Enlarge image

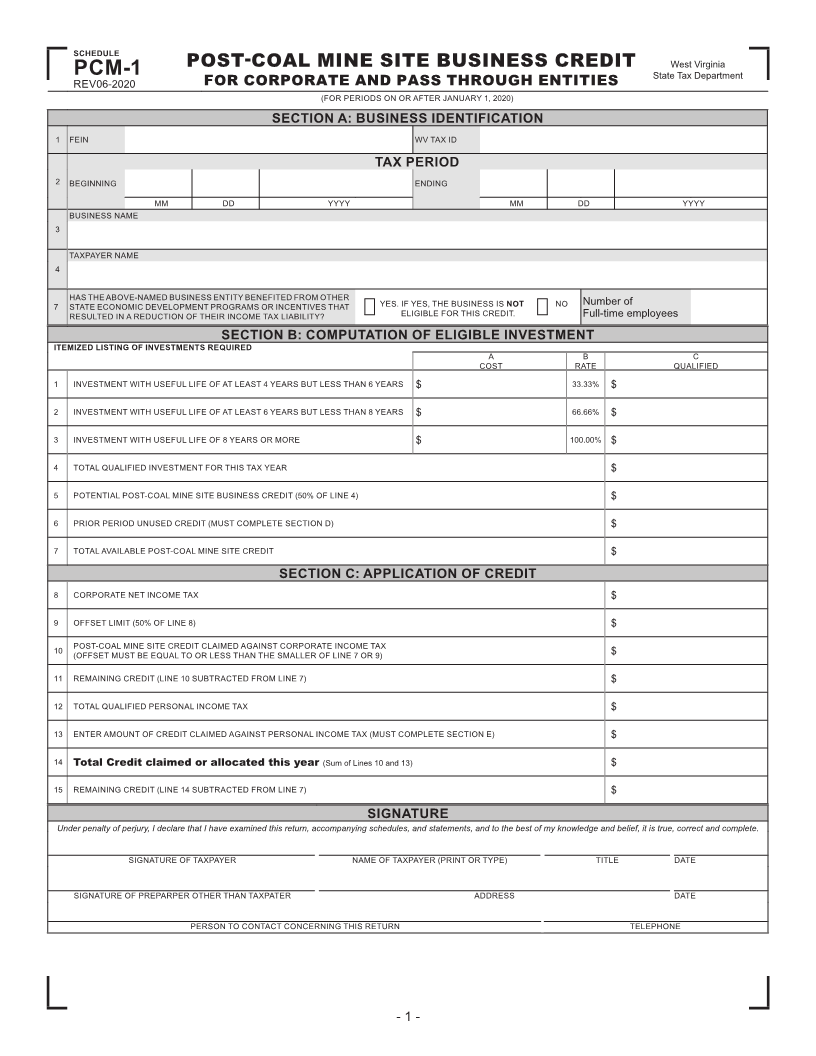

SCHEDULE

POST-COAL MINE SITE BUSINESS CREDIT West Virginia

PCM-1 State Tax Department

REV06-2020 FOR CORPORATE AND PASS THROUGH ENTITIES

(FOR PERIODS ON OR AFTER JANUARY 1, 2020)

SECTION A: BUSINESS IDENTIFICATION

1 FEIN WV TAX ID

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

TAXPAYER NAME

4

HAS THE ABOVE-NAMED BUSINESS ENTITY BENEFITED FROM OTHER

7 STATE ECONOMIC DEVELOPMENT PROGRAMS OR INCENTIVES THAT YES. IF YES, THE BUSINESS IS NOT NO Number of

RESULTED IN A REDUCTION OF THEIR INCOME TAX LIABILITY? ELIGIBLE FOR THIS CREDIT. Full-time employees

SECTION B: COMPUTATION OF ELIGIBLE INVESTMENT

ITEMIZED LISTING OF INVESTMENTS REQUIRED

A B C

COST RATE QUALIFIED

1 INVESTMENT WITH USEFUL LIFE OF AT LEAST 4 YEARS BUT LESS THAN 6 YEARS $ 33.33% $

2 INVESTMENT WITH USEFUL LIFE OF AT LEAST 6 YEARS BUT LESS THAN 8 YEARS $ 66.66% $

3 INVESTMENT WITH USEFUL LIFE OF 8 YEARS OR MORE $ 100.00% $

4 TOTAL QUALIFIED INVESTMENT FOR THIS TAX YEAR $

5 POTENTIAL POST-COAL MINE SITE BUSINESS CREDIT (50% OF LINE 4) $

6 PRIOR PERIOD UNUSED CREDIT (MUST COMPLETE SECTION D) $

7 TOTAL AVAILABLE POST-COAL MINE SITE CREDIT $

SECTION C: APPLICATION OF CREDIT

8 CORPORATE NET INCOME TAX $

9 OFFSET LIMIT (50% OF LINE 8) $

10 POST-COAL MINE SITE CREDIT CLAIMED AGAINST CORPORATE INCOME TAX $

(OFFSET MUST BE EQUAL TO OR LESS THAN THE SMALLER OF LINE 7 OR 9)

11 REMAINING CREDIT (LINE 10 SUBTRACTED FROM LINE 7) $

12 TOTAL QUALIFIED PERSONAL INCOME TAX $

13 ENTER AMOUNT OF CREDIT CLAIMED AGAINST PERSONAL INCOME TAX (MUST COMPLETE SECTION E) $

14 Total Credit claimed or allocated this year (Sum of Lines 10 and 13) $

15 REMAINING CREDIT (LINE 14 SUBTRACTED FROM LINE 7) $

SIGNATURE

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (PRINT OR TYPE) TITLE DATE

SIGNATURE OF PREPARPER OTHER THAN TAXPATER ADDRESS DATE

PERSON TO CONTACT CONCERNING THIS RETURN TELEPHONE

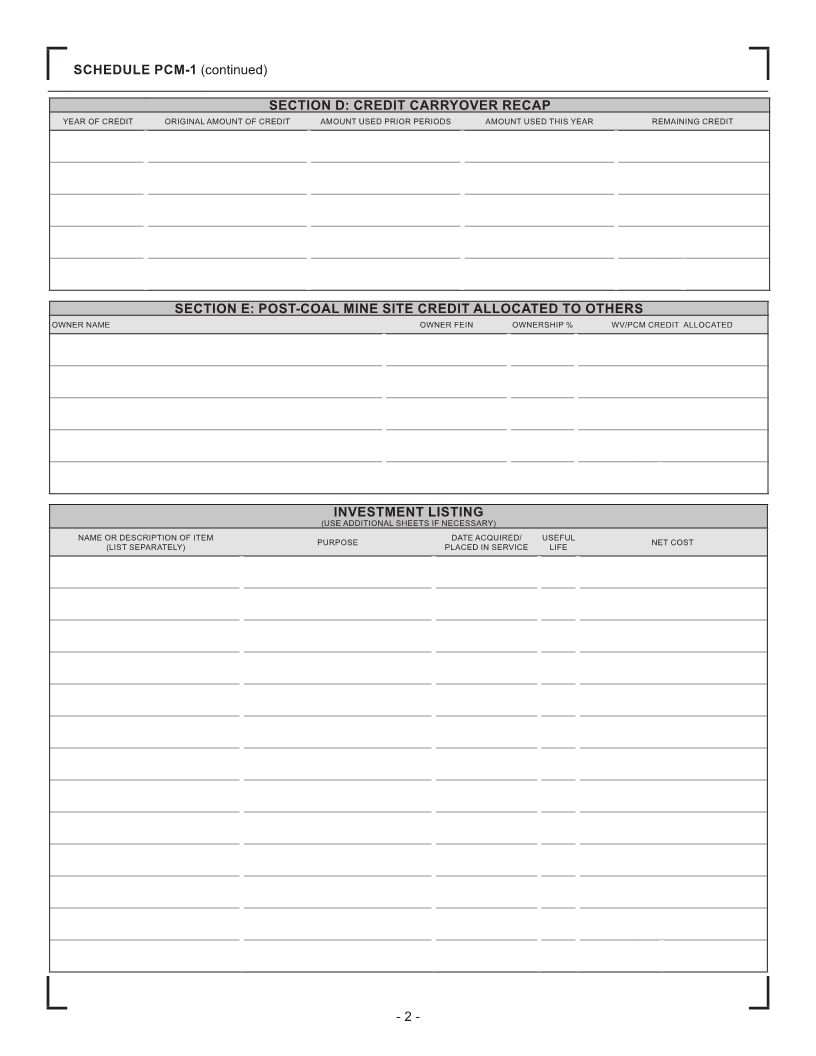

- 1 -