Enlarge image

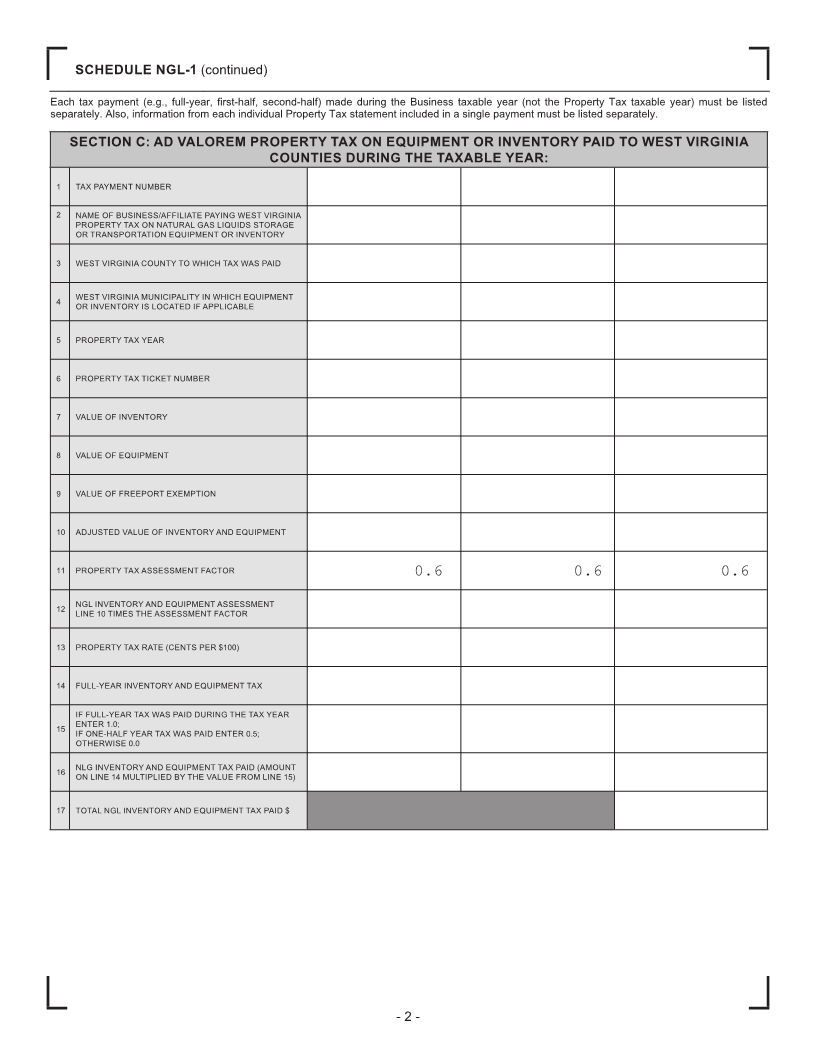

SCHEDULE

NATURAL GAS LIQUIDS West Virginia

NGL-1 PROPERTY TAX ADJUSTMENT CREDIT State Tax Department

REV07-2021 For Eligible Businesses engaged in the storage or transportation of Natural Gas Liquids

(For tax periods beginning on or after July 1, 2020)

In order to claim the Natural Gas Liquids Property Tax Adjustment Credit, the claimant must be in the business of transportation or storage of natural gas

liquids and also have paid Ad Valorem Property Tax on equipment or inventory, used in the transportation or storage of natural gas liquids, to one or more

West Virginia Counties during the taxable year.

SECTION A: BUSINESS IDENTIFICATION

NORTH AMERICAN INDUSTRY

1 FEIN WV TAX ID CLASSIFICATION SYSTEM CODE

(Enter 6-digit NAICS Code Number)

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

NAME OF ENTITY WHICH EARNED THE CREDIT

3

ADDRESS

4 CITY STATE ZIP

SECTION B: NATURAL GAS LIQUIDS PROPERTY TAX ADJUSTMENT CREDIT CALCULATION

1 QUALIFIED BUSINESS ACTIVITY:

‘NATURAL GAS LIQUIDS TRANSPORTER’ DEFINED AS A PERSON WHO OWNS OR OPERATES PIPELINE FACILITIES USED FOR THE TRANSPORTATION AND DELIVERY

OF NGLS FOR STORAGE, USE IN MANUFACTURING OR CONSUMPTION, BUT DOES NOT INCLUDE PIPELINES USED FOR THE TRANSPORTATION OF NATURAL GAS

THAT MAY INCLUDE SOME NGLS AS PART OF THE GAS STREAM.

‘NATURAL GAS LIQUIDS STORER’ DEFINED AS A PERSON WHO OWNS OR OPERATES ONE OR MORE UNDERGROUND FACILITIES DESIGNED AND DEVELOPED FOR

THE RECEIPT, STORAGE AND SUBSEQUENT DELIVERY OF NGLS FOR USE IN MANUFACTURING OR CONSUMPTION.

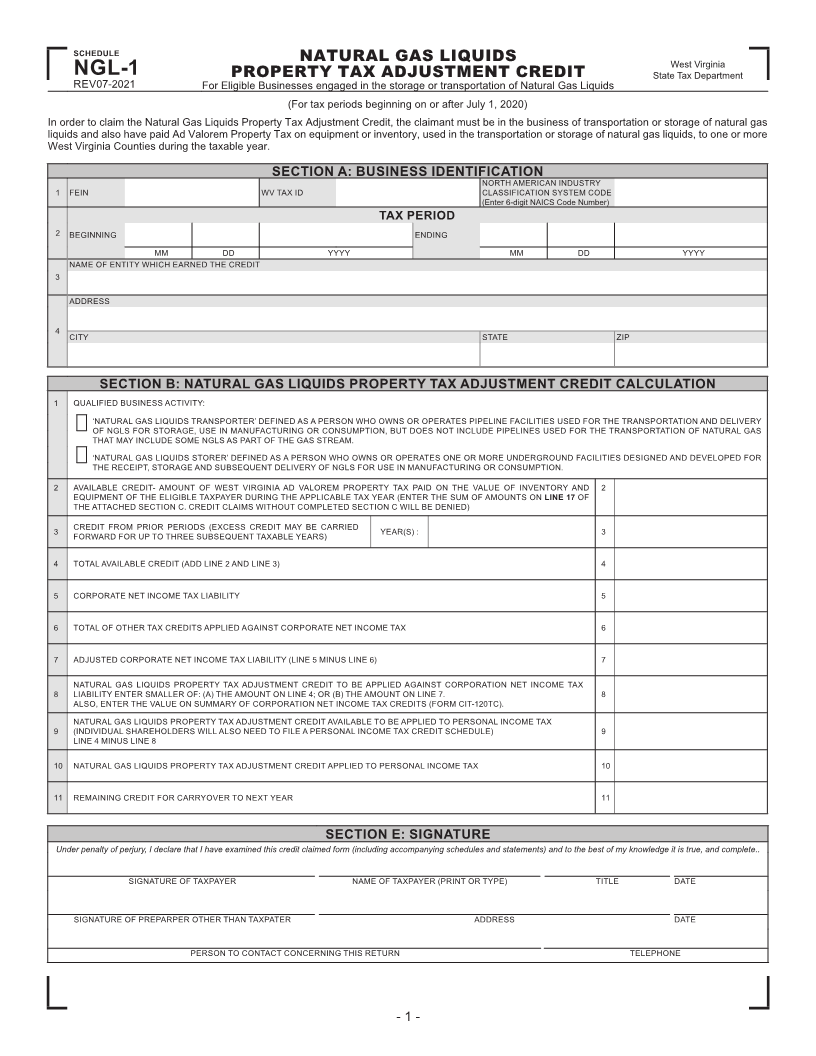

2 AVAILABLE CREDIT- AMOUNT OF WEST VIRGINIA AD VALOREM PROPERTY TAX PAID ON THE VALUE OF INVENTORY AND 2

EQUIPMENT OF THE ELIGIBLE TAXPAYER DURING THE APPLICABLE TAX YEAR (ENTER THE SUM OF AMOUNTS ON LINE 17 OF

THE ATTACHED SECTION C. CREDIT CLAIMS WITHOUT COMPLETED SECTION C WILL BE DENIED)

3 CREDIT FROM PRIOR PERIODS (EXCESS CREDIT MAY BE CARRIED YEAR(S) : 3

FORWARD FOR UP TO THREE SUBSEQUENT TAXABLE YEARS)

4 TOTAL AVAILABLE CREDIT (ADD LINE 2 AND LINE 3) 4

5 CORPORATE NET INCOME TAX LIABILITY 5

6 TOTAL OF OTHER TAX CREDITS APPLIED AGAINST CORPORATE NET INCOME TAX 6

7 ADJUSTED CORPORATE NET INCOME TAX LIABILITY (LINE 5 MINUS LINE 6) 7

NATURAL GAS LIQUIDS PROPERTY TAX ADJUSTMENT CREDIT TO BE APPLIED AGAINST CORPORATION NET INCOME TAX

8 LIABILITY ENTER SMALLER OF: (A) THE AMOUNT ON LINE 4; OR (B) THE AMOUNT ON LINE 7. 8

ALSO, ENTER THE VALUE ON SUMMARY OF CORPORATION NET INCOME TAX CREDITS (FORM CIT-120TC).

NATURAL GAS LIQUIDS PROPERTY TAX ADJUSTMENT CREDIT AVAILABLE TO BE APPLIED TO PERSONAL INCOME TAX

9 (INDIVIDUAL SHAREHOLDERS WILL ALSO NEED TO FILE A PERSONAL INCOME TAX CREDIT SCHEDULE) 9

LINE 4 MINUS LINE 8

10 NATURAL GAS LIQUIDS PROPERTY TAX ADJUSTMENT CREDIT APPLIED TO PERSONAL INCOME TAX 10

11 REMAINING CREDIT FOR CARRYOVER TO NEXT YEAR 11

SECTION E: SIGNATURE

Under penalty of perjury, I declare that I have examined this credit claimed form (including accompanying schedules and statements) and to the best of my knowledge it is true, and complete..

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (PRINT OR TYPE) TITLE DATE

SIGNATURE OF PREPARPER OTHER THAN TAXPATER ADDRESS DATE

PERSON TO CONTACT CONCERNING THIS RETURN TELEPHONE

- 1 -