Enlarge image

1

Enlarge image | 1 |

Enlarge image |

Table of Contents

1. What’s New & General information page 3

2. My Taxes page 4

3. Record Format & Record Delimiter page 5

4. Required RS record layout page 6

5. Required RV record layout page 7

6. Importing W-2 Files via MyTaxes page 8 - 9

7. Contact information page 10

8. CD Rom page 11

9. WV-IT 105 Transmitter Summary page 12

2

|

Enlarge image |

WV/IT-105

12/2018

What’s New for 2018

West Virginia is now operating on a January 31 due date.

Any employer who uses a payroll service or is required to file a withholding return for 25

or more employees must file electronically.

2018 withholding data must be submitted via MyTaxes secure website (see pg. 4)

All files MUST contain the IT-103 in the RV record (see pg. 7)

Note! the money fields in the RV record differ from the standard EFW2 format

Use only WHOLE DOLLAR entries (see pg. 7)

The submission MUST include the RS and RV record (pgs. 6-7)

For every RE, there must be a corresponding RV record

Failure to include these records will result in the submission being rejected.

General Information

West Virginia Accepts EFW2 Format ONLY! We follow the current Social Security

Administration’s EFW2 publication located:

https://www.ssa.gov/employer/efw/18efw2.pdf#zoom=100

ONLY Submit your file ONE time. Duplicate submissions will negatively impact your account

and the accounts of those you have submitted for.

ALL Files submitted to West Virginia MUST be in text (.txt) format, 512 bytes in length per line

All files MUST have record delimiters.

Corrected W-2s must be submitted on paper with an amended WV/IT-103 form

Prior year data must be submitted on CD Rom (see pg. 11 & 12)

3

|

Enlarge image |

WV/IT-105

12/2018

MyTaxes provides a more secure environment to submit data files and requires less paperwork to

process. If you are not already registered for MyTaxes, when accessing https://mytaxes.wvtax.gov

you will be required to complete the following steps:

Taxpayer Verification – This requires your Federal Tax ID Number, individual taxpayer ID

number, social security number or WV tax ID number. (If you are unsure of your WV ID,

contact Taxpayer Services at 1-800-982-8297)

You will choose a tax account type, the account number and your zip code.

Create Logon Information

Add Access to Accounts (Optional)

Once registered, you may request access to any or all your tax accounts that are available on

MyTaxes.

If you are a Payroll Service Provider and have not yet registered, contact

Christine.D.Stephenson@wv.gov

ALL OTHER registration questions must contact Taxpayer Services Division at 1-800-982-8297

4

|

Enlarge image |

WV/IT-105

12/2018

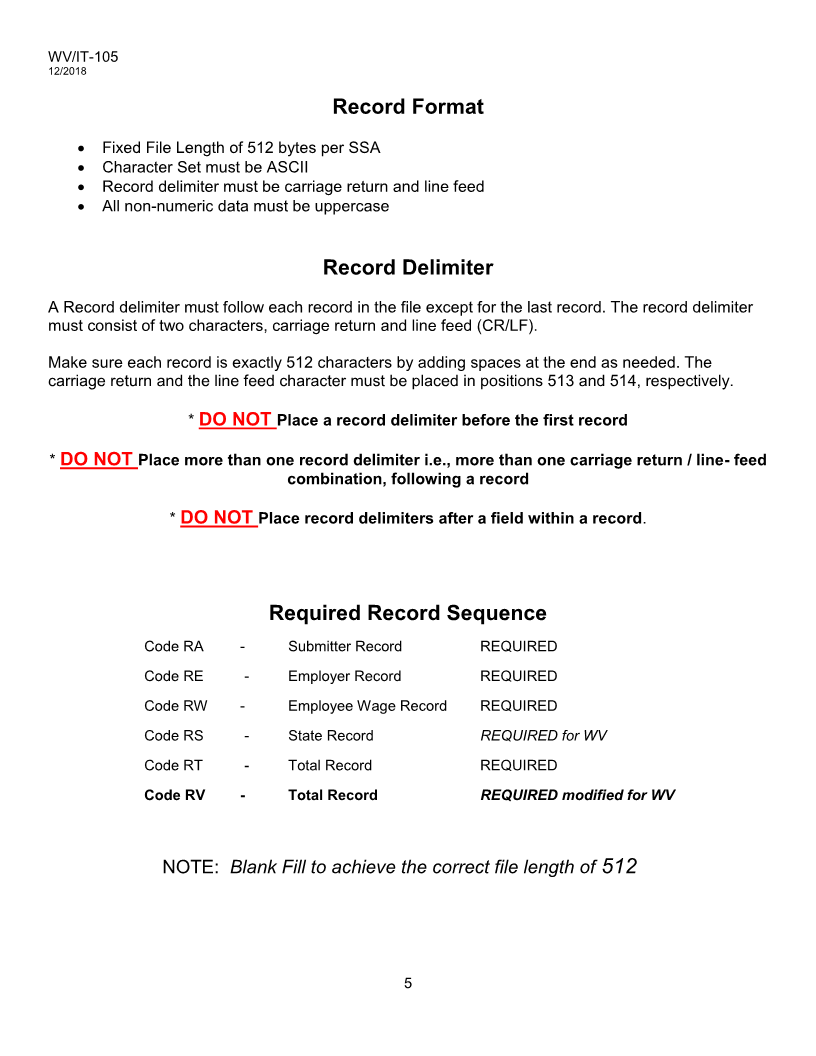

Record Format

Fixed File Length of 512 bytes per SSA

Character Set must be ASCII

Record delimiter must be carriage return and line feed

All non-numeric data must be uppercase

Record Delimiter

A Record delimiter must follow each record in the file except for the last record. The record delimiter

must consist of two characters, carriage return and line feed (CR/LF).

Make sure each record is exactly 512 characters by adding spaces at the end as needed. The

carriage return and the line feed character must be placed in positions 513 and 514, respectively.

* DO NOT Place a record delimiter before the first record

* DO NOT Place more than one record delimiter i.e., more than one carriage return / line- feed

combination, following a record

* DO NOT Place record delimiters after a field within a record.

Required Record Sequence

Code RA - Submitter Record REQUIRED

Code RE - Employer Record REQUIRED

Code RW - Employee Wage Record REQUIRED

Code RS - State Record REQUIRED for WV

Code RT - Total Record REQUIRED

Code RV - Total Record REQUIRED modified for WV

NOTE: Blank Fill to achieve the correct file length of 512

5

|

Enlarge image |

WV/IT-105

12/2018

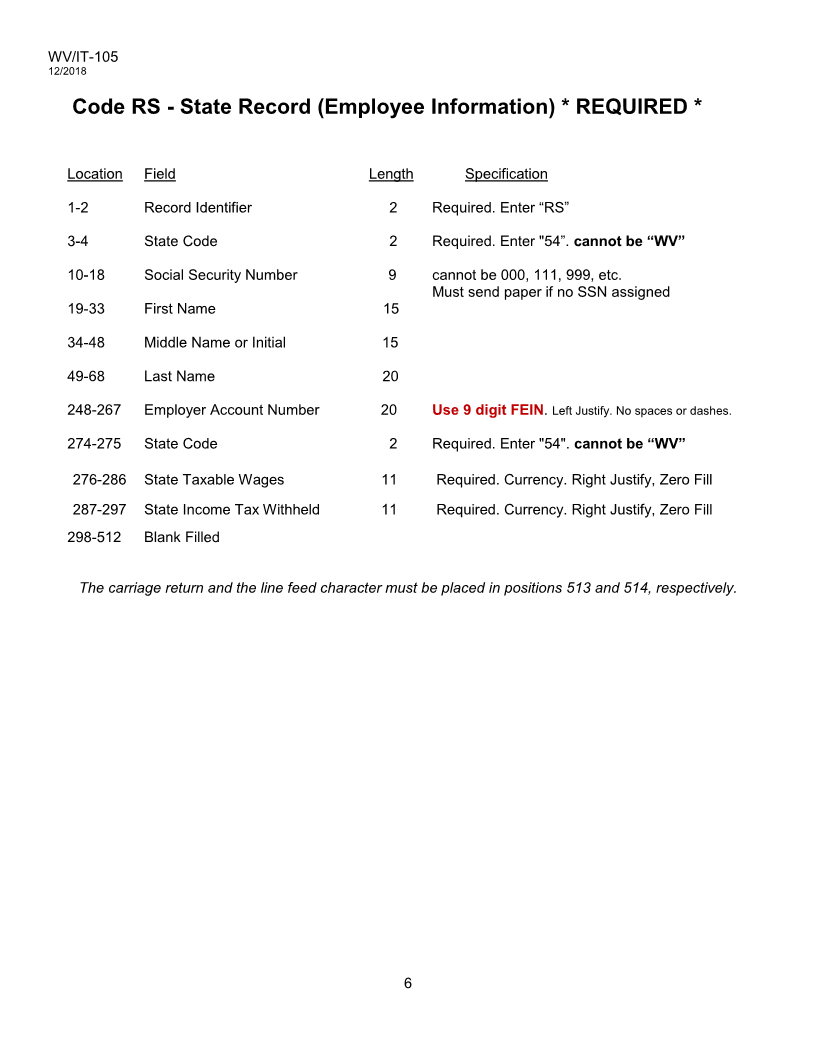

Code RS - State Record (Employee Information) * REQUIRED *

Location Field Length Specification

1-2 Record Identifier 2 Required. Enter “RS”

3-4 State Code 2 Required. Enter "54”. cannot be “WV”

10-18 Social Security Number 9 cannot be 000, 111, 999, etc.

Must send paper if no SSN assigned

19-33 First Name 15

34-48 Middle Name or Initial 15

49-68 Last Name 20

248-267 Employer Account Number 20 Use 9 digit FEIN. Left Justify. No spaces or dashes.

274-275 State Code 2 Required. Enter "54". cannot be “WV”

276-286 State Taxable Wages 11 Required. Currency. Right Justify, Zero Fill

287-297 State Income Tax Withheld 11 Required. Currency. Right Justify, Zero Fill

298-512 Blank Filled

The carriage return and the line feed character must be placed in positions 513 and 514, respectively.

6

|

Enlarge image |

WV/IT-105

12/2018

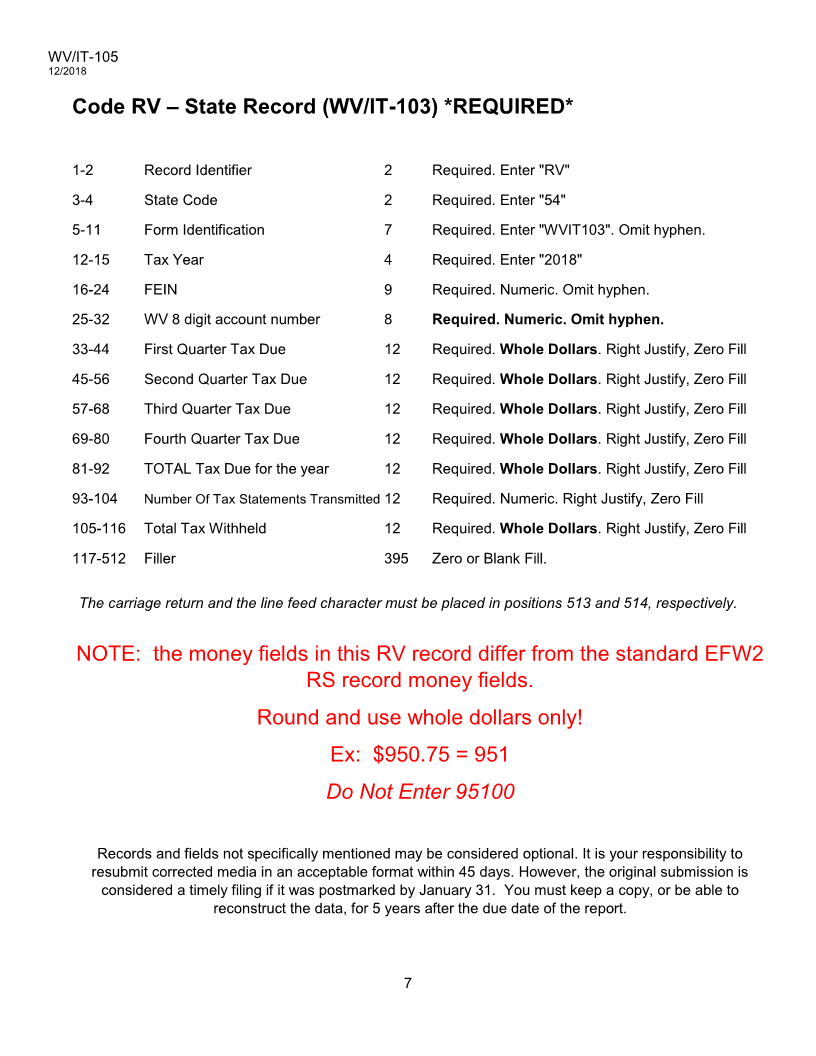

Code RV – State Record (WV/IT-103) *REQUIRED*

1-2 Record Identifier 2 Required. Enter "RV"

3-4 State Code 2 Required. Enter "54"

5-11 Form Identification 7 Required. Enter "WVIT103". Omit hyphen.

12-15 Tax Year 4 Required. Enter "2018"

16-24 FEIN 9 Required. Numeric. Omit hyphen.

25-32 WV 8 digit account number 8 Required. Numeric. Omit hyphen.

33-44 First Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

45-56 Second Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

57-68 Third Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

69-80 Fourth Quarter Tax Due 12 Required. Whole Dollars. Right Justify, Zero Fill

81-92 TOTAL Tax Due for the year 12 Required. Whole Dollars. Right Justify, Zero Fill

93-104 Number Of Tax Statements Transmitted 12 Required. Numeric. Right Justify, Zero Fill

105-116 Total Tax Withheld 12 Required. Whole Dollars. Right Justify, Zero Fill

117-512 Filler 395 Zero or Blank Fill.

The carriage return and the line feed character must be placed in positions 513 and 514, respectively.

NOTE: the money fields in this RV record differ from the standard EFW2

RS record money fields.

Round and use whole dollars only!

Ex: $950.75 = 951

Do Not Enter 95100

Records and fields not specifically mentioned may be considered optional. It is your responsibility to

resubmit corrected media in an acceptable format within 45 days. However, the original submission is

considered a timely filing if it was postmarked by January 31. You must keep a copy, or be able to

reconstruct the data, for 5 years after the due date of the report.

7

|

Enlarge image |

WV/IT-105

12/2018

HOW TO Import a File…

Under “I want to” (Top Right Side)

Click Submit W-2

Click Import

Browse for your file and click Open

Click Import

Click Next (Bottom Right)

Review information for each record

Click Next until you are given the submit bottom

Click Submit

Re Enter your password

Print the confirmation page for your records

HOW TO Manually Enter W-2’s…

*** Required Fields are designated by tiny orange triangle in the upper Left corner ***

Check box for Manual

Click Submit then click Next (same place)

Your Employer information should pre-populate

You can only proceed with one RE record line, if there are multiple RE records/lines

you must delete the extra rows by clicking the red at thexbeginning of the row.

Enter Tax Year “2018” at the end of the row

Click Next

Enter SSN of first employee followed by any information “Required” noted by a tiny orange triangle in the upper

Left corner

You must have an RW and a RS record for each employee

You can use the chevrons across the top to navigate back or use the back button

8

|

Enlarge image |

WV/IT-105

12/2018

Please review all information and click the button then blue link to “View W-2s” before submitting

There is not an individual printing option available at this time, but choosing to print screen while the

employee is in the window will give you a copy if you need.

Click Submit and re Enter your password

Print conformation page for your records

9

|

Enlarge image |

WV/IT-105

12/2018

Contact Information

Mailing Address:

West Virginia State Tax Department

TAAD/ Withholding

PO Box 3943

Charleston, WV 25339-3943

Courier or Overnight Deliveries (ONLY):

West Virginia State Tax Department

Revenue Center / Withholding

1001 Lee Street East

Charleston, WV 25301-1725

Email

Christine.D.Stephenson@wv.gov

10

|

Enlarge image |

WV/IT-105

12/2018

If unable to comply with new guidelines…

CD ROM will be permitted for a transition year ONLY

CD ROM must have External Label containing the following:

Name, address and FEIN of sender

Name and telephone number of contact person

Type of information being reported (e.g. W-2) and tax year

Volume number (if multi-volume reports)

FILE NAME MUST BE: w2report.txt or w2report.zip and open to w2report.txt

Your package must include a WV/IT-105 Transmitter Summary Report

and WV/IT-103 Annual Reconciliation or it will be rejected & returned.

WV/IT-103 can be found on our website:

http://tax.wv.gov/Documents/TaxForms/it103.pdf

WV/IT-105 is on the following page of this document

11

|

Enlarge image |

WV/IT-105

12/2018

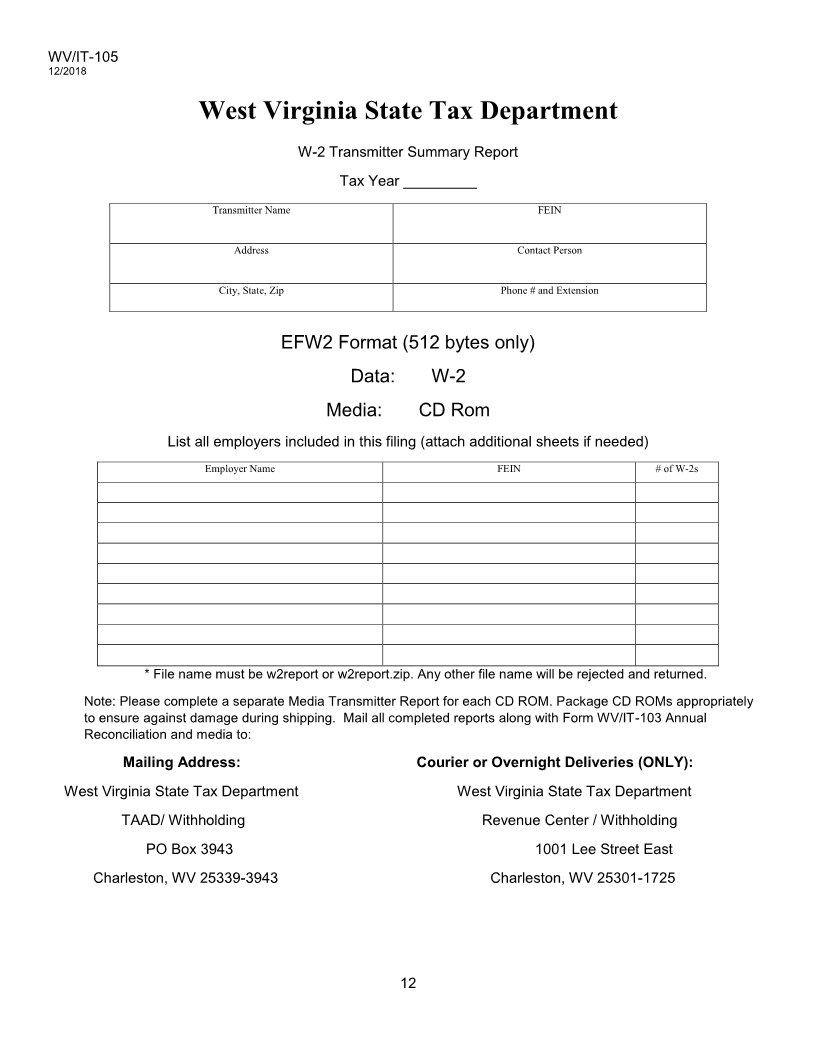

West Virginia State Tax Department

W-2 Transmitter Summary Report

Tax Year _________

Transmitter Name FEIN

Address Contact Person

City, State, Zip Phone # and Extension

EFW2 Format (512 bytes only)

Data: W-2

Media: CD Rom

List all employers included in this filing (attach additional sheets if needed)

Employer Name FEIN # of W-2s

* File name must be w2report or w2report.zip. Any other file name will be rejected and returned.

Note: Please complete a separate Media Transmitter Report for each CD ROM. Package CD ROMs appropriately

to ensure against damage during shipping. Mail all completed reports along with Form WV/IT-103 Annual

Reconciliation and media to:

Mailing Address: Courier or Overnight Deliveries (ONLY):

West Virginia State Tax Department West Virginia State Tax Department

TAAD/ Withholding Revenue Center / Withholding

PO Box 3943 1001 Lee Street East

Charleston, WV 25339-3943 Charleston, WV 25301-1725

12

|