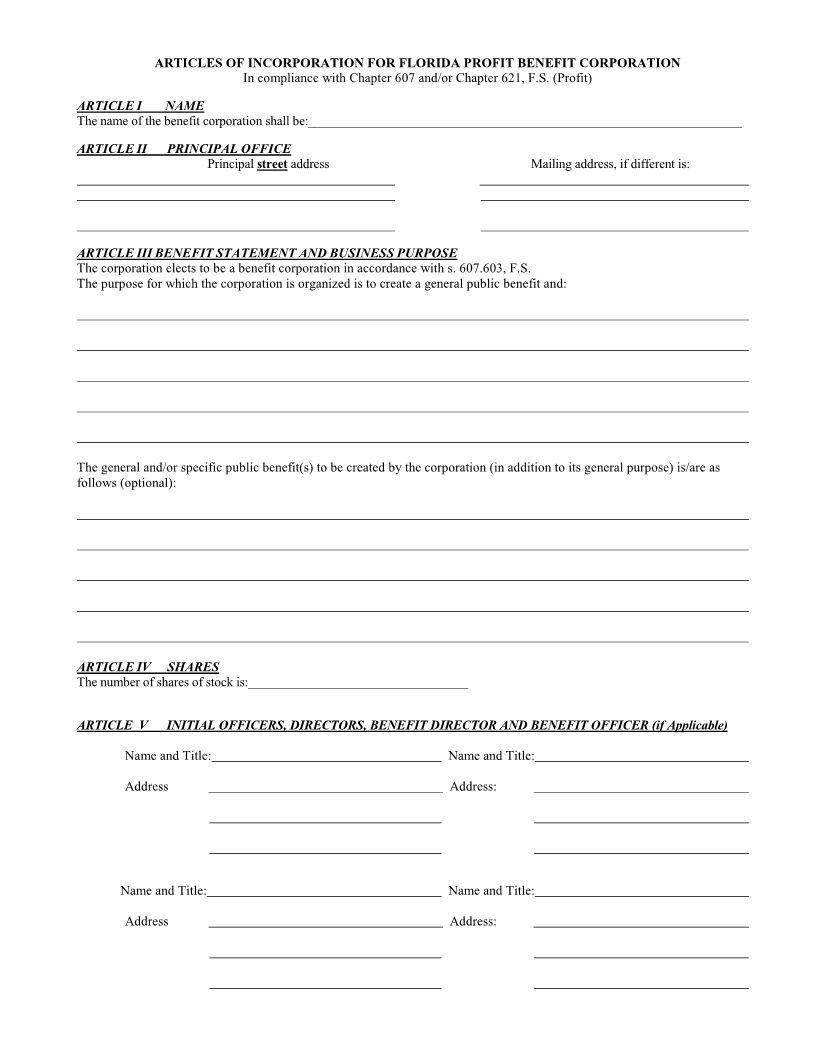

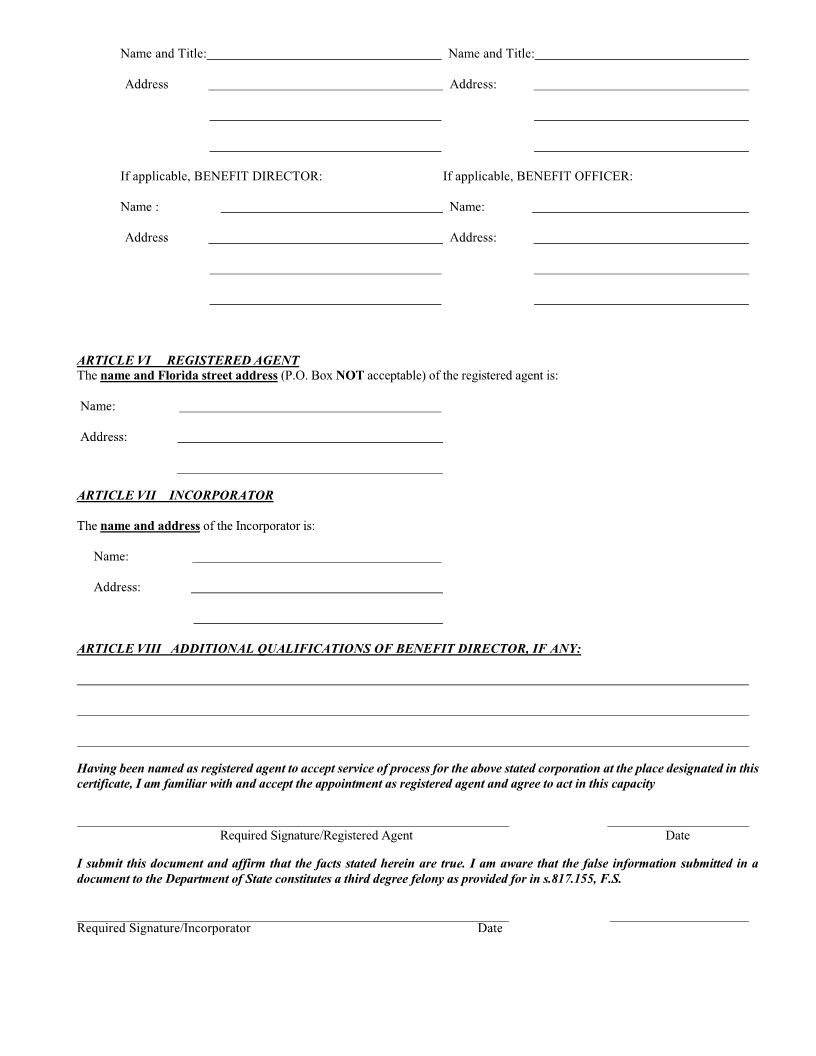

Pursuant to Chapter 607 or 621 F.S., the articles of incorporation must set forth the following:

Article I: The name of the corporation must include a corporate suffix such as Corporation,

Corp., Incorporated, Inc., Company, or Co.

A Professional Association must contain the word “chartered” or “professional

association” or “P.A.”.

Article II: The principal place of business and mailing address of the corporation. The principal

address must be a street address. The mailing address, if different, can be a P.O. Box

address.

Article III: ● Include a general business purpose or specific professional service, if a professional

benefit corporation.

● Include general and/or specific public benefit(s) to be created by the

corporation.

Article IV: The number of shares of stock that this corporation is authorized to have must be

stated.

INHS75 (6/14)