Enlarge image

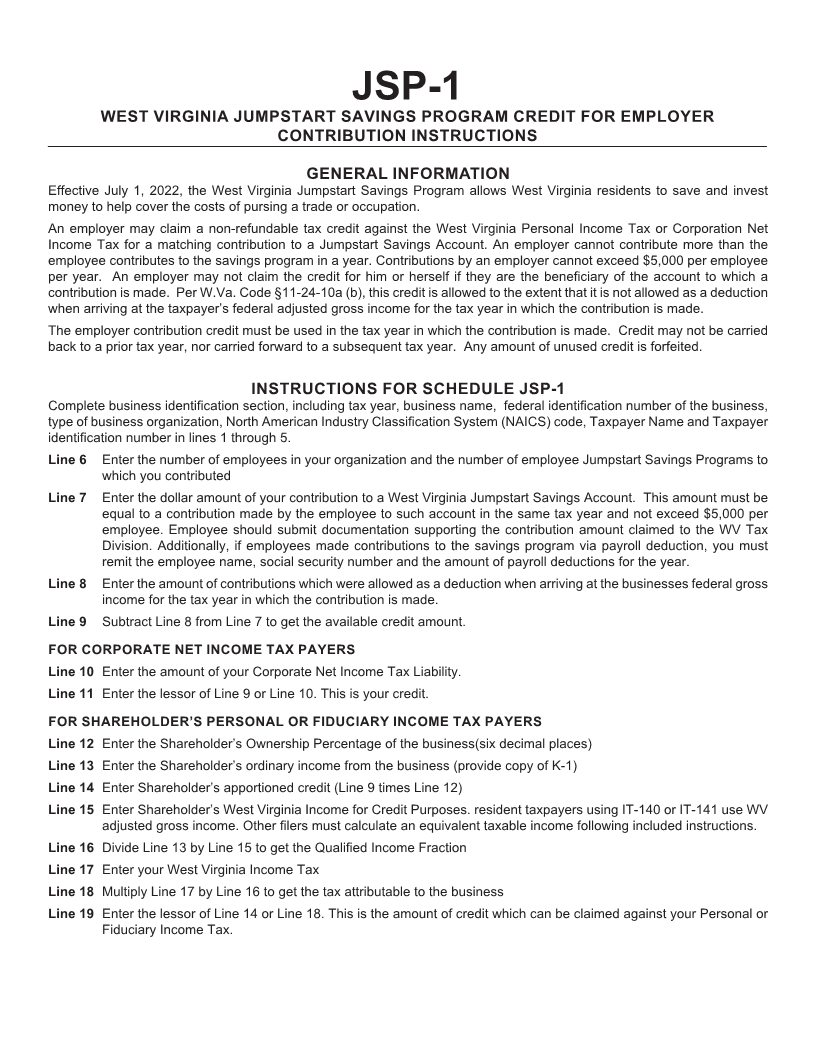

SCHEDULE

WEST VIRGINIA JUMPSTART SAVINGS PROGRAM West Virginia

JSP-1 Tax Division

REV08/2022 CREDIT FOR EMPLOYER CONTRIBUTION

(FOR PERIODS ON OR AFTER JULY 1, 2022)

NOTE: THE CREDIT ALLOWED MUST BE USED IN THE TAX YEAR IN WHICH THE EMPLOYER CONTRIBUTION WAS MADE.

CREDITS MAY NOT BE CARRIED BACK TO A PRIOR TAX YEAR NOR CARRIED FORWARD TO A SUBSEQUENT TAX YEAR. ANY AMOUNT OF UNUSED CREDIT IS FORFEITED.

SECTION A: BUSINESS IDENTIFICATION

TAX PERIOD

1 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME(The entity generating the credit) FEIN OR SSN

2

PLEASE SPECIFY THE FORM OF ORGANIZATION THE BUSINESS NAMED ON LINE 2 BELONGS TO. PLEASE NOTE THAT YOU MAY CHECK MORE THAN ONE LINE.

FOR EXAMPLE, YOU MAY BELONG AN LLC PARTNERSHIP, THEREFORE YOU WOULD CHECK LLC AND PARTNERSHIP

3

SOLE PROPRIETORSHIP PARTNERSHIP LLC S CORPORATION C CORPORATION

4 NORTH AMERICAN INDUSTRY CLASSIFICATION SYSTEM CODE

(ENTER 6 DIGIT NAICS CODE NUMBER)

TAXPAYER NAME (Entity or individual claiming the credit. for pass through credits, this is the shareholder) FEIN OR SSN

5

SECTION B: CALCULATION OF AVAILABLE CREDIT

6 NUMBER OF EMPLOYEES NUMBER OF EMPLOYEE JUMPSTART SAVINGS PROGRAM

IN YOUR ORGANIZATION ACCOUNTS TO WHICH THE EMPLOYER CONTRIBUTED

ENTER THE TOTAL AMOUNT OF YOUR CONTRIBUTIONS TO WEST VIRGINIA JUMPSTART SAVINGS ACCOUNTS

7 (The amount must be equal to the contribution made by the employee in the same year not to exceed $5,000)

(The employer must attach documentation to verify the contribution amount)

8 AMOUNT OF LINE 7 WHICH WAS ALLOWABLE AS A DEDUCTION WHEN ARRIVING AT THE TAXPAYER’S FEDERAL ADJUSTED GROSS

INCOME FOR THE TAXABLE YEAR IN WHICH THE CONTRIBUTION WAS MADE

9 AVAILABLE CREDIT (LINE 7 MINUS LINE 8)

AN EMPLOYER MAY NOT CLAIM THE CREDIT AGAINST MORE THAN ONE TYPE OF TAX FOR A SINGLE CONTRIBUTION TO A JUMPSTART SAVINGS ACCOUNT PER WV CODE

SECTION C: CORPORATIONS CLAIMING THE CREDIT AGAINST CORPORATE NET INCOME TAX

10 ENTER THE AMOUNT OF YOUR TAX LIABILITY

11 AMOUNT OF CREDIT CLAIMED (ENTER THE LESSER OF LINE 9 OR LINE 10)

SECTION D: PASS-THROUGH ENTITY OR SOLE PROPRIETOR CREDIT CLAIMED

AGAINST PERSONAL INCOME TAX OR FIDUCIARY INCOME TAX

12 SHAREHOLDER'S OWNERSHIP PERCENTAGE OF BUSINESS EXPRESSED AS A DECIMAL TO SIX PLACES

13 SHAREHOLDER'S ORDINARY INCOME FROM BUSINESS (COPY OF K-1 SHOULD BE PROVIDED)

14 SHAREHOLDER'S APPORTIONED CREDIT (LINE 9 MULIPLIED BY LINE 12)

15 ENTER SHAREHOLDER’S WEST VIRGINIA INCOME FOR CREDIT PURPOSES (Full-year residents use WV adjusted gross income.

Non-resident/part-year resident filers must calculate an equivalent taxable income following the instructions included below.)

16 QUALIFIED INCOME FRACTION (EXPRESS AS A DECIMAL TO SIX PLACES,NOT GREATER THAN 1, LINE 13 DIVIDED BY LINE 15)

17 WEST VIRGINIA INCOME TAX

18 TAX ATTRIBUTABLE TO QUALIFIED BUSINESS (LINE 17 MULTIPLIED BY LINE 16)

19 AMOUNT OF CREDIT CLAIMED (ENTER THE LESSOR OF LINE 14 OR LINE 18)

SIGNATURE

Under penalties of perjury, I declare that I have examined this credit claim form and to the best of my knowledge it is true and complete.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (PRINT OR TYPE) TITLE DATE

SIGNATURE OF PREPARER OTHER THAN TAXPAYER ADDRESS DATE

PERSON TO CONTACT CONCERNING THIS RETURN TELEPHONE

- 1 -