Enlarge image

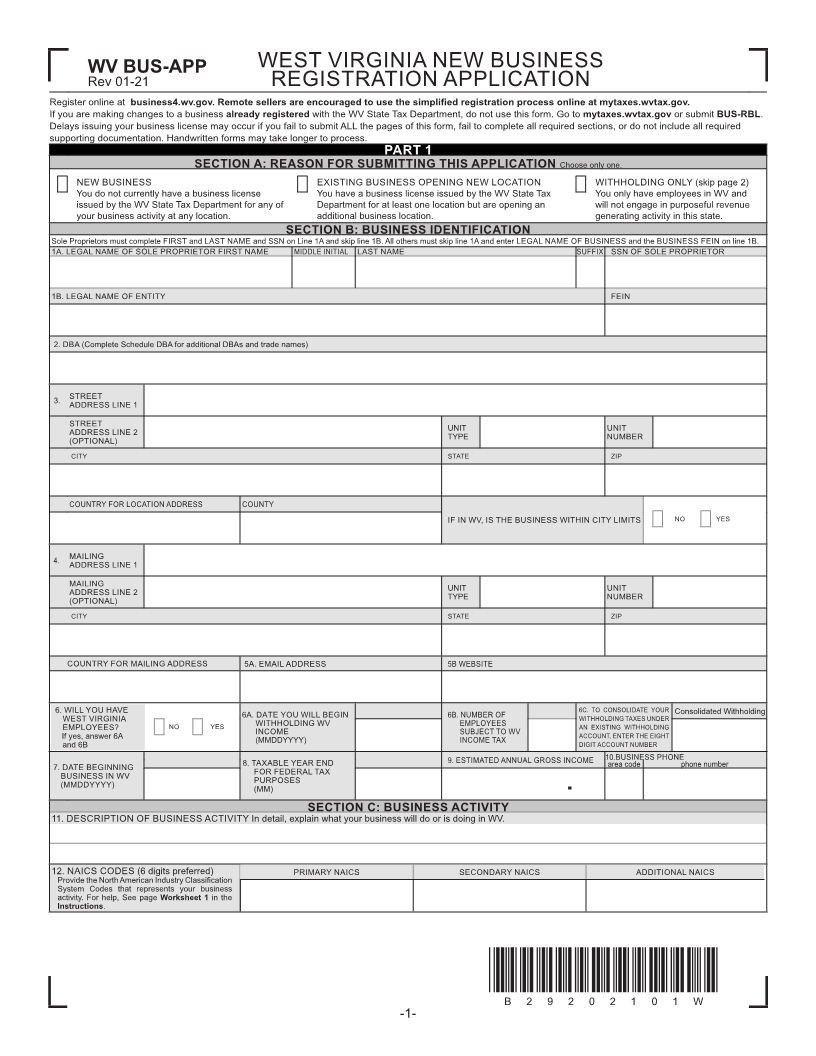

WV BUS-APP WEST VIRGINIA NEW BUSINESS

Rev 01-21 REGISTRATION APPLICATION

Register online at business4.wv.gov. Remote sellers are encouraged to use the simpli edfi registration process online at mytaxes.wvtax.gov.

If you are making changes to a business already registered with the WV State Tax Department, do not use this form. Go to mytaxes.wvtax.gov or submit BUS-RBL.

Delays issuing your business license may occur if you fail to submit ALL the pages of this form, fail to complete all required sections, or do not include all required

supporting documentation. Handwritten forms may take longer to process.

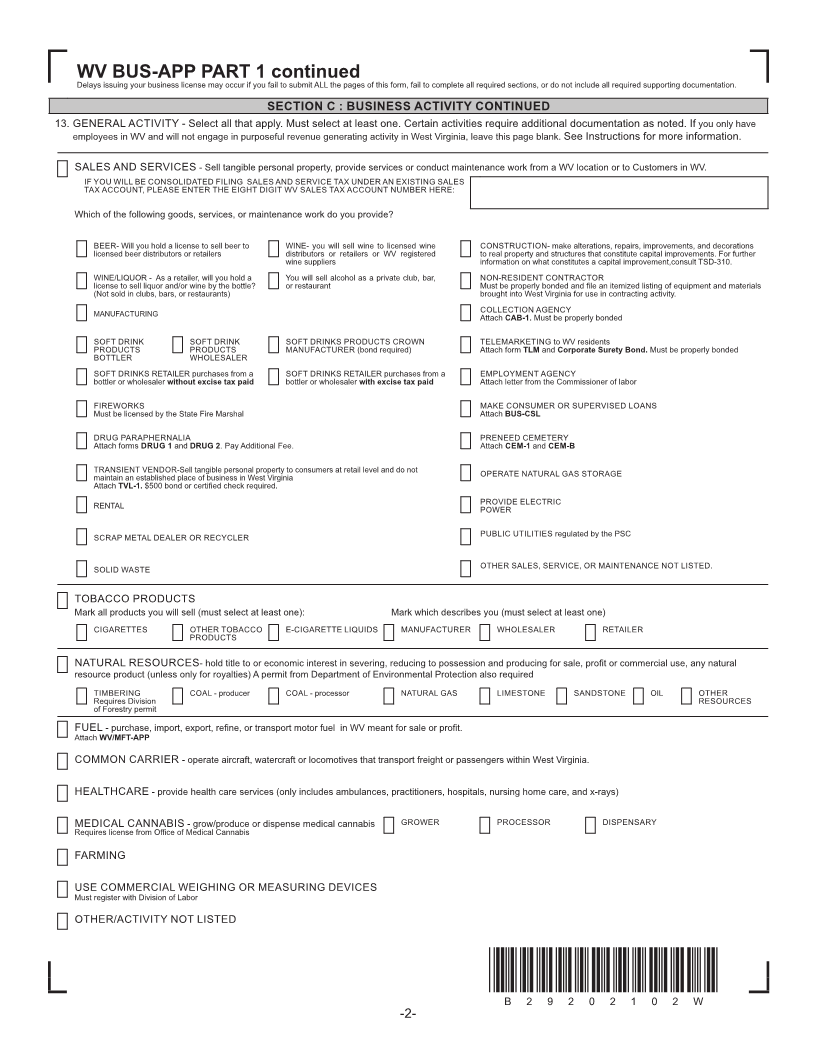

PART 1

SECTION A: REASON FOR SUBMITTING THIS APPLICATION Choose only one.

NEW BUSINESS EXISTING BUSINESS OPENING NEW LOCATION WITHHOLDING ONLY (skip page 2)

You do not currently have a business license You have a business license issued by the WV State Tax You only have employees in WV and

issued by the WV State Tax Department for any of Department for at least one location but are opening an will not engage in purposeful revenue

your business activity at any location. additional business location. generating activity in this state.

SECTION B: BUSINESS IDENTIFICATION

Sole Proprietors must complete FIRST and LAST NAME and SSN on Line 1A and skip line 1B. All others must skip line 1A and enter LEGAL NAME OF BUSINESS and the BUSINESS FEIN on line 1B.

1A. LEGAL NAME OF SOLE PROPRIETOR FIRST NAME MIDDLE INITIAL LAST NAME SUFFIX SSN OF SOLE PROPRIETOR

1B. LEGAL NAME OF ENTITY FEIN

2. DBA (Complete Schedule DBA for additional DBAs and trade names)

3. STREET

ADDRESS LINE 1

STREET UNIT UNIT

ADDRESS LINE 2 TYPE NUMBER

(OPTIONAL)

CITY STATE ZIP

COUNTRY FOR LOCATION ADDRESS COUNTY

IF IN WV, IS THE BUSINESS WITHIN CITY LIMITS NO YES

4. MAILING

ADDRESS LINE 1

MAILING UNIT UNIT

ADDRESS LINE 2 TYPE NUMBER

(OPTIONAL)

CITY STATE ZIP

COUNTRY FOR MAILING ADDRESS 5A. EMAIL ADDRESS 5B WEBSITE

6. WILL YOU HAVE 6A. DATE YOU WILL BEGIN 6B. NUMBER OF 6C. TO CONSOLIDATE YOUR Consolidated Withholding

WEST VIRGINIA WITHHOLDING WV EMPLOYEES WITHHOLDING TAXES UNDER

EMPLOYEES? NO YES INCOME SUBJECT TO WV AN EXISTING WITHHOLDING

If yes, answer 6A (MMDDYYYY) INCOME TAX ACCOUNT, ENTER THE EIGHT

and 6B DIGIT ACCOUNT NUMBER

7. DATE BEGINNING 8. TAXABLE YEAR END 9. ESTIMATED ANNUAL GROSS INCOME 10.BUSINESS PHONE

area code phone number

BUSINESS IN WV FOR FEDERAL TAX

(MMDDYYYY) PURPOSES

(MM) .

SECTION C: BUSINESS ACTIVITY

11. DESCRIPTION OF BUSINESS ACTIVITY In detail, explain what your business will do or is doing in WV.

12. NAICS CODES (6 digits preferred) PRIMARY NAICS SECONDARY NAICS ADDITIONAL NAICS

Provide the North American Industry Classi fication

System Codes that represents your business

activity. For help, See page Worksheet 1 in the

Instructions.

*B29202101W*

B29202101W

-1-