Enlarge image

SCHEDULE WEST VIRGINIA TAX CREDIT FOR West Virginia

SAAM-1 FEDERAL EXCISE TAX IMPOSED UPON State Tax Department

REV10/2021 SMALL ARMS AND AMMUNITION MANUFACTURERS

(FOR PERIODS ON OR AFTER JULY 1, 2021)

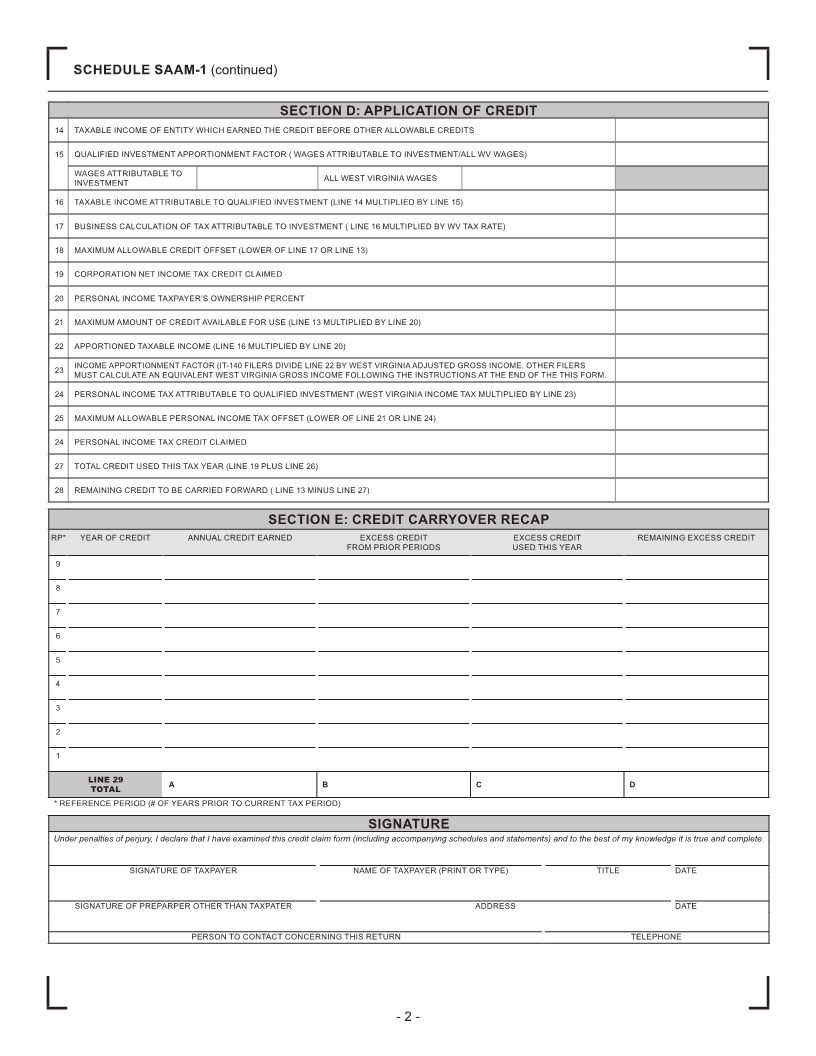

SECTION A: BUSINESS IDENTIFICATION

1 FEIN WV TAX ID

TAX PERIOD

2 BEGINNING ENDING

MM DD YYYY MM DD YYYY

BUSINESS NAME

3

TAXPAYER NAME

4

SECTION B: COMPUTATION OF QUALIFIED INVESTMENT

ITEMIZED LISTING OF INVESTMENTS REQUIRED IF NOT SUBMITTED WITH APPLICATION (SAAM-A)

INVESTMENTS THIS YEAR A B C

NET COST RATE ALLOWABLE COST

1 INVESTMENT WITH USEFUL LIFE OF $ 33 ⅓%

AT LEAST 4 YEARS BUT LESS THAN 6 YEARS

2 INVESTMENT WITH USEFUL LIFE OF $ 66 ⅔%

AT LEAST 6 YEARS BUT LESS THAN 8 YEARS

3 INVESTMENT WITH USEFUL LIFE OF 8 YEARS OR MORE $ 100%

4 TOTAL QUALIFIED INVESTMENT FOR THIS TAX YEAR (SUM OF COLUMN 3)

PRIOR YEAR QUALIFIED INVESTMENTS

5 REFERENCE PERIOD (# of TAX PERIOD ENDING A B C

years prior to current tax period) ORIGINAL QUALIFIED INVESTMENT ADJUSTMENTS * NET QUALIFIED INVESTMENT

9

8

7

6

5

4

3

2

1

TOTAL PRIOR PERIOD QUALIFIED INVESTMENTS

* ADJUSTMENT, INCLUDING THE DISPOSAL OF PROPERTY OR MACHINERY BEFORE THE ORIGINALY STATED USEFUL LIFE, MAY ALSO RESULT IN THE RECAPTURE OF

CREDIT PREVIOUSLY CLAIMED.

6 TOTAL QUALIFIED INVESTMENT FOR 10 YEAR PERIOD (LINE 4 PLUS LINE 5)

SECTION C: CALCULATION OF AVAILABLE CREDIT

7 FEDERAL EXCISE TAX PAID THIS TAX YEAR ATTTRIBUTABLE TO THE QUALIFIED INVESTMENT (TITLE 26 SECTION 4181 INTERNAL

REVENUE CODE) COPIES OF FEDERAL FIREARMS AND AMMUNITION QUARTERLY EXCISE TAX RETURNS ARE REQUIRED

8 TAX CREDIT EARNED THIS TAX YEAR (IF THE AMOUNT ON LINE 6 IS EQUAL TO OR GREAT THAN $2 MILLION, ENTER AMOUNT ON

LINE 7; IF THE AMOUNT ON LINE 6 IS LESS THAN $2 MILLION ENTER “0”)

9 CURRENT YEAR TAX CREDIT AVAILABLE FOR USE THIS TAX YEAR (10% OF LINE 8)

10 TOTAL OF ANNUAL CREDITS EARNED IN PRIOR PERIODS (SECTION E, LINE 29, COLUMN A)

11 PRIOR PERIOD UNUSED CREDIT CARRIED FORWARD TO THIS TAX YEAR (COMPLETE SECTION D)

12 TOTAL AVAILABLE CREDIT FOR THIS TAX PERIOD ( SUM OF LINES 9, 10, AND 11)

13 MAXIMUM AMOUNT OF CREDIT AVAILABLE FOR USE (OR DISTRIBUTION) THIS TAX YEAR (LOWER OF LINE 7 OR LINE 12)

- 1 -