- 5 -

Enlarge image

|

WV/IT-105.1

09/2021

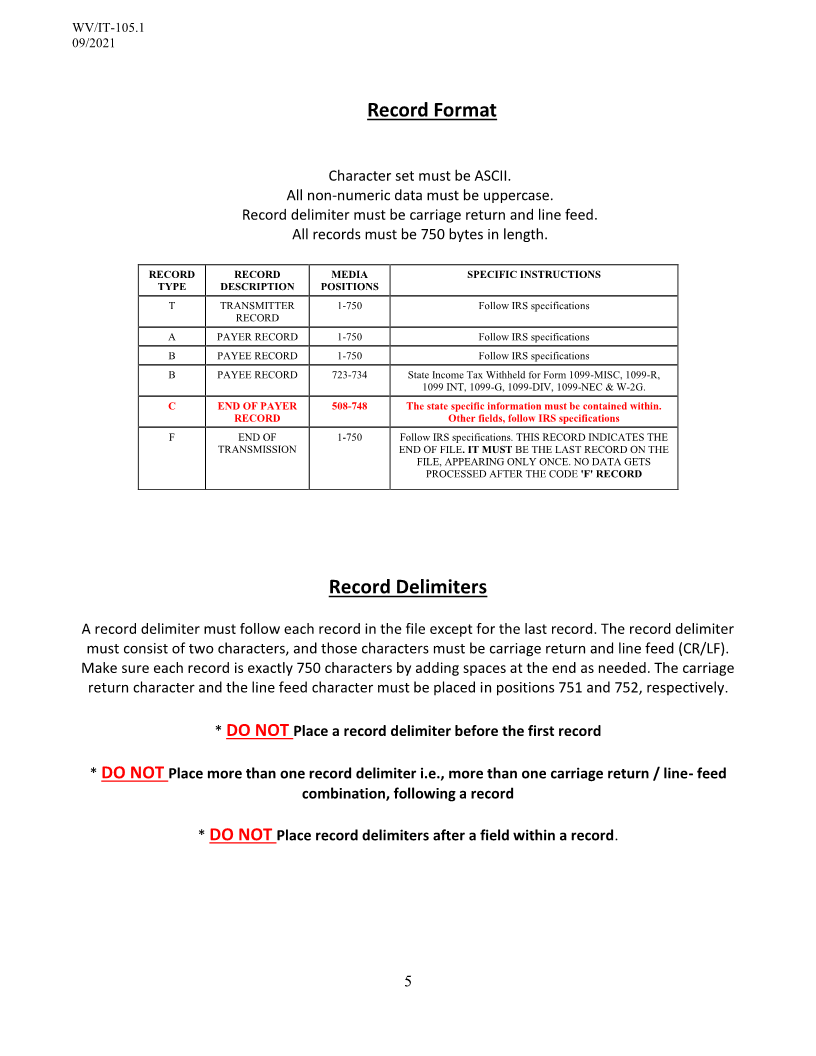

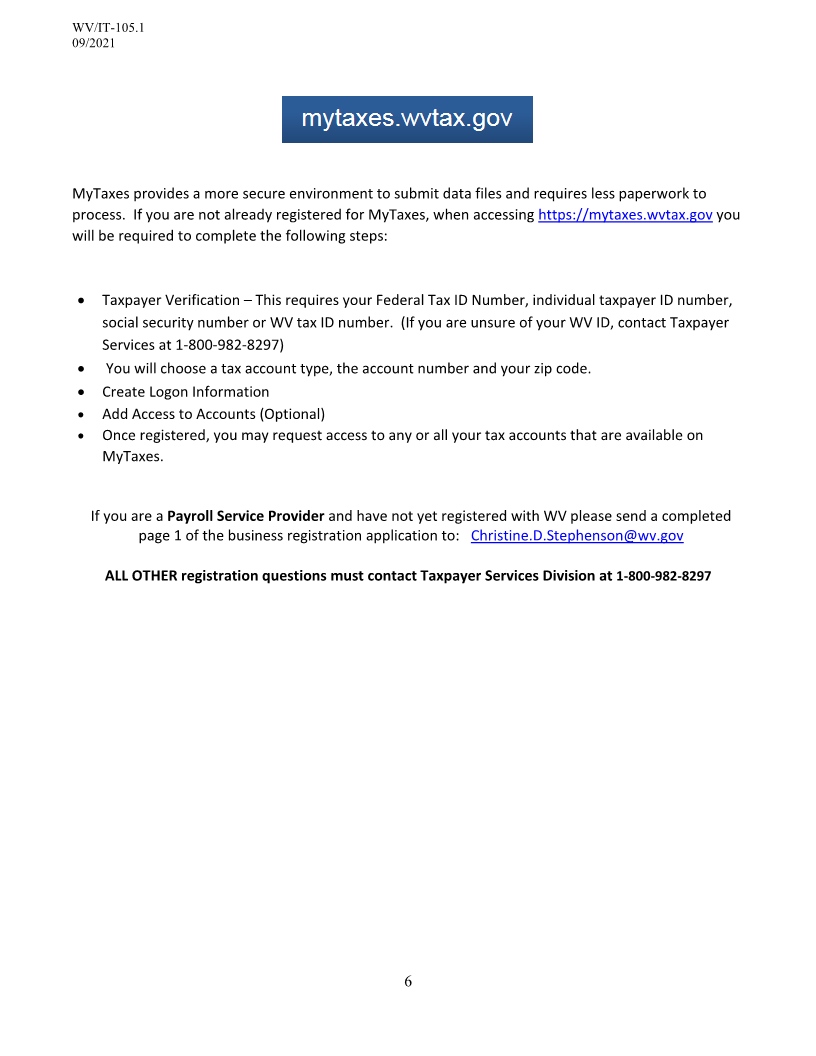

Record Format

Character set must be ASCII.

All non-numeric data must be uppercase.

Record delimiter must be carriage return and line feed.

All records must be 750 bytes in length.

RECORD RECORD MEDIA SPECIFIC INSTRUCTIONS

TYPE DESCRIPTION POSITIONS

T TRANSMITTER 1-750 Follow IRS specifications

RECORD

A PAYER RECORD 1-750 Follow IRS specifications

B PAYEE RECORD 1-750 Follow IRS specifications

B PAYEE RECORD 723-734 State Income Tax Withheld for Form 1099-MISC, 1099-R,

1099 INT, 1099-G, 1099-DIV, 1099-NEC & W-2G.

C END OF PAYER 508-748 The state specific information must be contained within.

RECORD Other fields, follow IRS specifications

F END OF 1-750 Follow IRS specifications. THIS RECORD INDICATES THE

TRANSMISSION END OF FILE. IT MUST BE THE LAST RECORD ON THE

FILE, APPEARING ONLY ONCE. NO DATA GETS

PROCESSED AFTER THE CODE 'F' RECORD

Record Delimiters

A record delimiter must follow each record in the file except for the last record. The record delimiter

must consist of two characters, and those characters must be carriage return and line feed (CR/LF).

Make sure each record is exactly 750 characters by adding spaces at the end as needed. The carriage

return character and the line feed character must be placed in positions 751 and 752, respectively.

* DO NOT Place a record delimiter before the first record

* DO NOT Place more than one record delimiter i.e., more than one carriage return / line- feed

combination, following a record

* DO NOT Place record delimiters after a field within a record.

5

|