- 2 -

Enlarge image

|

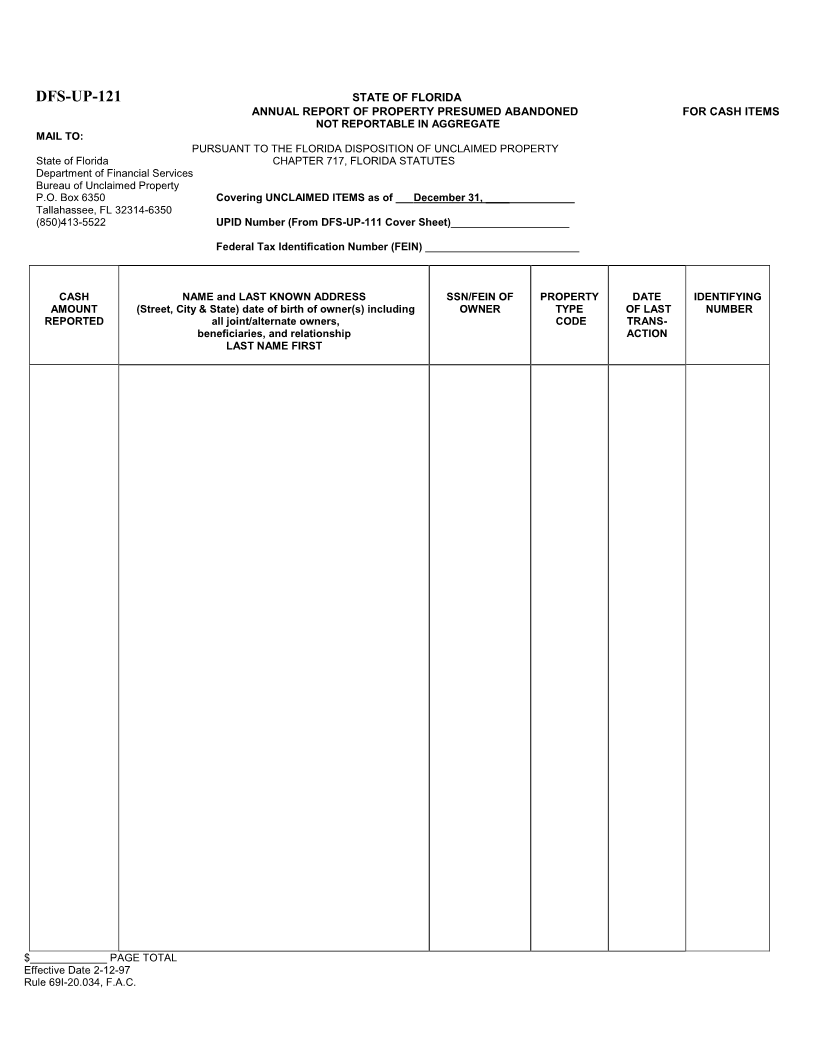

DFS-UP-121 FOR CASH ITEMS

This form is used to list the ‘Cash” related property amounts due for owners. The remittance (payment) for these items is

due at the same time you submit your unclaimed property report.

REMINDER: The Department forms cannot be used if your unclaimed property report includes 25 or more

owners.

DFS-UP-121 F ORM ETAILD

A. Column “ CASH AMOUNT REPORTED ” - Enter the sum of the cash amount(s) due the owner.

B. Column “ NAME and LAST KNOWN ADDRESS ” - Enter the last name, first name and full middle name, if

available. Corporate or other titles must be entered exactly as adopted, except the word “the” must be omitted

when it is the first word in the name. If the owner name is not known, insert “Unknown” as the owner name. List

the last known address, including zip code of the owner as it last appeared in the holder’s records. Include the

address, even when incomplete or erroneous. If no address is available, insert “Address Unknown” beneath the

name. If the property has more than one owner, the names and addresses of the alternate owners must be listed

beneath the original owner’s name. If there is no alternate owner for this account, then the wording “No Alternate

Owner” must be entered after each account .

1. The relationship between the owners must also be shown (A list of valid relationship codes can be found

in the RELATIONSHIP CODE TABLE). Enter the date of birth, if available. Reports not adhering to

these requirements will be returned to the holder to supply the omitted information and are subject to

potential fines and interest penalties.

C. Column “ SSN/FEIN OF OWNER ” - Enter the social security number of the individual or FEIN for the business

of the reported owner of the property. Social security numbers must be reported, specifically for payroll items,

bank accounts, and life insurance and securities holdings. If the alternate owner’s SSN is available, it must also

be reported. If no social security number is available, insert “Unknown” in this column. Common abbreviations

are SSN, FEID, EIN, and TIN. The SSN/FEIN of owner is required information that must be included on the

report.

D. Column “ PROPERTY TYPE CODE ” - Enter the property type code of each item. The property type codes are

listed in the FLORIDA PROPERTY CODE AND DORMANCY TABLE. Select the 4-character code that

best describes the property being reported. The property type code is required information that must be included

on the report.

E. Column “ DATE OF LAST TRANSACTION ” - Enter the date the property became payable, redeemable or

returnable. This is the date of the vendor check, the date a dividend became payable, the date a note became

payable, the date a check or draft was issued, etc. or the last date there was positive contact from the owner

regarding the property. The date of last transaction is required information that must be included on the report.

The Date of Last Transaction is not the date of the holder’s due diligence letter.

Make sure that all reported accounts have reached the end of their statutory

dormancy period.

F. Column “IDENTIFYING NUMBER” - Enter the identifying number of each item such as check number,

account number, employee number, etc. This number is not the holder number or federal employer identification

number. The identifying number is required information that must be included on the report.

ALL of the columns on the form must be completed. Any incomplete forms

will be recorded as non-compliant and will be returned to the holder to correct.

Information not known must be marked as “Unknown”.

|