Enlarge image

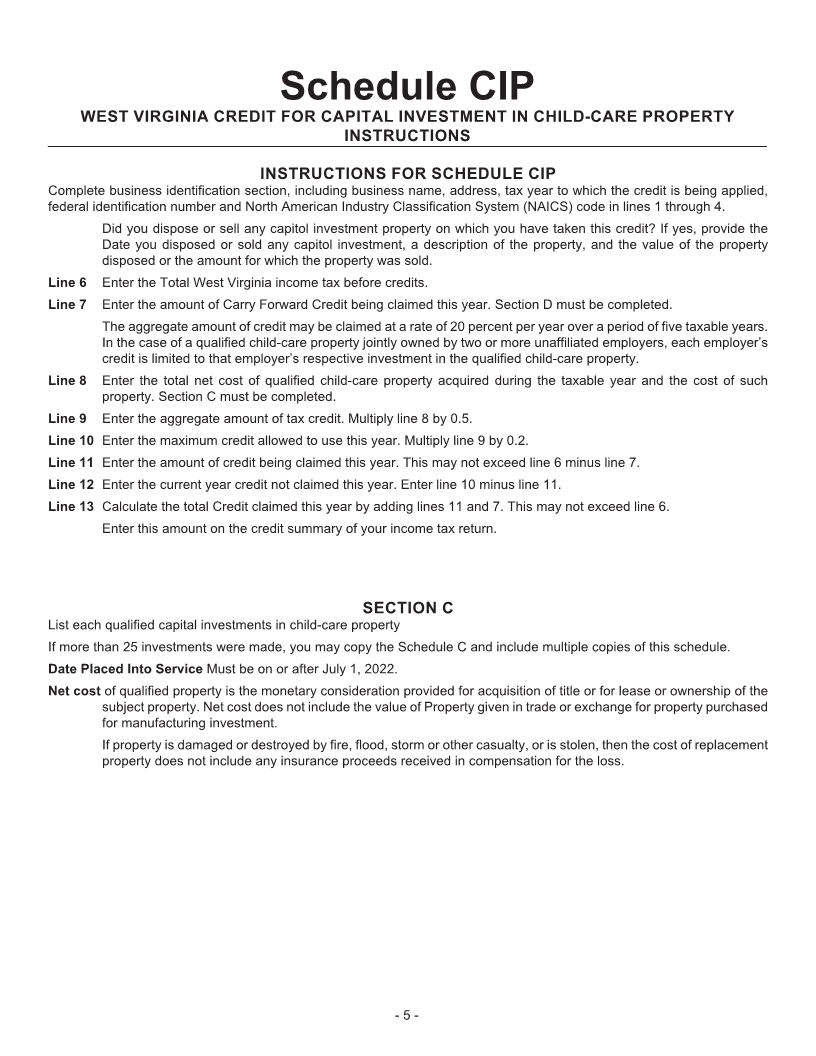

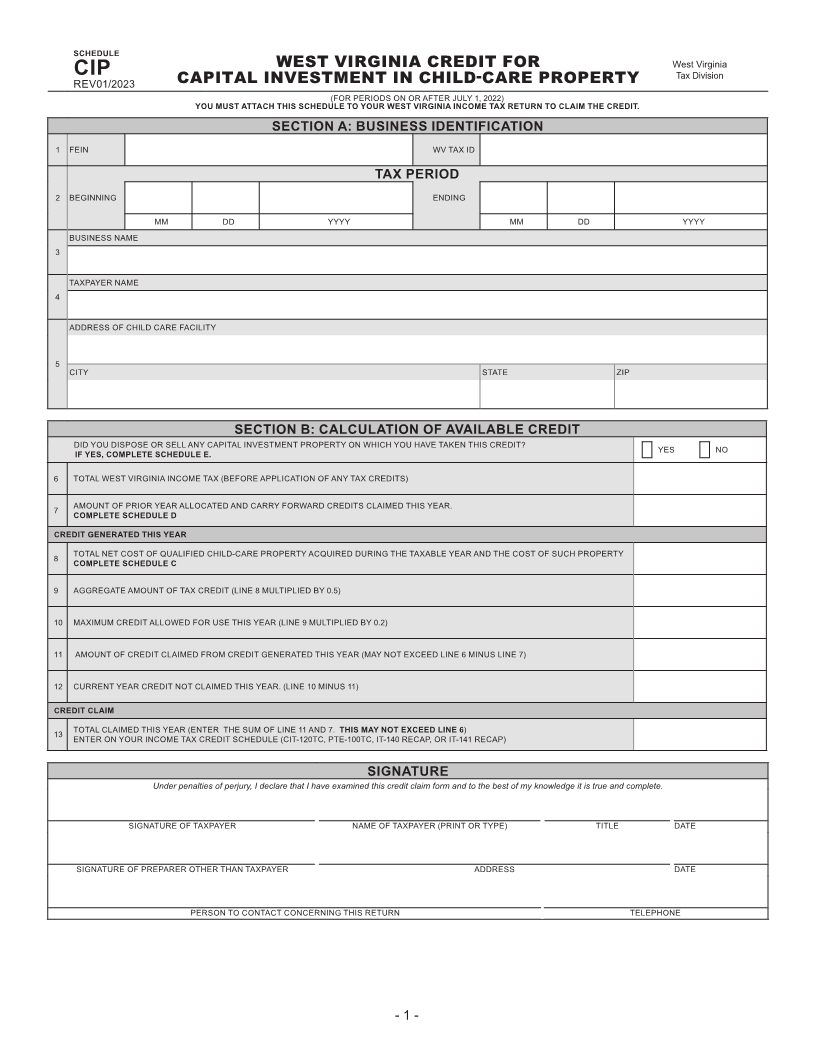

SCHEDULE

WEST VIRGINIA CREDIT FOR West Virginia

CIP Tax Division

REV01/2023 CAPITAL INVESTMENT IN CHILD-CARE PROPERTY

(FOR PERIODS ON OR AFTER JULY 1, 2022)

YOU MUST ATTACH THIS SCHEDULE TO YOUR WEST VIRGINIA INCOME TAX RETURN TO CLAIM THE CREDIT.

SECTION A: BUSINESS IDENTIFICATION

1 FEIN WV TAX ID

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

TAXPAYER NAME

4

ADDRESS OF CHILD CARE FACILITY

5

CITY STATE ZIP

SECTION B: CALCULATION OF AVAILABLE CREDIT

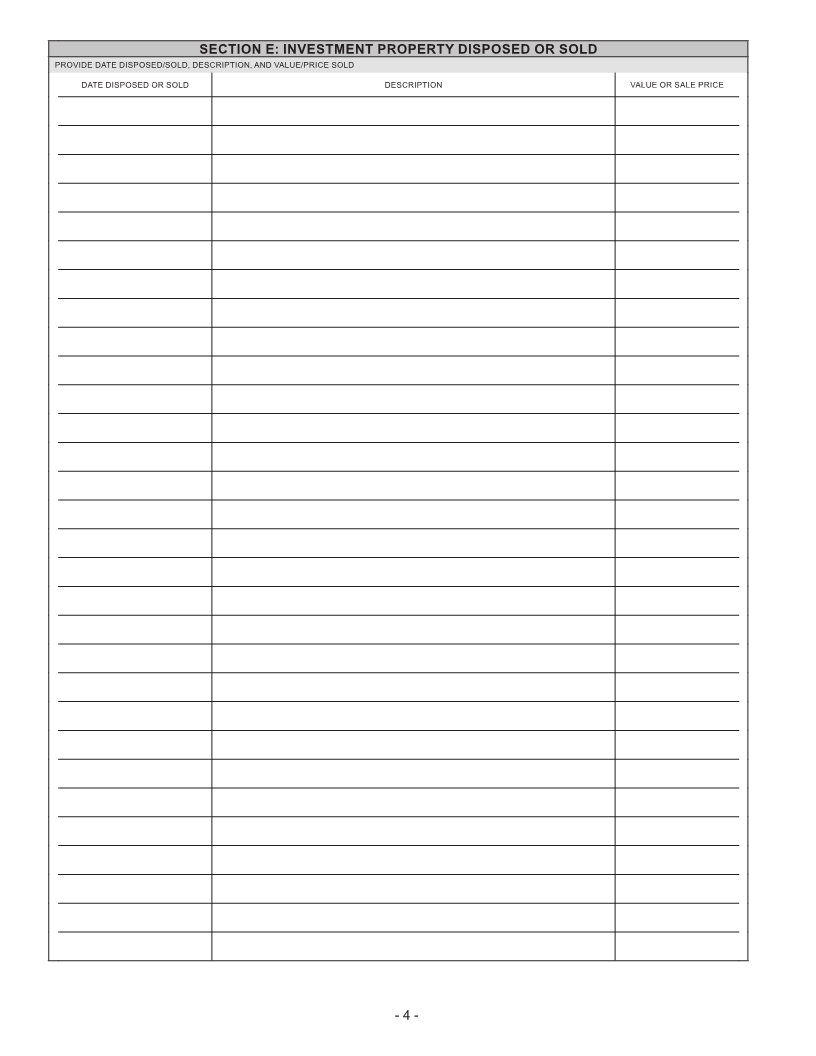

DID YOU DISPOSE OR SELL ANY CAPITAL INVESTMENT PROPERTY ON WHICH YOU HAVE TAKEN THIS CREDIT? YES NO

IF YES, COMPLETE SCHEDULE E.

6 TOTAL WEST VIRGINIA INCOME TAX (BEFORE APPLICATION OF ANY TAX CREDITS)

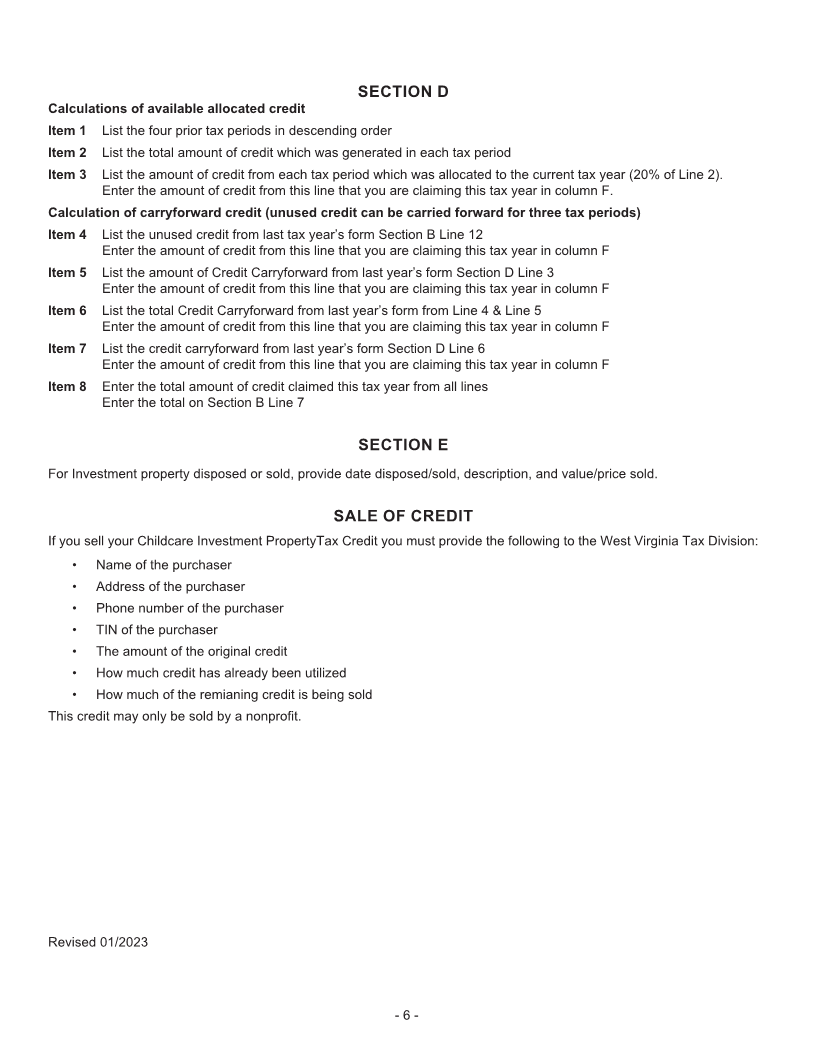

7 AMOUNT OF PRIOR YEAR ALLOCATED AND CARRY FORWARD CREDITS CLAIMED THIS YEAR.

COMPLETE SCHEDULE D

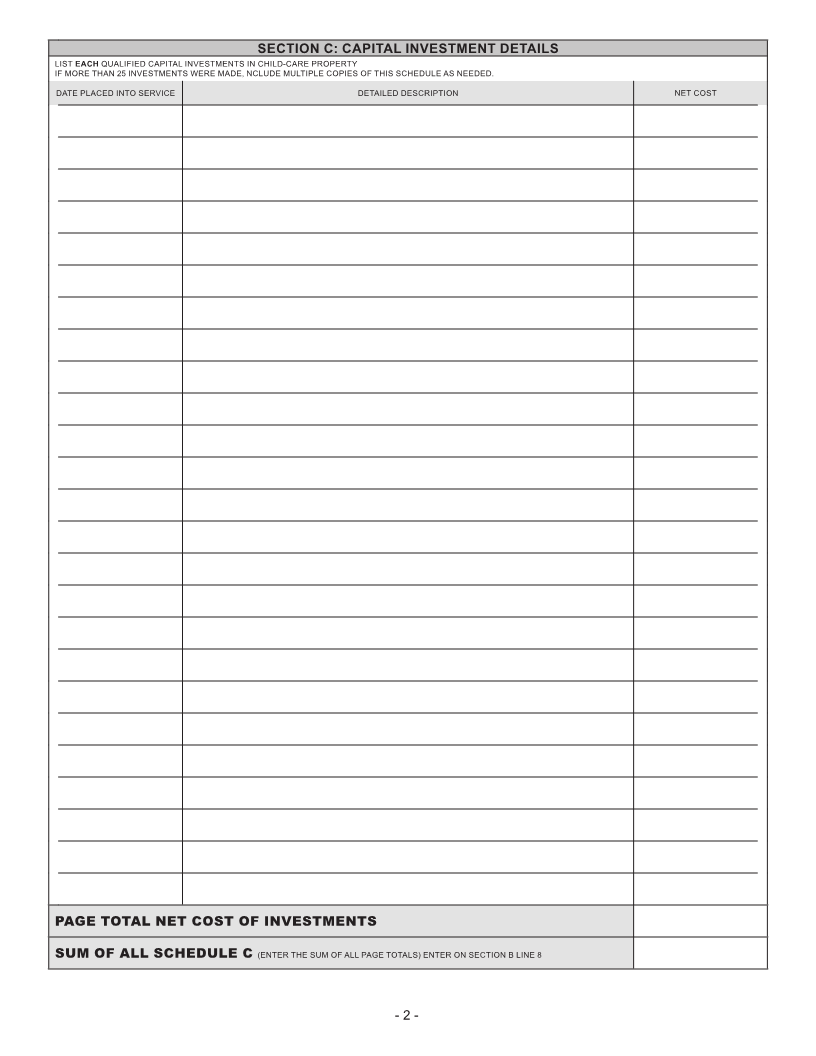

CREDIT GENERATED THIS YEAR

8 TOTAL NET COST OF QUALIFIED CHILD-CARE PROPERTY ACQUIRED DURING THE TAXABLE YEAR AND THE COST OF SUCH PROPERTY

COMPLETE SCHEDULE C

9 AGGREGATE AMOUNT OF TAX CREDIT (LINE 8 MULTIPLIED BY 0.5)

10 MAXIMUM CREDIT ALLOWED FOR USE THIS YEAR (LINE 9 MULTIPLIED BY 0.2)

11 AMOUNT OF CREDIT CLAIMED FROM CREDIT GENERATED THIS YEAR (MAY NOT EXCEED LINE 6 MINUS LINE 7)

12 CURRENT YEAR CREDIT NOT CLAIMED THIS YEAR. (LINE 10 MINUS 11)

CREDIT CLAIM

13 TOTAL CLAIMED THIS YEAR (ENTER THE SUM OF LINE 11 AND 7. THIS MAY NOT EXCEED LINE 6)

ENTER ON YOUR INCOME TAX CREDIT SCHEDULE (CIT-120TC, PTE-100TC, IT-140 RECAP, OR IT-141 RECAP)

SIGNATURE

Under penalties of perjury, I declare that I have examined this credit claim form and to the best of my knowledge it is true and complete.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (PRINT OR TYPE) TITLE DATE

SIGNATURE OF PREPARER OTHER THAN TAXPAYER ADDRESS DATE

PERSON TO CONTACT CONCERNING THIS RETURN TELEPHONE

- 1 -