Enlarge image

1

Enlarge image | 1 |

Enlarge image |

Table of Contents

1. What’s New & General information page 3

2. My Taxes page 4

3. Record Format & Record Delimiter page 5

4. Required RS record layout page 6

5. Required RV record layout page 7

6. Splitting Large Files page 8

7. Importing W-2 Files via MyTaxes page 9

8. Contact information page 10

9. CD Rom page 11

10. WV-IT 105 Transmitter Summary page 12

2

|

Enlarge image |

WV/IT-105

10/2019

What’s New for 2019

✓ Any employer who uses a payroll service or is required to file a withholding return for 25 or more

employees must file electronically.

✓ West Virginia is operating on a January 31 due date.

✓ 2019 withholding data must be submitted via MyTaxes secure website (see pg. 4)

✓ All files MUST contain the IT-103 in the RV record (see pg. 7)

✓ Note! the money fields in the RV record differ from the standard EFW2 format

▪ Use only WHOLE DOLLAR entries (see pg. 7)

✓ The submission MUST include the RS and RV record (pgs. 6-7)

✓ For every RE, there must be a corresponding RV record

✓ Failure to include these records will result in the submission being rejected.

General Information

• West Virginia Accepts EFW2 Format ONLY! We follow the current Social Security Administration’s

EFW2 publication located:

https://www.ssa.gov/employer/efw/19efw2.pdf#zoom=100

• ONLY Submit your file ONE time. Duplicate submissions will negatively impact your account and the

accounts of those you have submitted for.

• ALL Files submitted to West Virginia MUST be in text (.txt) format, 512 bytes in length per line

• All files MUST have record delimiters.

• Corrected W-2s must be submitted on paper with an amended WV/IT-103 form

• Prior year data must be submitted on CD Rom (see pg. 11 & 12)

• File size can be no larger than 30,000 records per file. Large files will need to be split. Each file must

contain a full set of record types: RA, RE, RW, RS, RT, RV & RF (see page 8 for details)

3

|

Enlarge image |

WV/IT-105

10/2019

MyTaxes provides a more secure environment to submit data files and requires less paperwork to process. If

you are not already registered for MyTaxes, when accessing https://mytaxes.wvtax.gov you will be required to

complete the following steps:

• Taxpayer Verification –This requires your Federal Tax ID Number, individual taxpayer ID number, social

security number or WV tax ID number. (If you are unsure of your WV ID, contact Taxpayer Services at

1-800-982-8297)

• You will choose a tax account type, the account number and your zip code.

• Create Logon Information

• Add Access to Accounts (Optional)

• Once registered, you may request access to any or all your tax accounts that are available on MyTaxes.

If you are a Payroll Service Provider and have not yet registered, contact Christine.D.Stephenson@wv.gov

ALL OTHER registration questions must contact Taxpayer Services Division at 1-800-982-8297

4

|

Enlarge image |

WV/IT-105

10/2019

Record Format

• Fixed File Length of 512 bytes per SSA

• Character Set must be ASCII

• Record delimiter must be carriage return and line feed

• All non-numeric data must be uppercase

Record Delimiter

A Record delimiter must follow each record in the file except for the last record. The record delimiter must

consist of two characters, carriage return and line feed (CR/LF).

Make sure each record is exactly 512 characters by adding spaces at the end as needed. The carriage return

and the line feed character must be placed in positions 513 and 514, respectively.

* DO NOT Place a record delimiter before the first record

* DO NOT Place more than one record delimiter i.e., more than one carriage return / line- feed

combination, following a record

* DO NOT Place record delimiters after a field within a record.

Required Record Sequence

Code RA - Submitter Record REQUIRED

Code RE - Employer Record REQUIRED

Code RW - Employee Wage Record REQUIRED

Code RS - State Record REQUIRED for WV

Code RT - Total Record REQUIRED

Code RV - Total Record REQUIRED modified for WV

NOTE: Blank Fill to achieve the correct file length of 512

5

|

Enlarge image |

WV/IT-105

10/2019

Code RS - State Record (Employee Information) * REQUIRED *

Location Field Length Specification

1-2 Record Identifier 2 Required. Enter “RS”

3-4 State Code 2 Required. Enter "54”. cannot be “WV”

10-18 Social Security Number 9 cannot be 000, 111, 999, etc.

Must send paper if no SSN assigned

19-33 First Name 15

34-48 Middle Name or Initial 15

49-68 Last Name 20

248-267 Employer Account Number 20 Use 9 digit FEIN. Left Justify. No spaces or dashes.

274-275 State Code 2 Required. Enter "54". cannot be “WV”

276-286 State Taxable Wages 11 Required. Currency. Right Justify, Zero Fill

287-297 State Income Tax Withheld 11 Required. Currency. Right Justify, Zero Fill

298-512 Blank Filled

The carriage return and the line feed character must be placed in positions 513 and 514, respectively.

6

|

Enlarge image |

WV/IT-105

10/2019

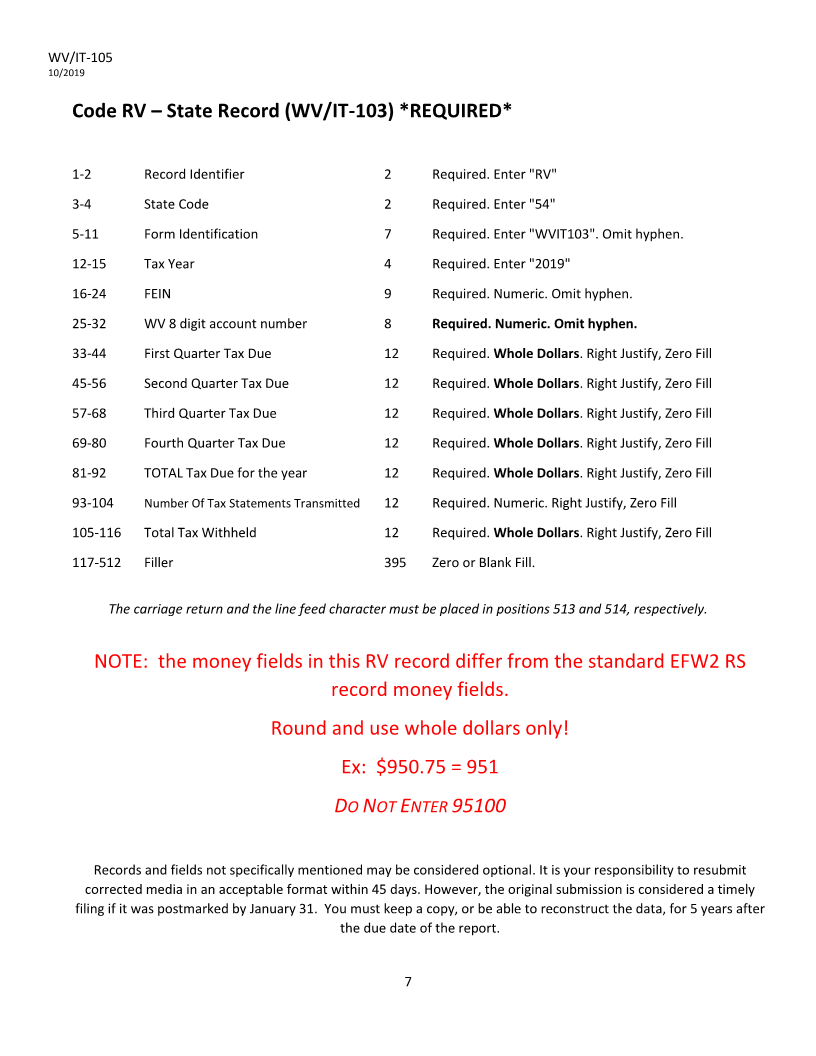

Code RV –State Record (WV/IT-103) *REQUIRED*

1-2 Record Identifier 2 Required. Enter "RV"

3-4 State Code 2 Required. Enter "54"

5-11 Form Identification 7 Required. Enter "WVIT103". Omit hyphen.

12-15 Tax Year 4 Required. Enter "2019"

16-24 FEIN 9 Required. Numeric. Omit hyphen.

25-32 WV 8 digit account number 8 Required. Numeric. Omit hyphen.

33-44 First Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

45-56 Second Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

57-68 Third Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

69-80 Fourth Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

81-92 TOTAL Tax Due for the year 12 Required. Whole Dollars. Right Justify, Zero Fill

93-104 Number Of Tax Statements Transmitted 12 Required. Numeric. Right Justify, Zero Fill

105-116 Total Tax Withheld 12 Required. Whole Dollars. Right Justify, Zero Fill

117-512 Filler 395 Zero or Blank Fill.

The carriage return and the line feed character must be placed in positions 513 and 514, respectively.

NOTE: the money fields in this RV record differ from the standard EFW2 RS

record money fields.

Round and use whole dollars only!

Ex: $950.75 = 951

DO NOT NTERE 95100

Records and fields not specifically mentioned may be considered optional. It is your responsibility to resubmit

corrected media in an acceptable format within 45 days. However, the original submission is considered a timely

filing if it was postmarked by January 31. You must keep a copy, or be able to reconstruct the data, for 5 years after

the due date of the report.

7

|

Enlarge image |

WV/IT-105

10/2019

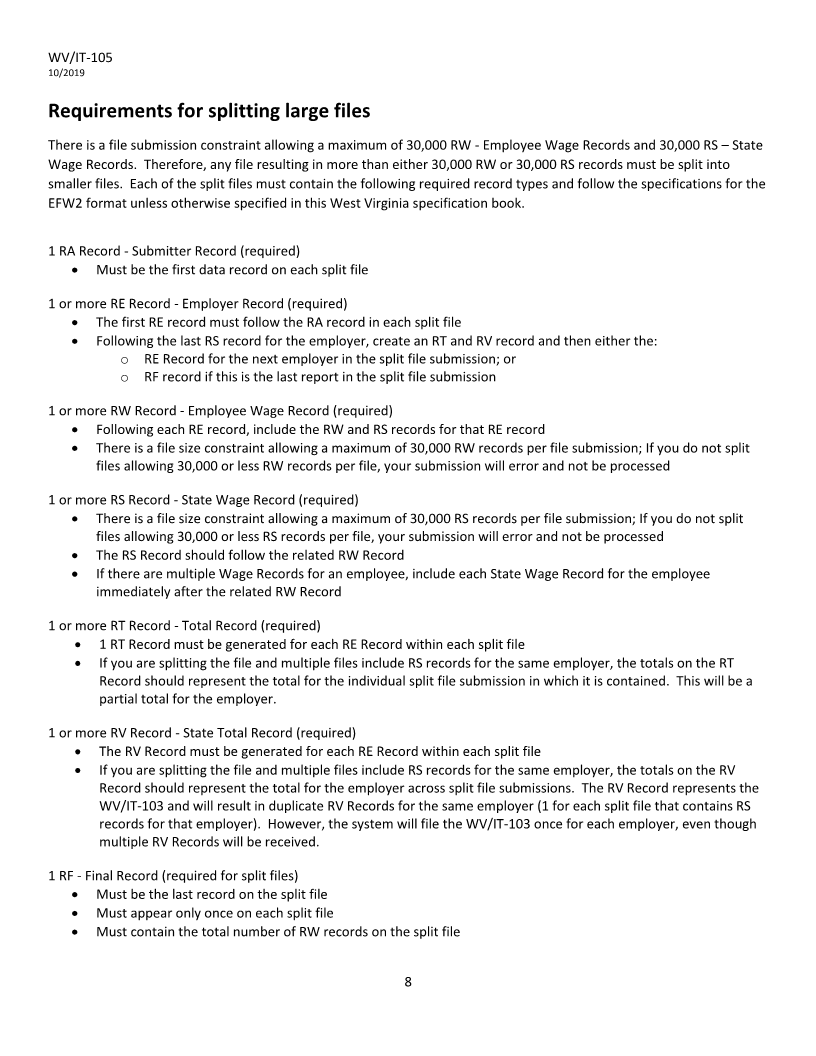

Requirements for splitting large files

There is a file submission constraint allowing a maximum of 30,000 RW - Employee Wage Records and 30,000 RS –State

Wage Records. Therefore, any file resulting in more than either 30,000 RW or 30,000 RS records must be split into

smaller files. Each of the split files must contain the following required record types and follow the specifications for the

EFW2 format unless otherwise specified in this West Virginia specification book.

1 RA Record - Submitter Record (required)

• Must be the first data record on each split file

1 or more RE Record - Employer Record (required)

• The first RE record must follow the RA record in each split file

• Following the last RS record for the employer, create an RT and RV record and then either the:

o RE Record for the next employer in the split file submission; or

o RF record if this is the last report in the split file submission

1 or more RW Record - Employee Wage Record (required)

• Following each RE record, include the RW and RS records for that RE record

• There is a file size constraint allowing a maximum of 30,000 RW records per file submission; If you do not split

files allowing 30,000 or less RW records per file, your submission will error and not be processed

1 or more RS Record - State Wage Record (required)

• There is a file size constraint allowing a maximum of 30,000 RS records per file submission; If you do not split

files allowing 30,000 or less RS records per file, your submission will error and not be processed

• The RS Record should follow the related RW Record

• If there are multiple Wage Records for an employee, include each State Wage Record for the employee

immediately after the related RW Record

1 or more RT Record - Total Record (required)

• 1 RT Record must be generated for each RE Record within each split file

• If you are splitting the file and multiple files include RS records for the same employer, the totals on the RT

Record should represent the total for the individual split file submission in which it is contained. This will be a

partial total for the employer.

1 or more RV Record - State Total Record (required)

• The RV Record must be generated for each RE Record within each split file

• If you are splitting the file and multiple files include RS records for the same employer, the totals on the RV

Record should represent the total for the employer across split file submissions. The RV Record represents the

WV/IT-103 and will result in duplicate RV Records for the same employer (1 for each split file that contains RS

records for that employer). However, the system will file the WV/IT-103 once for each employer, even though

multiple RV Records will be received.

1 RF - Final Record (required for split files)

• Must be the last record on the split file

• Must appear only once on each split file

• Must contain the total number of RW records on the split file

8

|

Enlarge image |

WV/IT-105

10/2019

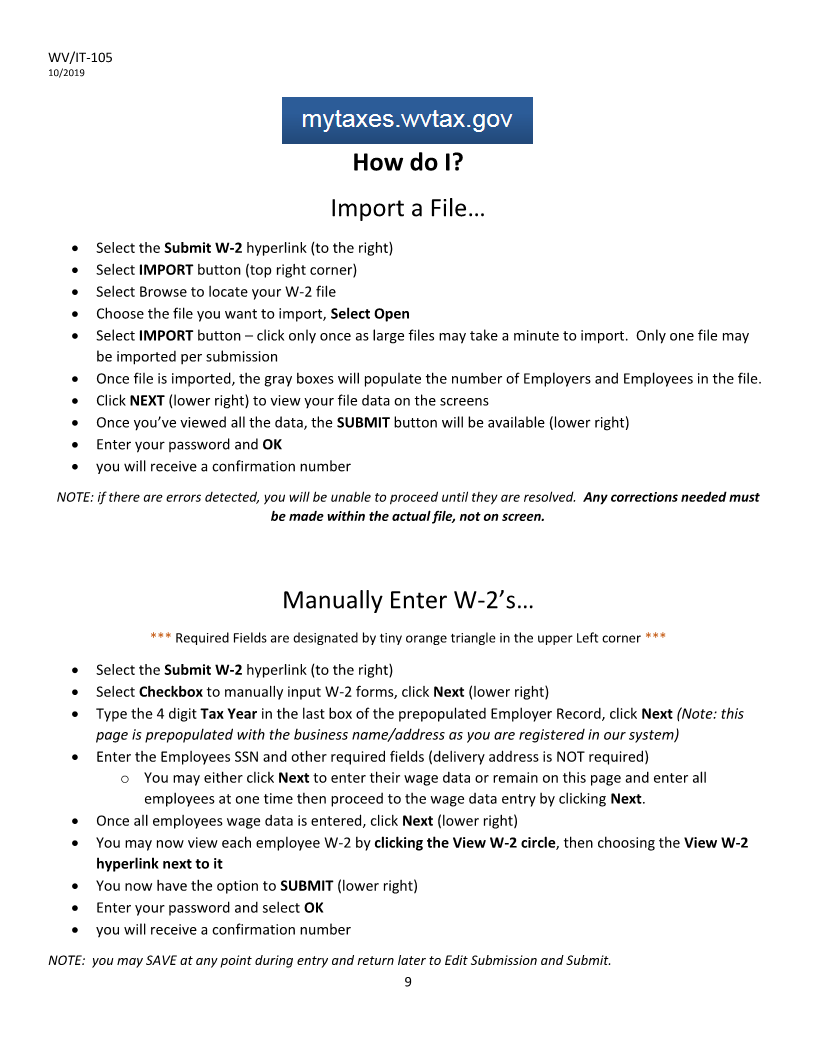

How do I?

Import a File …

• Select the Submit W-2 hyperlink (to the right)

• Select IMPORT button (top right corner)

• Select Browse to locate your W-2 file

• Choose the file you want to import, Select Open

• SelectIMPORT button –click only once as large files may take a minute to import. Only one file may

be imported per submission

• Once file is imported, the gray boxes will populate the number of Employers and Employees in the file.

• Click NEXT (lower right) to view your file data on the screens

• Once you’ve viewed all the data, the SUBMIT button will be available (lower right)

• Enter your password and OK

• you will receive a confirmation number

NOTE: if there are errors detected, you will be unable to proceed until they are resolved. Any corrections needed must

be made within the actual file, not on screen.

Manually Enter W-2’s…

*** Required Fields are designated by tiny orange triangle in the upper Left corner ***

• Select the Submit W-2 hyperlink (to the right)

• Select Checkbox to manually input W-2 forms, click Next (lower right)

• Type the 4 digit Tax Year in the last box of the prepopulated Employer Record, click Next (Note: this

page is prepopulated with the business name/address as you are registered in our system)

• Enter the Employees SSN and other required fields (delivery address is NOT required)

o You may either click Next to enter their wage data or remain on this page and enter all

employees at one time then proceed to the wage data entry by clicking Next.

• Once all employees wage data is entered, click Next (lower right)

• You may now view each employee W-2 by clicking the View W-2 circle, then choosing the View W-2

hyperlink next to it

• You now have the option to SUBMIT (lower right)

• Enter your password and select OK

• you will receive a confirmation number

NOTE: you may SAVE at any point during entry and return later to Edit Submission and Submit.

9

|

Enlarge image |

WV/IT-105

10/2019

Contact Information

Mailing Address:

West Virginia State Tax Department

TAAD/ Withholding

PO Box 3943

Charleston, WV 25339-3943

Courier or Overnight Deliveries (ONLY):

West Virginia State Tax Department

Revenue Center / Withholding

1001 Lee Street East

Charleston, WV 25301-1725

Email

Christine.D.Stephenson@wv.gov

10

|

Enlarge image |

WV/IT-105

10/2019

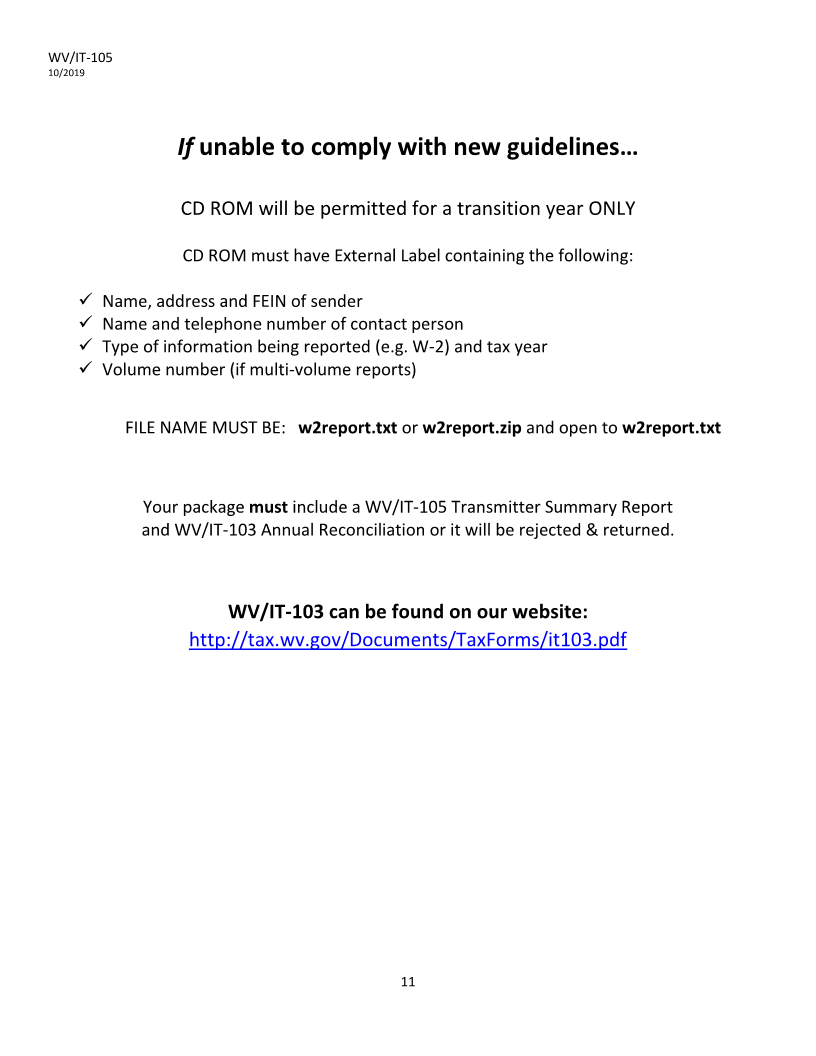

If unable to comply with new guidelines…

CD ROM will be permitted for a transition year ONLY

CD ROM must have External Label containing the following:

✓

Name, address and FEIN of sender

✓

Name and telephone number of contact person

✓

Type of information being reported (e.g. W-2) and tax year

✓

Volume number (if multi-volume reports)

FILE NAME MUST BE: w2report.txt or w2report.zip and open to w2report.txt

Your package must include a WV/IT-105 Transmitter Summary Report

and WV/IT-103 Annual Reconciliation or it will be rejected & returned.

WV/IT-103 can be found on our website:

http://tax.wv.gov/Documents/TaxForms/it103.pdf

11

|

Enlarge image |

WV/IT-105

10/2019

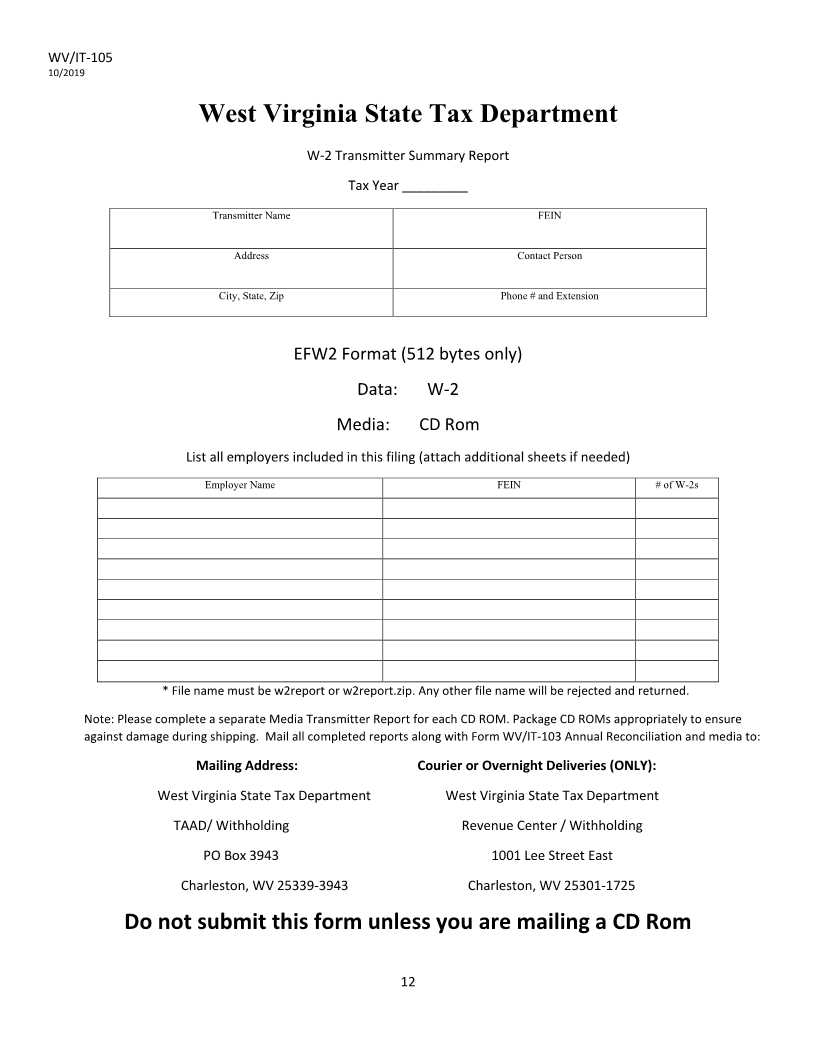

West Virginia State Tax Department

W-2 Transmitter Summary Report

Tax Year _________

Transmitter Name FEIN

Address Contact Person

City, State, Zip Phone # and Extension

EFW2 Format (512 bytes only)

Data: W-2

Media: CD Rom

List all employers included in this filing (attach additional sheets if needed)

Employer Name FEIN # of W-2s

* File name must be w2report or w2report.zip. Any other file name will be rejected and returned.

Note: Please complete a separate Media Transmitter Report for each CD ROM. Package CD ROMs appropriately to ensure

against damage during shipping. Mail all completed reports along with Form WV/IT-103 Annual Reconciliation and media to:

Mailing Address: Courier or Overnight Deliveries (ONLY):

West Virginia State Tax Department West Virginia State Tax Department

TAAD/ Withholding Revenue Center / Withholding

PO Box 3943 1001 Lee Street East

Charleston, WV 25339-3943 Charleston, WV 25301-1725

Do not submit this form unless you are mailing a CD Rom

12

|