Enlarge image

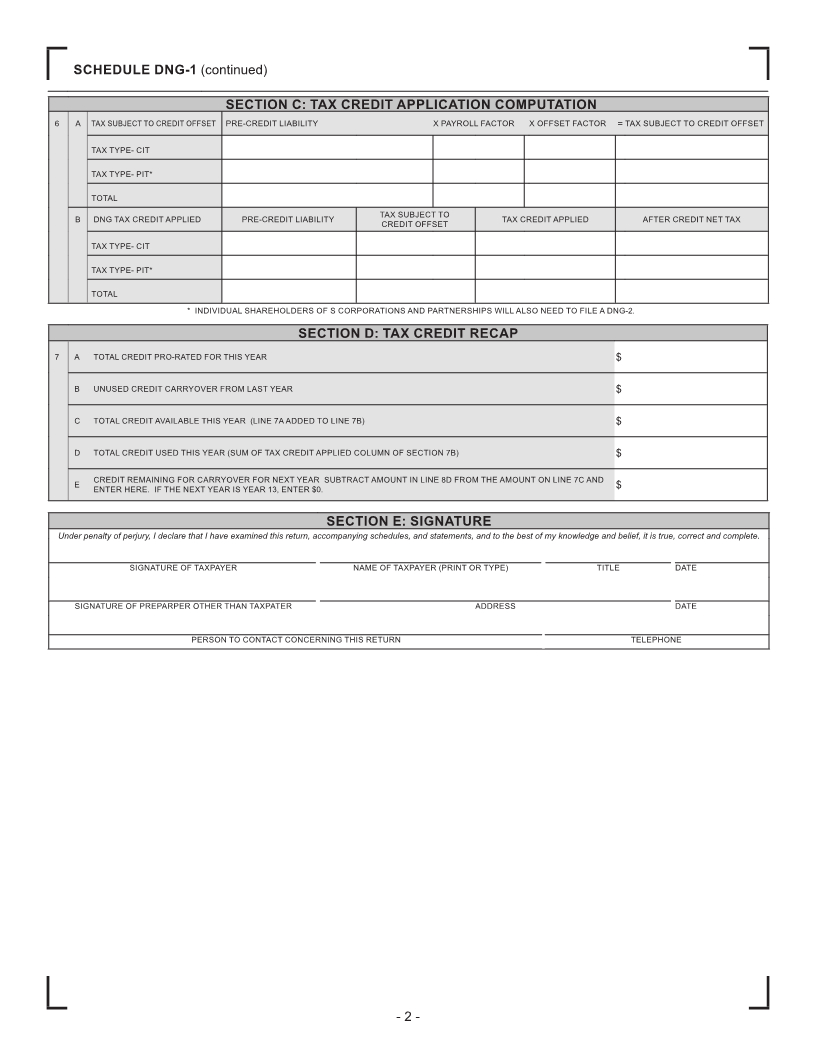

SCHEDULE

DOWNSTREAM NATURAL GAS West Virginia

DNG-1 State Tax Department

REV07-2020 MANUFACTURING INVESTMENT TAX CREDIT

SECTION A: BUSINESS IDENTIFICATION

NORTH AMERICAN INDUSTRY

1 FEIN OR SSN WV TAX ID CLASSIFICATION SYSTEM CODE

(Enter 6-digit NAICS Code Number)

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

ADDRESS

4 CITY STATE ZIP

SECTION B: CREDIT CALCULATION AND QUALIFIED INVESTMENT

1 INVESTMENT YEAR

2

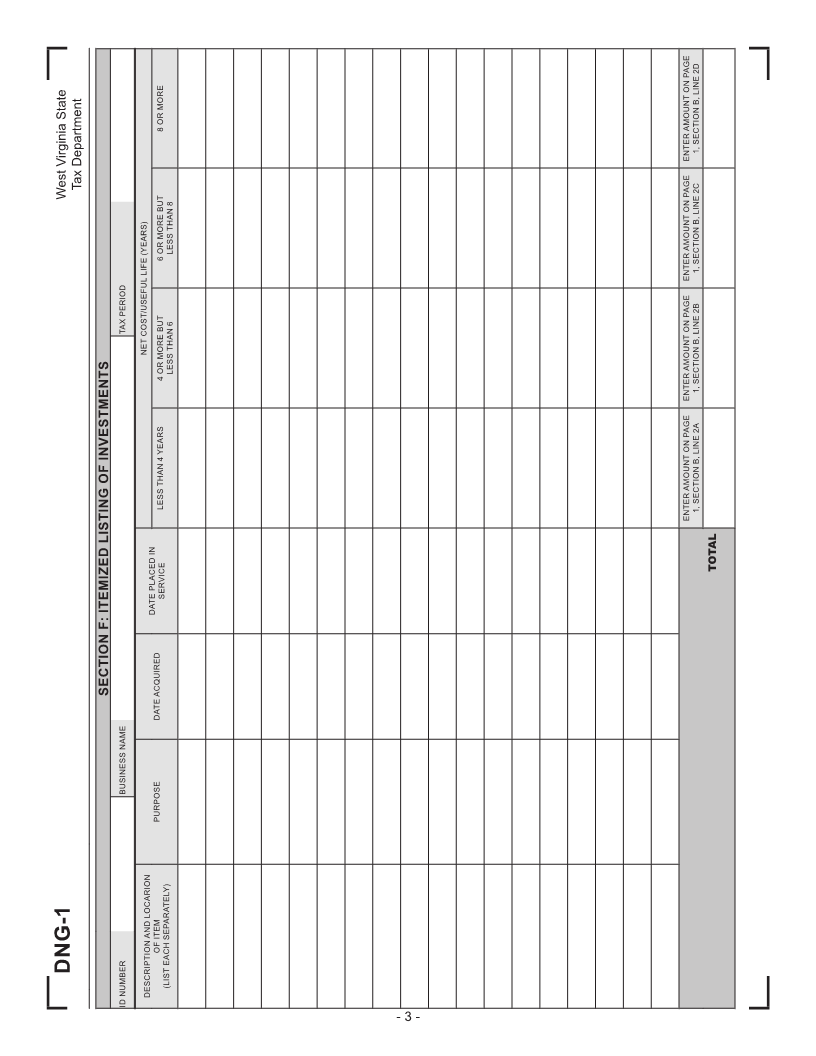

TEMIZED LISTING OF INVESTMENTS REQUIRED. COMPLETE SECTION F A B C

COST RATE QUALIFIED

A INVESTMENT WITH USEFUL LIFE OF LESS THAN 4 YEARS $ 00.00% $ 0.00

B INVESTMENT WITH USEFUL LIFE OF AT LEAST 4 YEARS BUT LESS THAN 6 YEARS $ 33.33% $

C INVESTMENT WITH USEFUL LIFE OF AT LEAST 6 YEARS BUT LESS THAN 8 YEARS $ 66.66% $

D INVESTMENT WITH USEFUL LIFE OF 8 YEARS OR MORE $ 100.00% $

Total Quali fi ed Investment

3 NEW JOBS PERCENTAGE NUMBER OF NEW JOBS APPLICABLE

PERCENTAGE Add 5% to new jobs percentage

IF THE NUMBER OF NEW JOBS CREATED IS LEAST 5 THEN 10% if you employ at least 50 full-time

equivalent construction workers

IF THE NUMBER OF NEW JOBS CREATED IS LEAST 50 THEN 15% at prevailing wage in $20 million

IF THE NUMBER OF NEW JOBS CREATED IS LEAST 150 THEN 20% or greater investment project.

QUALIFIED INVESTMENT X NEW JOBS % = TAX CREDIT x 10%/YEAR

AVAILABLE CREDIT CALCULATION:

$

4 ANNUAL NEW JOBS/PAYROLL FACTOR COMPUTATION NUMBER OF EMPLOYEES PAYROLL OF EMPLOYEES

A PRE-CREDIT EMPLOYMENT LEVELS:

NEW JOBS EMPLOYED FOR CREDIT

TOTAL EMPLOYMENT IN WV

NEW JOBS PAYROLL / TOTAL WV PAYROLL = PAYROLL FACTOR

B PAYROLL FACTOR:

IF MEDIAN COMPENSATION OF NEW JOBS IS HIGHER THAN THE STATEWIDE AVERAGE MEDIAN COMPENSATION FOR

5 ANNUAL TAX OFFSET FACTOR NONFARM PAYROLL AS DETERMINED ANNUALLY BY WORKFORCE WEST VIRGINIA AND THIS YEAR IS

PUBLISHED IN THE APPLICABLE ADMINISTRATIVE NOTICE THEN THE TAX OFFSET IS 100%.

OTHERWISE THE TAX OFFSET IS 80%.

CONTINUED ON NEXT PAGE

- 1 -