Enlarge image

W V Information & Instructions for Business Registration W EST VIRGINIA STAT E TA X DEPARTMENT

Enlarge image | W V Information & Instructions for Business Registration W EST VIRGINIA STAT E TA X DEPARTMENT |

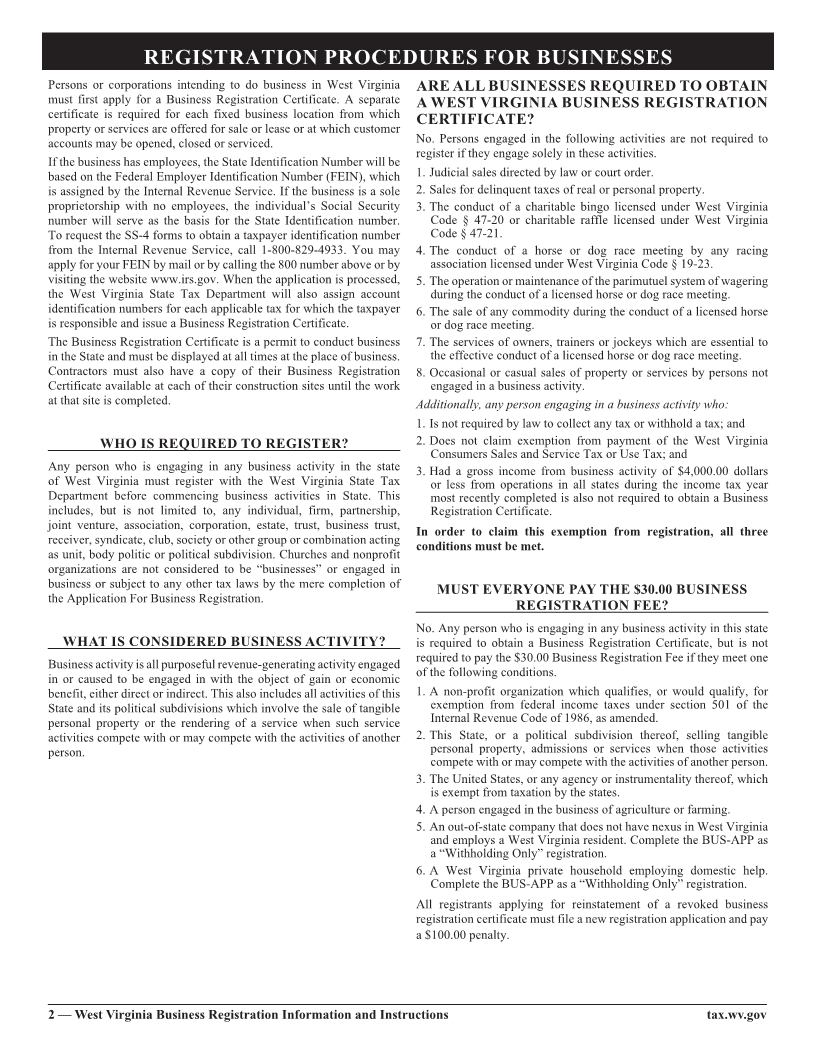

Enlarge image | TABLE OF CONTENTS Before You Begin To Do Business In West Virginia ............................................. 1 Secretary of State Business Organization Filing .................................................... 1 Registration Procedures for Businesses .................................................................. 2 Register with the WV State Tax Department ......................................................... 4 Register for an Unemployment Compensation account ......................................... 8 Your Responsibilities as a West Virginia Taxpayer ............................................... 9 Other Registration Requirements ......................................................................... 10 Update Your Registration and Reissue a License ................................................. 12 Close Your Registration and Other Tax Accounts .............................................. 13 COVER PHOTO: CHARLESTON, WV. PHOTOGRAPH BY MATT MURPHY BOOKLET VERSION 2019V1 |

Enlarge image |

BEFORE YOU BEGIN TO DO BUSINESS IN WEST VIRGINIA

When starting a business, you will need to decide how the business is owned 2: REGISTRATION

and operated; who will be liable for the debts and obligations of the business;

who will have a right to the assets of the business; and tax status. The Small Every person or company intending to do business in this State, including

Business Development Center, a division of the West Virginia Development every individual who is self-employed or hires employees, must obtain

Office, will provide managerial and technical assistance, financing and loan a business registration certificate from the West Virginia State Tax

packaging information, education and training in a variety of areas. Department.

Every person or company (with very few exceptions) with employees in

Telephone: (304) 558-2960 this State must file for Unemployment Compensation coverage, and obtain

Toll free: 1-888-WVA-SBDC (1-888-982-7232) Workers’ Compensation Insurance coverage.

Website: www.wvsbdc.org IMPORTANT - West Virginia employers are now required by law to obtain

You may register with all necessary agencies at the same time if you register Workers’ Compensation insurance coverage for their employees from a

online at www.business4wv.com. If you choose not to register online, private insurance company.

follow the three steps below. After reviewing this booklet, COMPLETE AND SIGN the BUS-APP and

mail all pages intact to the West Virginia State Tax Department, Office of

1: ORGANIZATION Business Registration. If you prefer, you may visit one of the offices listed

on the last page to register your business.

For a sole proprietorship, a general partnership, or an out of state company

registering for a ‘withholding only’ account, go to step 2. For a corporation, 3: LICENSING

association, limited liability company, limited partnership or limited liability

partnership, you must first file organization papers with the Secretary Many businesses perform work that is regulated. The work you do may

of State whether you are based inside or outside of the State. Your other require one or more special licenses or permits. If you indicate on the

registration and licensing applications will not be processed until this step tax registration form that you are doing construction related work, the

is completed. Contractor’s Licensing Board will send you an application form.

Many other licenses are listed in the section describing various business

activity. Review the list carefully to determine if you need licenses or

permits for the type of business you will operate. If you have questions, call

the agency most likely to handle that service to inquire.

SECRETARY OF STATE BUSINESS ORGANIZATION FILING

You are not required to file with the Secretary of State if you are starting To obtain forms or information please contact the Secretary of State’s

a sole proprietorship, a general partnership or if you are registering a Office by visiting their web site at www.sos.wv.gov, or by calling

‘withholding only’ account. 304-558-8000 or by coming to the Secretary of State’s Office at 1900

You must first get your business officially organized by filing with the Kanawha Blvd., Room W-151 on the first floor of the main Capitol

Secretary of State if you are forming one of the types of businesses listed building.

in the chart below. The chart also lists the necessary documents which must

be filed for both West Virginia based companies and out-of-state companies Obtain the correct form to organize the business, or have your

wanting to conduct business within the State. Other agencies will not attorney or accountant prepare the filings.

process your application for registration until registration with the

Secretary of State has been completed and a control number has been

obtained.

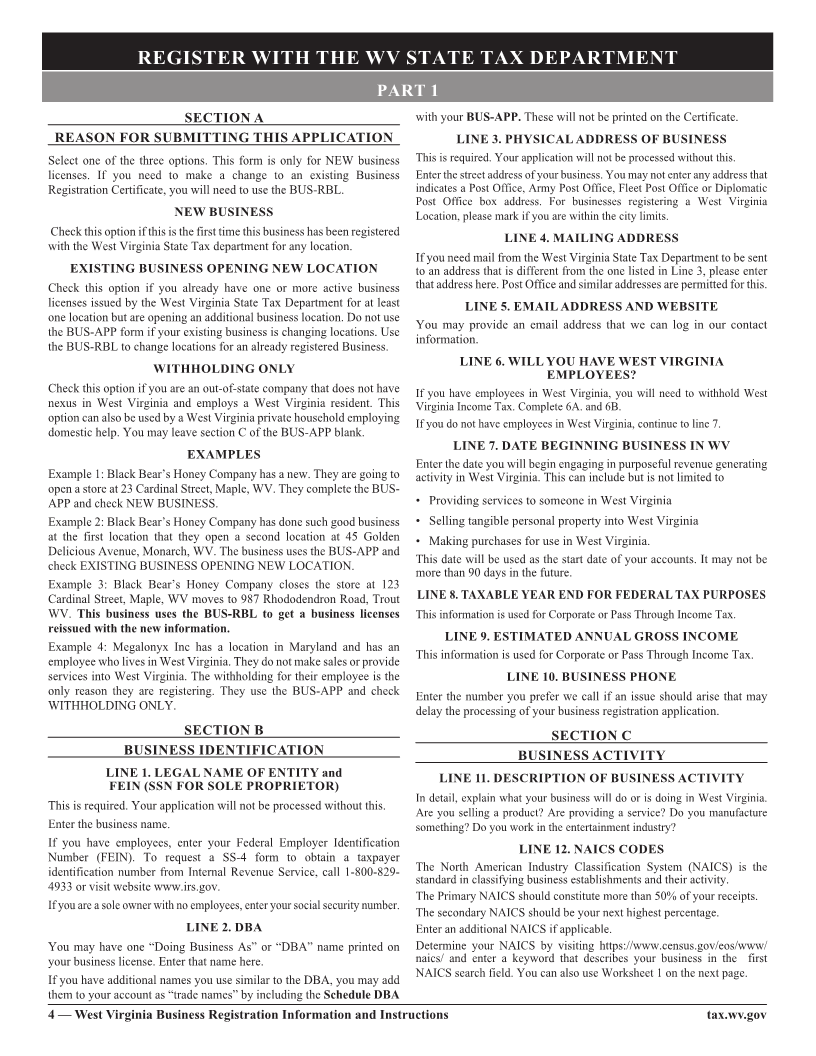

SECRETARY OF STATE

TYPE OF FILING REQUIRED FOR NEW SECRETARY OF STATE FILING REQUIRED FOR

BUSINESS WEST VIRGINIA-BASED COMPANY OUT-OF-STATE COMPANY OTHER REQUIREMENTS

FORM NAME FORM NAME

For-Profit Application for Certificate of Authority; Home

Corporation CD-1 Articles of Incorporation CF-1 state good-standing certificate

Obtain IRS 501(c) status

Non-Profit before applying for business

Corporation CD-1np Same as above CF-1 Same as above registration certificate

Limited Liability For ABCC License, business

Company LLD-1 Articles of Organization LLF-1 Application for Certificate of Authority must be registered as an

association, corporation or

Association AS-1 Articles of Association Articles of Association LLC

Limited Certificate of Limited Statement of Registration for Limited

Partnership LP-1 Partnership LP-2 Partnership; Home state certificate of existence

Limited Liability Statement of Registration Home state certificate

Partnership LLP-1 Statement of Registration LLP-1 of existence

Agreement and statement agreeing to be

Business Trust governed by law governing corporations Same as in-state; Home state certificate of existence

–1–

|

Enlarge image |

REGISTRATION PROCEDURES FOR BUSINESSES

Persons or corporations intending to do business in West Virginia ARE ALL BUSINESSES REQUIRED TO OBTAIN

must first apply for a Business Registration Certificate. A separate A WEST VIRGINIA BUSINESS REGISTRATION

certificate is required for each fixed business location from which CERTIFICATE?

property or services are offered for sale or lease or at which customer

accounts may be opened, closed or serviced. No. Persons engaged in the following activities are not required to

register if they engage solely in these activities.

If the business has employees, the State Identification Number will be

based on the Federal Employer Identification Number (FEIN), which 1. Judicial sales directed by law or court order.

is assigned by the Internal Revenue Service. If the business is a sole 2. Sales for delinquent taxes of real or personal property.

proprietorship with no employees, the individual’s Social Security 3. The conduct of a charitable bingo licensed under West Virginia

number will serve as the basis for the State Identification number. Code § 47-20 or charitable raffle licensed under West Virginia

To request the SS-4 forms to obtain a taxpayer identification number Code § 47-21.

from the Internal Revenue Service, call 1-800-829-4933. You may 4. The conduct of a horse or dog race meeting by any racing

apply for your FEIN by mail or by calling the 800 number above or by association licensed under West Virginia Code § 19-23.

visiting the website www.irs.gov. When the application is processed, 5. The operation or maintenance of the parimutuel system of wagering

the West Virginia State Tax Department will also assign account during the conduct of a licensed horse or dog race meeting.

identification numbers for each applicable tax for which the taxpayer 6. The sale of any commodity during the conduct of a licensed horse

is responsible and issue a Business Registration Certificate. or dog race meeting.

The Business Registration Certificate is a permit to conduct business 7. The services of owners, trainers or jockeys which are essential to

in the State and must be displayed at all times at the place of business. the effective conduct of a licensed horse or dog race meeting.

Contractors must also have a copy of their Business Registration 8. Occasional or casual sales of property or services by persons not

Certificate available at each of their construction sites until the work engaged in a business activity.

at that site is completed. Additionally, any person engaging in a business activity who:

1. Is not required by law to collect any tax or withhold a tax; and

WHO IS REQUIRED TO REGISTER? 2. Does not claim exemption from payment of the West Virginia

Consumers Sales and Service Tax or Use Tax; and

Any person who is engaging in any business activity in the state 3. Had a gross income from business activity of $4,000.00 dollars

of West Virginia must register with the West Virginia State Tax or less from operations in all states during the income tax year

Department before commencing business activities in State. This most recently completed is also not required to obtain a Business

includes, but is not limited to, any individual, firm, partnership, Registration Certificate.

joint venture, association, corporation, estate, trust, business trust, In order to claim this exemption from registration, all three

receiver, syndicate, club, society or other group or combination acting conditions must be met.

as unit, body politic or political subdivision. Churches and nonprofit

organizations are not considered to be “businesses” or engaged in

business or subject to any other tax laws by the mere completion of MUST EVERYONE PAY THE $30.00 BUSINESS

the Application For Business Registration.

REGISTRATION FEE?

No. Any person who is engaging in any business activity in this state

WHAT IS CONSIDERED BUSINESS ACTIVITY? is required to obtain a Business Registration Certificate, but is not

required to pay the $30.00 Business Registration Fee if they meet one

Business activity is all purposeful revenue-generating activity engaged

of the following conditions.

in or caused to be engaged in with the object of gain or economic

benefit, either direct or indirect. This also includes all activities of this 1. A non-profit organization which qualifies, or would qualify, for

State and its political subdivisions which involve the sale of tangible exemption from federal income taxes under section 501 of the

personal property or the rendering of a service when such service Internal Revenue Code of 1986, as amended.

activities compete with or may compete with the activities of another 2. This State, or a political subdivision thereof, selling tangible

person. personal property, admissions or services when those activities

compete with or may compete with the activities of another person.

3. The United States, or any agency or instrumentality thereof, which

is exempt from taxation by the states.

4. A person engaged in the business of agriculture or farming.

5. An out-of-state company that does not have nexus in West Virginia

and employs a West Virginia resident. Complete the BUS-APP as

a “Withholding Only” registration.

6. A West Virginia private household employing domestic help.

Complete the BUS-APP as a “Withholding Only” registration.

All registrants applying for reinstatement of a revoked business

registration certificate must file a new registration application and pay

a $100.00 penalty.

2 — West Virginia Business Registration Information and Instructions tax.wv.gov

|

Enlarge image |

HOW DO I REGISTER? REVOCATION OR SUSPENSION OF CERTIFICATE

To register with the West Virginia State Tax Department, you must The Tax Commissioner may cancel or suspend a business registration

complete the Application for Registration Certificate (Form WV/ certificate at any time if:

BUS-APP) in this booklet and return to: 1. The registrant filed an application for a business registration

West Virginia State Tax Department certificate that was false or fraudulent.

PO Box 2666 2. The registrant willfully refused or neglected to file a tax return for

Charleston, West Virginia 25330-2666 any tax imposed.

You may register with all agencies online at www.business4wv.com. 3. The registrant willfully refused or neglected to pay any tax,

Out-of-state sellers who have no physical presence in West Virginia additions to tax, penalties or interest when they became due and

and no activity in West Virginia other than making other than making payable.

sales over the Internet, by telephone, or mail order are considered 4. The registrant neglected to pay the Tax Commissioner on or before

remote sellers and may use a simplified Remote Seller Registration it’s due date any tax imposed which the registrant collects and

on mytaxes.wvtax.gov. holds in trust for the State of West Virginia.

5. The registrant abused the privilege of claiming an exemption from

WHAT HAPPENS AFTER I HAVE COMPLETED payment of the consumers sales and service tax and use tax on

THE APPLICATION AND MAILED IT TO THE some or all of its purchases for use in business; failed to timely

WEST VIRGINIA STATE TAX DEPARTMENT? pay purchasers use tax on taxable purchases; or failed to either pay

Upon receipt of your Application for Registration Certificate, we the tax or provide a vendor with a properly executed exemption

certificate or direct pay permit number.

will determine what tax forms you should receive by reviewing the

application. For each tax you are responsible for, an account ID number 6. The registrant failed to pay delinquent personal property tax to the

will be assigned. Once your application is processed, you will receive County Sheriff where their business is located.

your West Virginia Business Registration Certificate. A list of West 7. It has been determined by the Tax Commissioner the registrant is

Virginia tax accounts and their identification numbers will be provided. an ‘alter ego’ of a business that has previously been subject of a

Tax returns will be mailed prior to their due dates. After your business is lawful refusal to issue, revocation, suspension or refusal to renew.

registered, you may choose to file and pay online at mytaxes.wvtax.gov. A business is presumed to be an ‘alter ego’ if:

See back of booklet for more information about MyTaxes. 1. More than twenty percent of the assets have been transferred from

another business or more than twenty percent of the assets were to

have been used to secure the debts of the other business.

WHAT DO I DO WITH THE WEST VIRGINIA 2. Ownership of the business is so configured that IRS Code Section

BUSINESS REGISTRATION CERTIFICATE? 267 or 318 would apply to cause ownership of the businesses to be

attributed to the same person or entity.

The Business Registration Certificate must be posted conspicuously in

the place where you are conducting business. 3. Substantial control of the business is held or retained by the same

person or entity.

Businesses that sell tangible personal property or services from or out of

one or more vehicles, must carry a copy of their Business Registration A revoked Business Registration Certificate may be reinstated upon

Certificate in each vehicle and publicly display it while business is payment of all outstanding delinquencies or by entering into an

conducted from or out of the vehicle. approved payment plan. There will be a $100.00 penalty imposed for

reinstatement and a $30.00 registration fee of a revoked certificate if

Any person engaging in any contracting business or activity must

applicable.

have a copy of their Business Registration Certificate available at each

construction site in West Virginia until their work is complete at that WHAT IF I DON’T OBTAIN A BUSINESS

site. REGISTRATION CERTIFICATE BEFORE

COMMENCING BUSINESS?

HOW LONG IS MY BUSINESS REGISTRATION Engaging in business within the State of West Virginia, without

CERTIFICATE VALID? obtaining a Business Registration Certificate when required by law, is

a serious offense and could subject you to penalties of up to $100.00

The Business Registration Certificate shall be permanent. For businesses a day for each day you continue to operate your business without a

registering after July 1, 2010 the Business Registration Certificate shall license.

be valid until cessation of the business or until it is suspended, revoked

or cancelled by the Tax Commissioner. WHAT IF I ANTICIPATE DOING BUSINESS IN

WEST VIRGINIA FROM OUTSIDE OF THE STATE

AND AM UNSURE OF MY TAX LIABILITY TO

WEST VIRGINIA?

Visit our website www.tax.wv.gov to download the WV/NEXUS

(nexus questionnaire). Complete the questionnaire and Application

for Registration Certificate and mail in the envelope provided in this

booklet.

The filing of an application for Registration Certificate and payment

of the registration fee may not be construed by the Tax Commissioner

or the Courts of this State as consent, submission or admission by the

registrant to the general taxing jurisdiction of this State. Any liability

for such other taxes imposed by this State shall depend upon the

relevant facts in each case and the relevant law.

tax.wv.gov West Virginia Business Registration Information and Instructions— 3

|

Enlarge image |

REGISTER WITH THE WV STATE TAX DEPARTMENT

PART 1

SECTION A with your BUS-APP. These will not be printed on the Certificate.

REASON FOR SUBMITTING THIS APPLICATION LINE 3. PHYSICAL ADDRESS OF BUSINESS

Select one of the three options. This form is only for NEW business This is required. Your application will not be processed without this.

licenses. If you need to make a change to an existing Business Enter the street address of your business. You may not enter any address that

Registration Certificate, you will need to use the BUS-RBL. indicates a Post Office, Army Post Office, Fleet Post Office or Diplomatic

Post Office box address. For businesses registering a West Virginia

NEW BUSINESS Location, please mark if you are within the city limits.

Check this option if this is the first time this business has been registered LINE 4. MAILING ADDRESS

with the West Virginia State Tax department for any location.

If you need mail from the West Virginia State Tax Department to be sent

EXISTING BUSINESS OPENING NEW LOCATION to an address that is different from the one listed in Line 3, please enter

Check this option if you already have one or more active business that address here. Post Office and similar addresses are permitted for this.

licenses issued by the West Virginia State Tax Department for at least LINE 5. EMAIL ADDRESS AND WEBSITE

one location but are opening an additional business location. Do not use

You may provide an email address that we can log in our contact

the BUS-APP form if your existing business is changing locations. Use

information.

the BUS-RBL to change locations for an already registered Business.

LINE 6. WILL YOU HAVE WEST VIRGINIA

WITHHOLDING ONLY EMPLOYEES?

Check this option if you are an out-of-state company that does not have If you have employees in West Virginia, you will need to withhold West

nexus in West Virginia and employs a West Virginia resident. This Virginia Income Tax. Complete 6A. and 6B.

option can also be used by a West Virginia private household employing If you do not have employees in West Virginia, continue to line 7.

domestic help. You may leave section C of the BUS-APP blank.

LINE 7. DATE BEGINNING BUSINESS IN WV

EXAMPLES

Enter the date you will begin engaging in purposeful revenue generating

Example 1: Black Bear’s Honey Company has a new. They are going to activity in West Virginia. This can include but is not limited to

open a store at 23 Cardinal Street, Maple, WV. They complete the BUS-

APP and check NEW BUSINESS. • Providing services to someone in West Virginia

Example 2: Black Bear’s Honey Company has done such good business • Selling tangible personal property into West Virginia

at the first location that they open a second location at 45 Golden • Making purchases for use in West Virginia.

Delicious Avenue, Monarch, WV. The business uses the BUS-APP and

This date will be used as the start date of your accounts. It may not be

check EXISTING BUSINESS OPENING NEW LOCATION. more than 90 days in the future.

Example 3: Black Bear’s Honey Company closes the store at 123

Cardinal Street, Maple, WV moves to 987 Rhododendron Road, Trout LINE 8. TAXABLE YEAR END FOR FEDERAL TAX PURPOSES

WV. This business uses the BUS-RBL to get a business licenses This information is used for Corporate or Pass Through Income Tax.

reissued with the new information.

LINE 9. ESTIMATED ANNUAL GROSS INCOME

Example 4: Megalonyx Inc has a location in Maryland and has an

This information is used for Corporate or Pass Through Income Tax.

employee who lives in West Virginia. They do not make sales or provide

services into West Virginia. The withholding for their employee is the LINE 10. BUSINESS PHONE

only reason they are registering. They use the BUS-APP and check Enter the number you prefer we call if an issue should arise that may

WITHHOLDING ONLY. delay the processing of your business registration application.

SECTION B SECTION C

BUSINESS IDENTIFICATION BUSINESS ACTIVITY

LINE 1. LEGAL NAME OF ENTITY and LINE 11. DESCRIPTION OF BUSINESS ACTIVITY

FEIN (SSN FOR SOLE PROPRIETOR)

In detail, explain what your business will do or is doing in West Virginia.

This is required. Your application will not be processed without this. Are you selling a product? Are providing a service? Do you manufacture

Enter the business name. something? Do you work in the entertainment industry?

If you have employees, enter your Federal Employer Identification

LINE 12. NAICS CODES

Number (FEIN). To request a SS-4 form to obtain a taxpayer

identification number from Internal Revenue Service, call 1-800-829- The North American Industry Classification System (NAICS) is the

standard in classifying business establishments and their activity.

4933 or visit website www.irs.gov.

The Primary NAICS should constitute more than 50% of your receipts.

If you are a sole owner with no employees, enter your social security number.

The secondary NAICS should be your next highest percentage.

LINE 2. DBA Enter an additional NAICS if applicable.

You may have one “Doing Business As” or “DBA” name printed on Determine your NAICS by visiting https://www.census.gov/eos/www/

your business license. Enter that name here. naics/ and enter a keyword that describes your business in the first

NAICS search field. You can also use Worksheet 1 on the next page.

If you have additional names you use similar to the DBA, you may add

them to your account as “trade names” by including the Schedule DBA

4 — West Virginia Business Registration Information and Instructions tax.wv.gov

|

Enlarge image |

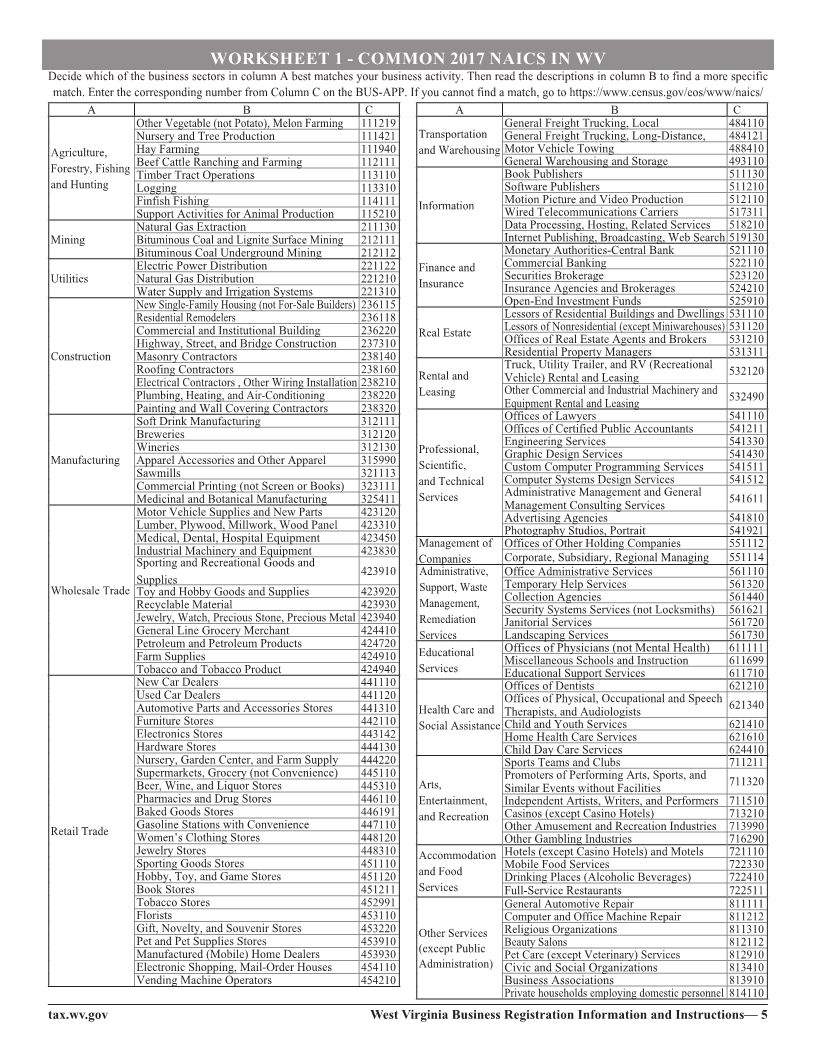

WORKSHEET 1 - COMMON 2017 NAICS IN WV

Decide which of the business sectors in column A best matches your business activity. Then read the descriptions in column B to find a more specific

match. Enter the corresponding number from Column C on the BUS-APP. If you cannot find a match, go to https://www.census.gov/eos/www/naics/

ABC A B C

Other Vegetable (not Potato), Melon Farming 111219 General Freight Trucking, Local 484110

Nursery and Tree Production 111421 Transportation General Freight Trucking, Long-Distance, 484121

Agriculture, Hay Farming 111940 and Warehousing Motor Vehicle Towing 488410

Forestry, Fishing Beef Cattle Ranching and Farming 112111 General Warehousing and Storage 493110

Timber Tract Operations 113110 Book Publishers 511130

and Hunting Logging 113310 Software Publishers 511210

Finfish Fishing 114111 Information Motion Picture and Video Production 512110

Support Activities for Animal Production 115210 Wired Telecommunications Carriers 517311

Natural Gas Extraction 211130 Data Processing, Hosting, Related Services 518210

Mining Bituminous Coal and Lignite Surface Mining 212111 Internet Publishing, Broadcasting, Web Search 519130

Bituminous Coal Underground Mining 212112 Monetary Authorities-Central Bank 521110

Electric Power Distribution 221122 Finance and Commercial Banking 522110

Securities Brokerage 523120

Utilities Natural Gas Distribution 221210 Insurance Insurance Agencies and Brokerages 524210

Water Supply and Irrigation Systems 221310

New Single-Family Housing (not For-Sale Builders) 236115 Open-End Investment Funds 525910

Residential Remodelers 236118 Lessors of Residential Buildings and Dwellings 531110

Commercial and Institutional Building 236220 Real Estate Lessors of Nonresidential (except Miniwarehouses) 531120

Highway, Street, and Bridge Construction 237310 Offices of Real Estate Agents and Brokers 531210

Construction Masonry Contractors 238140 Residential Property Managers 531311

Truck, Utility Trailer, and RV (Recreational 532120

Roofing Contractors 238160 Rental and Vehicle) Rental and Leasing

Electrical Contractors , Other Wiring Installation 238210

Plumbing, Heating, and Air-Conditioning 238220 Leasing Other Commercial and Industrial Machinery and 532490

Painting and Wall Covering Contractors 238320 Equipment Rental and Leasing

Soft Drink Manufacturing 312111 Offices of Lawyers 541110

Breweries 312120 Offices of Certified Public Accountants 541211

Engineering Services 541330

Wineries 312130 Professional, Graphic Design Services 541430

Manufacturing Apparel Accessories and Other Apparel 315990 Scientific, Custom Computer Programming Services 541511

Sawmills 321113 Computer Systems Design Services 541512

Commercial Printing (not Screen or Books) 323111 and Technical

Medicinal and Botanical Manufacturing 325411 Services Administrative Management and General 541611

Motor Vehicle Supplies and New Parts 423120 Management Consulting Services

Advertising Agencies 541810

Lumber, Plywood, Millwork, Wood Panel 423310 Photography Studios, Portrait 541921

Medical, Dental, Hospital Equipment 423450 Management of Offices of Other Holding Companies 551112

Industrial Machinery and Equipment 423830 Corporate, Subsidiary, Regional Managing 551114

Sporting and Recreational Goods and Companies

423910 Administrative, Office Administrative Services 561110

Supplies

Wholesale Trade Toy and Hobby Goods and Supplies 423920 Support, Waste Temporary Help Services 561320

Recyclable Material 423930 Management, Collection Agencies 561440

Security Systems Services (not Locksmiths) 561621

Jewelry, Watch, Precious Stone, Precious Metal 423940 Remediation Janitorial Services 561720

General Line Grocery Merchant 424410 Services Landscaping Services 561730

Petroleum and Petroleum Products 424720 Offices of Physicians (not Mental Health) 611111

Farm Supplies 424910 Educational

Miscellaneous Schools and Instruction 611699

Tobacco and Tobacco Product 424940 Services Educational Support Services 611710

New Car Dealers 441110 Offices of Dentists 621210

Used Car Dealers 441120 Offices of Physical, Occupational and Speech 621340

Automotive Parts and Accessories Stores 441310 Health Care and Therapists, and Audiologists

Furniture Stores 442110 Social Assistance Child and Youth Services 621410

Electronics Stores 443142 Home Health Care Services 621610

Hardware Stores 444130 Child Day Care Services 624410

Nursery, Garden Center, and Farm Supply 444220 Sports Teams and Clubs 711211

Supermarkets, Grocery (not Convenience) 445110 Promoters of Performing Arts, Sports, and 711320

Beer, Wine, and Liquor Stores 445310 Arts, Similar Events without Facilities

Pharmacies and Drug Stores 446110 Entertainment, Independent Artists, Writers, and Performers 711510

Baked Goods Stores 446191 and Recreation Casinos (except Casino Hotels) 713210

Retail Trade Gasoline Stations with Convenience 447110 Other Amusement and Recreation Industries 713990

Women’s Clothing Stores 448120 Other Gambling Industries 716290

Jewelry Stores 448310 Accommodation Hotels (except Casino Hotels) and Motels 721110

Sporting Goods Stores 451110 Mobile Food Services 722330

Hobby, Toy, and Game Stores 451120 and Food Drinking Places (Alcoholic Beverages) 722410

Book Stores 451211 Services Full-Service Restaurants 722511

Tobacco Stores 452991 General Automotive Repair 811111

Florists 453110 Computer and Office Machine Repair 811212

Gift, Novelty, and Souvenir Stores 453220 Other Services Religious Organizations 811310

Pet and Pet Supplies Stores 453910 Beauty Salons 812112

Manufactured (Mobile) Home Dealers 453930 (except Public Pet Care (except Veterinary) Services 812910

Electronic Shopping, Mail-Order Houses 454110 Administration) Civic and Social Organizations 813410

Vending Machine Operators 454210 Business Associations 813910

Private households employing domestic personnel 814110

tax.wv.gov West Virginia Business Registration Information and Instructions— 5

|

Enlarge image |

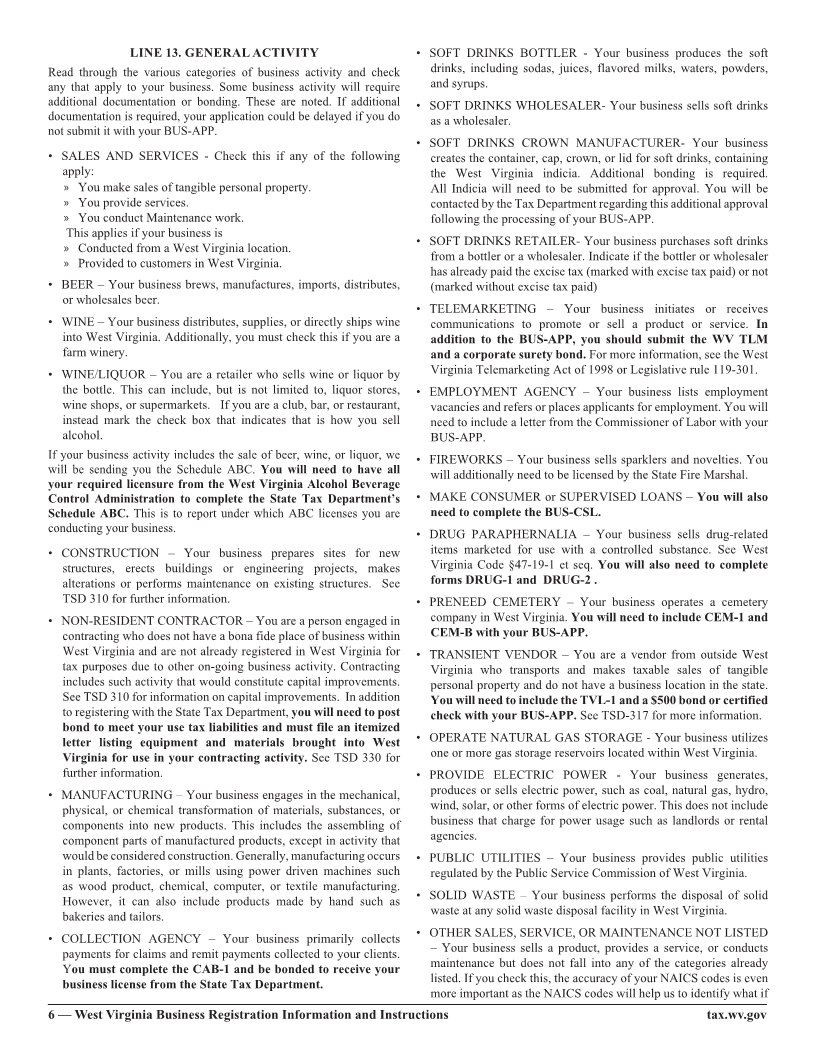

LINE 13. GENERAL ACTIVITY • SOFT DRINKS BOTTLER - Your business produces the soft

Read through the various categories of business activity and check drinks, including sodas, juices, flavored milks, waters, powders,

any that apply to your business. Some business activity will require and syrups.

additional documentation or bonding. These are noted. If additional • SOFT DRINKS WHOLESALER- Your business sells soft drinks

documentation is required, your application could be delayed if you do as a wholesaler.

not submit it with your BUS-APP.

• SOFT DRINKS CROWN MANUFACTURER- Your business

• SALES AND SERVICES - Check this if any of the following creates the container, cap, crown, or lid for soft drinks, containing

apply: the West Virginia indicia. Additional bonding is required.

» You make sales of tangible personal property. All Indicia will need to be submitted for approval. You will be

» You provide services. contacted by the Tax Department regarding this additional approval

» You conduct Maintenance work. following the processing of your BUS-APP.

This applies if your business is

• SOFT DRINKS RETAILER- Your business purchases soft drinks

» Conducted from a West Virginia location.

from a bottler or a wholesaler. Indicate if the bottler or wholesaler

» Provided to customers in West Virginia.

has already paid the excise tax (marked with excise tax paid) or not

• BEER – Your business brews, manufactures, imports, distributes, (marked without excise tax paid)

or wholesales beer.

• TELEMARKETING – Your business initiates or receives

• WINE – Your business distributes, supplies, or directly ships wine communications to promote or sell a product or service. In

into West Virginia. Additionally, you must check this if you are a addition to the BUS-APP, you should submit the WV TLM

farm winery. and a corporate surety bond. For more information, see the West

• WINE/LIQUOR – You are a retailer who sells wine or liquor by Virginia Telemarketing Act of 1998 or Legislative rule 119-301.

the bottle. This can include, but is not limited to, liquor stores, • EMPLOYMENT AGENCY – Your business lists employment

wine shops, or supermarkets. If you are a club, bar, or restaurant, vacancies and refers or places applicants for employment. You will

instead mark the check box that indicates that is how you sell need to include a letter from the Commissioner of Labor with your

alcohol. BUS-APP.

If your business activity includes the sale of beer, wine, or liquor, we • FIREWORKS – Your business sells sparklers and novelties. You

will be sending you the Schedule ABC. You will need to have all will additionally need to be licensed by the State Fire Marshal.

your required licensure from the West Virginia Alcohol Beverage

Control Administration to complete the State Tax Department’s • MAKE CONSUMER or SUPERVISED LOANS – You will also

Schedule ABC. This is to report under which ABC licenses you are need to complete the BUS-CSL.

conducting your business. • DRUG PARAPHERNALIA – Your business sells drug-related

• CONSTRUCTION – Your business prepares sites for new items marketed for use with a controlled substance. See West

structures, erects buildings or engineering projects, makes Virginia Code §47-19-1 et seq. You will also need to complete

alterations or performs maintenance on existing structures. See forms DRUG-1 and DRUG-2 .

TSD 310 for further information. • PRENEED CEMETERY – Your business operates a cemetery

• NON-RESIDENT CONTRACTOR – You are a person engaged in company in West Virginia. You will need to include CEM-1 and

contracting who does not have a bona fide place of business within CEM-B with your BUS-APP.

West Virginia and are not already registered in West Virginia for • TRANSIENT VENDOR – You are a vendor from outside West

tax purposes due to other on-going business activity. Contracting Virginia who transports and makes taxable sales of tangible

includes such activity that would constitute capital improvements. personal property and do not have a business location in the state.

See TSD 310 for information on capital improvements. In addition You will need to include the TVL-1 and a $500 bond or certified

to registering with the State Tax Department, you will need to post check with your BUS-APP. See TSD-317 for more information.

bond to meet your use tax liabilities and must file an itemized

letter listing equipment and materials brought into West • OPERATE NATURAL GAS STORAGE - Your business utilizes

Virginia for use in your contracting activity. See TSD 330 for one or more gas storage reservoirs located within West Virginia.

further information. • PROVIDE ELECTRIC POWER - Your business generates,

• MANUFACTURING – Your business engages in the mechanical, produces or sells electric power, such as coal, natural gas, hydro,

physical, or chemical transformation of materials, substances, or wind, solar, or other forms of electric power. This does not include

components into new products. This includes the assembling of business that charge for power usage such as landlords or rental

component parts of manufactured products, except in activity that agencies.

would be considered construction. Generally, manufacturing occurs • PUBLIC UTILITIES – Your business provides public utilities

in plants, factories, or mills using power driven machines such regulated by the Public Service Commission of West Virginia.

as wood product, chemical, computer, or textile manufacturing.

However, it can also include products made by hand such as • SOLID WASTE – Your business performs the disposal of solid

bakeries and tailors. waste at any solid waste disposal facility in West Virginia.

• COLLECTION AGENCY – Your business primarily collects • OTHER SALES, SERVICE, OR MAINTENANCE NOT LISTED

payments for claims and remit payments collected to your clients. – Your business sells a product, provides a service, or conducts

You must complete the CAB-1 and be bonded to receive your maintenance but does not fall into any of the categories already

business license from the State Tax Department. listed. If you check this, the accuracy of your NAICS codes is even

more important as the NAICS codes will help us to identify what if

6 — West Virginia Business Registration Information and Instructions tax.wv.gov

|

Enlarge image |

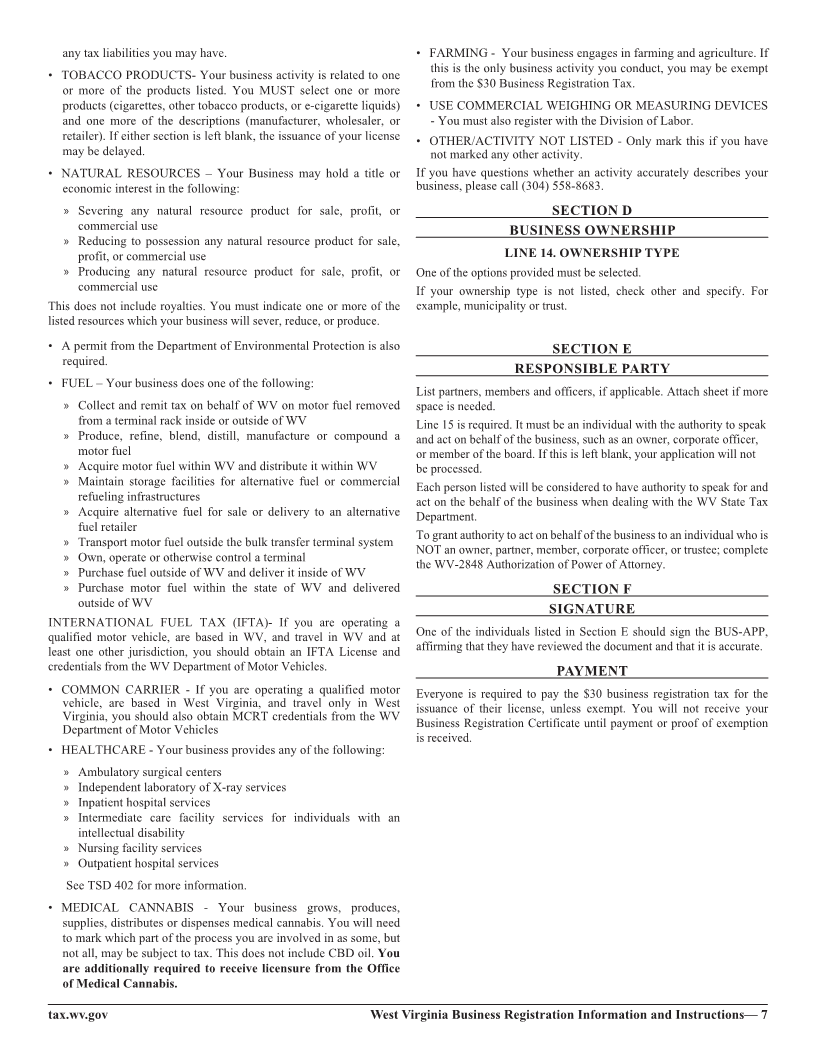

any tax liabilities you may have. • FARMING - Your business engages in farming and agriculture. If

this is the only business activity you conduct, you may be exempt

• TOBACCO PRODUCTS- Your business activity is related to one

from the $30 Business Registration Tax.

or more of the products listed. You MUST select one or more

products (cigarettes, other tobacco products, or e-cigarette liquids) • USE COMMERCIAL WEIGHING OR MEASURING DEVICES

and one more of the descriptions (manufacturer, wholesaler, or - You must also register with the Division of Labor.

retailer). If either section is left blank, the issuance of your license • OTHER/ACTIVITY NOT LISTED - Only mark this if you have

may be delayed. not marked any other activity.

• NATURAL RESOURCES – Your Business may hold a title or If you have questions whether an activity accurately describes your

economic interest in the following: business, please call (304) 558-8683.

» Severing any natural resource product for sale, profit, or SECTION D

commercial use BUSINESS OWNERSHIP

» Reducing to possession any natural resource product for sale,

profit, or commercial use LINE 14. OWNERSHIP TYPE

» Producing any natural resource product for sale, profit, or One of the options provided must be selected.

commercial use If your ownership type is not listed, check other and specify. For

This does not include royalties. You must indicate one or more of the example, municipality or trust.

listed resources which your business will sever, reduce, or produce.

• A permit from the Department of Environmental Protection is also SECTION E

required.

RESPONSIBLE PARTY

• FUEL – Your business does one of the following:

List partners, members and officers, if applicable. Attach sheet if more

» Collect and remit tax on behalf of WV on motor fuel removed space is needed.

from a terminal rack inside or outside of WV Line 15 is required. It must be an individual with the authority to speak

» Produce, refine, blend, distill, manufacture or compound a and act on behalf of the business, such as an owner, corporate officer,

motor fuel or member of the board. If this is left blank, your application will not

» Acquire motor fuel within WV and distribute it within WV be processed.

» Maintain storage facilities for alternative fuel or commercial Each person listed will be considered to have authority to speak for and

refueling infrastructures act on the behalf of the business when dealing with the WV State Tax

» Acquire alternative fuel for sale or delivery to an alternative Department.

fuel retailer

To grant authority to act on behalf of the business to an individual who is

» Transport motor fuel outside the bulk transfer terminal system

NOT an owner, partner, member, corporate officer, or trustee; complete

» Own, operate or otherwise control a terminal the WV-2848 Authorization of Power of Attorney.

» Purchase fuel outside of WV and deliver it inside of WV

» Purchase motor fuel within the state of WV and delivered SECTION F

outside of WV SIGNATURE

INTERNATIONAL FUEL TAX (IFTA)- If you are operating a

qualified motor vehicle, are based in WV, and travel in WV and at One of the individuals listed in Section E should sign the BUS-APP,

least one other jurisdiction, you should obtain an IFTA License and affirming that they have reviewed the document and that it is accurate.

credentials from the WV Department of Motor Vehicles. PAYMENT

• COMMON CARRIER - If you are operating a qualified motor Everyone is required to pay the $30 business registration tax for the

vehicle, are based in West Virginia, and travel only in West issuance of their license, unless exempt. You will not receive your

Virginia, you should also obtain MCRT credentials from the WV

Department of Motor Vehicles Business Registration Certificate until payment or proof of exemption

is received.

• HEALTHCARE - Your business provides any of the following:

» Ambulatory surgical centers

» Independent laboratory of X-ray services

» Inpatient hospital services

» Intermediate care facility services for individuals with an

intellectual disability

» Nursing facility services

» Outpatient hospital services

See TSD 402 for more information.

• MEDICAL CANNABIS - Your business grows, produces,

supplies, distributes or dispenses medical cannabis. You will need

to mark which part of the process you are involved in as some, but

not all, may be subject to tax. This does not include CBD oil. You

are additionally required to receive licensure from the Office

of Medical Cannabis.

tax.wv.gov West Virginia Business Registration Information and Instructions— 7

|

Enlarge image |

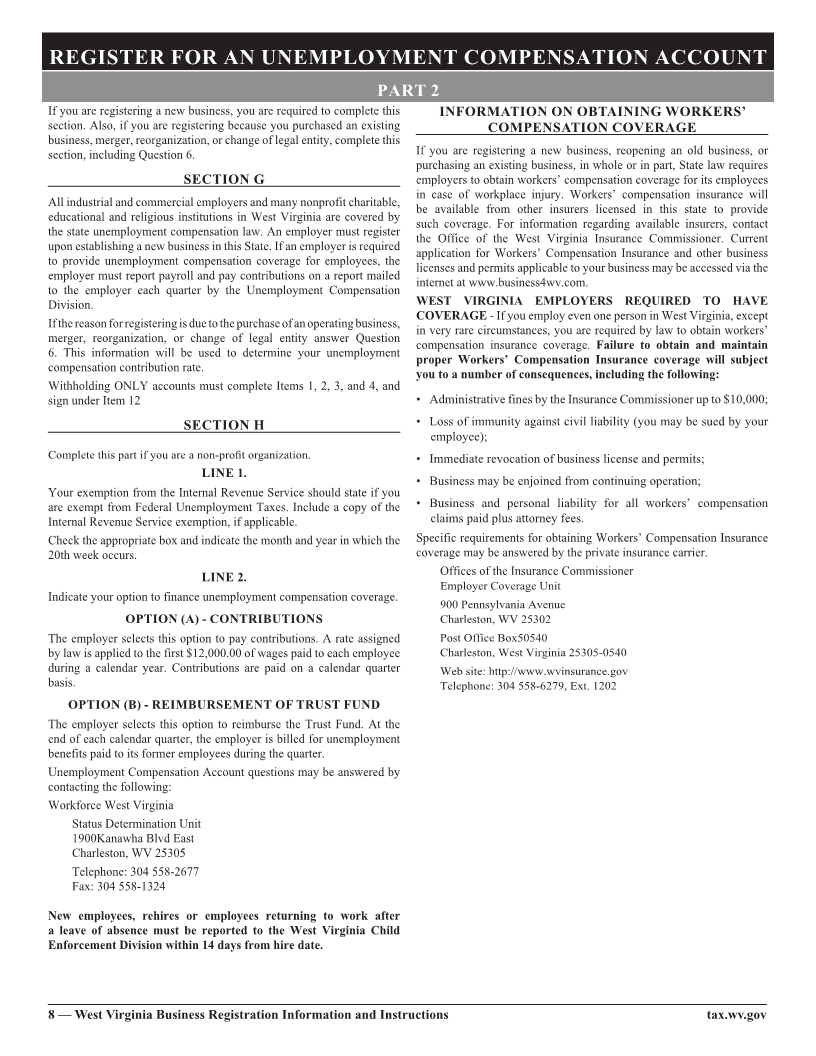

REGISTER FOR AN UNEMPLOYMENT COMPENSATION ACCOUNT

PART 2

If you are registering a new business, you are required to complete this INFORMATION ON OBTAINING WORKERS’

section. Also, if you are registering because you purchased an existing COMPENSATION COVERAGE

business, merger, reorganization, or change of legal entity, complete this

section, including Question 6. If you are registering a new business, reopening an old business, or

purchasing an existing business, in whole or in part, State law requires

SECTION G employers to obtain workers’ compensation coverage for its employees

in case of workplace injury. Workers’ compensation insurance will

All industrial and commercial employers and many nonprofit charitable,

be available from other insurers licensed in this state to provide

educational and religious institutions in West Virginia are covered by

such coverage. For information regarding available insurers, contact

the state unemployment compensation law. An employer must register

the Office of the West Virginia Insurance Commissioner. Current

upon establishing a new business in this State. If an employer is required

application for Workers’ Compensation Insurance and other business

to provide unemployment compensation coverage for employees, the

licenses and permits applicable to your business may be accessed via the

employer must report payroll and pay contributions on a report mailed

internet at www.business4wv.com.

to the employer each quarter by the Unemployment Compensation

Division. WEST VIRGINIA EMPLOYERS REQUIRED TO HAVE

COVERAGE - If you employ even one person in West Virginia, except

If the reason for registering is due to the purchase of an operating business,

in very rare circumstances, you are required by law to obtain workers’

merger, reorganization, or change of legal entity answer Question

compensation insurance coverage. Failure to obtain and maintain

6. This information will be used to determine your unemployment

proper Workers’ Compensation Insurance coverage will subject

compensation contribution rate.

you to a number of consequences, including the following:

Withholding ONLY accounts must complete Items 1, 2, 3, and 4, and

sign under Item 12 • Administrative fines by the Insurance Commissioner up to $10,000;

SECTION H • Loss of immunity against civil liability (you may be sued by your

employee);

Complete this part if you are a non-pro tfiorganization. • Immediate revocation of business license and permits;

LINE 1.

• Business may be enjoined from continuing operation;

Your exemption from the Internal Revenue Service should state if you

are exempt from Federal Unemployment Taxes. Include a copy of the • Business and personal liability for all workers’ compensation

Internal Revenue Service exemption, if applicable. claims paid plus attorney fees.

Check the appropriate box and indicate the month and year in which the Specific requirements for obtaining Workers’ Compensation Insurance

20th week occurs. coverage may be answered by the private insurance carrier.

LINE 2. Offices of the Insurance Commissioner

Employer Coverage Unit

Indicate your option to finance unemployment compensation coverage.

900 Pennsylvania Avenue

OPTION (A) - CONTRIBUTIONS Charleston, WV 25302

The employer selects this option to pay contributions. A rate assigned Post Office Box50540

by law is applied to the first $12,000.00 of wages paid to each employee Charleston, West Virginia 25305-0540

during a calendar year. Contributions are paid on a calendar quarter Web site: http://www.wvinsurance.gov

basis. Telephone: 304 558-6279, Ext. 1202

OPTION (B) - REIMBURSEMENT OF TRUST FUND

The employer selects this option to reimburse the Trust Fund. At the

end of each calendar quarter, the employer is billed for unemployment

benefits paid to its former employees during the quarter.

Unemployment Compensation Account questions may be answered by

contacting the following:

Workforce West Virginia

Status Determination Unit

1900Kanawha Blvd East

Charleston, WV 25305

Telephone: 304 558-2677

Fax: 304 558-1324

New employees, rehires or employees returning to work after

a leave of absence must be reported to the West Virginia Child

Enforcement Division within 14 days from hire date.

8 — West Virginia Business Registration Information and Instructions tax.wv.gov

|

Enlarge image |

YOUR RESPONSIBILITIES AS A WEST VIRGINIA TAXPAYER

The employees of the West Virginia State Tax Department are here to IF YOU SELL OR DISCONTINUE YOUR BUSINESS

assist you in complying with your responsibilities as a West Virginia

taxpayer. The following are some important points that will help you in One of the most common problems encountered by taxpayers occurs

meeting these obligations. when a person ceases to do business and does not inform the Licensing

Agencies. This often results in unnecessary billing and collection

FILING YOUR BUSINESS TAX RETURNS activities, which can be very difficult and time consuming for both the

agencies involved and the taxpayer/client to resolve. You may avoid

The Tax Department makes every effort to provide businesses with the unnecessary corrective measures by notifying each Licensing Agency

proper tax forms prior to the due date of the tax return. However, it is as soon as possible when you sell or discontinue your business. You

your responsibility to ensure that your return is filed by the due date, should also file final tax returns for each tax you are required to file with

and lack of the proper form is not considered reasonable cause for not the West Virginia State Tax Department. File the BUS-FIN to notify the

filing a timely tax return. If you do not receive the proper form from the West Virginia State Tax Department that you have sold or discontinued

Department, you may obtain forms from our website www.tax.wv.gov. your business. See instructions on page 13.

You may also obtain forms from any of our regional field offices listed

on the back of this booklet. THE BILLING AND COLLECTION PROCESS

Upon completing your business registration, you may view, file and pay If you fail to file a required business tax return, file a tax return without

your taxes online at mytaxes.wvtax.gov. Learn more about MyTaxes on payment of the tax or fail to file on or before the due date, you will

the back of this booklet. receive a notice from the West Virginia State Tax Department. To

If you are required to file monthly or quarterly tax returns, you must file protect your rights, it is very important that you respond, in writing, to

the return even if you owe no tax. Failure to file returns will result in these notices immediately.

your account being referred to our Compliance Division for corrective The Tax Department has implemented a new tax system that allows

action. Please file all required tax returns even if you owe no tax for the us to better serve you. This new system decreases processing time and

reporting period. allows us to contact taxpayers in a timely manner. If a change has been

PAYMENT OF THE TAX made to your return, you will first receive a letter from us explaining the

change. If there is an additional amount due the State, you will receive

The full amount of tax that you owe is due and payable on the due date a Statement of Account. If you disagree with the amount shown to be

of the tax return. Failure to pay the full amount of tax by the due date due, return a copy of the statement with your comments and provide

will result in interest and penalties being added to any unpaid amount of any additional schedule to substantiate your claim. You will receive

tax. If for any reason you are unable to pay the full amount of tax on the a statement of account on a monthly basis until such time as your

due date, you should file your tax return along with a written explanation outstanding liability is either paid or your account is settled. If you send

of why you are unable to pay and when you will pay the tax due. The us information and receive a second statement of account, it may be a

employees of the Tax Division are here to assist you. Anytime you find timing issue. Please allow appropriate time for mailing and processing

you cannot file a tax return or pay the tax due, contact us. We are here of the additional information.

to help! If you fail to respond to the notice, an assessment of tax due will be

PENALTIES AND INTEREST issued by the West Virginia State Tax Department. This assessment

is the means by which the West Virginia State Tax Department

Interest and additions to tax (penalties) attach by law to any amount of establishes a legal tax liability. If you disagree with the assessment for

tax not paid on or before the due date of the tax return. any reason, you are entitled to an administrative hearing to present your

The law requires the Tax Commissioner to establish interest rates for tax reasons. If you fail to respond to the assessment within 60 days, the

underpayments based on the adjusted prime rate. This rate will never be assessment becomes final, conclusive and payable and is not subject to

less than 8% per year and is determined every six months. administrative or judicial review.

Additions to tax (penalties) are imposed for failure to file a required tax Once the assessment becomes final (through inaction or by the

return by the due date and/or late payment of the tax due. The penalty affirmative decision of the administrative hearing officer) a tax lien will

for failure to file a return is 5% per month, up to 25%. The penalty for be filed against all of the property of the taxpayer and will be recorded

failure to pay the tax due is ½ of 1% per month, up to 25%. in the county courthouse. A distress warrant will be issued which

These penalties may both be imposed when you fail to timely file your authorizes the levy or seizure of any property or wages of the taxpayer.

return and pay the tax due. You may reduce the amount of penalties You may avoid these collection actions by contacting the West Virginia

assessed by filing your tax return on the due date even if you require State Tax Department whenever you have difficulties in meeting your

additional time to pay the tax. tax responsibilities.

There will be a $100.00 penalty imposed for reinstatement of a suspended Remember, we are here to assist you in meeting your tax obligations.

or revoked business registration certificate.

There are harsher penalties for operating a business without a license,

filing a false return or the willful and knowing failure to pay a tax. These

may include criminal penalties.

tax.wv.gov West Virginia Business Registration Information and Instructions— 9

|

Enlarge image |

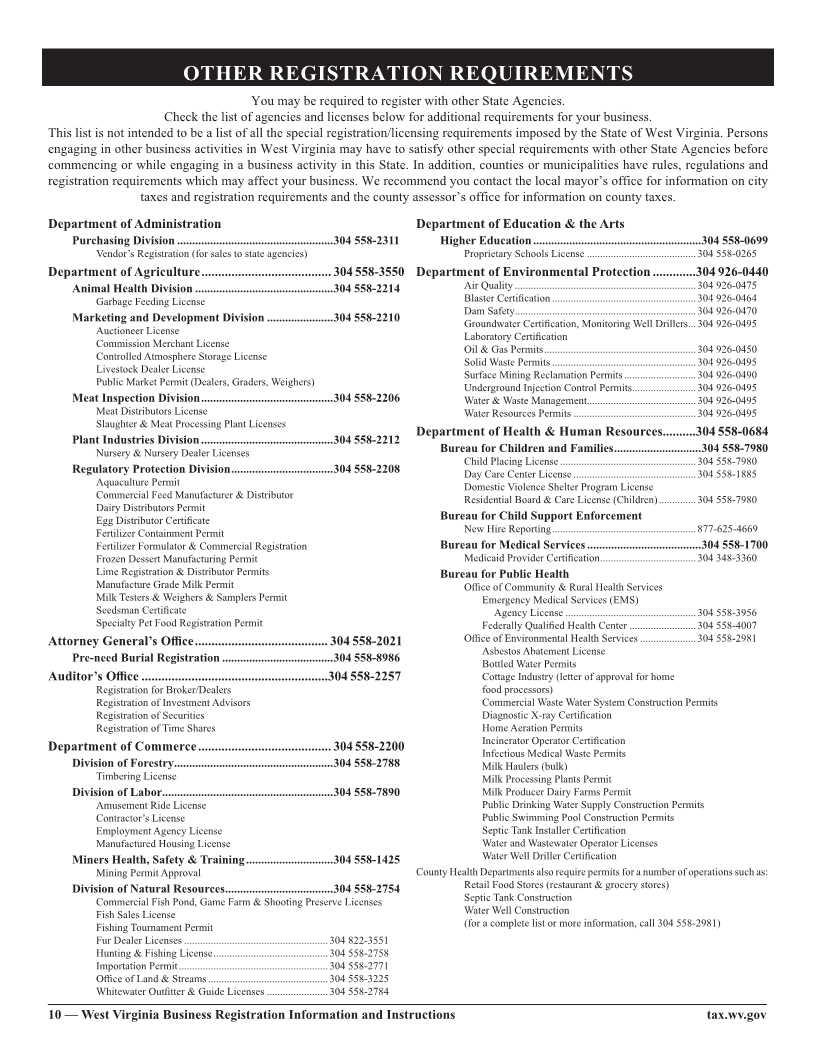

OTHER REGISTRATION REQUIREMENTS

You may be required to register with other State Agencies.

Check the list of agencies and licenses below for additional requirements for your business.

This list is not intended to be a list of all the special registration/licensing requirements imposed by the State of West Virginia. Persons

engaging in other business activities in West Virginia may have to satisfy other special requirements with other State Agencies before

commencing or while engaging in a business activity in this State. In addition, counties or municipalities have rules, regulations and

registration requirements which may affect your business. We recommend you contact the local mayor’s office for information on city

taxes and registration requirements and the county assessor’s office for information on county taxes.

Department of Administration Department of Education & the Arts

Purchasing Division ....................................................304 558-2311 Higher Education ........................................................304 558-0699

Vendor’s Registration (for sales to state agencies) Proprietary Schools License .........................................304 558-0265

Department of Agriculture ....................................... 304 558-3550 Department of Environmental Protection .............304 926-0440

Animal Health Division ..............................................304 558-2214 Air Quality ....................................................................304 926-0475

Garbage Feeding License Blaster Certi fication ......................................................304 926-0464

Dam Safety ....................................................................304 926-0470

Marketing and Development Division ......................304 558-2210 Groundwater Certi fication, Monitoring Well Drillers ...304 926-0495

Auctioneer License Laboratory Certi fication

Commission Merchant License Oil & Gas Permits .........................................................304 926-0450

Controlled Atmosphere Storage License Solid Waste Permits ......................................................304 926-0495

Livestock Dealer License Surface Mining Reclamation Permits ...........................304 926-0490

Public Market Permit (Dealers, Graders, Weighers) Underground Injection Control Permits ........................304 926-0495

Meat Inspection Division ............................................304 558-2206 Water & Waste Management.........................................304 926-0495

Meat Distributors License Water Resources Permits ..............................................304 926-0495

Slaughter & Meat Processing Plant Licenses

Department of Health & Human Resources..........304 558-0684

Plant Industries Division ............................................304 558-2212

Nursery & Nursery Dealer Licenses Bureau for Children and Families .............................304 558-7980

Child Placing License ...................................................304 558-7980

Regulatory Protection Division ..................................304 558-2208 Day Care Center License ..............................................304 558-1885

Aquaculture Permit Domestic Violence Shelter Program License

Commercial Feed Manufacturer & Distributor Residential Board & Care License (Children) ..............304 558-7980

Dairy Distributors Permit

Egg Distributor Certi ficate Bureau for Child Support Enforcement

Fertilizer Containment Permit New Hire Reporting ......................................................877-625-4669

Fertilizer Formulator & Commercial Registration Bureau for Medical Services ......................................304 558-1700

Frozen Dessert Manufacturing Permit Medicaid Provider Certi fication ....................................304 348-3360

Lime Registration & Distributor Permits Bureau for Public Health

Manufacture Grade Milk Permit O ffice of Community & Rural Health Services

Milk Testers & Weighers & Samplers Permit Emergency Medical Services (EMS)

Seedsman Certi ficate Agency License .................................................304 558-3956

Specialty Pet Food Registration Permit Federally Quali fied Health Center .........................304 558-4007

Attorney General’s O ffice ........................................ 304 558-2021 O ffice of Environmental Health Services .....................304 558-2981

Asbestos Abatement License

Pre-need Burial Registration .....................................304 558-8986 Bottled Water Permits

Auditor’s O ffice ........................................................304 558-2257 Cottage Industry (letter of approval for home

Registration for Broker/Dealers food processors)

Registration of Investment Advisors Commercial Waste Water System Construction Permits

Registration of Securities Diagnostic X-ray Certi fication

Registration of Time Shares Home Aeration Permits

Incinerator Operator Certi fication

Department of Commerce ........................................ 304 558-2200 Infectious Medical Waste Permits

Division of Forestry .....................................................304 558-2788 Milk Haulers (bulk)

Timbering License Milk Processing Plants Permit

Division of Labor .........................................................304 558-7890 Milk Producer Dairy Farms Permit

Amusement Ride License Public Drinking Water Supply Construction Permits

Contractor’s License Public Swimming Pool Construction Permits

Employment Agency License Septic Tank Installer Certi fication

Manufactured Housing License Water and Wastewater Operator Licenses

Miners Health, Safety & Training .............................304 558-1425 Water Well Driller Certi fication

Mining Permit Approval County Health Departments also require permits for a number of operations such as:

Division of Natural Resources ....................................304 558-2754 Retail Food Stores (restaurant & grocery stores)

Commercial Fish Pond, Game Farm & Shooting Preserve Licenses Septic Tank Construction

Fish Sales License Water Well Construction

Fishing Tournament Permit (for a complete list or more information, call 304 558-2981)

Fur Dealer Licenses ......................................................304 822-3551

Hunting & Fishing License ...........................................304 558-2758

Importation Permit ........................................................304 558-2771

O ffice of Land & Streams .............................................304 558-3225

Whitewater Out fitter & Guide Licenses .......................304 558-2784

10 — West Virginia Business Registration Information and Instructions tax.wv.gov

|

Enlarge image |

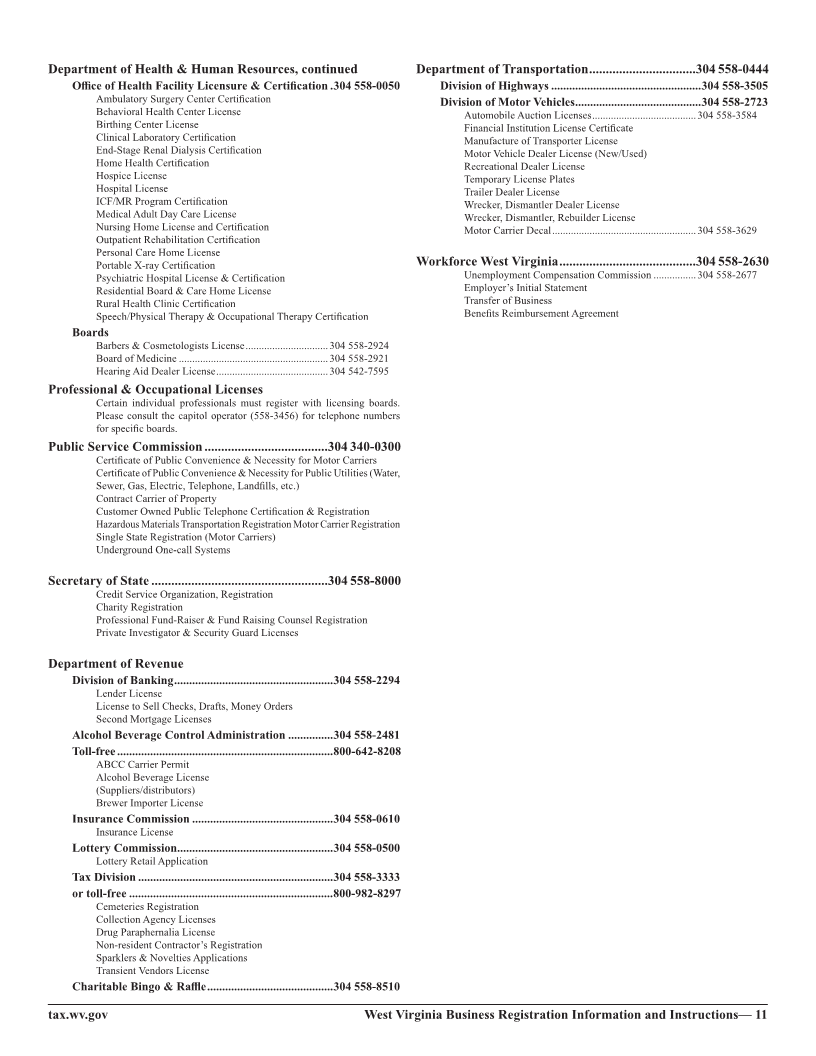

Department of Health & Human Resources, continued Department of Transportation ................................304 558-0444

O ffice of Health Facility Licensure & Certi fication .304 558-0050 Division of Highways ..................................................304 558-3505

Ambulatory Surgery Center Certi fication Division of Motor Vehicles ..........................................304 558-2723

Behavioral Health Center License Automobile Auction Licenses .......................................304 558-3584

Birthing Center License Financial Institution License Certi ficate

Clinical Laboratory Certi fication Manufacture of Transporter License

End-Stage Renal Dialysis Certi fication Motor Vehicle Dealer License (New/Used)

Home Health Certi fication Recreational Dealer License

Hospice License Temporary License Plates

Hospital License Trailer Dealer License

ICF/MR Program Certi fication Wrecker, Dismantler Dealer License

Medical Adult Day Care License Wrecker, Dismantler, Rebuilder License

Nursing Home License and Certi fication Motor Carrier Decal ......................................................304 558-3629

Outpatient Rehabilitation Certi fication

Personal Care Home License

Portable X-ray Certi fication Workforce West Virginia .........................................304 558-2630

Psychiatric Hospital License & Certi fication Unemployment Compensation Commission ................304 558-2677

Residential Board & Care Home License Employer’s Initial Statement

Rural Health Clinic Certi fication Transfer of Business

Speech/Physical Therapy & Occupational Therapy Certi fication Bene fits Reimbursement Agreement

Boards

Barbers & Cosmetologists License ...............................304 558-2924

Board of Medicine ........................................................304 558-2921

Hearing Aid Dealer License ..........................................304 542-7595

Professional & Occupational Licenses

Certain individual professionals must register with licensing boards.

Please consult the capitol operator (558-3456) for telephone numbers

for speci fic boards.

Public Service Commission .....................................304 340-0300

Certi ficate of Public Convenience & Necessity for Motor Carriers

Certi ficate of Public Convenience & Necessity for Public Utilities (Water,

Sewer, Gas, Electric, Telephone, Land fills, etc.)

Contract Carrier of Property

Customer Owned Public Telephone Certi fication & Registration

Hazardous Materials Transportation Registration Motor Carrier Registration

Single State Registration (Motor Carriers)

Underground One-call Systems

Secretary of State .....................................................304 558-8000

Credit Service Organization, Registration

Charity Registration

Professional Fund-Raiser & Fund Raising Counsel Registration

Private Investigator & Security Guard Licenses

Department of Revenue

Division of Banking .....................................................304 558-2294

Lender License

License to Sell Checks, Drafts, Money Orders

Second Mortgage Licenses

Alcohol Beverage Control Administration ...............304 558-2481

Toll-free ........................................................................800-642-8208

ABCC Carrier Permit

Alcohol Beverage License

(Suppliers/distributors)

Brewer Importer License

Insurance Commission ...............................................304 558-0610

Insurance License

Lottery Commission ....................................................304 558-0500

Lottery Retail Application

Tax Division .................................................................304 558-3333

or toll-free ....................................................................800-982-8297

Cemeteries Registration

Collection Agency Licenses

Drug Paraphernalia License

Non-resident Contractor’s Registration

Sparklers & Novelties Applications

Transient Vendors License

Charitable Bingo & Ra ffle ..........................................304 558-8510

tax.wv.gov West Virginia Business Registration Information and Instructions— 11

|

Enlarge image |

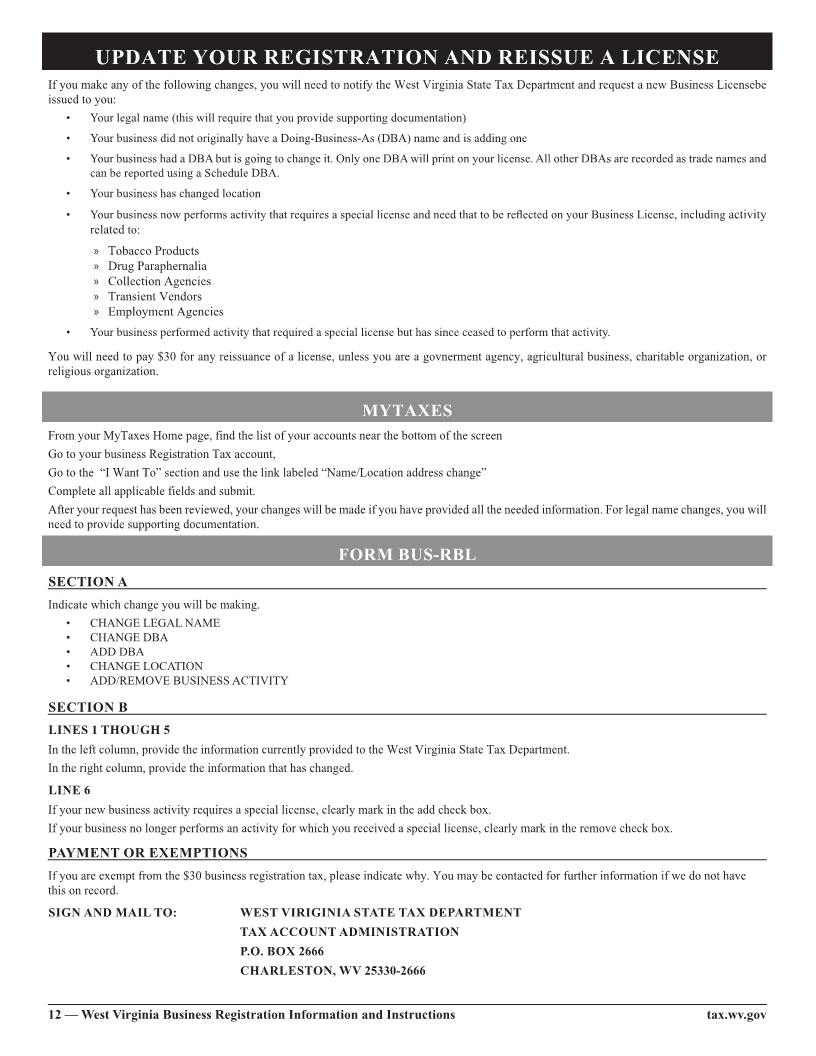

UPDATE YOUR REGISTRATION AND REISSUE A LICENSE

If you make any of the following changes, you will need to notify the West Virginia State Tax Department and request a new Business Licensebe

issued to you:

• Your legal name (this will require that you provide supporting documentation)

• Your business did not originally have a Doing-Business-As (DBA) name and is adding one

• Your business had a DBA but is going to change it. Only one DBA will print on your license. All other DBAs are recorded as trade names and

can be reported using a Schedule DBA.

• Your business has changed location

• Your business now performs activity that requires a special license and need that to be re flected on your Business License, includingactivity

related to:

» Tobacco Products

» Drug Paraphernalia

» Collection Agencies

» Transient Vendors

» Employment Agencies

• Your business performed activity that required a special license but has since ceased to perform that activity.

You will need to pay $30 for any reissuance of a license, unless you are a govnerment agency, agricultural business, charitable organization, or

religious organization.

MYTAXES

From your MyTaxes Home page, find the list of your accounts near the bottom of the screen

Go to your business Registration Tax account,

Go to the “I Want To” section and use the link labeled “Name/Location address change”

Complete all applicable fields and submit.

After your request has been reviewed, your changes will be made if you have provided all the needed information. For legal name changes, you will

need to provide supporting documentation.

FORM BUS-RBL

SECTION A

Indicate which change you will be making.

• CHANGE LEGAL NAME

• CHANGE DBA

• ADD DBA

• CHANGE LOCATION

• ADD/REMOVE BUSINESS ACTIVITY

SECTION B

LINES 1 THOUGH 5

In the left column, provide the information currently provided to the West Virginia State Tax Department.

In the right column, provide the information that has changed.

LINE 6

If your new business activity requires a special license, clearly mark in the add check box.

If your business no longer performs an activity for which you received a special license, clearly mark in the remove check box.

PAYMENT OR EXEMPTIONS

If you are exempt from the $30 business registration tax, please indicate why. You may be contacted for further information if we do not have

this on record.

SIGN AND MAIL TO: WEST VIRIGINIA STATE TAX DEPARTMENT

TAX ACCOUNT ADMINISTRATION

P.O. BOX 2666

CHARLESTON, WV 25330-2666

12 — West Virginia Business Registration Information and Instructions tax.wv.gov

|

Enlarge image |

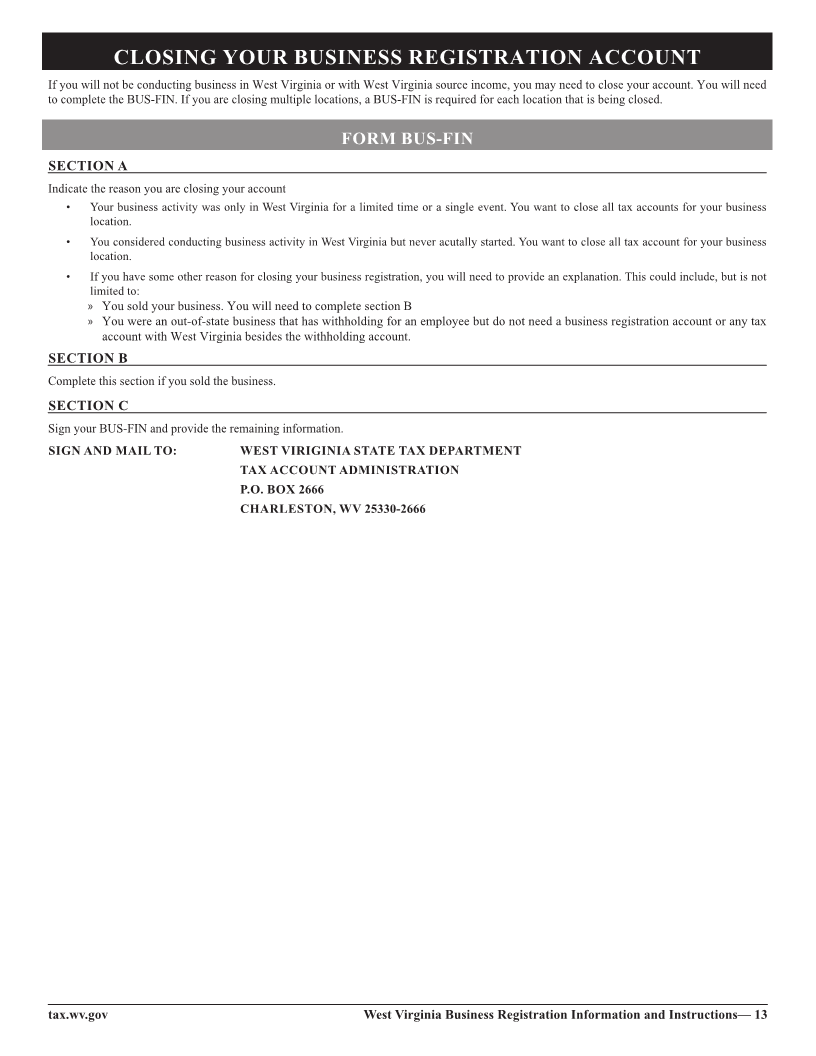

CLOSING YOUR BUSINESS REGISTRATION ACCOUNT

If you will not be conducting business in West Virginia or with West Virginia source income, you may need to close your account. You will need

to complete the BUS-FIN. If you are closing multiple locations, a BUS-FIN is required for each location that is being closed.

FORM BUS-FIN

SECTION A

Indicate the reason you are closing your account

• Your business activity was only in West Virginia for a limited time or a single event. You want to close all tax accounts for your business

location.

• You considered conducting business activity in West Virginia but never acutally started. You want to close all tax account for your business

location.

• If you have some other reason for closing your business registration, you will need to provide an explanation. This could include, but is not

limited to:

» You sold your business. You will need to complete section B

» You were an out-of-state business that has withholding for an employee but do not need a business registration account or any tax

account with West Virginia besides the withholding account.

SECTION B

Complete this section if you sold the business.

SECTION C

Sign your BUS-FIN and provide the remaining information.

SIGN AND MAIL TO: WEST VIRIGINIA STATE TAX DEPARTMENT

TAX ACCOUNT ADMINISTRATION

P.O. BOX 2666

CHARLESTON, WV 25330-2666

tax.wv.gov West Virginia Business Registration Information and Instructions— 13

|

Enlarge image |

ONCE YOUR BUSINESS IS REGISTERED,

YOU MAY FILE AND PAY YOUR TAXES ONLINE

MYTAXES.WVTAX.GOV

MyTaxes gives West Virginia business Taxpayers, Certi fied Public Accountants and Tax Preparers the ability to view their accounts,

make changes to their accounts, and file and pay their taxes through the secure website. The 24 hour a day, 7 days a week access to tax

accounts and the State Tax Department makes tax compliancy easy, quick and simple.

Whether you have one account or several to manage, MyTaxes can help Taxpayers keep track of their filing and payment history as the

website allows users to view account activity for the past three years.

MyTaxes allows users to pay their business taxes by EFT or credit card, schedule a future payment, or submit a return without making a

payment. Users can amend returns and even change a return that has already been submitted but has not yet been processed.

MyTaxes provides Taxpayers with the flexibility needed to conduct business in West Virginia with ease. Log on and sign up today at

mytaxes.wvtax.gov.

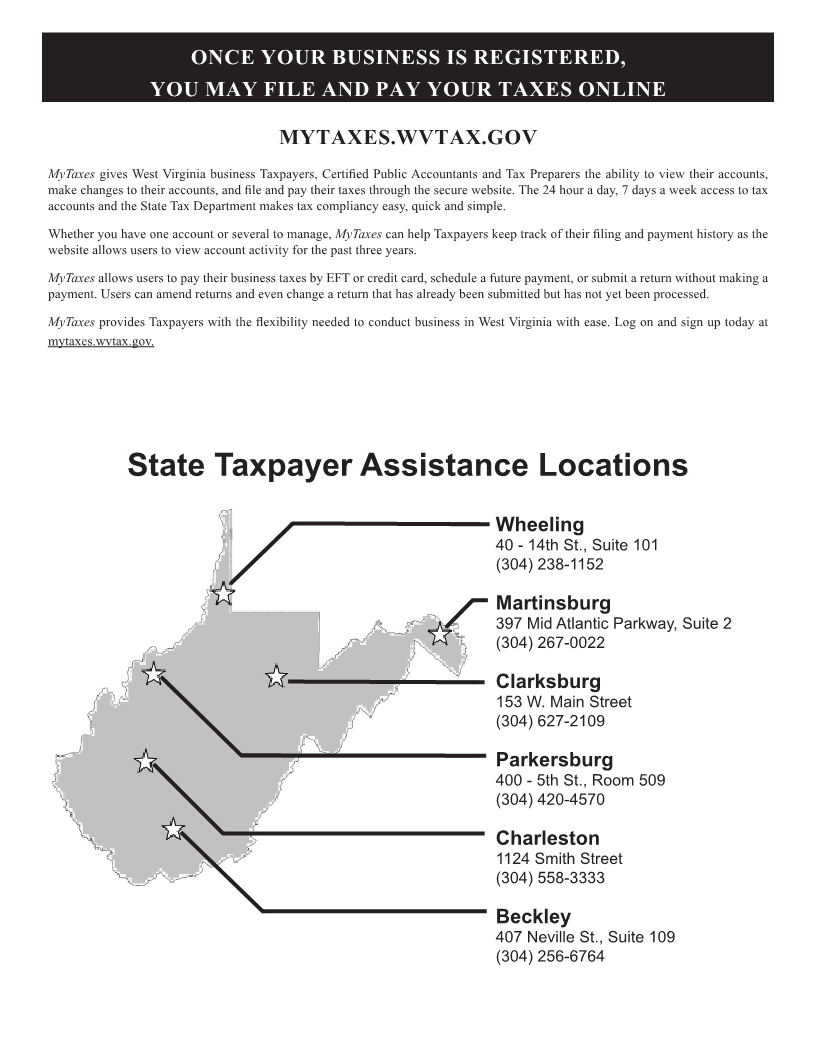

State Taxpayer Assistance Locations

Wheeling

40 - 14th St., Suite 101

(304) 238-1152

Martinsburg

397 Mid Atlantic Parkway, Suite 2

(304) 267-0022

Clarksburg

153 W. Main Street

(304) 627-2109

Parkersburg

400 - 5th St., Room 509

(304) 420-4570

Charleston

1124 Smith Street

(304) 558-3333

Beckley

407 Neville St., Suite 109

(304) 256-6764

|