Enlarge image

SAAM-A

West Virginia Tax Credit For Federal Excise Tax Imposed

Upon Small Arms And Ammunition Manufacturers Application Instructions

The West Virginia Tax Credit For Federal Excise Tax Imposed Upon Small Arms And Ammunition

Manufacturers (SAAM) is available to a manufacturer making a qualified investment (on or after July 1, 2021)

in a new or expanded small arms and ammunition manufacturing facility in this state of at least $2 million

dollars. Qualified businesses include only those engaged in the business activity of small arms and ammunition

manufacturing within West Virginia. A Small Arms and Ammunition Manufacturing Business is defined as a

business primarily engaged in small arms or ammunition manufacturing which is or may be classified under the

North American industry Classification System with a six-digit code for a product produced at a facility under

code numbers 332992 or 332994.

Business expansion is defined as capital investment in a new or expanded small arms or ammunition

manufacturing facility in this State. Expanded facility means a small arms and ammunition manufacturing

facility, other than a new or replacement facility, resulting from the acquisition, construction, reconstruction,

installation, or erection of improvements or additions to existing property if the improvements or additions are

purchased on or after July 1, 2021, but only to the extent of the taxpayers’ qualified investment in the

improvements or additions. New small arms and ammunition manufacturing facility means a business facility

which is employed by the taxpayer in the conduct of small arms and ammunition manufacturing activity and

was purchased by or leased to the taxpayer on or after July 1, 2021,

By Law, no credit may be allowed or applied for any qualified investment property placed in service until the

person asserting a claim for the credit makes a written application to the Tax Commissioner. Failure to timely

apply for the credit will result in forfeiture of 50% of the annual credit allowance otherwise available under this

requirement. Form SAAM-A is designed to be a general application form for taxpayers wishing to claim credit

based upon investments placed into use or service on or after July 1, 2021. The timely filing of this application

is a condition precedent to claiming tax credits. This application must be filed annually no later than the due

date of the taxpayer’s West Virginia income tax return including any legally granted extension of time for filing

such returns.

Note: For the application to be considered timely filed, all information in the application must be completed fully.

Instructions to SAAM-A

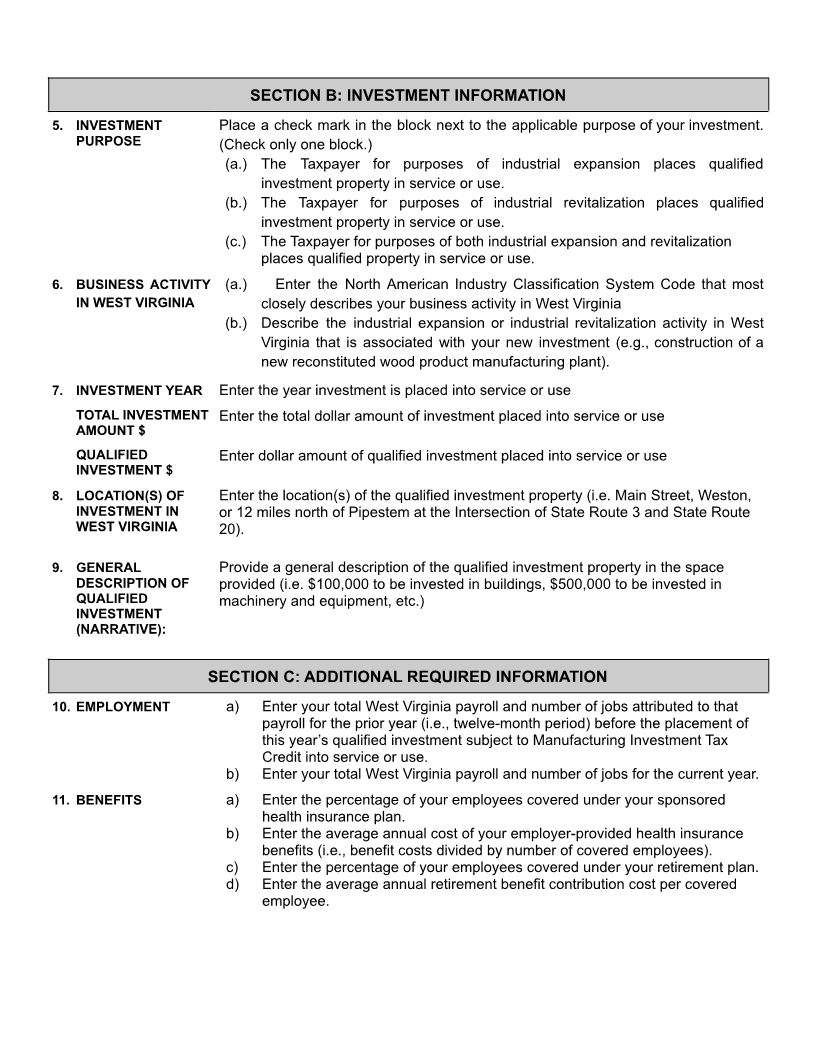

SECTION A: BUSINESS IDENTIFICATION

FEIN Enter Federal Employer Identification Number

WV TAX ID Enter eight digit West Virginia Account number for which the credit will be used

TAX PERIOD Enter beginning and ending dates for the tax period in which the investments was

made

BUSINESS NAME Enter the name of the business which made the investments.

TAXPAYER NAME Enter the full legal name of the individual who made the investment.