Enlarge image

WV/IT-105.1

12/2018

1

Enlarge image |

WV/IT-105.1

12/2018

1

|

Enlarge image |

WV/IT-105.1

12/2018

Table of Contents

1. What’s New page 3

2. Media Types page 3

3. Record Format page 3

4. Record Delimiter page 4

5. MyTaxes page 4

6. Importing 1099 & W-2G Files page 5

7. Manually Adding 1099 & W-2G Information page 5

8. CD ROMs page 6

9. General Information page 6

10. Contact Information page 7

11. Sample of WV IT 103 Annual Reconciliation page 7

12. WV/IT-105 Transmitter Summary page 8

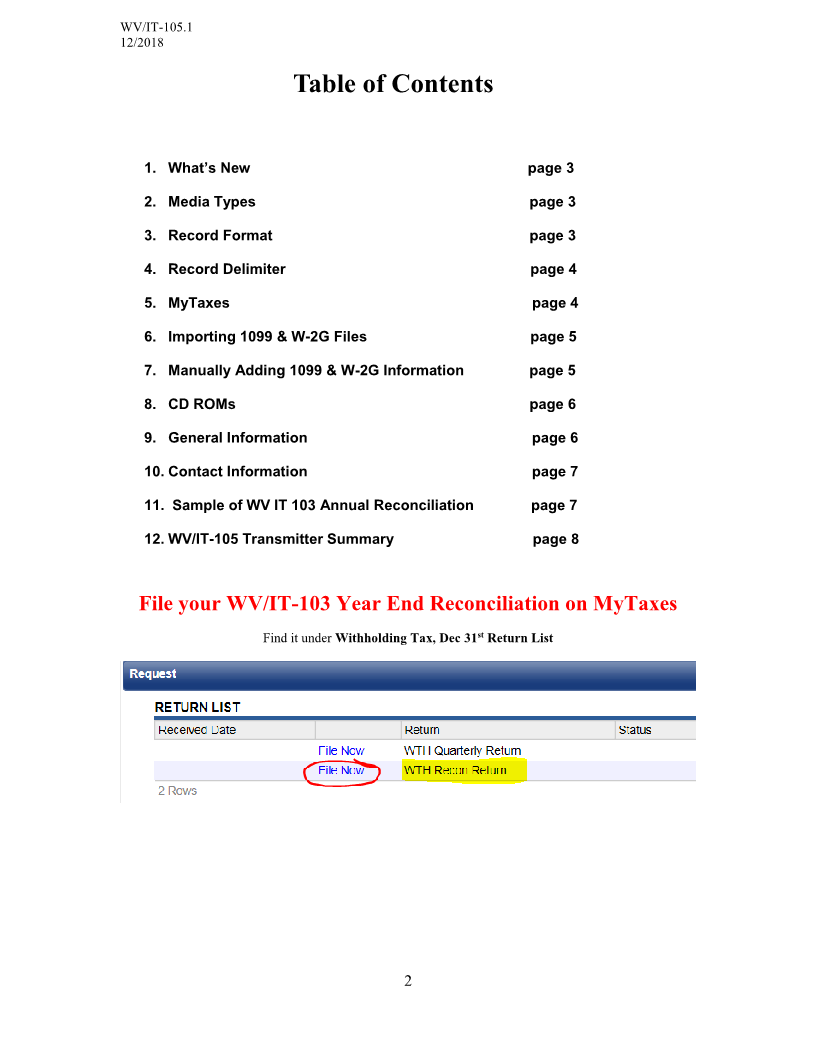

File your WV/IT-103 Year End Reconciliation on MyTaxes

Find it under Withholding Tax, Dec 31 Return List st

2

|

Enlarge image |

WV/IT-105.1

12/2018

What’s New for 2018

West Virginia is now operating on a January 31 due date.

Any employer who uses a payroll service or is required to file a withholding

return for 25 or more employees must file electronically.

2018 withholding data must be submitted via MyTaxes secure website

Tabs have been added to MyTaxes for easier navigation and error

correction.

FILING 1099’S & W-2 G’S IS REQUIRED ONLY WHEN THERE IS WV TAX WITHHELD

Please review the most current version of the 2018 IRS Publication 1220 at

https://www.irs.gov/pub/irs-pdf/p1220.pdf

Media Types

2018 1099 & W-2G – file on MyTaxes

Prior year – CD Rom

Record Format

Character set must be ASCII.

All non-numeric data must be uppercase.

Record delimiter must be carriage return and line feed.

All records must be 750 bytes in length.

RECORD RECORD MEDIA SPECIFIC INSTRUCTIONS

TYPE DESCRIPTION POSITIONS

T TRANSMITTER 1-750 Follow IRS specifications

RECORD

A PAYER RECORD 1-750 Follow IRS specifications

B PAYEE RECORD 1-750 Follow IRS specifications

B PAYEE RECORD 723-734 State Income Tax Withheld for Form 1099-MISC, 1099-R, &

W-2G.

C END OF PAYER 1-750 Follow IRS specifications

RECORD

F END OF 1-750 Follow IRS specifications. THIS RECORD INDICATES THE

TRANSMISSION END OF FILE. IT MUST BE THE LAST RECORD ON THE

FILE, APPEARING ONLY ONCE. NO DATA GETS

PROCESSED AFTER THE CODE 'F' RECORD

3

|

Enlarge image |

WV/IT-105.1

12/2018

Record Delimiters

A record delimiter must follow each record in the file except for the last record.

The record delimiter must consist of two characters, and those characters must

be carriage return and line feed (CR/LF). Make sure each record is exactly 750

characters by adding spaces at the end as needed. The carriage return character

and the line feed character must be placed in positions 751 and 752,

respectively.

DO NOT

Place a record delimiter before the first record

Place more than one record delimiter i.e., more than one carriage /

line-feed combination, following a record

Place record delimiters after a field within the record

MyTaxes

MyTaxes provides a more secure environment to submit data files and requires

less paperwork to process.

If you are not already registered for MyTaxes, when accessing

https://mytaxes.wvtax.gov you will be required to complete the following steps:

Taxpayer Verification – This requires your Federal Tax ID Number,

individual taxpayer ID number, social security number or WV tax ID

number. In addition you will choose a tax account type, the account

number and your zip code.

Create Logon Information

Add Access to Accounts (Optional)

Once registered, you may request access to any or all of your tax

accounts that are available on MyTaxes.

If you have any issues or questions, please contact:

Christine.D.Stephenson@wv.gov

4

|

Enlarge image |

WV/IT-105.1

12/2018

Importing 1099 & W-2G Files

Log into MyTaxes

I Want To… (Upper right corner)

Click Submit 1099

Click Import (Upper right corner)

Click Browse to locate your file to submit. (Must have (.txt) extension)

Click Open

Click Import

Click Submit (upper right corner)

Print the conformation page for your records

(If you did not receive a Confirmation page, your file has NOT been submitted)

Manually Adding 1099 & W-2G Information

(Not recommended for more than 10 forms)

1. Log into MyTaxes and locate I Want to… (upper right corner)

2. Choose Submit 1099

3. Check box for Manual Input of Forms

4. Select Add Transmitter Record

Complete Required Information

Click “OK”

5. Select Add Payer Records

Complete Required Information

Click “OK”

6. Select Add 1099 Records by Type

Locate Blue Hyperlink with RED !( ) To Complete Form

Click “OK”

7. Repeat Steps 5 & 6 for All 1099s of Each Type (To add a new record of the SAME

type, click the add-record tab at the top of the screen).

5

|

Enlarge image |

WV/IT-105.1

12/2018

Note: If Transmitting More Than One Type of 1099 Repeat Steps 5 & 6

8. If you have entered 1099 records with state tax withholdings select “Add State

Controls”, enter the Payer EIN, return type and state for each payer with 1099 records

indicating state tax withholdings.

9. Click “OK”

10. Click “SUBMIT”

11. Re-enter password and click “OK”

12. Print page for your records

(If you did not receive a Confirmation page, your file has NOT been submitted)

CD ROMs

MUST include a WV/IT-105.1 Transmitter Summary Report (Page 8) and

WV/IT-103 Annual Reconciliation (Page 7)

CD ROMs must have External Label containing the following:

Name, address and FEIN of sender

Name and telephone number of contact person

Type of information being reported (e.g. 1099) and tax year

Volume number (if multi-volume reports)

File name must be 1099report.txt or 1099report.zip

and open to file name 1099report.txt.

General Information

1099S AND W-2GS ARE REQUIRED ONLY WHEN THEY REFLECT WEST IRGINIAV

WITHHOLDING.

Information returns of any one type for 25 or more payees must be submitted on

electronic media following the specifications set forth by the IRS in Publication

1220.

All files submitted to the state of West Virginia MUST be in text (.txt) format.

All files MUST contain record delimiters.

ALL FORMS -Transmitter “T” Record, Payer “A” Record, and Payee B” Record;

Payment Year, Field Positions 2-5, must be updated with the four-digit reporting

year (2018), unless reporting prior year data.

6

|

Enlarge image |

WV/IT-105.1

12/2018

Electronic media must be postmarked by January 31. If you are unable to make

this deadline, you may submit a written request for extension of time for filing

WV/IT-103. Your request must be postmarked by January 31.

It is imperative that the files submitted have a contact phone number and email

address entered in the appropriate positions. Failure to include correct and

complete contact information may result in the rejection of your submission by

the State of West Virginia.

Enclose a completed Form WV/IT-105.1 Transmitter Summary and a

completed Form WV/IT-103 Annual Reconciliation, for each payer’s record

that is included on the media.

The State of West Virginia does not participate in the Combined Federal/State

Filing Program.

You will find the WV/IT-103 located here:

https://tax.wv.gov/Documents/TaxForms/it103.pdf

Contact Information

Mailing Address:

West Virginia State Tax Department

TAAD/ Withholding

PO Box 3943

Charleston, WV 25339-3943

Courier or Overnight Deliveries (ONLY):

West Virginia State Tax Department

Revenue Center / Withholding

1001 Lee Street East

Charleston, WV 25301-1725

If you have any issues or questions, please contact:

Christine.D.Stephenson@wv.gov

7

|

Enlarge image |

WV/IT-105.1

12/2018

West Virginia State Tax Department

Transmitter Summary Report

Tax Year _________

Transmitter Name__________________________ FEIN_____________________________

Address__________________________________ Contact___________________________

City, State & Zip___________________________ Phone____________________________

Media: CD Rom

List all payers included in this filing (attach additional sheets if needed)

Name FEIN # of forms

* File name must be 1099report.txt or 1099report.zip and open to 1099report.txt. Any other file

name will be rejected and returned.

Note: For each CD ROM submitted, please complete a separate Media Transmitter Report.

To ensure against damage during shipping package CD ROMs appropriately.

Mail all completed reports along with Form WV/IT-103 Annual Reconciliation and media to:

Mailing Address: Courier or Overnight Deliveries (ONLY):

West Virginia State Tax Department West Virginia State Tax Department

TAAD/ Withholding Revenue Center / Withholding

PO Box 3943 1001 Lee Street East

Charleston, WV 25339-3943 Charleston, WV 25301-1725

Email: Christine.D.Stephenson@wv.gov

8

|