Enlarge image

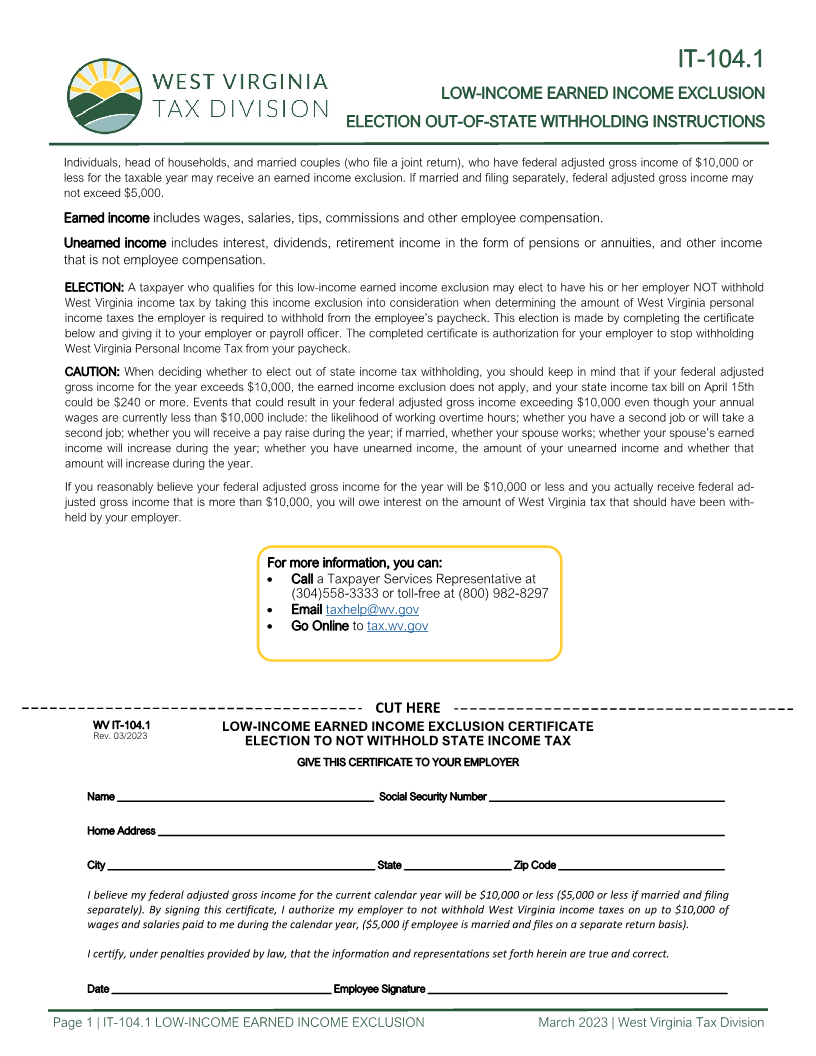

IT 104.1-

LOW INCOME EARNED INCOME EXCLUSION -

ELECTION OUT OF STATE WITHHOLDING INSTRUCTIONS - -

Individuals, head of households, and married couples (who le a joint return), who have federal adjusted gross income of $10,000 or

less for the taxable year may receive an earned income exclusion. If married and ling separately, federal adjusted gross income may

not exceed $5,000.

Earned income includes wages, salaries, tips, commissions and other employee compensation.

Unearned income includes interest, dividends, retirement income in the form of pensions or annuities, and other income

that is not employee compensation.

ELECTION: A taxpayer who quali es for this low income earned income exclusion may elect to have his or her employer NOT withhold -

West Virginia income tax by taking this income exclusion into consideration when determining the amount of West Virginia personal

income taxes the employer is required to withhold from the employee’s paycheck. This election is made by completing the certi cate

below and giving it to your employer or payroll of cer. The completed certi cate is authorization for your employer to stop withholding

West Virginia Personal Income Tax from your paycheck.

CAUTION: When deciding whether to elect out of state income tax withholding, you should keep in mind that if your federal adjusted

gross income for the year exceeds $10,000, the earned income exclusion does not apply, and your state income tax bill on April 15th

could be $240 or more. Events that could result in your federal adjusted gross income exceeding $10,000 even though your annual

wages are currently less than $10,000 include: the likelihood of working overtime hours; whether you have a second job or will take a

second job; whether you will receive a pay raise during the year; if married, whether your spouse works; whether your spouse’s earned

income will increase during the year; whether you have unearned income, the amount of your unearned income and whether that

amount will increase during the year.

If you reasonably believe your federal adjusted gross income for the year will be $10,000 or less and you actually receive federal ad-

justed gross income that is more than $10,000, you will owe interest on the amount of West Virginia tax that should have been with-

held by your employer.

For more information, you can:

· Call a Taxpayer Services Representative at

(304)558 3333 or toll free at (800) 982 8297- - -

· Email taxhelp@wv.gov

· Go Online to tax.wv.gov

CUT HERE

WV IT 104.1- LOW INCOME EARNED INCOME EXCLUSION CERTIFICATE -

Rev. 03/2023

ELECTION TO NOT WITHHOLD STATE INCOME TAX

GIVE THIS CERTIFICATE TO YOUR EMPLOYER

Name ________________________________________________ Social Security Number ____________________________________________

Home Address __________________________________________________________________________________________________________

City __________________________________________________ State ____________________ Zip Code _______________________________

I believe my federal adjusted gross income for the current calendar year will be $10,000 or less ($5,000 or less if married and filing

separately). By signing this cer ficate, I authorize my employer to not withhold West Virginia income taxes on up to $10,000 of

wages and salaries paid to me during the calendar year, ($5,000 if employee is married and files on a separate return basis).

I cer fy, under penal es provided by law, that the informa on and representa ons set forth herein are true and correct.

Date _________________________________________ Employee Signature ________________________________________________________

Page 1 | IT 104.1 LOW INCOME EARNED INCOME EXCLUSION - - March 2023 | West Virginia Tax Division